Fannie Mae HomePath is a program designed by the Federal National Mortgage Association, commonly known as Fannie Mae, to facilitate the sale of its foreclosed properties. The primary objective of HomePath is not just to sell these properties quickly but also to stabilize neighborhoods and minimize the negative impact foreclosures might have on communities. This is achieved by offering homes at competitive prices with favorable terms, often to owner-occupants over investors in the initial stages of property listings. One of the standout benefits for homebuyers is that HomePath properties don't require an appraisal, potentially expediting the buying process. Additionally, buyers can benefit from low down payment options, reduced mortgage insurance requirements, and flexible mortgage terms. Navigating the path to homeownership with Fannie Mae's HomePath program requires understanding the key eligibility criteria. These criteria are set to ensure that potential buyers can financially handle the responsibility of owning a home and to offer fair opportunities to various types of buyers. Owner-Occupants: These are individuals who intend to live in the purchased property as their primary residence. Investors: Investors can also purchase HomePath properties, but they can only bid on homes once the First Look period has expired. This ensures owner-occupants have the initial opportunity. Public Entities: Government entities and certain non-profit organizations can also be eligible to purchase HomePath properties, potentially even during the First Look period. First-Time Homebuyers: While not exclusively for first-time buyers, the program has certain benefits tailored to them. Potential buyers are often required to be prequalified or, in some cases, pre approved by a mortgage lender. Financing prequalification offers an early assessment of how much a potential buyer can afford, based on information provided about their income, assets, and debts. Not only does this give buyers clarity about their budget, but it also signals to sellers that they are serious contenders, often giving them an edge in competitive buying situations. For certain deals, especially where closing cost assistance is provided, first-time homebuyers might be mandated to complete a homebuyer education course through a provider that meets Fannie Mae specifications. This ensures buyers are well-informed and prepared for homeownership responsibilities. To make an offer on a HomePath property, buyers generally need to do so through a licensed real estate agent. While not a strict "eligibility" requirement, working with an agent familiar with the HomePath process can be advantageous, as they can provide insights and streamline the buying journey. The HomePath program offers specialized mortgage options to cater to buyers, making the purchasing process more streamlined. Here's a comprehensive overview of these financing pathways: Designed specifically for the purchase of HomePath properties, this loan option provides an efficient route to homeownership. Reduced Down Payment: A significant benefit is the potential for a lower down payment, sometimes as little as 3%, making it more accessible for many buyers. No Appraisal: The HomePath Mortgage typically forgoes the need for property appraisal, thereby speeding up the buying process and saving potential appraisal costs. Varied Loan Terms: This mortgage offers flexibility in terms of loan durations, encompassing both fixed and adjustable-rate structures. Limited Mortgage Insurance: With this option, there might be reduced requirements for mortgage insurance, further decreasing monthly obligations. This loan is specially curated for HomePath properties in need of repairs or renovations. It finances not just the home's purchase, but also its refurbishment. Incorporated Renovation Costs: With this mortgage, buyers can fold the renovation expenses into the loan amount, negating the need for separate financing. Consolidated Loan Structure: It simplifies the borrowing process by merging the home purchase and renovation loans into one, with a single set of closing costs. Controlled Renovation Fund Disbursement: Post-closing funds earmarked for renovation are typically held in an escrow account. Conventional Mortgages: HomePath properties aren't restricted to the program's proprietary financing. Buyers can also tap into standard financing channels, such as conventional fixed or adjustable-rate mortgages. Government-Backed Loans: Federal Housing Authority (FHA), Veterans Administration (VA) and U.S. Department of Agriculture (USDA) loans might be applicable, depending on the property's condition and the buyer's eligibility. Cash Transactions: For those with the means, a cash purchase is always an option. This often accelerates the acquisition process and can be attractive to Fannie Mae as it minimizes complications. Local and Portfolio Lenders: These institutions often provide more tailored loan products since they retain their loans instead of selling them on the secondary market. Purchasing through Fannie Mae's HomePath program can be an attractive avenue for many buyers. However, it's crucial to have a clear understanding of both its advantages and potential drawbacks. Competitive Pricing: HomePath properties are typically priced lower than the market rate, offering a cost-effective entry point into homeownership or property investment. First Look Advantage: Owner-occupants get a priority window of 20 days before investors can bid, enhancing their chances of securing a property without excessive competition. No Appraisal Requirement: Certain HomePath financing options can eliminate the need for property appraisal, reducing costs and simplifying the buying process. Clear Titles: Fannie Mae ensures that each HomePath property has a clear title, removing potential legal entanglements related to liens or ownership disputes. Move-in Ready Options: Many HomePath properties are listed as move-in ready, minimizing the need for immediate repairs or renovations. High Competition Post First Look: Once the initial 20-day window closes, there can be fierce competition from investors, which might drive up the price. Limited Property History: Fannie Mae typically doesn't provide comprehensive property disclosures since they don't occupy the homes, possibly leaving buyers with gaps in property history. Financing Restrictions: While there are dedicated HomePath mortgages, not every buyer may qualify, and not all lenders offer these specialized products. Possible Additional Costs: The property might harbor hidden defects or issues that only become apparent after purchase, leading to unexpected expenses. Neighborhood Factors: Some HomePath properties might be situated in neighborhoods with economic challenges or higher foreclosure rates, potentially impacting future property appreciation. For potential buyers considering a property, be it a HomePath listing or a traditional sale, a few practical tips can make the journey smoother and more rewarding. Research the Market: Understand the prevailing pricing dynamics, demand metrics, and recent sales of comparable properties, or "comps." These insights will empower you to make informed decisions and set realistic expectations. Secure Financing Early: Approach financial institutions for pre-approval rather than just pre-qualification. This not only gives you a clear idea of your buying capacity but also strengthens your position when negotiating. Inspect the Property: Always engage a qualified home inspector to assess the property. Their expert eye can identify potential problems or necessary repairs that might not be immediately visible, helping you avoid future costs or regrets. Negotiate Smartly: While it's tempting to go for a property you like, stay grounded in your financial realities. Use insights from your research and property inspection to negotiate the best possible deal. Understand Total Ownership Costs: Beyond the purchase price, factor in ongoing expenses like property taxes, maintenance, homeowners insurance, and potential homeowner association (HOA) fees. Work With a Realtor: A seasoned realtor can be your compass in the vast real estate landscape. Their expertise in local property trends, negotiation tactics, and intricate processes can save you time, money, and potential missteps. Review All Documents: Take your time to understand every clause and commitment in the documents. If any aspect is unclear, seek clarification or even legal counsel. Plan for the Long-Term: Consider the property's potential resale value, its proximity to amenities, and how it aligns with your future life plans. Fannie Mae's HomePath program provides a pathway to homeownership by facilitating the sale of foreclosed properties. One of the features of HomePath properties is the elimination of the appraisal requirement. These properties also come with low down payment options, reduced mortgage insurance, and flexible mortgage terms. To support various types of buyers, the program sets specific eligibility criteria. The First Look initiative gives owner-occupants a head start in the buying process, allowing them a 20-day window to bid without investor competition. While the program offers several benefits, potential buyers should also be aware of potential drawbacks, including possible hidden property defects and the challenges of securing specialized financing. Engaging a qualified real estate agent and conducting thorough research are crucial steps for those considering a HomePath property.What Is Fannie Mae HomePath?

