Passive income in retirement refers to the money earned without actively participating in the generation of that income. In other words, it is the income earned through investments, rental property, royalties, or other passive activities that require minimal effort and time to maintain. Passive income is an essential component of retirement planning as it provides financial stability, flexibility, and a diversified income stream. Retirees who have passive income streams can enjoy their retirement without worrying about financial constraints. Unlike active income, passive income does not require physical presence, continuous efforts, or active participation in the generation of income. Passive income can be a valuable source of financial stability during retirement, providing retirees with a steady stream of income that does not require constant attention or effort. Rental income is one of the most popular forms of passive income during retirement. It involves owning rental property and collecting rent from tenants. Rental income can provide retirees with a steady stream of income, but it also requires maintenance and management of the property. Retirees can hire a property management company to manage the property and collect rent on their behalf. Rental income can be an excellent source of passive income if the property is in a desirable location, and the rent is set at a competitive rate. Dividend income is earned through owning dividend-paying stocks. Dividends are payments made by companies to their shareholders as a portion of their profits. Dividend income can provide retirees with a steady stream of income that is relatively stable compared to other forms of passive income. Retirees can invest in dividend-paying stocks with a history of steady dividend payments and stable earnings. Interest income is earned through owning bonds, certificates of deposit (CDs), or other fixed-income securities. Interest income is a predictable source of passive income that can provide retirees with a steady stream of income. Retirees can invest in bonds with a high credit rating and a history of stable returns. Capital gains are earned through the sale of an asset, such as stocks or real estate, at a higher price than the purchase price. Capital gains can provide retirees with a significant source of passive income, but they are not predictable and can be volatile. Retirees can invest in stocks or real estate that has a potential for appreciation in value. Royalties are earned through owning intellectual property such as patents, copyrights, or trademarks. Royalties can provide retirees with a steady stream of income if they own valuable intellectual property that is in demand. Royalties can be a significant source of passive income if the intellectual property has a potential for long-term income generation. Annuities are financial products that provide a guaranteed stream of income for a specified period or for life. Annuities can be purchased with a lump sum or through regular payments, and the payments are typically made monthly. Annuities can provide retirees with a guaranteed source of passive income, but they can also be expensive and have complex terms and conditions. Passive income provides retirees with financial stability by providing a steady stream of income that is not reliant on active work or employment. Passive income can be a reliable source of income during retirement, reducing the risk of running out of money or experiencing financial hardship. Passive income provides retirees with flexibility by allowing them to manage their time and resources as they see fit. Retirees can use their passive income to travel, pursue hobbies, or spend time with family and friends. Passive income can also provide retirees with the flexibility to delay taking Social Security benefits, allowing them to maximize their retirement income. Passive income requires minimal effort and time investment, making it an attractive source of income for retirees who want to enjoy their retirement without the burden of active work or employment. Passive income can be generated through investments or rental property that requires little or no day-to-day involvement. Passive income provides retirees with a diversified income stream that reduces the risk of dependency on a single source of income. Diversification of income streams can help retirees manage the risk of running out of money or experiencing financial hardship during