Social Security income in retirement refers to the benefits provided by the Social Security Administration (SSA) to eligible individuals who have reached the age of retirement. It is a government program designed to provide a basic level of financial support to individuals in their later years. Social Security income serves as a vital source of retirement income for many Americans. The Social Security system is funded through payroll taxes paid by workers and employers. Throughout your working years, a portion of your earnings is deducted from your paycheck as Social Security taxes. These taxes are used to fund the Social Security program and provide benefits to current retirees. The calculation of Social Security income takes into account various factors, including your earnings history, age, and the time of claiming benefits. To calculate your Social Security income, you must first understand two critical elements: The Average Indexed Monthly Earnings (AIME) and the Primary Insurance Amount (PIA). The SSA calculates your benefits based on your lifetime earnings. They adjust or 'index' your actual past earnings to account for changes in average wages since the year the earnings were received. The SSA uses your 35 highest-earning years to calculate your AIME. If you've worked less than 35 years, the SSA will still use 35 years for calculation, which means that years with zero earnings will be included, which could lower your benefits. Your Primary Insurance Amount is the monthly amount you'll receive if you decide to begin receiving benefits at your full retirement age. The PIA is determined using a formula applied to your AIME, which involves fixed percentages of different amounts of income. For many, Social Security serves as the foundation of their retirement income. It provides a base of income that is adjusted for inflation and lasts as long as you live. Understanding how your benefits are calculated can empower you to make informed decisions about when to claim benefits and how to optimize your retirement income. Several factors influence the calculation of Social Security benefits, including your retirement age and lifetime earnings. The age at which you choose to start receiving benefits can significantly affect your monthly Social Security income. You can start receiving benefits as early as age 62 but doing so may result in a reduction of as much as 30 percent. The full retirement age is the age at which you're eligible to receive full benefits. It depends on your birth year and for most people today, it ranges from 66 to 67. You can choose to delay receiving benefits past your full retirement age. If you do, your benefit amount will increase by a certain percentage from the time you reach full retirement age until you start receiving benefits or until you reach age 70. The higher your lifetime earnings, the higher your Social Security benefits. If there are years you did not work or had a low income, your benefit amount might be lower than if you had worked steadily. To ensure that the purchasing power of Social Security benefits isn't eroded by inflation, benefit amounts are adjusted each year, based on the increase in the Consumer Price Index. Armed with the knowledge of how Social Security income is calculated, you can now devise strategies to maximize your benefits. There are various ways to maximize your Social Security benefits. One common strategy is to delay claiming your benefits until age 70, which results in a higher monthly benefit. It's also important to coordinate your Social Security benefits with other retirement income sources, such as pensions, retirement savings, and part-time work. This coordination can help ensure a steady income stream throughout your retirement. If you're married, divorced, or widowed, you may be eligible for spousal or survivor benefits, which can significantly increase your Social Security income. Understanding how Social Security income is calculated for retirement is fundamental to securing a comfortable post-work life. This knowledge helps you leverage key factors such as the Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA). Recognizing the role of retirement age and lifetime earnings aids in optimizing benefits, especially through strategies such as deferring benefits until age 70 or coordinating benefits with other income sources. It's equally essential to stay informed about potential legislative changes that could affect benefit calculations and understand the impact of future economic trends on your Social Security income. By harnessing this knowledge, you are better equipped to maximize your Social Security benefits and navigate the path to a financially stable retirement.What Is Social Security Income in Retirement?

How Social Security Income for Retirement is Calculated

Basics of Social Security Income Calculation

Role of the Average Indexed Monthly Earnings (AIME)

Calculation of Primary Insurance Amount (PIA)

Importance of Social Security Income in Retirement

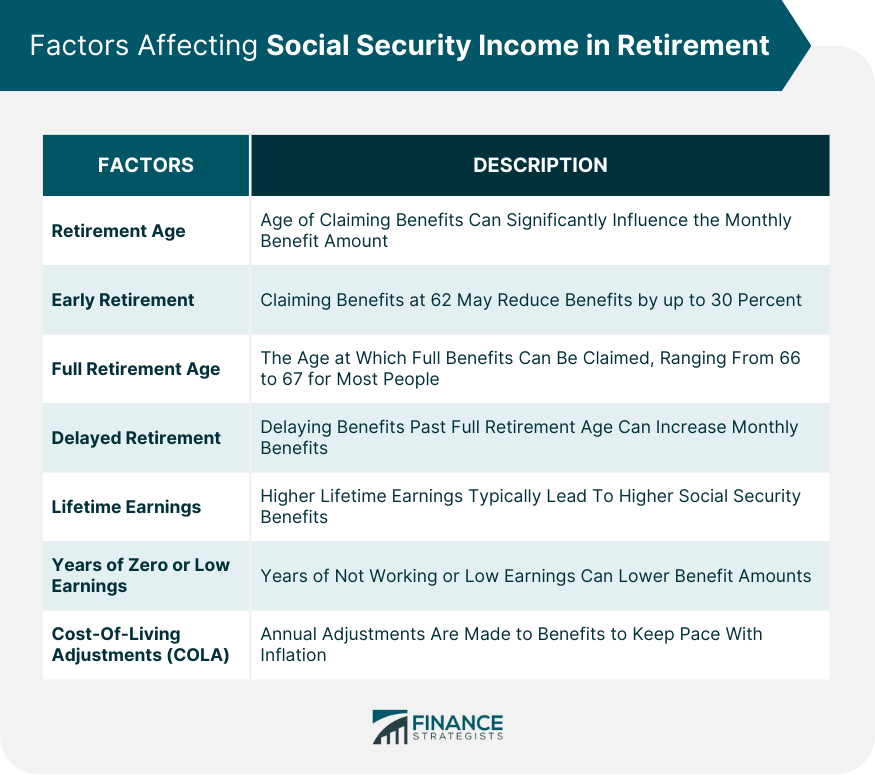

Factors Affecting Social Security Income in Retirement

The Impact of the Retirement Age

Early Retirement and Its Effects on Benefits

Full Retirement Age and Its Impact

Delayed Retirement and Increased Benefits

Effect of Lifetime Earnings on Social Security Benefits

Cost-Of-Living Adjustments (COLA) And Social Security Benefits

Social Security Income Planning Strategies for Retirement

Maximizing Social Security Benefits

Coordination of Social Security Benefits With Other Retirement Income

Considering Spousal and Survivor Benefits

Conclusion

How Do You Calculate Social Security Income for Retirement? FAQs

Social Security income for retirement is calculated based on your lifetime earnings, specifically your 35 highest-earning years which are adjusted for inflation to compute your Average Indexed Monthly Earnings (AIME). This AIME is then used to calculate your Primary Insurance Amount (PIA), the monthly benefit you'll receive at full retirement age.

The age at which you choose to begin receiving Social Security benefits can significantly influence your monthly income. Starting at 62 can reduce your benefits by up to 30 percent, while delaying benefits until after your full retirement age, up to age 70, can increase your monthly benefits.

Your lifetime earnings have a significant impact on your Social Security benefits. The Social Security Administration uses your 35 highest-earning years to calculate your benefits. If there are years you didn't work or earned a lower income, this might decrease your benefit amount.

To maintain the purchasing power of Social Security benefits, the amount is adjusted each year based on the increase in the Consumer Price Index. This Cost-of-Living Adjustment ensures that your benefits keep pace with inflation.

Yes, there are several strategies to maximize your Social Security income. For instance, delaying the claiming of benefits until age 70 increases your monthly benefit. Coordinating your Social Security benefits with other retirement income sources, and considering spousal or survivor benefits, can also increase your overall retirement income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.