The housing market bubble burst, leading to an unprecedented crisis that affected Fannie Mae and Freddie Mac. As key players in the U.S. mortgage market, these Government-Sponsored Enterprises (GSEs) held significant investments in risky subprime mortgages. When the market collapsed, they were on the brink of failure, and the government had to intervene to prevent a catastrophic effect on the economy. The bailout became a necessary measure to instill confidence and stability in the financial markets. The bailout's immediate effects were felt across the economy and housing market. By stabilizing Fannie Mae and Freddie Mac, the government aimed to revive the mortgage lending sector and protect homeowners. However, the intervention led to debates and controversies regarding government overreach, ultimately shaping future financial regulations and policies. During the early 2000s, a housing bubble was formed, driven by easy credit and subprime lending. This led to inflated property prices and an unsustainable market that was destined to collapse. The bubble burst in 2007, leading to a sharp decline in housing prices. Many homeowners found themselves underwater, owing more on their mortgages than their homes were worth. The decline in housing prices triggered a wave of mortgage defaults. Many borrowers, particularly those with subprime loans, were unable to meet their mortgage obligations, leading to foreclosures. Both Fannie Mae and Freddie Mac were heavily invested in subprime mortgages. When these loans began to default, the GSEs faced enormous losses. Losses quickly escalated, putting tremendous financial strain on both institutions. They became a significant risk to financial stability, as their failure could have had a domino effect on the entire financial system. The potential collapse of Fannie Mae and Freddie Mac was seen as a grave threat to the financial stability of the U.S. Their failure could have led to a collapse in the mortgage market, affecting banks, homeowners, and the broader economy. In response to the crisis, Congress passed the Housing and Economic Recovery Act of 2008. This legislation allowed the government to place both GSEs under conservatorship, effectively taking control of their operations. Federal Housing Finance Agency (FHFA) took over the conservatorship, implementing measures to stabilize the institutions and overseeing their daily operations. The government provided substantial financial assistance through the Treasury, purchasing preferred shares and providing liquidity to ensure both entities remained solvent. The agreements outlined the terms of the bailout, specifying the government's investment, obligations of the GSEs, and the expected repayment plans. Stringent restrictions were placed on both Fannie Mae and Freddie Mac's operations, and regular audits were conducted to ensure compliance and transparency. A structured repayment plan was implemented, detailing how the GSEs would return the government's investment over time. The bailout stabilized the housing market temporarily but led to prolonged uncertainty and slow recovery. It affected lending practices and shaped new regulations for the mortgage industry. By preventing the collapse of two major financial institutions, the bailout preserved the integrity of the financial system but raised questions about moral hazard and government intervention in private enterprise. The bailout came at a significant cost to taxpayers, sparking debates and leading to greater scrutiny of government financial interventions. The bailout was met with mixed reactions from the public. Some saw it as a necessary intervention, while others viewed it as a rescue of failed institutions at the expense of taxpayers. Several legal challenges were raised against the government's actions, questioning the legality and constitutionality of the intervention. The crisis and subsequent bailout led to new legislative reforms, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, aimed at preventing future financial disasters. Over time, Fannie Mae and Freddie Mac have repaid a significant portion of the government funds, demonstrating a return to financial stability. Both GSEs have undergone substantial reforms, including changes to their business models and increased regulatory oversight. Today, Fannie Mae and Freddie Mac continue to play vital roles in the U.S. mortgage market, albeit under a different regulatory framework. Their long-term future remains a subject of debate and potential reform. The crisis led to increased regulatory oversight, including stricter lending standards and greater scrutiny of financial institutions. The Fannie Mae and Freddie Mac bailouts shaped future bailout policies, emphasizing the need for careful evaluation and responsible government intervention. The bailout had a lasting impact on mortgage lending practices, leading to more conservative lending standards and greater transparency in the mortgage industry. The bailout of Fannie Mae and Freddie Mac in 2008 was a landmark event that resonated across the U.S. economy and housing market. By intervening at a critical time, the government averted a potential financial catastrophe but ignited intense debates about the government's role in private enterprises. The immediate stabilization was shadowed by lingering uncertainties, costly implications for taxpayers, and sweeping regulatory changes. Through restructuring, repayment, and reform, both GSEs have since regained stability, but their future remains an ongoing subject of discussion. This complex situation illustrates the multifaceted consequences of financial interventions and underscores the importance of prudent regulatory oversight, risk assessment, and transparent lending practices. The episode continues to influence policy decisions and offers enduring lessons for managing systemic financial risks.Fannie Mae and Freddie Mac Bailout Overview