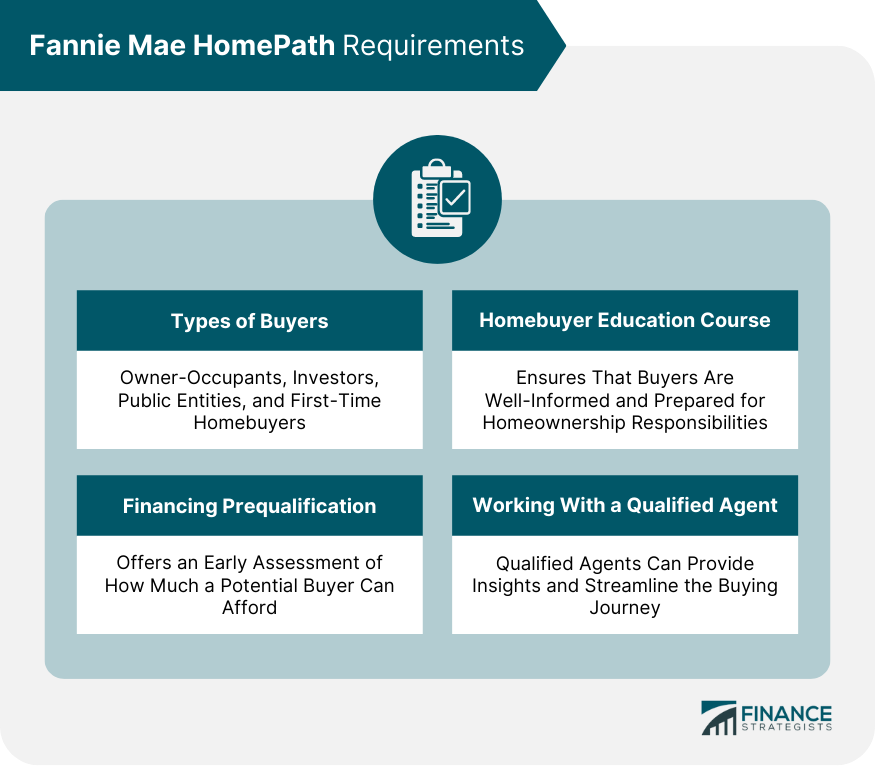

Fannie Mae HomePath Requirements

Types of Buyers

HomePath gives these buyers a distinct advantage with the First Look initiative, allowing them a specific window of time (typically the first 20 days after the property is listed) to make offers without competition from investors.

