Individual Retirement Accounts (IRAs) are a foundational element in retirement planning for many Americans, offering tax-advantaged savings and a range of investment options. These accounts come in various types, such as Traditional, Roth, SEP, and SIMPLE IRAs, each tailored to different financial needs and retirement strategies. IRAs are particularly beneficial for long-term savings, as they allow earnings to grow tax-deferred or tax-free, depending on the type of account. This feature can significantly enhance the compounding of returns over time, making IRAs an attractive option for securing financial stability in retirement. Investing in gold within an IRA combines the growth potential of precious metals with the tax benefits of retirement accounts, offering a unique approach to diversification. This strategy can be particularly appealing to investors seeking stability in the face of volatile stock markets and uncertain economic conditions. Yes, it is indeed possible and permissible to buy gold in an IRA, subject to specific rules and regulations set forth by the IRS. These rules detail the types of gold products eligible for IRAs and the manner in which they should be stored and managed. Understanding and adhering to these guidelines is essential for anyone considering gold as a part of their retirement investment strategy, ensuring compliance with tax laws, and maximizing the benefits of IRA investments. Additionally, this option opens up opportunities for investors to diversify their retirement portfolios in a way that aligns with their risk tolerance and investment goals. The IRS has set forth specific guidelines for incorporating gold into IRAs, which include stipulations on the purity levels of gold products and the approved forms of gold, such as certain coins and bullions. These guidelines are designed to maintain the integrity of retirement investments and ensure that the gold held in IRAs meets the standards for investment quality. Additionally, the IRS mandates that such investments be held under the supervision of an approved custodian and stored in a secure, IRS-sanctioned depository, safeguarding the investor's assets and ensuring compliance with federal regulations. Adhering to these guidelines is crucial for investors to benefit from the tax advantages of gold IRAs and avoid potential penalties. Self-directed IRAs allow for a broad range of investment choices, including gold, real estate, and other alternative assets. This type of IRA is ideal for investors who seek more control and diversification in their retirement portfolio. Traditional self-directed IRAs offer tax-deferred growth, meaning taxes on gold investments are not paid until withdrawals are made, typically in retirement. This can be beneficial for those who expect to be in a lower tax bracket in the future. Roth self-directed IRAs allow for tax-free growth and withdrawals, making them suitable for investors who anticipate higher tax rates in the future or prefer tax-free distributions in retirement. Gold investments in a Roth IRA can grow and be withdrawn tax-free. SEP IRAs, ideal for self-employed individuals and small business owners, offer higher contribution limits and flexible contributions. This type of IRA is advantageous for those who want to invest significantly in gold and other assets, given their potentially higher earnings and need for increased retirement savings. Physical gold in IRAs typically includes bullion bars and certain types of coins that meet the IRS's standards for fineness. Investing in physical gold offers the tangible assurance of holding a real asset, which can be particularly comforting during times of economic uncertainty. This form of investment appeals to those who value the intrinsic and historical significance of gold. Moreover, owning physical gold can provide a sense of security and tangibility that is not found in paper assets, making it a preferred choice for many conservative investors. Gold Exchange-Traded Funds (ETFs) provide an alternative means of investing in gold within an IRA. These funds hold physical gold but are traded on stock exchanges like regular stocks, offering ease of trading and exposure to gold price movements without the need for physical possession. Gold ETFs are an attractive option for investors seeking the benefits of gold investment coupled with the liquidity and convenience of stock trading. Additionally, they allow for smaller investment increments and more flexibility in managing investment exposure to gold, catering to a broader range of investment strategies and risk appetites. Gold mutual funds offer investment in gold-related companies, such as mining firms, rather than direct investment in physical gold. While these funds do not offer direct exposure to gold prices, they provide a way to invest in the broader gold industry. This can include exposure to gold miners, processors, and other companies involved in the gold sector. Gold mutual funds can offer diversification within the gold investment segment and may respond differently to market conditions than physical gold, providing an additional layer of investment strategy for those interested in the gold market. Comparing physical gold, ETFs, and mutual funds reveals significant differences in liquidity, exposure to gold prices, and investment management style. Physical gold offers the security of direct ownership, but it lacks the liquidity and ease of trading associated with ETFs and mutual funds. ETFs and mutual funds, on the other hand, provide more flexibility and diversification, along with the ease of integrating into a broader investment