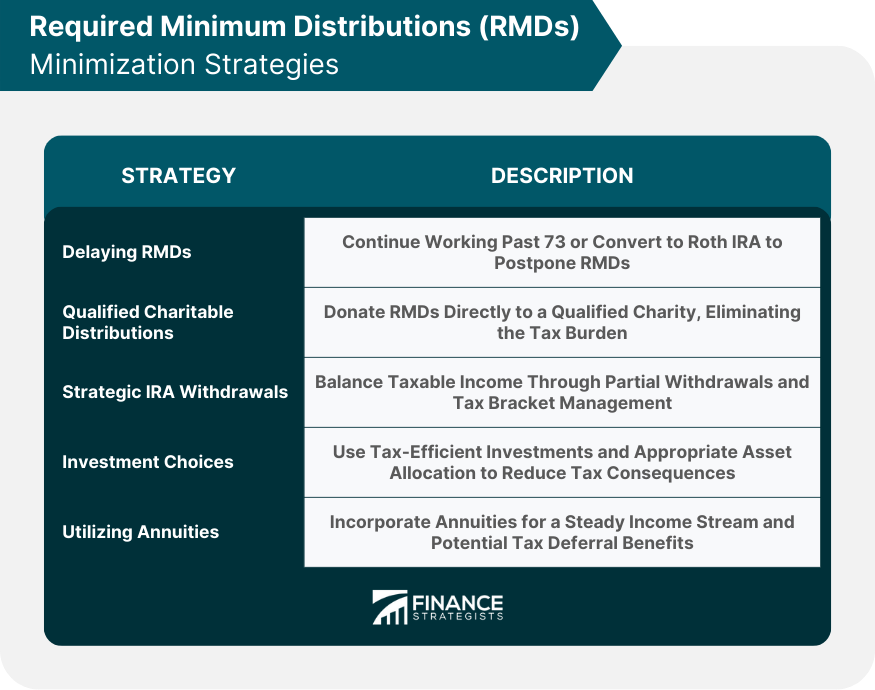

Required Minimum Distributions (RMDs) Minimization Strategies refer to a set of financial planning approaches aimed at managing the mandatory withdrawals from tax-deferred retirement accounts, such as 401(k)s and IRAs, for individuals aged 73 or older. These strategies aim to minimize tax liabilities, optimize retirement income, and ensure compliance with regulatory requirements while preserving the account holder's wealth and financial goals. Individuals who continue to work past the age of 73 and participate in their employer's retirement plan may be able to delay RMDs until they retire, provided they do not own more than 5% of the company. Converting a traditional IRA to a Roth IRA can help reduce RMDs since Roth IRAs do not require RMDs. However, this conversion will result in a taxable event, so it's essential to evaluate the potential tax consequences. QCDs allow individuals to donate their RMDs directly to a qualified charity, effectively eliminating the tax burden associated with the distribution. QCDs can be used to satisfy RMD requirements while supporting a charitable cause. To be eligible for a QCD, the account holder must be at least 70½ years old, and the distribution must be made directly to a qualified charity. The maximum QCD amount per year is $100,000 per individual. By strategically withdrawing from retirement accounts before reaching the age of 73, individuals can lower their future RMDs and balance their taxable income across multiple years. Managing withdrawals to stay within a specific tax bracket can help reduce the overall tax burden. This strategy requires careful planning and monitoring of annual income. Investing in tax-efficient assets, such as municipal bonds and index funds, can help reduce the tax burden on investment gains, which can ultimately lower RMDs. Strategically placing assets in tax-advantaged accounts, such as Roth IRAs, can help reduce RMDs and their associated tax consequences. Annuities can provide a steady stream of income during retirement, potentially reducing the need for RMDs. There are several types of annuities, including fixed, variable, and indexed annuities. Annuities can offer a guaranteed income stream and potential tax deferral benefits. However, they may also come with higher fees, surrender charges, and limited liquidity. It's essential to weigh the pros and cons before incorporating annuities into an RMD minimization strategy. RMDs apply to most retirement accounts, such as traditional IRAs, SEP IRAs, SIMPLE IRAs, and 401(k) plans. The age at which RMDs must begin is 73, though some individuals may choose to delay these distributions under certain circumstances. The RMD amount is calculated based on the account holder's life expectancy and the balance of their retirement accounts. The IRS provides life expectancy tables to assist in determining the appropriate RMD amount. RMDs are generally considered taxable income, which means they may increase an individual's tax burden. Failure to take the RMDs can result in a 50% penalty on the amount that should have been withdrawn. HSAs can be used to cover medical expenses in retirement, which can help reduce the need for RMDs. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. A 529 plan allows individuals to save for education expenses on a tax-advantaged basis. Withdrawals for qualified educational expenses are tax-free, which can help reduce RMDs if funds from retirement accounts would have otherwise been used for these costs. Roth IRAs provide tax-free withdrawals in retirement, which can help offset the taxable income generated by RMDs. Additionally, Roth IRAs do not require RMDs, making them an effective tool for RMD minimization. Inherited IRAs have their own RMD rules, which can impact beneficiaries' tax burdens. Non-spouse beneficiaries are generally required to withdraw the entire account balance within ten years, while