The 401(k) Plan Restatement Cycle refers to a required periodic review and updating of a 401(k) retirement plan's document. It is part of an ongoing compliance process regulated by the Internal Revenue Service (IRS) and the Department of Labor (DOL) to ensure plans adhere to changing federal laws and regulations. Every six years, the IRS opens a window for restatement—this period is known as a "cycle." During this cycle, plan sponsors must update or "restate" their plans to incorporate any legal or regulatory changes that have occurred. These changes are typically related to the plan's operation, contributions, distributions, and other provisions. The purpose of the 401(k) Plan Restatement Cycle is to ensure compliance with regulations, update plan documents, enhance plan efficiency, and mitigate legal and financial risks associated with 401(k) plans. The restatement cycle operates as a regular process where 401(k) plan sponsors must review, update, and resubmit their plan documents to the IRS. This cycle ensures that the plan document remains compliant with the current federal tax laws and any changes that may have been made. The cycle starts when the IRS issues a Cumulative List of Changes in Plan Qualification Requirements. Plan sponsors, with the help of legal advisors or plan administrators, must then review their current plan document and make necessary amendments to meet the new requirements. Once the amendments are made, the restated plan document is submitted to the IRS for approval. The restatement period for a 401(k) plan is usually a six-year cycle, determined by the IRS. However, the specific start and end dates for a cycle depend on various factors, such as the type of plan and its last restatement date. The IRS issues notifications, typically through its official bulletins, to inform plan sponsors about the commencement of a new restatement cycle. Sponsors should keep track of these notifications to ensure timely compliance with the restatement requirements. The process of restatement involves a thorough review of the 401(k) plan document. This review is to identify any necessary updates or modifications based on changes in laws or regulations or plan operations. Often, this review is conducted with the assistance of legal counsel or a plan administrator. The goal is to ensure the restated plan aligns with current laws, regulations, and operational practices and continues to meet the needs and objectives of the employer and plan participants. In addition to updating the plan document, the restatement process may also involve compliance testing. The testing ensures the plan's provisions meet specific nondiscrimination requirements and other regulatory standards. If any compliance issues are identified during testing, corrections must be made. This might involve modifying certain plan provisions, making additional contributions, or taking other remedial actions to ensure the plan's compliance with regulatory requirements. Once the 401(k) plan document is updated and compliance tests are passed, the restated plan document must be submitted to the IRS for review and approval. The IRS reviews the plan to ensure it meets the current qualification requirements under the Internal Revenue Code. After submitting the plan, sponsors must wait for an IRS Determination Letter, which officially approves the restated plan. This letter provides assurance that the plan is compliant with tax laws and is a critical document that should be kept in the plan's records. Each restatement cycle comes with a specific deadline by which the restated plan document must be submitted to the IRS. It's crucial for plan sponsors to be aware of and adhere to this deadline to avoid potential penalties or the disqualification of the plan. If a plan sponsor fails to restate their plan by the deadline, the plan may lose its tax-qualified status. This could result in significant tax consequences for both the employer and plan participants. By requiring regular restatement, the IRS and DOL provide a mechanism for plans to adapt to legal and regulatory changes, thereby maintaining their tax-qualified status. Compliance with these rules is critical. It enables the plan sponsor and participants to continue receiving the tax advantages associated with 401(k) plans, such as tax-deferred contributions and earnings. The restatement process also provides an opportunity to review and enhance the plan's design and operational efficiency. As plan sponsors review the plan document, they can identify areas for improvement or adjustment based on their organization's needs, industry trends, or participant feedback. For instance, plan sponsors might choose to add a Roth 