portfolio. Each type of gold investment has its own set of benefits and considerations, making it important for investors to evaluate their individual investment goals and risk tolerance when deciding how to include gold in their IRAs. The IRS enforces specific quality standards for gold in IRAs to ensure that only high-purity gold is included. These standards include a minimum purity level of 99.5% for gold bullion and a list of approved gold coin designs. These regulations are designed to maintain the investment quality of gold within IRAs and provide a consistent benchmark for eligible gold assets. This emphasis on quality helps protect investors from lower-grade gold investments and ensures that the gold held in IRAs is of a standard recognized globally for investment purposes. The requirement to store IRA gold in a secure, IRS-approved depository is a critical aspect of gold IRA investments. This rule is intended to ensure the safety, security, and proper accounting of gold assets, preventing misuse and fraud. Investors are not permitted to store IRA gold at home or on personal safes, as this could lead to potential tax violations and security risks. The use of approved depositories ensures that gold investments are kept in a secure environment, with professional oversight and insurance coverage, providing peace of mind and compliance with IRS regulations. Gold IRAs must be managed by an IRS-approved custodian responsible for overseeing the purchase, sale, and storage of gold assets. These custodians are typically financial institutions, such as banks or trust companies, that have the necessary expertise and authorization to handle precious metals investments. They play a crucial role in ensuring compliance with IRS rules and providing administrative support, including record-keeping and tax reporting. Choosing a reliable and experienced custodian is a key decision for any investor setting up a gold IRA, as it can greatly impact the ease of management and overall success of the investment. Selecting the appropriate type of IRA is a critical first step in setting up a gold IRA. The choice between a Traditional or Roth IRA depends on individual tax circumstances and retirement planning goals. Traditional IRAs offer tax-deferred growth, potentially providing tax benefits at the time of contribution, while Roth IRAs offer tax-free growth and withdrawals, which can be advantageous for those expecting higher tax rates in retirement. Each type has its eligibility criteria and contribution limits, making it important for investors to understand the differences and choose the IRA that best aligns with their financial situation and long-term retirement objectives. Finding a reputable and IRS-approved custodian is essential for the successful management of a gold IRA. This custodian will handle the administrative and operational aspects of the gold IRA, including facilitating the purchase of gold and ensuring its proper storage and management. The choice of custodian should be based on their experience, reliability, and the range of services they offer, as well as their fees and customer service quality. A trustworthy custodian not only ensures compliance with IRS regulations but also provides valuable guidance and support throughout the investment process. Funding the gold IRA is a key step in the setup process, and it can be achieved through direct contributions, rollovers from other retirement accounts, or transfers from existing IRAs. It's important to be aware of the annual contribution limits set by the IRS, as well as the rules governing rollovers and transfers, to maximize the tax advantages and growth potential of the IRA. Strategic funding of the gold IRA, aligned with broader retirement planning and financial goals, can enhance the long-term benefits of the investment. Once the IRA is funded, the next step is to select and purchase gold assets that meet IRS standards. This involves choosing from approved gold coins, bullions, or other eligible gold products. The custodian typically facilitates this process, working with accredited dealers to ensure the gold purchased is of the required purity and quality. This step is crucial, as the right selection of gold assets can impact the performance and security of the gold IRA investment. Arranging for the secure storage of gold assets in an IRS-approved depository is the final step in setting up a gold IRA. This involves coordinating with the custodian to select a depository that offers the necessary security features, insurance coverage, and compliance with IRS regulations. The choice of depository can affect the safety and accessibility of the gold investment, making it an important consideration for any gold IRA investor. Proper storage ensures that the gold is protected against theft, loss, and damage while also maintaining its eligibility as an IRA investment. The custodian's role in this process includes negotiating storage fees, ensuring proper handling of the gold, and providing regular account statements that reflect the storage and valuation of the gold assets. This safeguarding of physical gold is a unique aspect of gold IRAs, distinguishing them from other types of IRA investments. Diversification is a key advantage of including gold in an IRA. Gold's price movements often differ from those of stocks and bonds, providing a counterbalance during market downturns or periods of high volatility. This diversification can reduce the overall risk in a retirement portfolio, potentially leading to more stable long-term returns. For investors seeking a balanced investment approach, gold can play a strategic