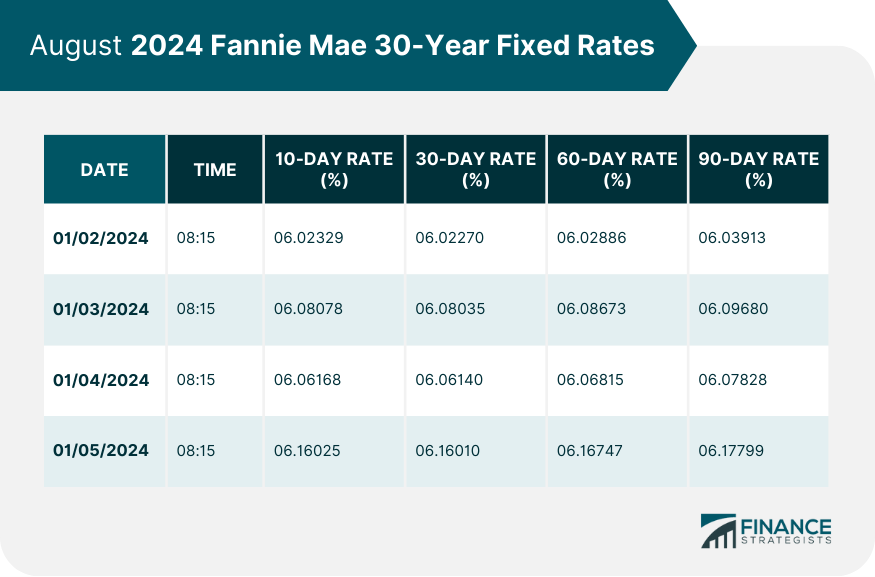

Mortgage rates, expressed as annual percentages, represent the cost of borrowing money for home purchase. These rates, driven by complex factors like inflation, economic growth, and bond market changes, are integral to the cost of mortgages and monthly payments. Understanding these variables is critical for prospective home buyers. Fannie Mae, or the Federal National Mortgage Association, is a government-sponsored enterprise. Its role is to stimulate the housing market and enhance homeownership and rental housing affordability. Rather than directly issuing mortgages to consumers, Fannie Mae purchases and guarantees mortgages from lenders, offering them the liquidity necessary to fund more mortgages and foster a healthy housing market. Fannie Mae Mortgage Rate refers to the interest rates of the mortgages that Fannie Mae buys or guarantees. These rates directly influence the cost of borrowing for homebuyers, impacting their mortgage payments and the overall affordability of homeownership. Fannie Mae's mortgage rates are not set in a vacuum. Instead, they're part of a large and fluid financial ecosystem, which consists of various moving parts, all interlinked. The next section will discuss some of the key factors that influence these rates. Like other interest rates, Fannie Mae mortgage rates are affected by broader economic conditions and market trends. The health of the economy, including aspects such as unemployment rates, GDP growth, and inflation, all play a role. A robust economy, for example, often leads to higher mortgage rates, as an increase in home buying pressure leads to inflation. Conversely, during economic downturns, rates may fall as monetary authorities take measures to stimulate economic activity. Federal Reserve policies can indirectly influence Fannie Mae mortgage rates. The Federal Reserve sets short-term interest rates, impacting borrowing costs throughout the economy. A rise in these rates often leads to an increase in mortgage rates, while a decline has the opposite effect. However, it's essential to note that the Fed does not directly set mortgage rates. Still, its monetary policy actions exert significant influence on the direction mortgage rates move. The health of the housing market also impacts Fannie Mae mortgage rates. A strong housing market can lead to higher rates as demand for mortgages increases. Conversely, a weak housing market can lead to lower rates as lenders compete for a smaller pool of borrowers. The state of the housing market can be affected by numerous factors, including economic conditions, demographic trends, and changes in housing policies. Lastly, Fannie Mae's financial health and its strategy also affect its mortgage rates. If Fannie Mae's financial condition is robust, and it's able to attract plenty of capital from investors, it can afford to offer more competitive, i.e., lower, mortgage rates. Conversely, if Fannie Mae's finances are under strain, it might need to raise the rates it offers. Moreover, Fannie Mae's strategic decisions, like changes to its loan purchasing or guarantee policies, can also influence the mortgage rates it offers. These decisions could be influenced by various factors, including regulatory changes, shifts in the housing market, or alterations in the wider economic environment. The Fannie Mae 30-Year Fixed Rates, offer a nuanced view of the mortgage rate environment during this time. The rates, which are fixed for the entire loan term, help us understand the underlying trends in the market. Here's a detailed representation of the data: Source: Fannie Mae The data illustrates a clear trend in rates across all four categories from January 2 to January 5. This increase suggests a market expectation of rising borrowing costs. For potential borrowers, these trends are informative, allowing them to strategize when to lock in their mortgage rate to obtain the most favorable conditions. These rates – 10-day, 30-day, 60-day, and 90-day – represent the averages of the fixed mortgage rates offered by lenders over these periods. It's essential to comprehend the implications of these varying timeframes. A 10-day rate is often utilized by lenders to provide rate locks on their quotes to borrowers, while 30-day, 60-day, and 90-day rates provide a broader perspective on the market trends. The trend of these rates moving upward in the 30-90 day range may suggest a trend of increasing mortgage rates in the broader market. The rates on Fannie Mae 30-year fixed-rate mortgages, or any mortgage rates for that matter, directly impact borrowers. These rates define the interest that a borrower will pay over the life of the loan. Higher rates increase the cost of borrowing, leading to larger monthly payments and a higher overall cost of homeownership. Conversely, lower rates can make homeownership more affordable. These rates also influence whether potential homeowners choose to enter the market or opt to wait for more favorable conditions. Freddie Mac, like Fannie Mae, is a government-sponsored enterprise that operates in the secondary mortgage market. While both institutions serve similar purposes, their rates can diverge due to various factors such as their respective financial health and the characteristics of the loans they purchase. While it is beyond the scope of this article to provide an exact comparison, it's safe to say that potential borrowers should consider rates from both Fannie Mae and Freddie Mac, as well as other sources, when shopping for a mortgage. In comparison to standard bank mortgage rates, Fannie Mae's rates might often appear more competitive. Banks fund mortgages from their deposits, and they often face higher costs than Fannie Mae, which can fund its mortgages from the large capital markets at potentially lower costs. However, it's crucial for borrowers to note that the rates offered by banks can be influenced by numerous factors, including the bank's funding costs, its business strategy, and the borrower's relationship with the bank. Therefore, it is advisable to compare rates from various sources before making a decision. FHA (Federal Housing Administration) and VA (Veterans Affairs) loans are government-insured mortgages with typically lower credit scores and down payment requirements. These types of loans often have