spouses have more flexible options. Stretch IRAs allow beneficiaries to extend the distribution of inherited retirement accounts over their life expectancy, potentially reducing the tax burden. However, recent legislation has limited the availability of stretch IRAs for most non-spouse beneficiaries. Naming a trust as an IRA beneficiary can provide greater control over the distribution of assets, but it may also result in higher RMDs for certain trusts. It's essential to consult with an estate planning attorney to understand the implications of this strategy. Required Minimum Distributions Minimization Strategies are financial planning approaches aimed at managing mandatory withdrawals from tax-deferred retirement accounts for individuals aged 73 or older. These strategies aim to minimize tax liabilities, optimize retirement income, and ensure compliance with regulatory requirements while preserving the account holder's wealth and financial goals. Some RMD minimization strategies include delaying RMDs, utilizing qualified charitable distributions, strategic IRA withdrawals, investment choices, utilizing annuities, and leveraging tax-advantaged accounts. Estate planning considerations for RMD minimization strategies include inherited IRAs and RMDs, stretch IRAs, and trusts as IRA beneficiaries. By carefully considering and implementing these strategies, individuals can optimize their retirement income while minimizing their tax burden and ensuring compliance with regulatory requirements. Additionally, incorporating estate planning considerations and seeking professional assistance from financial advisors and tax professionals can help ensure that these strategies are tailored to individual circumstances and remain effective over time.What Are Required Minimum Distributions (RMDs) Strategies?

RMD Minimization Strategies

Delaying RMDs

Qualified Charitable Distributions (QCDs)

Strategic IRA Withdrawals

Investment Choices and Asset Allocation

Utilizing Annuities

Understanding RMD Rules and Regulations

RMD Eligibility and Age Requirements

Calculation of RMD Amounts

Tax Implications and Penalties

Leveraging Tax-Advantaged Accounts for RMD Minimization Strategies

Health Savings Accounts (HSAs)

529 Plans for Educational Expenses

Using Roth IRAs for Tax-Free Withdrawals

Estate Planning Considerations for RMD Minimization Strategies

Inherited IRAs and RMDs

Stretch IRAs and Their Impact on RMDs

Trusts as IRA Beneficiaries

The Bottom Line

Required Minimum Distributions (RMDs) Minimization Strategies FAQs

RMD minimization strategies aim to reduce the taxable income generated by Required Minimum Distributions (RMDs), helping retirees preserve their wealth, maintain financial security, and minimize their tax burden.

Roth IRA conversions can be an effective component of RMD minimization strategies because Roth IRAs do not require RMDs. Converting a traditional IRA to a Roth IRA can reduce future RMDs, though it's important to consider the potential tax consequences of the conversion itself.

QCDs are a powerful tool in RMD minimization strategies as they allow individuals to donate their RMDs directly to a qualified charity, eliminating the tax burden associated with the distribution. QCDs can satisfy RMD requirements while supporting charitable causes.

Tax-advantaged accounts, like HSAs and 529 plans, can help reduce the need for RMDs by providing alternative sources of tax-free income for medical and educational expenses, respectively. Using these accounts strategically can minimize RMDs and their associated tax implications.

A financial advisor can help individuals navigate complex RMD rules and develop tailored strategies for minimizing RMDs and tax burdens. Their expertise can ensure that retirement assets are optimized for long-term financial security and that RMD minimization strategies remain effective over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.