role in spreading risk and protecting against market uncertainties. Gold has traditionally served as an effective hedge against inflation, maintaining its value even as the purchasing power of paper currencies declines. In times of high inflation, gold can preserve wealth and safeguard the purchasing power of retirement savings. This characteristic makes gold a prudent choice for those concerned about the long-term effects of inflation on their retirement funds, offering a form of financial insurance against eroding currency values. Gold has the potential for significant growth, particularly in response to certain economic and geopolitical events. Its price can appreciate during periods of economic distress, currency devaluation, or geopolitical tensions, adding a growth component to retirement portfolios. While past performance is not a guarantee of future results, gold's history of appreciation under certain conditions makes it an attractive option for those looking to capitalize on potential market opportunities. Owning a tangible asset like gold can be psychologically reassuring for investors, offering a sense of physical security and stability. Unlike digital or paper assets, physical gold cannot be erased or devalued by technological failures or market collapses. This tangibility can be especially appealing in an increasingly digital and volatile financial world, providing a concrete representation of wealth and investment. While gold can be a stable store of value over the long term, its price can be quite volatile in the short term. This volatility is influenced by a variety of factors, including global economic conditions, interest rates, and currency fluctuations. For retirement investors, this volatility can introduce an element of risk and uncertainty, particularly for those nearing retirement age who may have less time to recover from price swings. The costs associated with storing and insuring physical gold can be a significant disadvantage of gold IRAs. These costs include fees for secure storage in an IRS-approved depository and insurance to protect against loss or theft. These ongoing expenses can erode the net returns from gold investments, making it important for investors to carefully consider the total cost of owning gold in an IRA. Gold does not produce income in the form of dividends or interest, unlike other investment assets such as stocks or bonds. This lack of yield means that gold does not contribute to cash flow or income generation within a retirement portfolio. For investors seeking regular income or yield from their investments, this can be a notable drawback of including gold in their IRA. Liquidating physical gold can be more complex and time-consuming compared to selling stocks or bonds. The process may involve finding a buyer, negotiating a price, and physically transferring the gold, which can incur additional costs and delays. These challenges can impact the liquidity and flexibility of a gold IRA, particularly for investors who may need quick access to their funds in an emergency or for unexpected expenses. When choosing a gold IRA provider, key criteria include the provider's experience, fees, range of services, and customer support quality. Investors should look for providers with a strong track record in managing gold IRAs, transparent fee structures, and a comprehensive range of services, including purchasing, storing, and managing gold investments. Additionally, responsive and knowledgeable customer support is essential for navigating the complexities of gold IRA investments. Conducting thorough due diligence is crucial when selecting a gold IRA provider. This process should involve researching the provider's history, understanding their fee structure, and reading reviews from other customers. Investors should also consult with financial advisors to assess the provider's reputation and compliance with regulatory standards. Due diligence helps investors avoid scams and choose a provider that aligns with their investment goals and values. Comparing different gold IRA providers can highlight differences in their services, fees, and investment options. This comparison should consider factors such as the provider's expertise in gold IRAs, the range of gold products offered, and their storage and custodial arrangements. By thoroughly comparing providers, investors can find a partner that offers the right combination of expertise, reliability, and value, ensuring a successful and satisfying gold IRA experience. Gold IRAs offer a unique and strategic avenue for diversifying retirement portfolios, providing a hedge against inflation, and potentially capitalizing on the growth of gold. While they come with their own set of challenges, such as volatility, storage costs, and liquidation complexities, the benefits of including gold in a retirement plan can be significant, especially for those looking for a tangible asset in an increasingly digital financial landscape. However, navigating the complexities of gold IRAs requires careful planning, a thorough understanding of IRS regulations, and a partnership with a reliable custodian. For those considering this investment route, it’s imperative to engage in comprehensive research and consult with experienced retirement planning services. A professional advisor can offer personalized guidance, helping to tailor a retirement strategy that aligns with individual financial goals and risk tolerance. Take the next step in your retirement planning journey by seeking expert advice and exploring the potential of gold in your IRA portfolio.Overview of Individual Retirement Accounts (IRAs)

