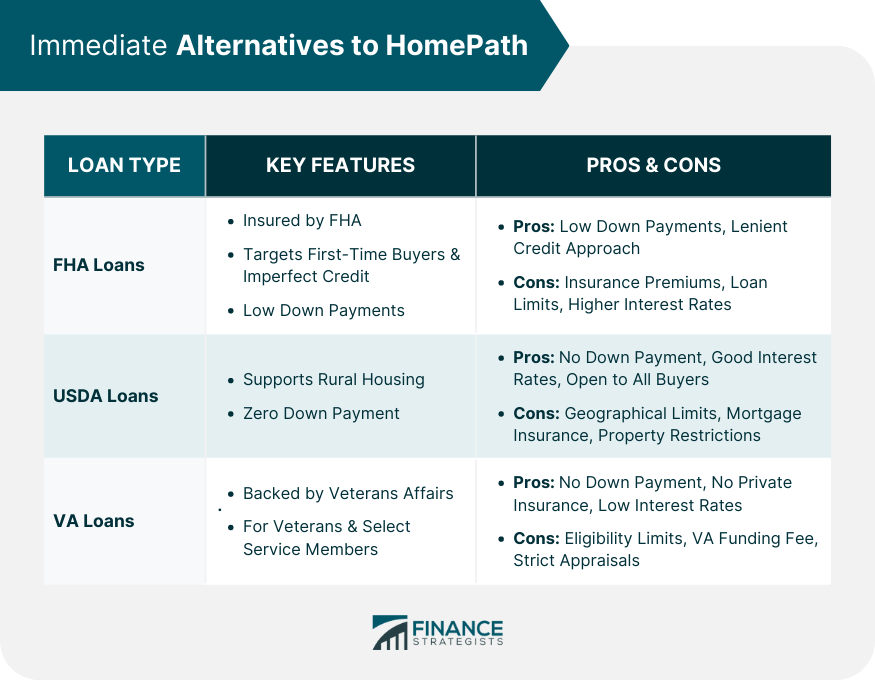

HomePath is Fannie Mae's proprietary program designed to help homeowners purchase Fannie Mae-owned properties. These properties often come with special financing options, and the program itself caters to various types of homebuyers, from first-timers to seasoned investors. By offering these homes, Fannie Mae seeks to contribute to neighborhood stabilization. The allure of HomePath homes extends beyond their often competitive pricing. These homes can offer unique financing terms, which often include low down payments, no need for appraisal, and no mortgage insurance. They're often perfect for those looking to find value in a market that might otherwise be challenging to navigate, especially for newcomers. While first-time buyers are drawn to HomePath due to its terms, seasoned investors and vacation home seekers also benefit from the program, showcasing its broad appeal. An FHA loan, insured by the Federal Housing Administration, caters primarily to first-time homebuyers and those with less-than-perfect credit. They often require smaller down payments and are more forgiving with credit histories. These loans can be a game-changer for many looking to step onto the property ladder. The allure of FHA loans doesn't mean they're handed out without checks and balances. Prospective borrowers must have a steady employment history or have worked for the same employer for the past two years. They should ideally have a credit score of 580 to qualify for the low down payment advantage. Additionally, the property must be appraised by an FHA-approved appraiser, and the borrower's front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, homeowners' insurance) should typically be less than 31% of their gross income. The driving force behind FHA's popularity lies in its advantages. The potentially lower down payments, sometimes as low as 3.5%, act as a magnet for first-time buyers. Their lenient stance on credit histories means that many who thought homeownership was out of reach now have a feasible path. And, in some cases, financial assistance for down payments or closing costs can be negotiated. However, the FHA loan is not without its caveats. Borrowers will find themselves subject to mortgage insurance premiums, which can add to monthly costs. There are also restrictive loan limits, which might make certain properties or areas unattainable. And, unfortunately, some might find themselves facing higher interest rates compared to conventional loans. USDA loans, often referred to as rural development loans, are designed to provide affordable housing in rural areas. The program's essence is to support the development of rural regions by offering incredibly favorable terms to those willing to relocate or buy in these areas. Potential borrowers should note that USDA loans come with their specifications. Firstly, the property must be located in an eligible rural area. Secondly, there are income limits, which vary by region, but are set with the intent of supporting those with modest incomes. The beauty of USDA loans lies in their zero down payment requirement. It’s not an exaggeration – eligible borrowers can secure a property without putting down a single dollar upfront. Add to that the competitive interest rates, and it's clear why many find this option enticing. Plus, both first-time and repeat homebuyers can avail of this facility. On the flip side, the geographical limitations can be a significant hurdle for many. Not every buyer is inclined to or can relocate to a rural region. And while the no down payment feature is fantastic, borrowers are still subject to mortgage insurance, which can impact monthly outgoings. Lastly, only certain properties get the green light for this financing option, further narrowing choices. The Department of Veterans Affairs backs VA loans. Tailored for veterans, active-duty service members, and certain members of the National Guard and Reserves, these loans come with benefits that far outweigh many conventional loans. To avail of a VA loan, one needs a valid Certificate of Eligibility (COE), proving they have met the service requirements. The property in question also needs to be the buyer's primary residence, and they must have a suitable credit score and income. VA loans are a shining beacon in the mortgage landscape. No down payment, no private mortgage insurance, and interest rates that often beat out many conventional loans, it's no wonder they're a top choice for those who qualify. Eligibility restrictions can be a barrier for many. There's also the VA Funding Fee, a one-time charge that can be rolled into the financing but can still add to the overall loan cost. And on the more practical side, some sellers are wary of VA appraisals, sometimes perceiving them as more stringent. Interest rates, inflation, job market health, and overall economic forecasts play pivotal roles. During prosperous times, borrowers might lean towards fixed-rate mortgages, enjoying stability. In contrast, in more turbulent times, adjustable-rate mortgages, with their initial