Retirement is a significant milestone in one's life, marked by a transition from a regular paycheck to relying on retirement income. While retirement income traditionally supports individuals during their golden years, it can also play a role in mortgage qualification. The potential utilization of retirement income for mortgage qualification opens up opportunities for retirees to pursue homeownership or access funds for other purposes. Retirement income, when properly documented and stable, can be considered as a valid source of income for mortgage qualification. Lenders understand that retirees often have substantial assets and a reliable income stream, making them attractive borrowers. However, several factors come into play when determining the acceptability and feasibility of using retirement income for mortgage qualification. Pensions are a common form of retirement income, providing a steady stream of payments to retirees. Lenders often view pension income favorably, considering it a stable and predictable source of funds. They typically include a portion of the pension income in the borrower's qualifying income calculation. Social Security benefits are another type of retirement income that lenders may consider. These benefits are received on a regular basis and can provide a reliable income stream. Lenders evaluate Social Security income by examining the benefit award letter and verifying its consistency. A 401(k) retirement account is a popular investment vehicle that individuals contribute to during their working years. Some lenders may accept 401(k) distributions as qualifying income if they are expected to continue for a certain period. The stability and consistency of the distributions are crucial factors in the lender's evaluation process. Individual Retirement Accounts (IRAs) can also contribute to one's retirement income. Lenders may consider IRA distributions as qualifying income, provided they meet certain criteria. Factors such as the length of time the distributions are expected to continue and the borrower's access to the funds are taken into account. Lenders may have specific age restrictions or eligibility requirements when considering retirement income for mortgage qualification. Some lenders require borrowers to be of a certain age, typically 59½ or older, to utilize retirement income. It is essential to understand these requirements and consult with lenders who are familiar with lending to retirees. Lenders prioritize stability and predictability when evaluating retirement income. They want assurance that the income will continue for the duration of the mortgage term. Retirees can strengthen their case by demonstrating a consistent income history and providing documentation to support the stability of their retirement income. Retirement income requires thorough documentation and verification. Lenders typically request copies of retirement account statements, benefit award letters, and tax returns to validate the income's existence and consistency. Retirees should be prepared to provide clear and organized documentation to facilitate the mortgage application process. Lenders employ various methods to evaluate retirement income when assessing mortgage applications. One common approach is to calculate the debt-to-income (DTI) ratio, comparing the borrower's monthly debts to their monthly income. Retirement income is factored into the income portion of the DTI calculation, along with other sources of income. Lenders may also scrutinize the duration and stability of retirement income. They analyze the longevity of retirement income streams to ensure they are sufficient to cover the mortgage payment over the loan term. Lenders typically require evidence that the income will continue for at least three years, either through retirement account statements or documentation from the issuing entity. Lenders consider several factors when assessing the acceptability of retirement income for mortgage qualification. The type of retirement income, such as pensions, Social Security, or distributions from retirement accounts, plays a significant role. Additionally, lenders evaluate the consistency, stability, and duration of the income to ensure it can sustain the mortgage payments. Lenders also assess the borrower's age and retirement status. Older borrowers who have already entered retirement may face different criteria than those who are still working or transitioning to retirement. Lenders will evaluate the borrower's retirement income relative to their current financial obligations and debts. Retirees can take steps to improve their likelihood of obtaining a mortgage using retirement income. Maintaining a good credit score and history is crucial, as lenders consider creditworthiness during the application process. Reducing existing debt, such as credit card balances or auto loans, can also enhance the borrower's debt-to-income ratio and overall financial stability. Lenders may evaluate additional factors, such as assets (investments, savings, or properties), to assess the borrower's overall financial situation. Credit and payment history on previous mortgages or loans can also instill confidence in lenders, increasing the chances of mortgage approval. Retirees seeking a mortgage should engage in thorough financial planning and preparation. This includes assessing their retirement income, expenses, and potential mortgage payments. Retirees should create a realistic budget that takes into account their retirement lifestyle and obligations. Adequate preparation and planning can help retirees navigate the mortgage application process with confidence. Using retirement income as a qualifying factor for a mortgage is a possibility for retirees, but it requires careful consideration and evaluation. Various types of retirement income, including pensions, Social Security, and distributions from retirement accounts, can be used for mortgage qualification. However, factors such as age restrictions, stability and predictability of income, and documentation requirements must be taken into account. By understanding lenders' evaluation methods, retirees can strengthen their mortgage applications and increase their chances of obtaining a mortgage using retirement income. To improve their chances of obtaining a mortgage using retirement income, retirees should maintain a good credit score and history. Reducing existing debt and considering additional factors like assets can enhance financial stability.Overview of Retirement Income