401(k) option, auto-enrollment feature, or loan provisions during the restatement process. These enhancements can improve participant satisfaction and engagement, contributing to the plan's overall success. Restating a 401(k) plan can help mitigate legal and financial risks. By regularly reviewing and updating the plan document, plan sponsors can identify and address potential compliance issues before they become significant problems. A proactive approach to plan restatement can prevent costly IRS penalties, protect the plan's tax-qualified status, and reduce the risk of lawsuits related to plan management or fiduciary responsibilities. In addition, it can provide peace of mind to plan sponsors, knowing their plan is compliant with the latest laws and regulations. One of the main challenges in the 401(k) plan restatement cycle is dealing with the complexities of plan documents and legal language. These documents are often dense and filled with technical terms, making them difficult for non-experts to understand and navigate. Without a clear understanding of the plan document and the laws it must comply with, plan sponsors might overlook necessary updates or make mistakes in the restatement process. This highlights the importance of working with knowledgeable advisors or administrators during the restatement process. Restating a 401(k) plan can be a time-consuming process, requiring careful review of the plan document, tracking of regulatory changes, and coordination with various stakeholders. For many small businesses, this can pose a significant challenge due to limited resources and competing priorities. These constraints can result in delays or oversights, potentially jeopardizing the plan's compliance and the timely submission of the restated plan document. To overcome these challenges, plan sponsors often rely on external service providers or dedicated internal teams to manage the restatement process. Plan sponsors need to communicate with these stakeholders about the restatement process, any changes to the plan, and their implications. This coordination can be complex and delicate, as it involves explaining technical changes in an accessible way and managing participant expectations. The challenge is to ensure transparency and engagement without causing unnecessary confusion or concern among participants. One best practice for a successful 401(k) plan restatement cycle is proactive monitoring and tracking of regulatory changes. By staying abreast of changes in laws and regulations, plan sponsors can ensure timely and accurate updates to the plan document. This can involve subscribing to regulatory bulletins, participating in industry seminars or webinars, or working with professional advisors who specialize in 401(k) plan compliance. With this proactive approach, plan sponsors can anticipate necessary changes and manage the restatement process more effectively. These professionals can provide expert guidance on complex legal language, compliance requirements, and the implications of different plan provisions. In addition to helping with the restatement process, legal and tax advisors can assist with ongoing plan management, compliance testing, and other aspects of 401(k) plan administration. Their expertise can be invaluable in ensuring a smooth and successful restatement cycle. Effective communication with plan stakeholders—such as administrators, employees, and participants—is also crucial for a successful restatement cycle. Clear and regular communication can keep these stakeholders informed about the restatement process and any changes to the plan. This communication should be tailored to the audience, with technical details explained in an accessible way. By maintaining open lines of communication, plan sponsors can promote transparency, build trust, and ensure the smooth implementation of any plan changes. The 401(k) Plan Restatement Cycle refers to the periodic review and update of a 401(k) retirement plan's document to comply with federal laws. The purpose of the restatement cycle is to ensure that 401(k) plans adhere to changing federal laws and regulations, thereby maintaining their tax-qualified status. It ensures tax-qualified status and involves incorporating legal and regulatory changes related to plan operations, contributions, and distributions. Compliance testing verifies adherence to non-discrimination requirements. The updated plan document is submitted to the IRS for approval. The restatement cycle enhances compliance, plan efficiency, and mitigates legal and financial risks. It allows plan sponsors to adapt to regulations, improve plan design, and communicate effectively with stakeholders.What Is a 401(k) Plan Restatement Cycle?