Reasons for the Bailout

Impact on the Economy and Housing Market

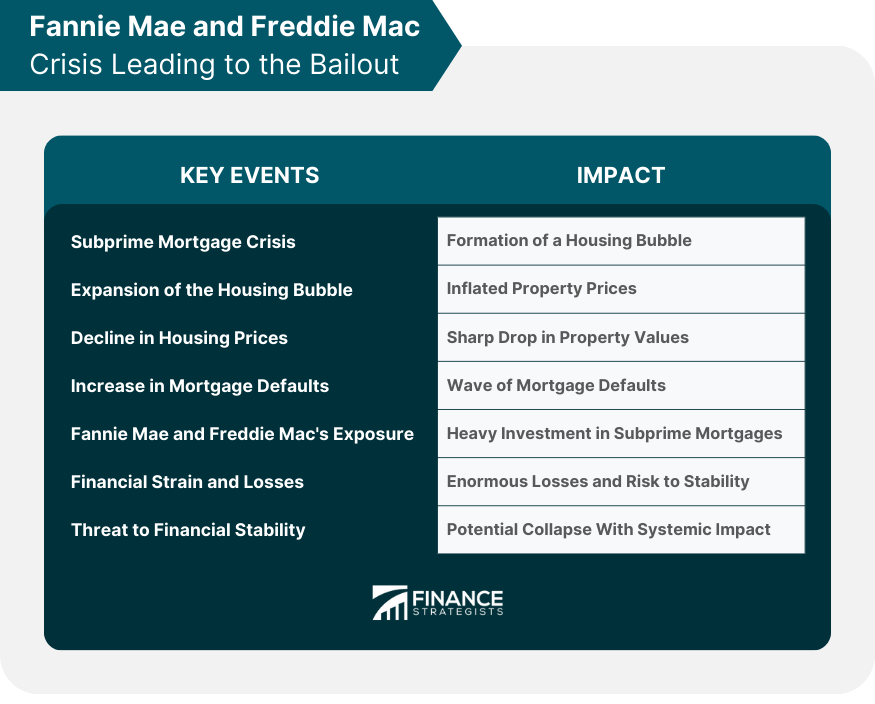

Fannie Mae and Freddie Mac Crisis Leading to the Bailout

Subprime Mortgage Crisis and Its Effect

Expansion of the Housing Bubble

A Decline in Housing Prices

Increase in Mortgage Defaults

Fannie Mae and Freddie Mac's Exposure

Investment in Subprime Mortgages

Financial Strain and Losses

Threat to Financial Stability

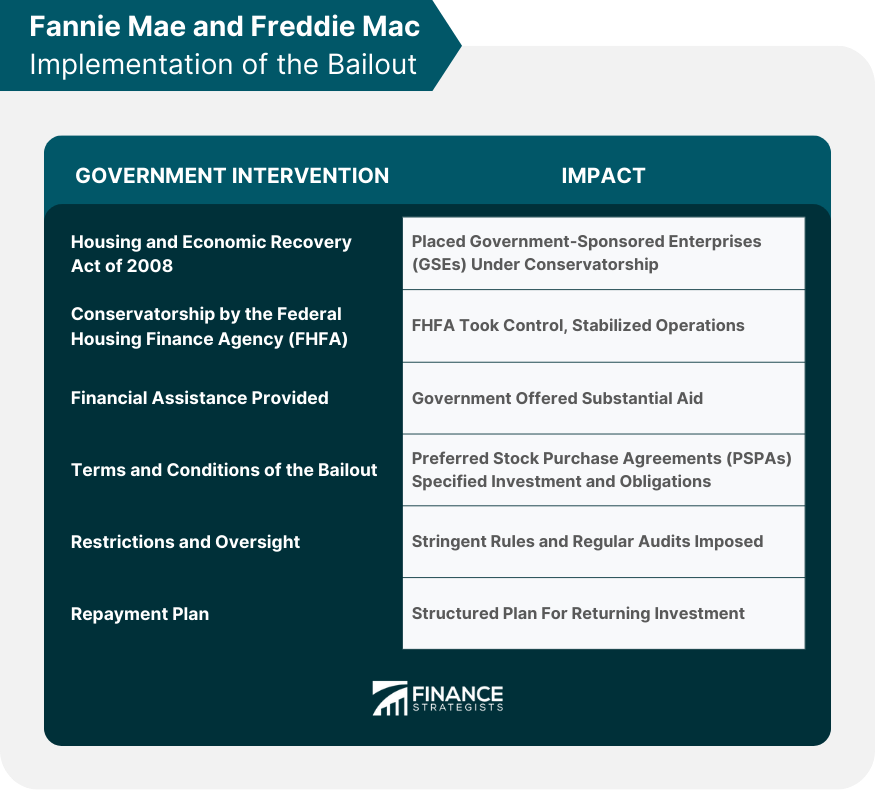

Fannie Mae and Freddie Mac Implementation of the Bailout

Government Intervention

Housing and Economic Recovery Act of 2008

Conservatorship by the Federal Housing Finance Agency (FHFA)

Financial Assistance Provided

Terms and Conditions of the Bailout

Preferred Stock Purchase Agreements (PSPAs)

Restrictions and Oversight

Repayment Plan

Impact and Controversies of the Fannie Mae and Freddie Mac Bailout

Economic Impact

Effects on the Housing Market

Influence on the Broader Financial System

Costs to Taxpayers

Political and Social Repercussions

Public Opinion

Legal Challenges

Legislative Changes

Long-Term Consequences and Recovery

Recovery of Fannie Mae and Freddie Mac

Repayment of the Government Funds

Reforms and Regulatory Changes

Current Status and Future Outlook

Lessons Learned and Policy Implications

Regulatory Oversight Enhancements

Influence on Future Bailout Policies

Impact on Mortgage Lending Practices

Bottom Line

Fannie Mae and Freddie Mac Bailout FAQs