Retirement Income as a Qualifying Factor for a Mortgage

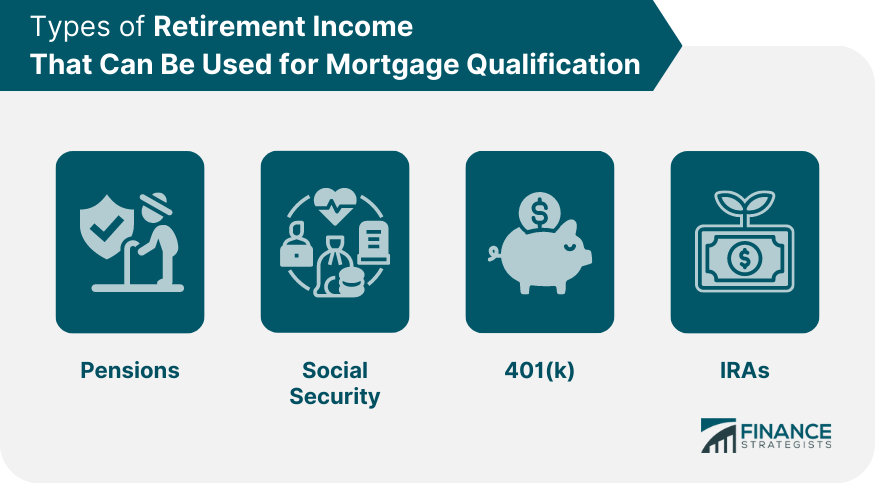

Types of Retirement Income That Can Be Used for Mortgage Qualification

Pensions

Social Security

401(k)

IRAs

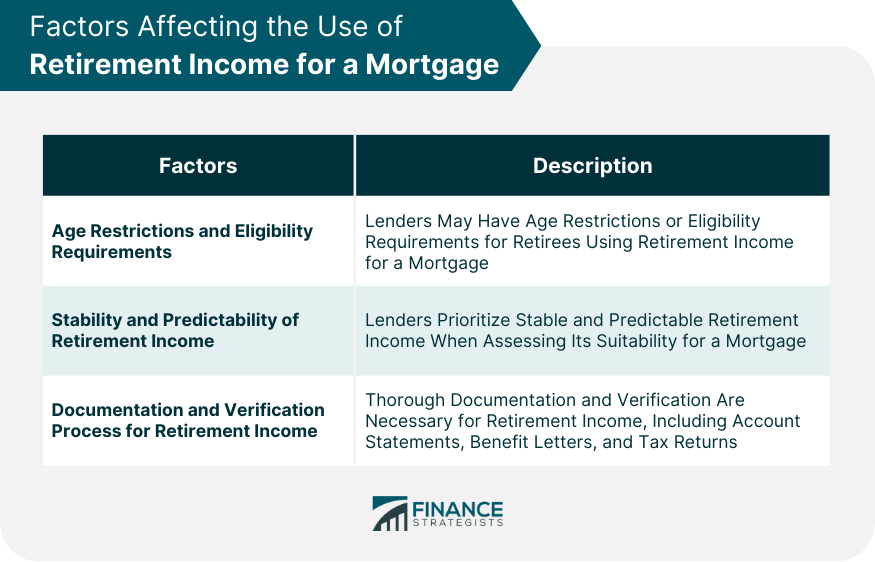

Factors Affecting the Use of Retirement Income for a Mortgage

Age Restrictions and Eligibility Requirements

Stability and Predictability of Retirement Income

Documentation and Verification Process for Retirement Income

How Lenders Evaluate Retirement Income for Mortgage Applications

Lenders’ Considerations and Criteria for Accepting Retirement Income

Tips to Strengthen Mortgage Approval With Retirement Income

Importance of Thorough Financial Planning and Preparation

Conclusion

Can Retirement Income Be Used to Get a Mortgage? FAQs

Yes, Social Security income can be used to qualify for a mortgage, provided it is stable and documented. Lenders will evaluate the consistency and longevity of the income when assessing the borrower's eligibility.

Yes, pension income is often considered a reliable source of income for mortgage qualification. Lenders may include a portion of the pension income in the borrower's overall income calculation.

Yes, distributions from retirement accounts can be used as qualifying income for a mortgage. However, lenders will assess the stability and duration of the distributions to ensure they can cover the mortgage payments.

Some lenders may have age restrictions when considering retirement income for mortgage qualification. Borrowers typically need to be of a certain age, typically 59½ or older, to utilize retirement income.

Documentation requirements vary among lenders, but generally, retirees will need to provide documentation such as retirement account statements, benefit award letters, and tax returns to verify the existence and consistency of their retirement income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.