Taxpayers may need to correct errors on past returns. The IRS offers the amended tax return process to ensure accurate federal tax records for individuals or entities. Even for the most meticulous among us, the dynamic nature of our financial lives can bring forth situations where an error or omission in a tax return becomes apparent only after submission. Whether due to receiving new information or realizing a prior mistake, amending is the route to set things right. Individuals often amend tax returns due to overlooked income, incorrect deductions, changes in dependents, or major life events like marriage or divorce. Additionally, discovering missed deductions or newfound credits post-filing may also necessitate amendments. The aim is always to align the return with actual circumstances. At the heart of the amendment process lies Form 1040-X. This essential document is what you'll use to detail and correct any errors from a prior individual federal tax return. While it's primarily about rectifying past mistakes, using the form also signals a taxpayer's commitment to transparency and accuracy. Designed by the IRS, Form 1040-X ensures that there's a standardized way for taxpayers to communicate changes. Every field and section within the form has a specific purpose, making the process systematic and organized. Form 1040-X may appear challenging, but with patience and the right guidance, it's manageable. Every section comes with clear instructions, aiding taxpayers in filling out each segment correctly. This ensures that the IRS receives accurate and easily comprehensible information. The instructions accompanying Form 1040-X are a resource worth its weight in gold. Providing clarity and direction, they aid in translating tax jargon into actionable steps, ensuring that each taxpayer knows exactly what's required of them. Choosing to file an amended return is rooted in the need for accuracy. Be it modifying the reported income, rectifying filing status, or adjusting tax credits, the changes made should be well-informed and precise. It's paramount to have clarity on what the actual discrepancies are and what triggered the need for an amendment. The clearer the cause, the smoother the process becomes, both for the taxpayer and the IRS. An amended return isn't just about adding or subtracting figures; it's about clarity and transparency. It's essential to illuminate any deviations from the original return, making sure the IRS comprehends the nature and reason for each change. This process is less about acknowledgment of a mistake and more about rectification. By clearly documenting each alteration, you create a transparent and traceable record, making it easier for the IRS to process and accept the amendments. Interestingly, not all errors necessitate an amended return. Simple math errors are typically caught and corrected by the IRS. Additionally, forgetting to attach specific forms or schedules doesn't always require an amendment, as the IRS will generally request these if needed. Moreover, it's beneficial for taxpayers to know that the IRS employs a rigorous system that catches many common errors. This means that some mistakes might already be flagged and corrected without the need for taxpayers to take any additional steps. Diving into the amendment process requires groundwork. This entails assembling all pertinent documents, such as the original tax return, newly received information, or even communications from the IRS regarding the return in question. Having all necessary documentation at your fingertips not only expedites the process but also ensures accuracy. Each document serves as a reference, guiding you through the intricacies of amendment. The essence of an accurate amendment lies in diligently completing Form 1040-X. While filling it out, one must cross-reference with the original return to ensure all changes are in line and well-justified. As comprehensive as the form is, it doesn't have to be overwhelming. With a methodical approach, coupled with occasional glances at the instructions, the task can be executed with precision and ease. Form 1040-X comes equipped with an "Explanation of Changes" section, an area that can't be overlooked. This segment demands clarity as taxpayers highlight the reasons behind each adjustment. Having a lucid explanation streamlines the IRS's reviewing process. By detailing the changes in a straightforward manner, you essentially create a road map, guiding reviewers through your amended return. Sometimes, it's not enough to merely indicate a change on the 1040-X. At times, you might need to attach additional schedules or forms that validate your amendments. Including the necessary documentation solidifies your changes and provides a clear picture of your tax situation. Remember, each additional form or document acts as evidence, reinforcing the authenticity of your claims. Ensuring these are accurate and relevant is crucial for a hassle-free amendment process. Upon making all the requisite amendments, the next step is a financial recalibration. The modifications might influence your tax liability, leading either to additional taxes owed or a larger refund. It's essential to pause and reassess. Your adjustments might have financial ramifications, and it's pivotal to understand these fully. This