Can You Buy Gold in an IRA?

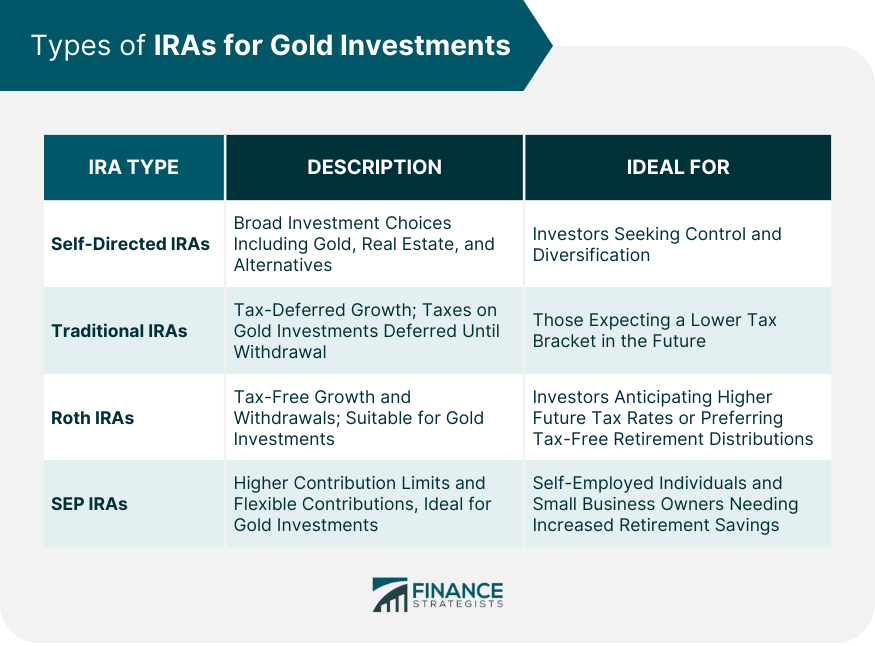

Types of IRAs for Gold Investments

Self-Directed IRAs

Traditional IRAs

Roth IRAs

SEP IRAs

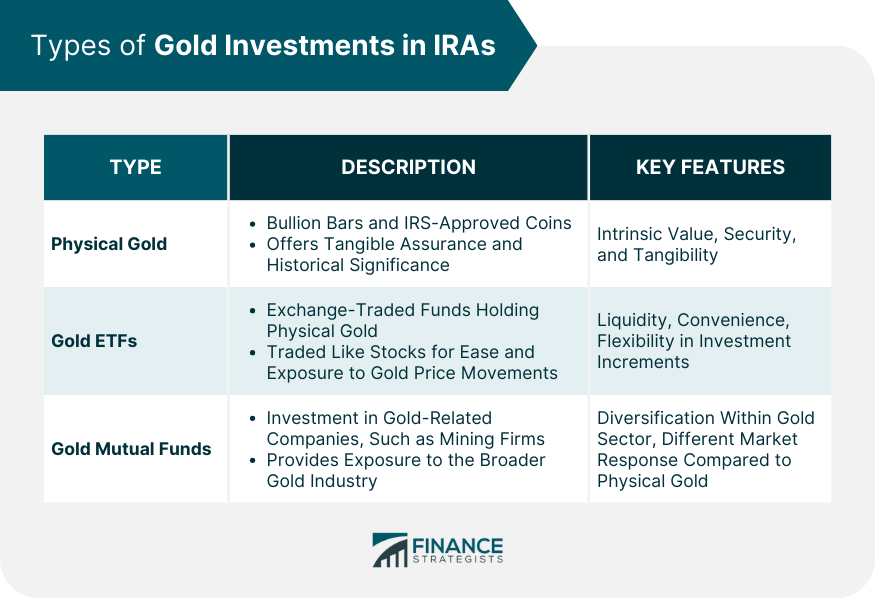

Types of Gold Investments in IRAs

Physical Gold

Gold ETFs

Gold Mutual Funds

Comparison of Gold Investments

Requirements and Restrictions for Gold IRAs

Quality Standards for Gold

Storage Requirements

Custodian Requirements

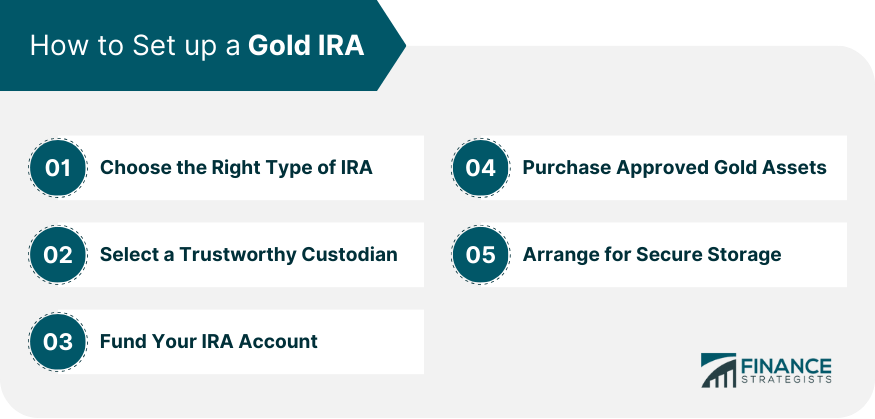

How to Set up a Gold IRA

Choose the Right Type of IRA

Select a Trustworthy Custodian

Fund Your IRA Account

Purchase Approved Gold Assets

Arrange for Secure Storage

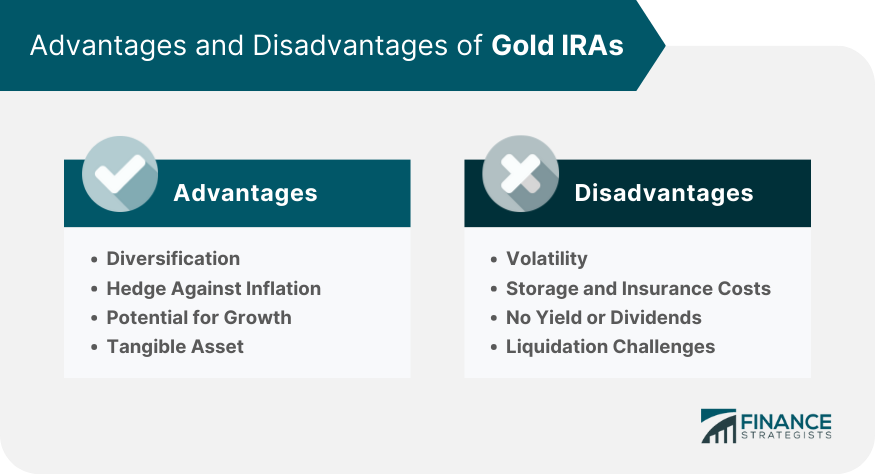

Advantages of Gold IRAs

Diversification

Hedge Against Inflation

Potential for Growth

Tangible Asset

Disadvantages of Gold IRAs

Volatility

Storage and Insurance Costs

No Yield or Dividends

Liquidation Challenges

How to Choose a Gold IRA Provider

Criteria for Selecting a Provider

Tips for Due Diligence

Comparison of Providers

Final Thoughts

Can You Buy Gold in an IRA? FAQs

Yes, you can include gold in your IRA investment portfolio, following specific IRS guidelines regarding the types of gold allowed and storage requirements.

In an IRA, you can invest in physical gold, such as bullion and certain coins, as well as gold ETFs and mutual funds, all of which must meet IRS purity standards.

Yes, gold in an IRA must be stored in an IRS-approved depository, ensuring safety and compliance with federal regulations.

Purchase approved gold assets and arrange for secure storage to set up a gold IRA, choose the right type of IRA, select a trustworthy custodian, and fund your account.

Gold IRAs offer advantages like diversification and inflation hedging but also have disadvantages such as volatility and storage costs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.