retirement. Passive income can provide retirees with tax benefits, such as lower tax rates on long-term capital gains and qualified dividends. Retirees can also take advantage of tax deductions and credits related to rental property, real estate investments, or other passive income sources. Generating passive income in retirement requires an initial investment of time and money. Retirees need to have sufficient savings or assets to generate passive income, which can be a challenge for those who have not saved enough for retirement. Generating passive income in retirement involves some level of risk, such as market risk, credit risk, or interest rate risk. Retirees need to be aware of the risks associated with different passive income sources and take steps to mitigate those risks. Finding reliable and profitable passive income sources can be a challenge for retirees. Retirees need to research different passive income sources, evaluate their potential returns and risks, and choose the ones that align with their financial goals and risk tolerance. Generating passive income in retirement can have tax implications, such as capital gains taxes, income taxes, or property taxes. Retirees need to be aware of the tax implications of different passive income sources and take steps to minimize their tax liability. Real estate investments can provide retirees with rental income, capital gains, and tax benefits. Retirees can invest in rental property, real estate investment trusts (REITs), or real estate crowdfunding platforms. Real estate investments require an initial investment of capital and time, but they can provide a reliable source of passive income during retirement. Stock market investments can provide retirees with dividend income, capital gains, and long-term growth. Retirees can invest in dividend-paying stocks, mutual funds, exchange-traded funds (ETFs), or index funds. Stock market investments require some level of risk tolerance, but they can provide a diversified source of passive income during retirement. Bond investments can provide retirees with interest income, capital preservation, and tax benefits. Retirees can invest in high-quality bonds, bond funds, or CDs. Bond investments are relatively stable but may offer lower returns than other passive income sources. Peer-to-peer lending platforms connect borrowers with investors, allowing investors to earn interest income on their investments. Retirees can invest in peer-to-peer lending platforms that specialize in personal loans, small business loans, or real estate loans. Peer-to-peer lending requires some level of risk tolerance and due diligence, but it can provide a reliable source of passive income during retirement. Intellectual property investments, such as patents, copyrights, or trademarks, can provide retirees with royalties and long-term income streams. Retirees can purchase or develop intellectual property that has a potential for long-term income generation. Intellectual property investments require some level of expertise and due diligence, but they can provide a unique and profitable source of passive income during retirement. Retirement accounts, such as 401(k)s, individual retirement accounts (IRAs), or Roth IRAs, can provide retirees with passive income through interest, dividends, or capital gains. Retirees can invest in retirement accounts that offer a diversified portfolio of stocks, bonds, or other assets. Retirement accounts provide tax benefits and can be a reliable source of passive income during retirement. Passive income is an essential component of retirement planning that can provide financial stability, flexibility, and a diversified income stream for retirees. There are different types of passive income sources, including rental income, dividend income, interest income, capital gains, royalties, and annuities. While generating passive income in retirement has many advantages, there are also challenges, such as the initial investment, risk of loss, difficulty in finding reliable sources, and tax implications. Retirees can create passive income in retirement through real estate investments, stock market investments, bond investments, peer-to-peer lending, intellectual property investments, and retirement accounts. By choosing the right passive income sources that align with their financial goals and risk tolerance, retirees can enjoy a financially secure and fulfilling retirement.What Is Passive Income in Retirement?