lower rates, might seem more attractive. At the heart of every mortgage decision lies personal finance. Like fingerprints, every individual's financial landscape is unique. Credit scores, existing debts, savings, investments, and financial behaviors all intertwine. Those with stellar credit scores might find doors opening to the best interest rates and terms. Meanwhile, those with lower scores might have to shop around a bit more, but options like FHA loans remain within reach. Bricks, mortar, and geographical coordinates - the actual property itself. A suburban family home has different financing implications compared to a downtown condo. Location, too, plays its part. A property in a rural area might unlock the benefits of a USDA loan, while a high-priced city property could push buyers towards jumbo loans. The length of the mortgage also holds weight. Some might gravitate towards 15-year loans, eager to own their home outright sooner and save on interest. Others, valuing lower monthly payments, might opt for the traditional 30-year route. It's a balancing act, one that requires considering current financial health and future prospects. Homeownership isn't an isolated financial decision; it's a piece of the puzzle. Some might see a home as a stepping stone, a short-term abode before moving on. Others might envision growing old in their new home. These visions influence mortgage choices, with some prioritizing low upfront costs, while others might focus on long-term savings. Outside the government-backed options lie conventional mortgages. Rooted in tradition, these loans are offered by private lenders without any government insurance. Borrowers often find a wide range of terms and interest rates, with the market's competitive nature pushing lenders to offer the best deals. However, high credit scores and sizable down payments are often the tickets to the best terms. For those eyeing luxury homes or properties in pricier neighborhoods, conventional loans might fall short, given their limits. Jumbo mortgages exceed the federal limit set for government-sponsored mortgages. With bigger loan amounts come bigger risks for lenders, so borrowers might find stricter credit requirements and higher interest rates. The adjustable-rate mortgage (ARM) is like the chameleon of the mortgage world, with rates that shift according to market conditions. Initial rates can be enticingly low, luring in borrowers. Yet, as the name suggests, these rates adjust, typically annually, after the initial fixed period, which can be anywhere from one to ten years. This changeability can be both a boon and a bane, depending on market conditions. In the world of home financing, fixed-rate mortgages are akin to a steady, reliable friend. The interest rate remains unchanged throughout the loan's life. Borrowers can rest easy, knowing their monthly payments are set in stone, unaffected by market fluctuations. While they might start off with slightly higher rates compared to ARMs, in the long run, they offer unparalleled stability. The bedrock of any mortgage decision should be an honest introspection of one's financial landscape. It means crunching numbers, understanding monthly outgoings, existing debts, savings, and potential future expenditures. Online calculators and professionals can help create a clear picture, laying the foundation for an informed decision. Beyond personal finance, the broader real estate market plays a role. A booming market with skyrocketing prices has different implications compared to a quieter one. Researching recent sales, understanding price trends, and even considering future developments in the area can give invaluable insights. While the digital age provides a wealth of information at our fingertips, there's still immense value in seeking advice from professionals. Mortgage brokers, financial advisors, and real estate agents have their fingers on the pulse of the market. Their guidance, tailored to individual circumstances, can often be the compass directing towards the best mortgage path. Choosing the right mortgage option involves a comprehensive understanding of available choices and a keen assessment of one's financial health. While HomePath is a proprietary program offering special financing for Fannie Mae-owned properties, several viable alternatives exist. FHA loans cater to first-timers and those with credit challenges, while USDA loans are specifically tailored for rural housing, requiring no down payment. VA loans, dedicated to veterans and service members, offer significant benefits, albeit with eligibility restrictions. Current economic conditions, personal financial health, property type, desired loan term, and long-term financial aspirations influence the mortgage decision. Conventional, jumbo, adjustable-rate, and fixed-rate mortgages also offer varied advantages based on the borrower's needs. Ultimately, understanding the local real estate market, self-assessing financial standing, and seeking expert advice are pivotal in navigating the maze of mortgage options to find the best fit.HomePath Overview