clarity helps in planning the next steps, whether it's making a payment or awaiting a refund. Seemingly simple, yet of utmost importance, is the act of dispatching the amended return to the correct IRS address. This address can vary based on several factors, including the nature of the amendment and the taxpayer's residence. By referencing the latest IRS guidelines, you can ensure your amended return lands in the right hands, preventing unnecessary delays or complications. The sensitivity and significance of the information within an amended return cannot be overstated. Hence, when mailing it off, opting for secure methods such as trackable or certified mail is advised. This not only provides peace of mind but also offers tangible proof of submission. By taking a little extra care at this stage, you can rest assured that your diligent efforts in amending the return don't go to waste due to postal mishaps or misdirection. Post-submission, a waiting game ensues. The IRS, known for its thoroughness, may take longer to process amended returns compared to regular ones. This extended duration is to ensure every change is vetted and validated. Although waiting can be the hardest part, it's beneficial to remember that the meticulousness of the IRS is to ensure accuracy. Thus, patience becomes a virtue worth embracing during this phase. The irony of making errors in a document meant to correct errors isn't lost on anyone. Therefore, it's paramount to double-check entries and calculations on your amended return. This ensures your efforts in rectification don't inadvertently introduce new mistakes. A thorough review, possibly even enlisting a second pair of eyes, can be invaluable. Ensuring that every change aligns with the evidence on hand can make the difference between swift processing and potential complications. Such minor details as ensuring adequate postage and correct addressing can have major impacts. Inadequate postage might lead to your return being sent back, causing unnecessary delays. It's always advisable to double-check postage rates, especially if your amended return includes additional forms or documentation. Similarly, verifying the address ensures your return reaches its intended destination. Once the amended return is out of your hands, it's tempting to put it out of mind. However, it's prudent to retain copies of every document related to the amendment. This ensures you have a reference in case of queries or if further clarification is sought by the IRS. Having a robust filing system, whether digital or physical, can come in handy. By retaining copies, you arm yourself with the ability to respond promptly and accurately to any future inquiries or requirements. In our digital age, the IRS has tools in place to aid taxpayers. One such utility is the "Where's My Amended Return?" online tool. This allows individuals to track the status of their amended return, providing real-time updates. While it's not necessary to check daily, the tool can offer peace of mind, confirming that your amended return is in the pipeline and under review. As with any bureaucratic process, timelines can be variable. Typically, the IRS takes up to 16 weeks to process an amended return. However, using the aforementioned tracking tool can provide insight into where your amendment stands. Though patience is required, it's heartening to know that each step in the timeline signifies progress. Before you know it, your amended return will be processed, and any resulting actions or refunds will be initiated. Submitting an amended return might lead to changes in your tax liability. This could result in owing more taxes or, on the flip side, receiving a larger refund. It's essential to be prepared for these financial shifts, ensuring you're ready to take the necessary actions. Understanding the financial ramifications also means being prepared for any potential interest or penalties. It's always best to be informed, allowing for proactive planning and decision-making. A common concern is whether amending a return increases the risk of an audit. While the act of amendment doesn't automatically trigger an audit, it's crucial to be aware that the IRS reviews all returns – original or amended – for accuracy. That said, if your amended return is transparent, accurate, and backed by valid documentation, there's nothing to fear. Preparedness is the best defense, and a well-structured amendment serves as evidence of a taxpayer's commitment to honesty and accuracy. Filing an amended tax return is a crucial process that ensures taxpayers correct errors and align their tax records with actual circumstances. The IRS has provided clear tools, like Form 1040-X and online tracking systems, to facilitate this amendment process. While the endeavor demands meticulousness, from gathering necessary documentation to understanding the financial implications, the overarching theme is transparency and accuracy. It's essential for taxpayers to approach this task with clarity, patience, and confidence. Even if the road to amendment may seem intricate, it's paved with the assurance of rectifying past mistakes and reaffirming a commitment to tax compliance. Every step, be it reviewing entries or awaiting IRS confirmation, is a stride toward financial integrity.Overview of Amended Tax Returns

