Paid-up Additional Insurance is a feature in certain life insurance policies that allows policyholders to use their policy dividends to purchase additional coverage without increasing their premium expenses. This additional coverage is fully paid for with the dividends, leading to an increased cash value and enhanced death benefit for the policyholder. Paid-up Additional Insurance offers guaranteed insurability, flexibility in premium payments, and potential tax advantages, making it an attractive option for long-term financial planning and security. Whole life insurance policies are a common type of policy that offers paid-up additional insurance. These policies provide coverage for the policyholder's entire life, as long as premiums are paid. Universal life insurance policies also offer paid-up additional insurance options. These policies provide greater flexibility in premium payments and cash value accumulation. Variable life insurance policies, which allow policyholders to invest their cash value in various investment options, can also include paid-up additional insurance provisions. Indexed universal life insurance policies, which tie cash value growth to a specific market index, may also offer paid-up additional insurance options for policyholders. Policy dividends are a key component of paid-up additional insurance. They represent a return of a portion of the policyholder's premiums, typically resulting from the insurer's better-than-expected investment returns or lower-than-anticipated expenses. Policyholders can choose to use their dividends to purchase paid-up additional insurance. This additional coverage is fully paid for with the dividends; hence the name "paid-up." By reinvesting their dividends into paid-up additional insurance, policyholders can benefit from long-term growth in both the cash value and death benefit of their policies. Insurance brokers play a critical role in helping clients understand and manage their paid-up additional insurance policies. This includes educating clients on policy benefits, customizing policy offerings based on client needs, and providing ongoing support. Insurance brokers should consider their client's financial goals and risk tolerance when recommending paid-up additional insurance. This type of coverage may be more suitable for clients seeking long-term growth and financial security. The cost of a policy, including premiums and fees, should be taken into account when evaluating paid-up additional insurance options. Clients should be able to afford the ongoing premiums and maintain their coverage over time. Insurance brokers should help clients understand the potential tax implications of adding paid-up additional insurance to their policies. While the growth in cash value and death benefits are generally tax-deferred, policy loans and withdrawals may have tax consequences. When recommending paid-up additional insurance, brokers should consider the long-term growth prospects of the policy, taking into account the insurer's financial strength, investment performance, and historical dividend rates. It's essential for brokers to compare paid-up additional insurance with other investment options available to clients, such as stocks, bonds, or mutual funds, to ensure that this coverage aligns with their financial goals and risk tolerance. One of the primary advantages of paid-up additional insurance is that it guarantees insurability for the policyholder. This means that as long as the policyholder continues to pay their premiums, they will have coverage without the need for additional underwriting or medical examinations. Paid-up additional insurance can help increase the cash value of a policy over time. This cash value can be accessed through policy loans, withdrawals, or even used as collateral for a personal loan. As paid-up additional insurance is added to the base policy, the death benefit also increases. This provides greater financial security for the policyholder's beneficiaries. Paid-up additional insurance offers flexibility in premium payments, as policyholders can choose to use their policy dividends to purchase additional coverage without increasing their out-of-pocket expenses. The growth in cash value and death benefits resulting from paid-up additional insurance are generally tax-deferred, providing significant tax advantages for the policyholder. Insurance brokers play a crucial role in educating clients about the benefits of paid-up additional insurance, helping them understand how it works and how it can enhance their overall policy. Not every client may be a good fit for paid-up additional insurance. Insurance brokers must identify clients who may benefit the most from this coverage based on their financial goals, risk tolerance, and long-term planning. Brokers should work closely with clients to customize their policy offerings, ensuring that paid-up additional insurance options align with the client's unique needs and objectives. Insurance brokers should maintain long-term relationships with their clients, offering ongoing support and guidance as their financial needs and goals evolve over time. This includes providing regular policy reviews and updates on paid-up additional insurance options. Paid-up additional insurance offers policyholders the opportunity to use their dividends to purchase additional coverage, enhancing their cash value and death benefit without increasing premiums. Whole life, universal life, variable life, and indexed universal life insurance are policy types that may include paid-up additional insurance options. Insurance brokers play a crucial role in educating clients, identifying suitable clients, customizing policy offerings, and providing ongoing support for paid-up additional insurance. Factors to consider when recommending this coverage include clients' financial goals, risk tolerance, policy cost, tax implications, and long-term growth prospects. The benefits of paid-up additional insurance include guaranteed insurability, increased cash value, enhanced death benefit, flexibility in premium payments, and potential tax advantages. Insurance brokers' role in marketing paid-up additional insurance involves educating clients, identifying suitable clients, customizing policies, and maintaining long-term relationships with ongoing support.Definition of Paid-Up Additional Insurance