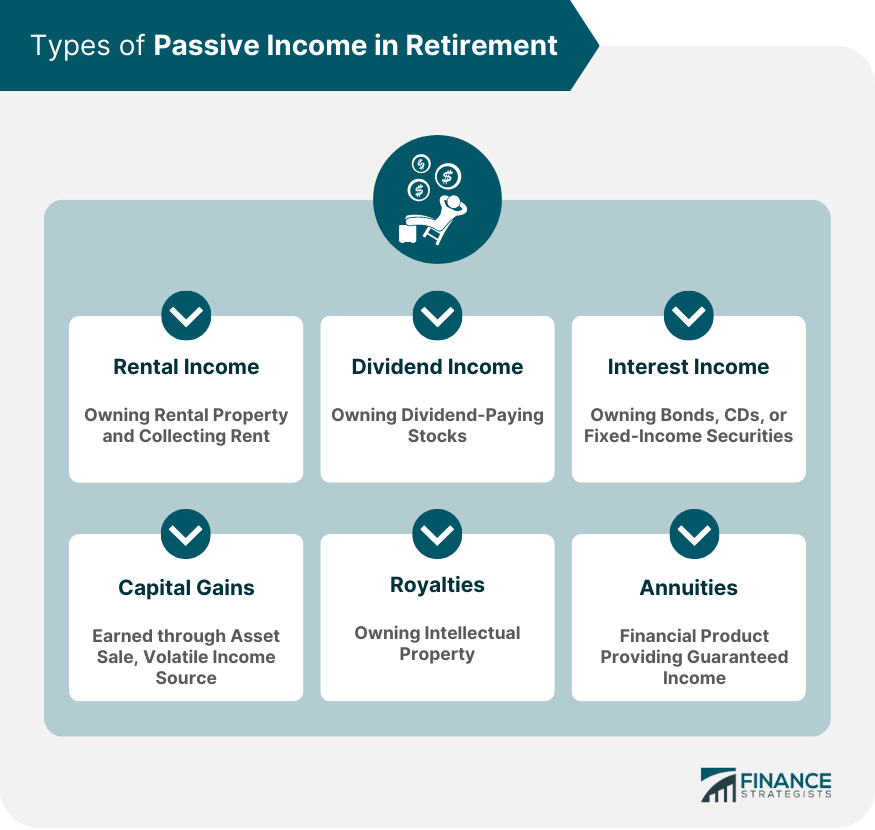

Types of Passive Income

Rental Income

Dividend Income

Interest Income

Capital Gains

Royalties

Annuities

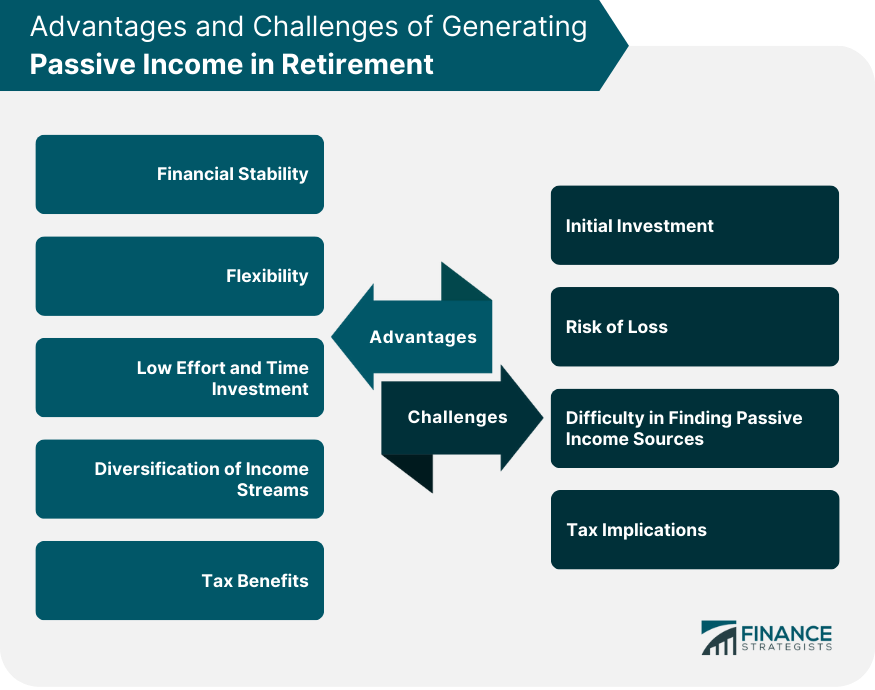

Advantages of Generating Passive Income in Retirement

Financial Stability

Flexibility

Low Effort and Time Investment

Diversification of Income Streams

Tax Benefits

Challenges in Generating Passive Income in Retirement

Initial Investment

Risk of Loss

Difficulty in Finding Passive Income Sources

Tax Implications

Creating Passive Income in Retirement

Real Estate Investments

Stock Market Investments

Bond Investments

Peer-to-Peer Lending

Intellectual Property Investments

Retirement Accounts

Conclusion

Passive Income in Retirement FAQs

Passive income in retirement refers to income earned without having to actively work for it, such as rental income, dividends, or royalties.

Passive income provides financial stability, flexibility, and diversification of income streams, reducing reliance on traditional retirement savings.

Some types of passive income sources in retirement include real estate investments, stock market investments, bond investments, peer-to-peer lending, and intellectual property investments.

Advantages of generating passive income in retirement include low effort and time investment, tax benefits, and the potential for long-term financial growth.

Some challenges in generating passive income in retirement include the initial investment required, the risk of loss, difficulty in finding passive income sources, and tax implications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.