Understanding Form 1040-X

Purpose of Form 1040-X

Following the Form's Detailed Instructions

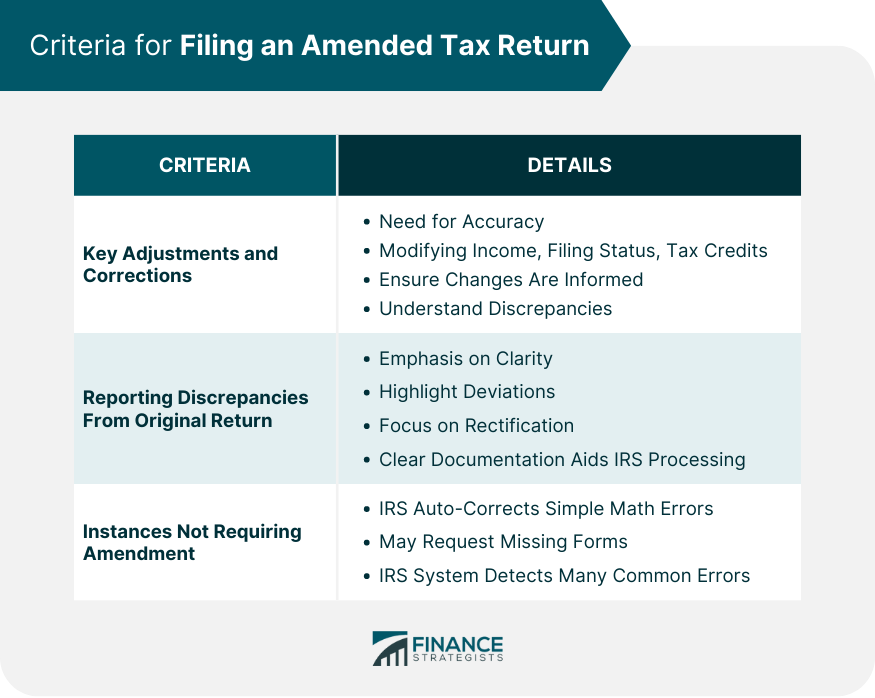

Criteria for Filing an Amended Tax Return

Key Adjustments and Corrections

Reporting Discrepancies From Original Return

Instances Not Requiring Amendment

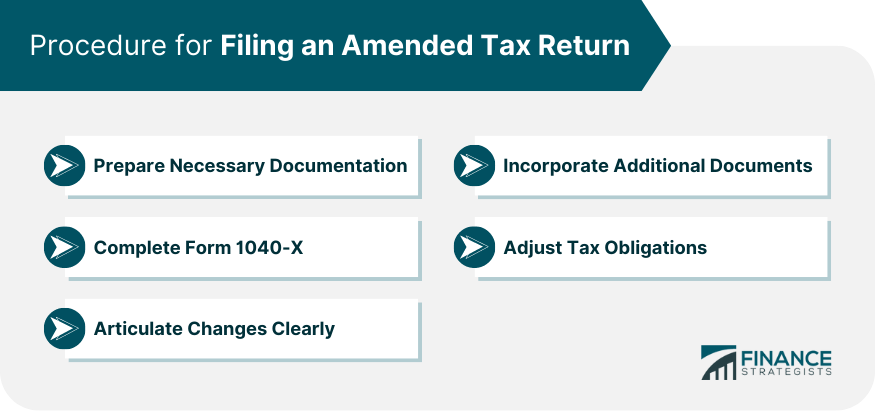

Process for Filing an Amended Tax Return

Prepare Necessary Documentation

Complete Form 1040-X

Articulate Changes Clearly

Incorporate Additional Documents

Adjust Tax Obligations

Submission of the Amended Return

Identifying the Correct IRS Mailing Address

Recommendations for Secure Mailing

Anticipating IRS Processing Durations

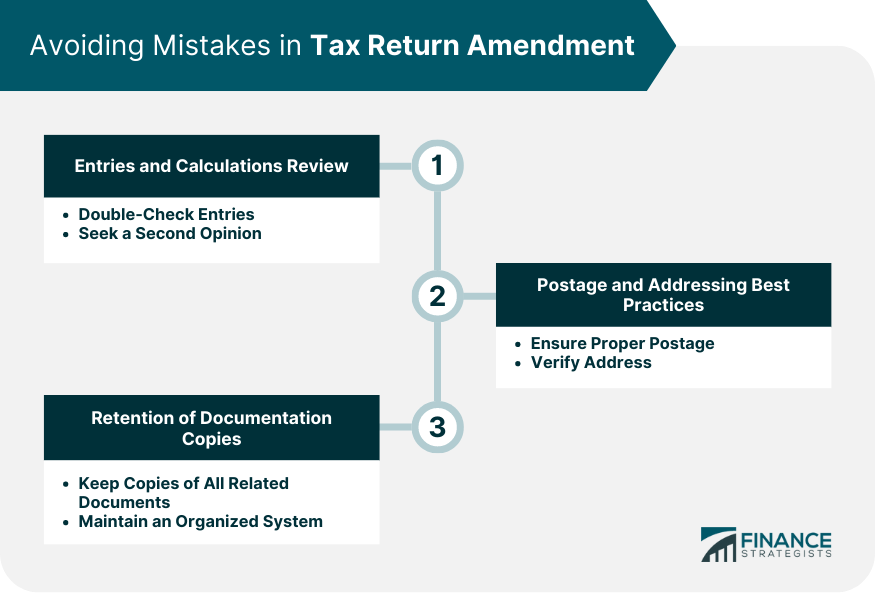

Avoiding Mistakes in Tax Return Amendment

Entries and Calculations Review

Postage and Addressing Best Practices

Retention of Documentation Copies

Tracking Your Amended Tax Return's Progress

Utilizing the "Where's My Amended Return?" Tool

Timelines for Receiving Updates and Responses

Implications of Submitting an Amended Return

Potential Financial Adjustments

Assessing Audit Risks and Preparedness

Bottom Line

How to File an Amended Tax Return FAQs

Form 1040-X is used to amend a previously filed tax return.

Use the "Where's My Amended Return?" tool on the IRS website.

Yes, reasons include incorrect reporting of income, deductions, credits, filing status, or dependents.

The IRS typically takes up to 16 weeks to process an amended return.

No, amending a return doesn't automatically trigger an audit. Transparency and accuracy are key.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.