For some properties, Fannie Mae offers closing cost assistance to first-time buyers who complete an online homebuying education course.Financing Prequalification

Homebuyer Education Course

Working With a Qualified Agent

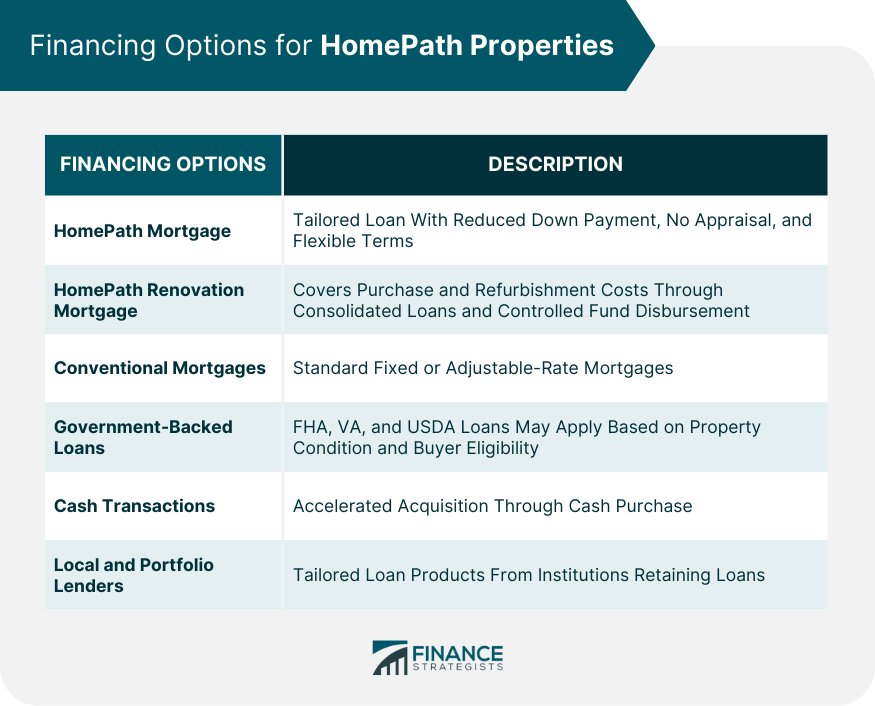

Financing Options for Fannie Mae HomePath Properties

HomePath Mortgage

HomePath Renovation Mortgage

They're released in stages as work progresses, ensuring that renovations adhere to agreed-upon standards and budgets.Alternative Financing Routes for HomePath Properties

This can be especially useful for unique HomePath properties or buyers with particular financing needs.

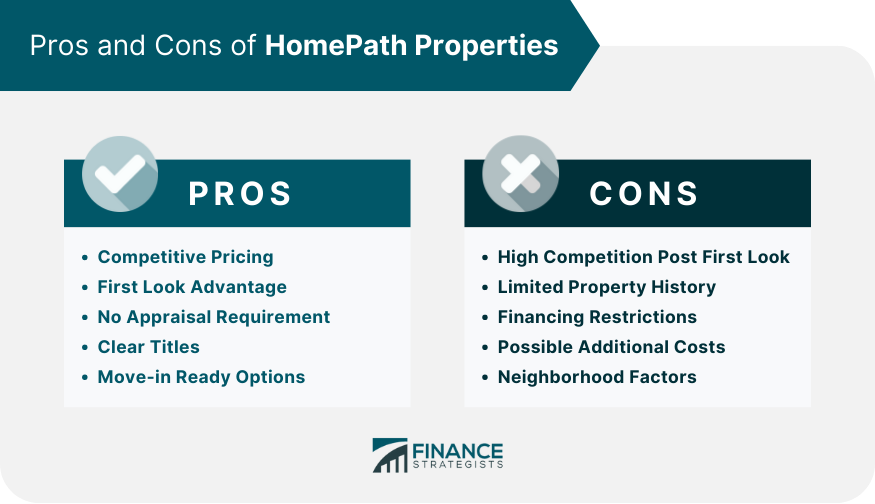

Pros and Cons of HomePath Properties

Pros

Cons

Practical Tips for Potential Buyers

This holistic financial understanding ensures you're adequately prepared for the real costs of homeownership.

Investing in real estate is not just about the present but should also serve your future aspirations.Conclusion

Fannie Mae HomePath FAQs

The Fannie Mae HomePath program is an initiative by the Federal National Mortgage Association, commonly known as Fannie Mae, to facilitate the sale of its foreclosed properties, aiming to stabilize neighborhoods and offer homes at competitive prices.

The Fannie Mae HomePath First Look initiative gives owner-occupants a priority window of 20 days to make offers on properties without competition from investors, ensuring they have the initial opportunity to purchase.

The Fannie Mae HomePath program offers specialized mortgage options like the HomePath Mortgage and HomePath Renovation Mortgage, which come with benefits such as reduced down payments and no appraisal requirements.

One of the advantages of certain Fannie Mae HomePath financing options is that they eliminate the need for property appraisal, expediting the buying process.

Investors can purchase Fannie Mae HomePath properties, but they can only bid after the First Look period, which typically lasts 20 days, has expired, ensuring owner-occupants have the initial opportunity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.