How Does 401(k) Plan Restatement Cycle Work

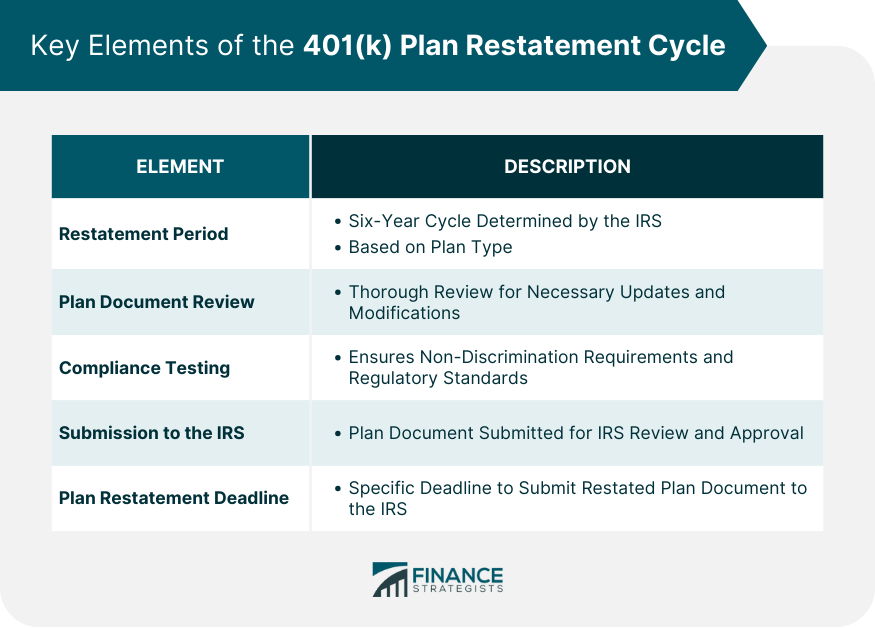

Key Elements of the 401(k) Plan Restatement Cycle

Restatement Period

Plan Document Review and Updates

Compliance Testing and Corrections

Submission to the Internal Revenue Service (IRS)

Plan Restatement Deadline

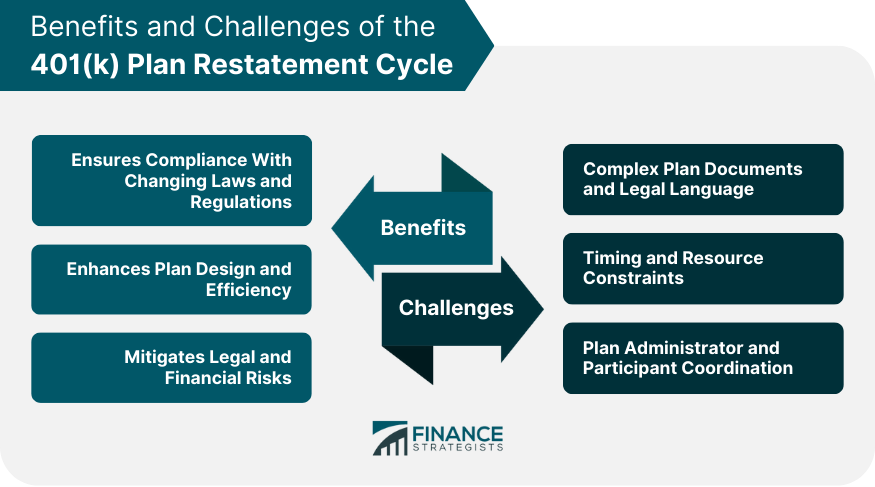

Benefits of the 401(k) Plan Restatement Cycle

Ensures Compliance With Changing Laws and Regulations

Enhances Plan Design and Efficiency

Mitigates Legal and Financial Risks

Challenges in the 401(k) Plan Restatement Cycle

Complex Plan Documents and Legal Language

Timing and Resource Constraints

Plan Administrator and Participant Coordination

Best Practices for a 401(k) Plan Restatement Cycle

Monitor and Track Regulatory Changes

Collaborate With Legal and Tax Advisors

Communicate With Plan Stakeholders

Conclusion

401(k) Plan Restatement Cycle FAQs

The 401(k) plan restatement cycle serves to ensure that a 401(k) plan remains compliant with changing federal laws and regulations. This is accomplished by periodically reviewing and updating the plan document to incorporate any necessary changes.

Typically, the IRS requires a 401(k) plan to be restated every six years. However, interim amendments may be necessary between restatement cycles if there are significant changes in laws or regulations.

If a plan is not restated by the deadline set by the IRS, it may lose its tax-qualified status. This can result in significant tax consequences for the plan sponsor and the plan participants.

The plan sponsor, usually the employer, is responsible for restating the 401(k) plan. However, the plan sponsor often works with legal counsel, plan administrators, or other advisors to navigate the restatement process.

During the restatement process, plan sponsors can make updates to comply with new laws or regulations, adjust to changes in plan operations, or enhance plan design based on the needs and objectives of the organization and plan participants. Changes could include adding new contribution options, modifying distribution rules, or introducing new plan features.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.