Hurricane deductibles are an essential component of homeowners' insurance policies in regions vulnerable to hurricane-related damages. They define the amount a policyholder is required to pay out-of-pocket before the insurance coverage begins for any damages caused by hurricanes. This amount is typically calculated as a percentage of the insured value of the home, making it different from a standard deductible, which is usually a fixed dollar amount. The importance of hurricane deductibles lies in their ability to balance financial risk. They shift part of the financial responsibility from the insurer to the homeowner, making it possible for insurance companies to offer coverage even in high-risk areas. Furthermore, hurricane deductibles encourage homeowners to undertake preventive measures to reduce potential damage, as the financial burden of any damage is shared. Understanding hurricane deductibles is essential for homeowners to manage their financial risk effectively. Hurricane deductibles are specific to homeowners' insurance policies for hurricane-related damage. They're typically set as a percentage of the home's insured value, not a flat dollar amount. Once a hurricane watch or warning is declared by the National Weather Service, the hurricane deductible applies. If damage occurs, homeowners are responsible for paying the deductible amount before their insurance coverage contributes. This concept is crucial in areas prone to hurricanes, helping balance risk between insurers and homeowners. Hurricane deductibles emerged in the aftermath of Hurricane Andrew in 1992, one of the most destructive hurricanes in U.S. history. Insurers faced massive claims, which threatened their financial stability and led to the inception of hurricane deductibles as a means of risk management. Over the years, states have implemented various regulatory measures to ensure the fair application of hurricane deductibles. These changes have often been responses to specific events or trends in the insurance and climate landscapes. Major hurricanes like Katrina and Sandy have been turning points, causing insurers to reevaluate their risk assessments and leading to adjustments in hurricane deductible policies. These storms highlighted the need for clearer policy language and greater transparency in how deductibles are implemented. The amount of a hurricane deductible can depend on various factors, including the location of the home, the home's value, and the specifics of the insurance policy. Location plays a significant role in determining the hurricane deductible. Homes in high-risk coastal areas often have higher deductibles due to the increased likelihood of hurricanes. The insured value of the home also impacts the hurricane deductible. Higher home values will typically result in higher deductibles, as the deductible is a percentage of the home's insured value. The application of a hurricane deductible is typically tied to official hurricane declarations from the NWS. However, this can vary by state and by the specifics of the insurance policy. The process for claiming hurricane damage begins with contacting the insurer as soon as possible after the event. Policyholders should document the damage, keep records of repairs, and maintain communication with their insurers throughout the process. The typical hurricane deductible usually ranges from 1% to 5% of the insured value of the house, but in certain high-risk coastal areas, this deductible could be even more. For instance, if a house is insured for $300,000, the typical hurricane deductible would typically range from $3,000 to $15,000 (1% to 5% of the insured value). Each state has its own laws and regulations regarding hurricane deductibles. These can include requirements about when a deductible can be applied and what percentage the deductible can be. State insurance departments play a vital role in regulating hurricane deductibles. They approve the language and terms of insurance policies, oversee the implementation of deductibles, and assist homeowners with insurance-related issues. There are significant variations in hurricane deductible regulations across states. For example, Florida allows insurers to offer hurricane deductibles of 1%, 2%, 5%, and 10%, while other states have different percentages and rules about when the deductible applies. Hurricane deductibles can have substantial financial implications for homeowners. Those in high-risk areas may find themselves paying thousands or tens of thousands of dollars out-of-pocket after a hurricane. The presence of hurricane deductibles can influence homeowners to invest in risk mitigation measures, such as storm shutters or reinforced roofs, to potentially minimize the out-of-pocket expenses following a hurricane. Climate change, with its predicted increase in hurricane frequency and intensity, may lead to further changes in hurricane deductible policies, including potentially higher deductibles in some areas. As climate change escalates the risks of hurricanes, there's potential for a greater financial burden on homeowners through increased deductibles. This might spur innovations in insurance policies, building codes, and risk mitigation practices. The field of hurricane deductibles is likely to continue evolving in response to changes in climate patterns, regulatory landscapes, and the insurance market. These changes will have significant implications for both insurers and homeowners. Homeowners in hurricane-prone regions should plan financially for the possibility of having to meet their hurricane deductible. This could include creating a dedicated savings account or considering a supplemental insurance policy. When choosing a deductible, homeowners should balance the lower premium costs of a higher deductible with the potential burden of having to pay that deductible after a hurricane. It's crucial for homeowners to understand their insurance policies, stay informed about local regulations, invest in hurricane-resistant measures, and maintain an open line of communication with their insurers. Hurricane deductibles are an essential component of homeowners' insurance policies, especially in regions prone to hurricanes. They specify the homeowner's out-of-pocket expense before insurance covers any hurricane-related damages. Unlike standard deductibles, hurricane deductibles are calculated as a percentage of the insured value of the home. They help insurance companies provide coverage in high-risk areas and encourage homeowners to undertake preventive measures. The development of hurricane deductibles has been shaped by significant hurricanes and regulatory changes, prompting policy modifications and enhanced transparency. The deductible amount is determined by factors like location and insured value, with state insurance departments overseeing regulations, leading to state-to-state variations. It's imperative for homeowners to financially prepare and make educated decisions about their deductibles. Proactive risk mitigation measures, staying informed about legislative changes, and understanding future trends are also crucial. Understanding hurricane deductibles is key to effective financial risk management and safeguarding homes amid increasingly volatile weather patterns.What Is a Hurricane Deductible?

