Underinsurance refers to a situation where an individual or entity possesses insurance coverage that falls short of adequately protecting against potential risks or losses. It occurs when the value of the insured property, the coverage limit, or the insured amount is insufficient to fully compensate for the financial impact of an event, such as an accident, theft, or natural disaster. Underinsurance can arise due to various factors, including inaccurate assessment of the value of the insured item or property, underestimation of potential risks, or the failure to update coverage as circumstances change. The consequences of underinsurance can be significant, as it places the policyholder at risk of bearing a substantial portion of the financial burden resulting from a loss. To mitigate the risk of underinsurance, it is essential for individuals and organizations to regularly review and update their insurance policies to ensure they adequately reflect the current value and potential risks associated with the insured assets. Lack of Awareness: Many people are unaware of the extent of their insurance needs or the details of their existing policies. Misunderstanding Insurance Policies: Insurance policies can be complex and difficult to understand, with numerous terms, conditions, and exclusions. Financial Constraints: Insurance premiums can be expensive, and some individuals may opt for lower coverage limits to save on costs. Overconfidence in Risk Management: Some people may underestimate the likelihood or severity of potential risks, believing they can effectively manage them without insurance. Underinsurance can result in substantial financial burdens for individuals and businesses. The costs associated with claims that exceed policy limits may be difficult or impossible to manage, leading to debt and even bankruptcy. Inadequate insurance coverage can expose policyholders to legal liabilities. For example, if a business is underinsured for liability claims, it may be subject to lawsuits and financial penalties that it cannot afford. Underinsurance can cause significant emotional stress for those affected, as they grapple with financial uncertainty and potential losses. This stress can negatively impact mental health and overall well-being. On a larger scale, underinsurance can lead to economic consequences. For example, natural disasters that result in widespread underinsurance can strain local economies, hinder recovery efforts, and contribute to long-term financial instability. To identify underinsurance, policyholders should carefully review their insurance policies and assess whether their coverage limits are adequate for their needs. They should also consider any exclusions, deductibles, and co-payments that may impact their financial risk. When evaluating property insurance policies, it is important to determine the current replacement cost of the insured assets. Policyholders should consider factors such as inflation, fluctuating market values, and construction costs to ensure their coverage limits accurately reflect the true value of their property. Individuals and businesses should periodically assess their risk exposure to identify potential gaps in their insurance coverage. This may involve considering changes in personal circumstances, business operations, or external factors that could affect their insurance needs. To ensure adequate coverage, policyholders should consult with insurance professionals, such as agents, brokers, or financial advisors. These experts can help identify underinsurance, provide guidance on appropriate coverage levels, and recommend tailored insurance solutions. Policyholders should conduct regular reviews of their insurance policies to ensure they remain up-to-date and aligned with their current needs. This may involve adjusting coverage limits, updating personal information, or adding endorsements for specific risks. When selecting insurance coverage, individuals and businesses should prioritize their unique needs and risk profiles. This may require a comprehensive analysis of potential risks and a careful evaluation of policy options to ensure sufficient coverage is in place. Implementing effective risk management strategies can help reduce the likelihood or severity of insurance claims. This may include adopting safety measures, maintaining property and equipment, or investing in employee training to minimize potential risks. Working with insurance brokers and agents can help policyholders navigate the complexities of insurance coverage and ensure they are adequately protected. These professionals can offer personalized advice, negotiate favorable policy terms, and advocate for clients during the claims process. In conclusion, underinsurance, the insufficient coverage to fully protect one's assets and liabilities, can have serious consequences for individuals and society as a whole. The causes of underinsurance are varied, but the impacts, such as financial hardship, legal issues, emotional stress, and economic effects, are universally detrimental. It is crucial for individuals to identify and address underinsurance in their lives to mitigate these negative outcomes. Preventing and managing underinsurance requires education, awareness, and proactive risk management, empowering individuals to safeguard their financial well-being and contribute to a more stable and resilient society.Definition of Underinsurance

Causes of Underinsurance

Impact of Underinsurance

Financial Hardship

Legal Issues

Emotional Stress

Economic Effects

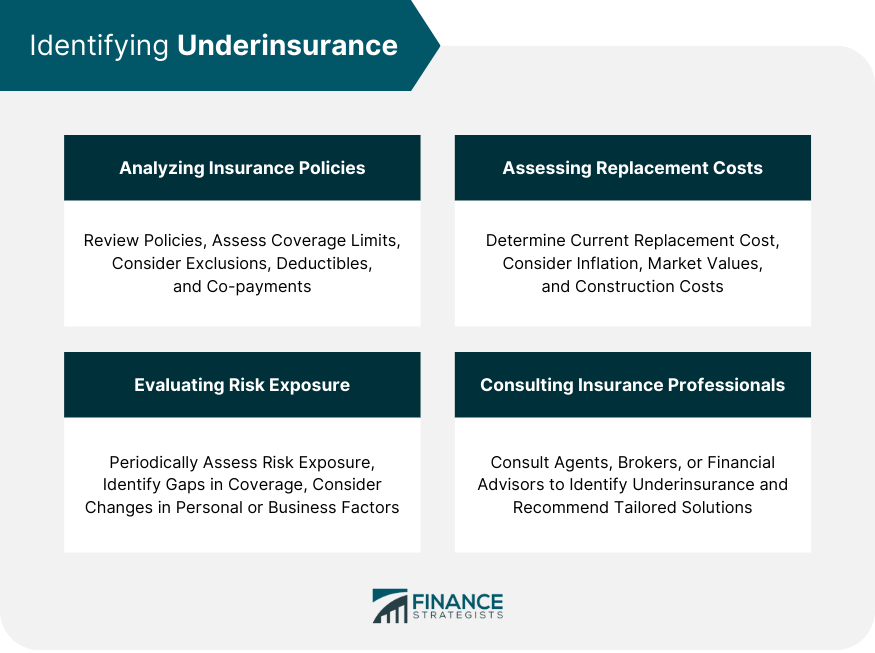

Identifying Underinsurance

Analyzing Insurance Policies

Assessing Replacement Costs

Evaluating Risk Exposure

Consulting Insurance Professionals

Prevention and Management of Underinsurance

Regular Policy Reviews

Adequate Coverage Selection

Risk Mitigation Strategies

Utilizing Insurance Brokers and Agents

Conclusion

Underinsurance FAQs

Underinsurance refers to a situation where an individual or business has insufficient insurance coverage to fully cover potential losses, leaving them financially vulnerable in the event of a claim.

To identify underinsurance, review your insurance policies to ensure coverage limits are adequate for your needs, assess the replacement costs of insured assets, evaluate your risk exposure, and consult with insurance professionals for guidance.

To avoid underinsurance, it's important to regularly review your insurance coverage and ensure that it adequately covers potential losses or liabilities. You can also consult with an insurance agent or broker to help assess your insurance needs.

Consequences of underinsurance can include financial hardship, legal liabilities, emotional stress, and negative economic effects. Insufficient coverage may lead to significant out-of-pocket expenses and financial strain for individuals, families, or businesses.

To prevent and manage underinsurance, conduct regular policy reviews, select adequate coverage based on your unique needs and risk profile, implement risk mitigation strategies, and work with insurance brokers or agents for expert guidance and personalized insurance solutions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.