rates that are competitive with Fannie Mae's rates. However, the overall cost of these loans to borrowers can also include other factors, like mortgage insurance premiums for FHA loans, which should be considered in addition to the mortgage rate when comparing different loan options. The first tangible impact of Fannie Mae mortgage rates on home buyers is the influence on monthly payments. The rate on your mortgage directly determines the amount of interest you'll pay over the life of the loan, which is then broken down into monthly payments. A lower rate means less interest paid and, consequently, a lower monthly payment. Conversely, a higher mortgage rate translates to higher monthly payments, assuming all other factors remain equal. This can significantly impact a home buyer's budget and their ability to afford a home. The impact of mortgage rates extends beyond monthly payments. Over the long term, even a small difference in rates can add up to a significant amount. A higher rate could result in tens of thousands of dollars in extra interest over the life of a mortgage. In contrast, securing a lower rate can save homeowners a substantial amount over time, making homeownership more affordable in the long run. For this reason, it's essential for potential buyers to consider not only what they can afford now, but also the long-term implications of their mortgage rate. Mortgage rates also directly affect a potential home buyer's purchasing power. In a nutshell, your purchasing power is the price of the home you can afford based on your available income and the prevailing mortgage rate. When rates are lower, you can afford a more expensive home for the same monthly payment. Conversely, when rates rise, your buying power decreases, and you may need to look at less expensive homes to keep your payment affordable. Hence, fluctuations in Fannie Mae mortgage rates can significantly impact home affordability. The first step to qualify for a Fannie Mae mortgage involves meeting certain financial requirements. These requirements ensure that you can afford the mortgage payments and typically include a maximum debt-to-income ratio and a minimum down payment. The debt-to-income ratio compares your monthly income to your monthly debt payments, and a lower ratio is preferred. The minimum down payment requirement varies based on the type of mortgage, but a common requirement is a down payment of at least 3%. Credit requirements are another crucial aspect of qualifying for a Fannie Mae mortgage. A good credit score and clean credit history can increase your chances of approval and secure a lower interest rate. Fannie Mae generally requires a minimum credit score of 620 for its mortgages. However, borrowers with higher scores are more likely to receive lower interest rates. Other aspects of your credit history, such as your record of repaying debts and the amount of credit you're currently using, can also affect your eligibility and rate. Aside from financial and credit prerequisites, potential borrowers must satisfy other important eligibility factors to qualify for a Fannie Mae mortgage: Property's Intended Use: The property must serve as your primary residence, a second home, or an investment property. Property Condition: The condition of the property in question must meet certain standards set by Fannie Mae. Legal Status: Applicants must either be a legal U.S. resident or a permanent resident alien. Securing eligibility based on these criteria is a significant step towards acquiring a Fannie Mae mortgage. This not only opens up the possibility of obtaining lower rates but also allows access to the unique advantages that these mortgages can offer. Having a good credit score is a key strategy to secure the best Fannie Mae mortgage rates. A high credit score signals to lenders that you're a reliable borrower, which could help you secure a lower interest rate. Your credit score is influenced by several factors, including your payment history, the amount of debt you owe, the length of your credit history, and your mix of credit types. Regularly reviewing your credit report, making timely payments, keeping your credit utilization low, and maintaining a mix of credit can help improve your score over time. Another strategy to secure a favorable rate is to lower your loan-to-value (LTV) ratio. This ratio measures the relationship between the loan amount and the property's appraised value. A lower LTV generally leads to a lower interest rate. You can lower your LTV ratio by making a larger down payment, which reduces the amount you need to borrow. Alternatively, if you're refinancing, you could opt for a cash-in refinance, where you bring money to the closing to pay down your loan balance. Finally, understanding and effectively using rate locks can be an essential strategy for securing a good rate. A rate lock allows you to lock in a specific interest rate for a certain period, typically between 30 and 60 days. Rate locks can be particularly useful in a rising interest rate environment, as they can protect you from rate increases while you finalize your mortgage application. However, rate locks can also come with fees, and if rates fall, you might miss out on the opportunity to secure a lower rate. Fannie Mae's role in buying and guaranteeing mortgages greatly influences homebuyer affordability and market trends. Understanding the multiple elements shaping Fannie Mae mortgage rates, from economic health to market conditions, is crucial for potential homeowners. The upward trend of rates, as illustrated by the 10-day, 30-day, 60-day, and 90-day averages, suggests a future rise in borrowing costs. This information helps borrowers strategize the best time to secure their mortgage rates. Moreover, rates significantly impact long-term homeownership costs and buying power. As such, securing lower rates can lead to substantial savings, making homeownership more affordable in the long run. Conversely, higher rates increase monthly payments and overall homeownership costs, reducing purchasing power. Prospective buyers must, therefore, consider both their present affordability and the long-term implications of their mortgage rate, in addition to meeting Fannie Mae's eligibility criteria and strategizing to secure the best mortgage rates.Overview of Fannie Mae and Mortgage Rates