Immediate Alternatives to HomePath

FHA Loans

Definition and Benefits

Requirements

Advantages

Disadvantages

USDA Loans

Definition and Benefits

Requirements

Advantages

Disadvantages

VA Loans

Definition and Benefits

Requirements

Advantages

Disadvantages

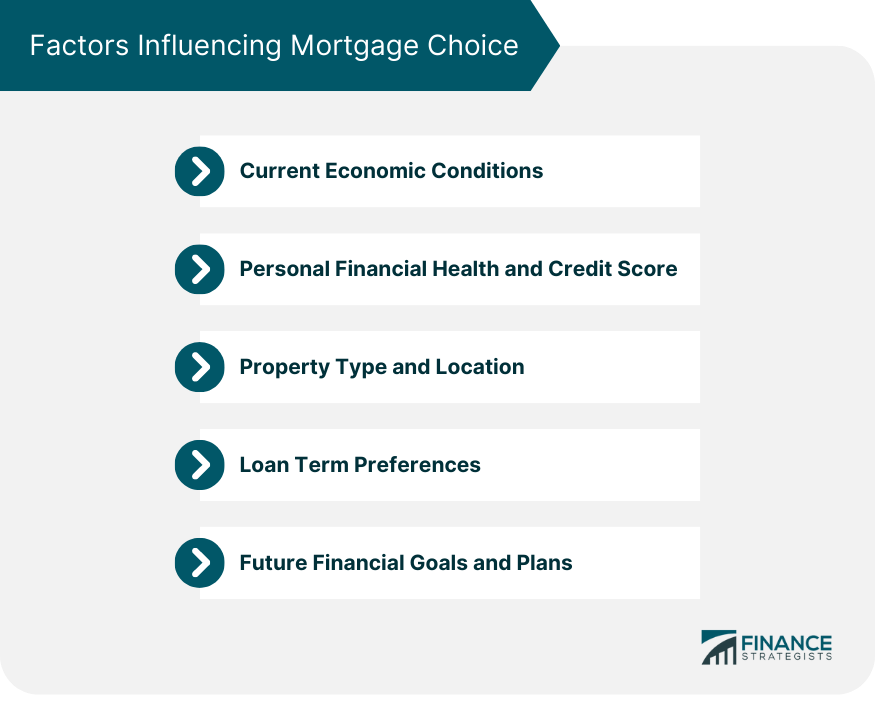

Factors Influencing Mortgage Choice

Current Economic Conditions

Personal Financial Health and Credit Score

Property Type and Location

Loan Term Preferences

Future Financial Goals and Plans

Other Financing Options for Home Buyers

Conventional Mortgages

Jumbo Mortgages

ARM (Adjustable-Rate Mortgage)

Fixed-Rate Mortgages

How to Choose the Right Alternative for Your Needs

Assess Personal Financial Situation

Understand the Local Real Estate Market

Seek Professional Advice

Bottom Line

Alternatives to HomePath FAQs

Some alternatives include FHA, USDA, VA loans, conventional mortgages, and jumbo mortgages.

Economic conditions, like interest rates and market health, can sway preferences between fixed-rate or adjustable-rate mortgages.

FHA loans are government-backed, require lower down payments, and are lenient with credit, while conventional mortgages are private loans often needing higher credit scores.

USDA loans are appealing for their zero down payment requirement and are designed for properties in eligible rural areas.

Assess your financial situation, understand local real estate trends, and seek professional advice to find the best financing option for you.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.