The W-2 form, also known as Wage and Tax Statement, is more than just another piece of paper; it's a critical wage and tax statement that employers provide to employees. This form offers a detailed breakdown of an individual's earnings, taxes withheld, and other pertinent financial data from the previous year. Without it, tax filing can become a significant challenge. Every year, taxpayers rely on their W-2 forms to ensure they report accurate information to the IRS. It's essential for reconciling one's earnings with the taxes paid and for determining if they owe more taxes or if they're due for a refund. Given its crucial role, losing a W-2 can stir panic among taxpayers, but knowing the right steps to take can ease those concerns. Your last pay stub can often come to the rescue. This document typically contains cumulative figures for the year, detailing your earnings and the taxes withheld. With this in hand, you can usually recreate much of the lost W-2's information. While it's a handy workaround, it's vital to be meticulous. Ensure you're not overlooking any details, as pay stubs may not encompass every aspect of your W-2. However, in a pinch, it's a valuable resource. When the clock is ticking, and you're still without a W-2, it might be time to consider filing an extension. This provides additional time, typically six months, to gather your documents and file your taxes without incurring penalties. However, remember that an extension to file is not an extension to pay. If you owe taxes, interest will accrue on the unpaid amount after the original deadline. To mitigate this, it's wise to estimate your tax liability and make a payment when filing the extension. Tax situations can be intricate, more so when pivotal documents go missing. In such situations, turning to an accountant or tax professional can be invaluable. They bring expertise to the table, ensuring you navigate the challenges efficiently. Moreover, professionals are familiar with the intricacies of tax regulations and can guide you through alternatives. Their insights can mean the difference between a smooth tax season and one mired in complications. First things first: reach out to your employer or the HR department as soon as you realize your W-2 is missing. Employers usually have a process in place to reissue lost or misplaced forms. By making this your initial step, you can potentially avoid many of the subsequent hassles. While employers are obligated to provide W-2 forms, there might be delays in getting a duplicate. It's always beneficial to have a sense of the expected timeframe, so you can plan your next steps accordingly, especially considering the looming tax deadline. In our digital age, many companies have embraced electronic delivery of tax documents. Take a moment to scan through your email archives or log in to your payroll portal. Many times, you'll find a digital copy of your W-2 waiting there. Having backups of critical documents is more than just good practice; it's a safety net. If you've been diligent in retaining copies of past tax documents, now is the time they prove their worth. A simple folder—digital or physical—can save hours of stress. If efforts with your employer prove fruitless and a review of past records comes up empty, it's time to seek assistance from the Internal Revenue Service. Informing them about your missing W-2 can kickstart another avenue to retrieve the necessary information. Moreover, the IRS isn't just a regulatory entity; it also serves to aid taxpayers in situations like these. Their database often contains wage information from employers, which can be invaluable when your W-2 goes missing. Form 4852 might sound unfamiliar, but it's essentially a lifesaver in these scenarios. Acting as a stand-in for your W-2, this form allows taxpayers to estimate their earnings and withholdings for the year. Using this form requires caution. You're essentially providing your best guess, which means there's room for error. However, in the absence of an official W-2, it's a legitimate and sanctioned method to ensure you file your taxes on time. Another solution is to tap into the IRS's repository of wage and income data. By requesting a transcript of this information, you can access a summary of the tax data they have on record for you. While this isn't a direct substitute for the W-2, the transcript can offer the key figures you need for tax filing. Just ensure you cross-reference this data for accuracy, to avoid discrepancies that might flag your return for review. In the modern era, digital storage solutions, like cloud services and encrypted drives, offer secure ways to store vital documents. By keeping a digital copy of your W-2, you ensure easy access whenever needed, without rummaging through stacks of paper. Beyond mere convenience, digital storage provides an element of security. Encrypted backups ensure your data remains confidential, and cloud services mean you can access your documents even if your primary device fails. A dedicated space for all tax-related documents can be a game-changer. Whether it's a specific drawer, folder, or file cabinet, having a designated spot ensures you know exactly where to look come tax season. Organization isn't just about convenience; it's also about peace of mind. Knowing where your crucial documents are can alleviate the anxiety that often accompanies tax preparation, making the process smoother and more efficient. It sounds basic, but ensuring your employer has your current address is pivotal. A significant number of missing W-2s can be traced back to outdated contact details. Keeping this information updated ensures timely receipt of important documents. Additionally, by promptly receiving tax forms, you allow yourself ample time for tax preparation. This minimizes last-minute scrambles and ensures you can approach tax season with confidence and clarity. Navigating the tax season without a crucial W-2 form can be daunting, but as outlined, there are structured measures to address this challenge. By initially reaching out to employers or diving into personal records, one can often retrieve the necessary information. If these methods fall short, the IRS stands as a robust support system, offering alternatives like Form 4852 or the wage and income transcript. But prevention is better than cure. Leveraging digital storage, maintaining organized physical records, and keeping personal details updated with employers not only simplifies tax season but also averts potential W-2 mishaps. In essence, while losing a W-2 might induce panic, understanding available recourses and emphasizing proactive measures can transform a taxing situation into a manageable endeavor.Overview of W-2 Form