How Hurricane Deductibles Work

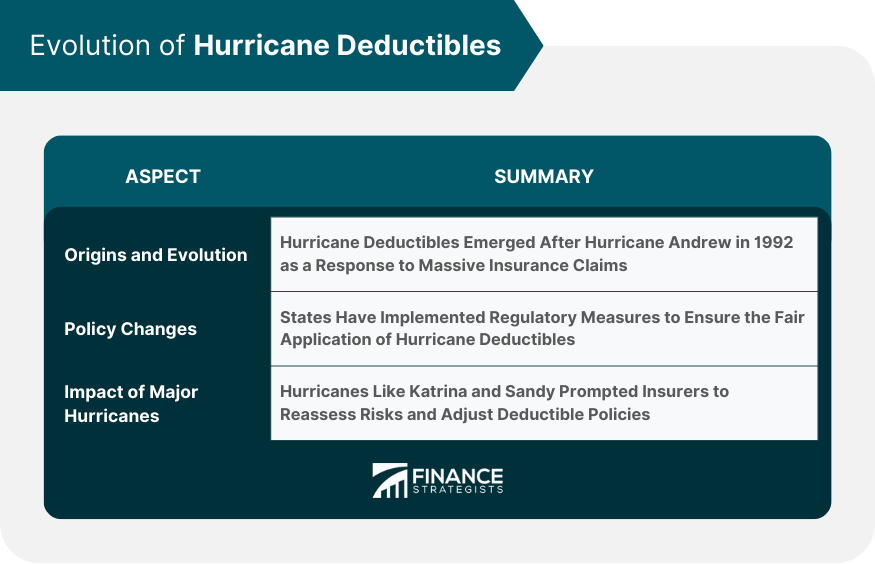

Evolution of Hurricane Deductibles

Origins and Evolution

Policy Changes Over the Years

Impact of Major Hurricanes

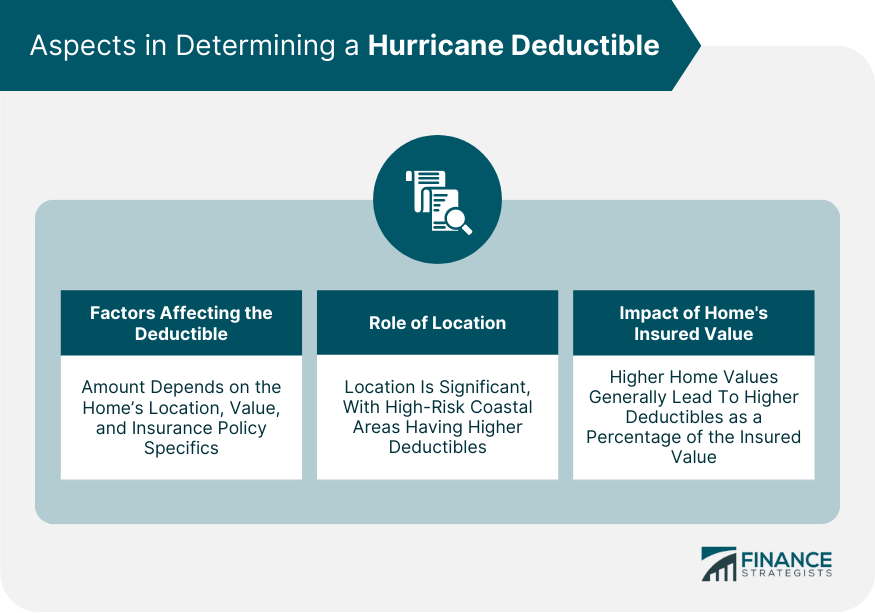

Determining a Hurricane Deductible

Factors Affecting the Deductible

Role of Location

Impact of Home's Insured Value

Implementation of Hurricane Deductibles

When the Deductible Applies

Claim Process

Calculating Hurricane Deductibles

Regulatory Aspects

Laws and Regulations

Role of State Insurance Departments

State Variations in Regulations

Impact on Policyholders

Financial Implications

Risk Management

Future Trends

Changes in Policies

Climate Change Impact

Future Predictions

Advice for Homeowners

Financial Preparation

Choosing a Deductible

Best Practices

Final Thoughts

Hurricane Deductible FAQs

Hurricane deductibles are provisions in homeowner's insurance policies that stipulate a specific amount that policyholders must pay out-of-pocket for hurricane-related damages before insurance coverage takes over. This amount is typically a percentage of the home's insured value.

Hurricane deductibles are crucial as they help manage financial risks associated with hurricanes. By shifting some of the risk from insurance companies to homeowners, they enable insurers to offer coverage in high-risk areas and encourage homeowners to take preventive measures to mitigate hurricane damage.

Unlike standard deductibles, which are usually a fixed dollar amount, hurricane deductibles are typically a percentage of the dwelling coverage. This percentage can range from 1% to 5% or even more in high-risk coastal areas.

Hurricane deductibles are determined based on a variety of factors, including the location of the home, the insured value of the home, and the specifics of the insurance policy. They usually apply once the National Weather Service declares a hurricane watch or warning.

Homeowners can financially prepare for hurricane deductibles by understanding their insurance policies, creating dedicated savings accounts to cover potential out-of-pocket costs, investing in preventive measures to reduce potential damage, and considering supplemental insurance policies if needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.