Fannie Mae and Freddie Mac were bailed out to prevent their collapse during the 2008 financial crisis. They held significant investments in risky subprime mortgages, and their failure could have triggered a domino effect on the entire financial system. The bailout was seen as a necessary measure to maintain financial stability in the U.S.

The terms and conditions were outlined in the Preferred Stock Purchase Agreements (PSPAs), which specified the government's investment, the obligations of the GSEs, and the expected repayment plans. There were stringent restrictions and oversight, including regular audits, to ensure transparency and compliance.

The bailout stabilized the housing market temporarily but led to prolonged uncertainty and slow recovery. It preserved the integrity of the financial system but also raised questions about government intervention in private enterprise. The bailout also influenced future regulations, such as the Dodd-Frank Act, and led to more conservative lending standards in the mortgage industry.

Fannie Mae and Freddie Mac recovered by repaying a significant portion of the government funds and undergoing substantial reforms, including changes to their business models and increased regulatory oversight. Their current status remains vital in the U.S. mortgage market, but their long-term future is still a subject of debate and potential reform.

The bailout sparked mixed reactions from the public, with some seeing it as a necessary intervention, while others viewed it as a rescue of failed institutions at taxpayers' expense. It led to legal challenges questioning the legality of the intervention and prompted debates over moral hazard, government overreach, and the significant cost to taxpayers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.