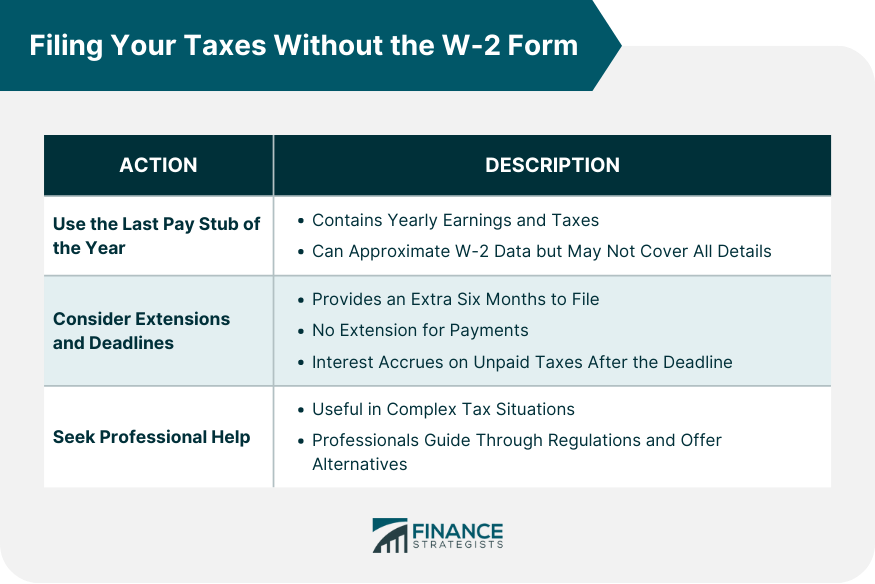

Filing Your Taxes Without the W-2 Form

Use the Last Pay Stub of the Year

Consider Extensions and Deadlines

Seek Professional Help

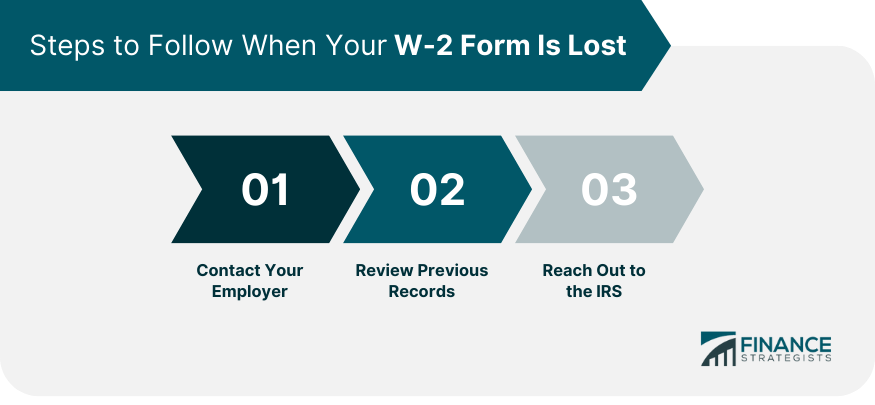

Steps to Follow When Your W-2 Form Is Lost

Contact Your Employer

Review Previous Records

Reach Out to the IRS

Alternative Solutions if Reissue Is Not Possible or Delayed

Form 4852: Substitute for Form W-2

Accessing the IRS's Wage and Income Transcript

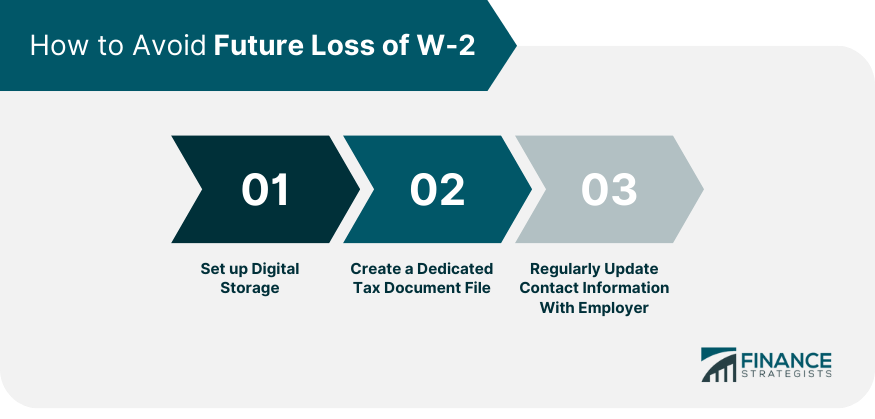

How to Avoid Future Loss of W-2

Set up Digital Storage

Create a Dedicated Tax Document File

Regularly Update Contact Information With Employer

Bottom Line

How to File Taxes if You Lost Your W-2 Form? FAQs

Begin by contacting your employer, review any digital records, and consider reaching out to the IRS for assistance.

Yes, Form 4852 acts as a stand-in for a W-2, allowing you to estimate your annual earnings and tax withholdings.

You can use the last pay stub of the year or request an IRS wage and income transcript. If unsure, consider consulting a tax professional.

Utilize digital storage solutions, create a dedicated tax document file, and regularly update your contact information with your employer.

You can file for an extension, granting more time to submit your tax return. However, any owed taxes should still be estimated and paid on time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.