Understanding Fannie Mae Mortgage Rates

Definition of Fannie Mae Mortgage Rate

Factors Influencing Fannie Mae Mortgage Rates

Economic Conditions and Market Trends

Federal Reserve Policies

State of the Housing Market

Fannie Mae's Financial Health and Strategy

Analyzing Current Fannie Mae Mortgage Rates

Overview of January 2024 Fannie Mae 30-Year Fixed Rates

Explanation of 10-day, 30-day, 60-day, and 90-day Rates

Implications of These Rates for Borrowers

How Fannie Mae Mortgage Rates Compare to Other Rates

Comparison With Freddie Mac Mortgage Rates

Comparison With Standard Bank Mortgage Rates

Comparison With FHA and VA Mortgage Rates

Impact of Fannie Mae Mortgage Rates on Home Buyers

Effect on Monthly Payments

Effect on Long-Term Cost of Home Ownership

How Fannie Mae Mortgage Rates Influence Buying Power

How to Qualify for a Fannie Mae Mortgage

Financial Requirements

Credit Requirements

Other Key Eligibility Criteria

Strategies to Secure the Best Fannie Mae Mortgage Rates

Maintain a Good Credit Score

Lower Loan-To-Value Ratio

Understand Rate Locks

Bottom Line

Fannie Mae Mortgage Rate FAQs

Fannie Mae mortgage rates are influenced by economic conditions, market trends, Federal Reserve policies, the state of the housing market, and Fannie Mae's financial health and strategy.

Fannie Mae mortgage rates directly impact a home buyer's monthly payments, long-term cost of home ownership, and buying power.

Fannie Mae mortgage rates can be competitive compared to Freddie Mac, standard bank, FHA, and VA mortgage rates. However, several factors can cause these rates to vary.

To qualify for a Fannie Mae mortgage, one must meet financial requirements, credit requirements, and other eligibility criteria such as property use and legal residency status.

Strategies to secure the best rates include maintaining a good credit score, lowering the loan-to-value ratio, and understanding how to use rate locks effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.