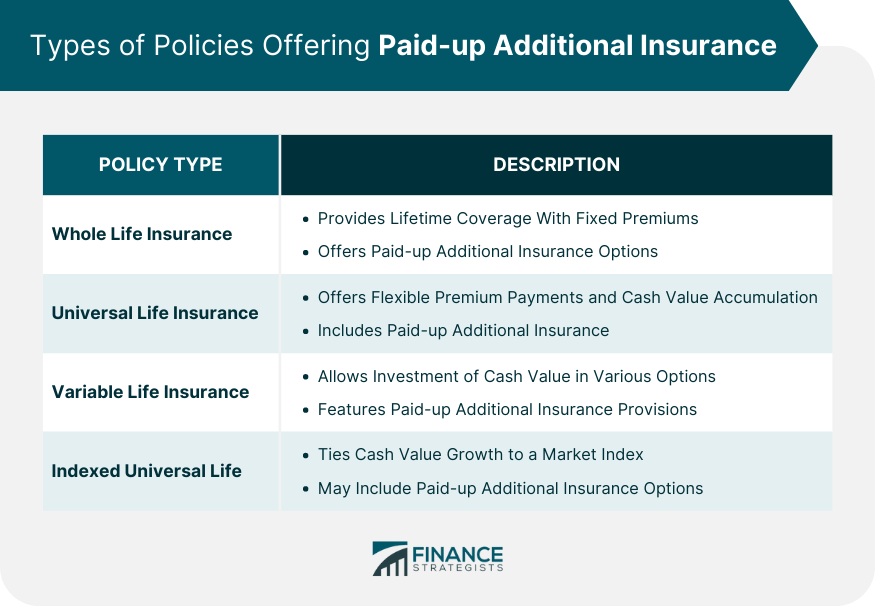

Types of Policies Offering Paid-up Additional Insurance

Whole Life Insurance

Universal Life Insurance

Variable Life Insurance

Indexed Universal Life Insurance

How Paid-up Additional Insurance Works

Understanding Policy Dividends

Using Dividends to Purchase Paid-up Additional Insurance

Reinvestment of Dividends for Long-Term Growth

Role of the Insurance Broker in Managing the Policy

Factors to Consider When Recommending Paid-up Additional Insurance

Client's Financial Goals and Risk Tolerance

Policy Cost and Affordability

Potential Tax Implications

Long-Term Growth Prospects

Comparison With Alternative Investment Options

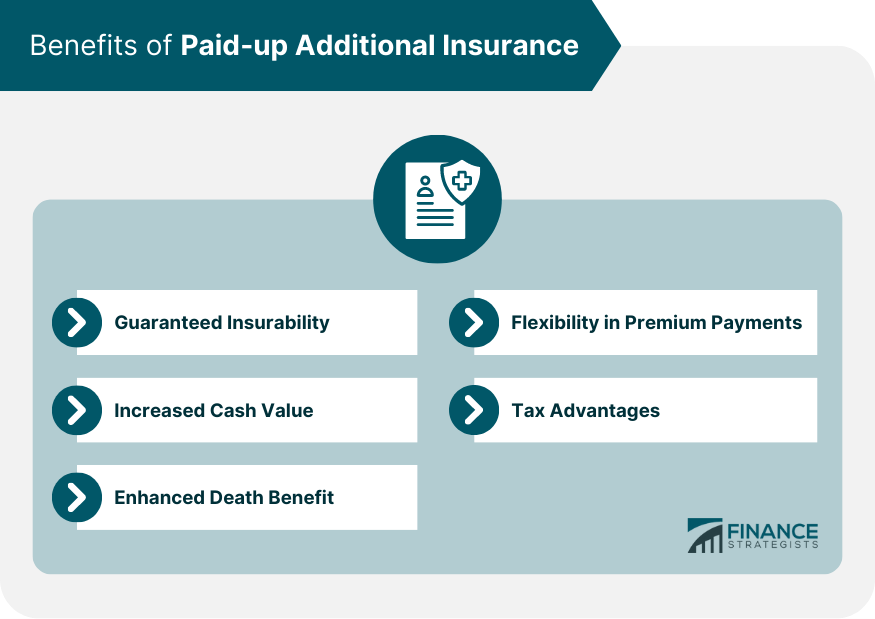

Benefits of Paid-up Additional Insurance

Guaranteed Insurability

Increased Cash Value

Enhanced Death Benefit

Flexibility in Premium Payments

Tax Advantages

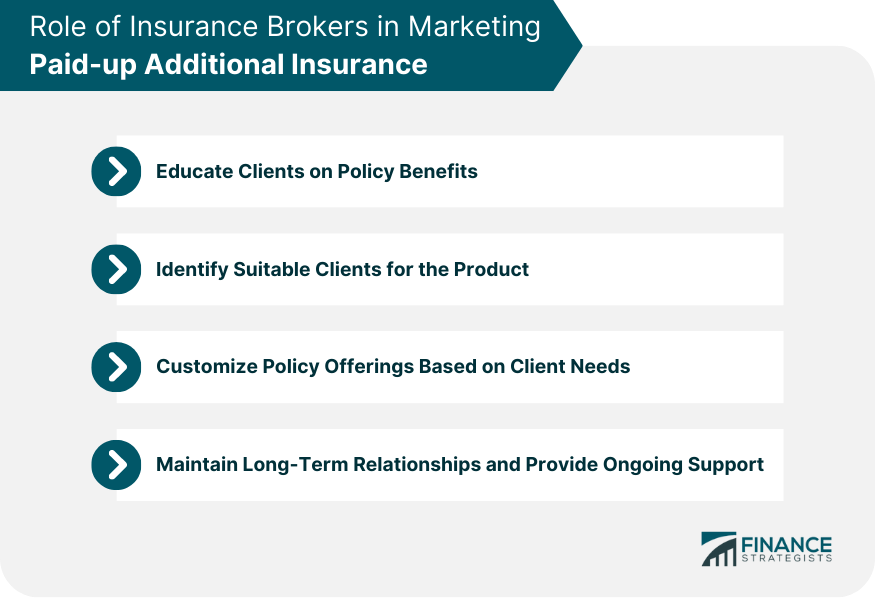

Role of Insurance Brokers in Marketing Paid-up Additional Insurance

Educating Clients on Policy Benefits

Identifying Suitable Clients for the Product

Customizing Policy Offerings Based on Client Needs

Maintaining Long-Term Relationships and Providing Ongoing Support

Final Thoughts

Paid-up Additional Insurance FAQs

Paid-up Additional Insurance is designed to increase the cash value and death benefit of a life insurance policy without increasing the policyholder's out-of-pocket premium expenses. By using policy dividends to purchase additional coverage, policyholders can enhance their overall policy value and provide greater financial security for their beneficiaries.

Paid-up Additional Insurance contributes to the cash value growth of a life insurance policy by reinvesting policy dividends into additional coverage. This increases the policy's overall cash value, which can be accessed through policy loans, withdrawals, or used as collateral for personal loans.

Paid-up Additional Insurance is most commonly available with whole life, universal life, variable life, and indexed universal life insurance policies. However, not all policies may offer this option. It's essential to consult with your insurance broker to determine if your specific policy allows for the addition of paid-up additional insurance.

Yes, the cash value of Paid-up Additional Insurance is typically accessible during the policyholder's lifetime, similar to the cash value of the base policy. Policyholders can access the cash value through policy loans, withdrawals, or by using it as collateral for personal loans. However, accessing the cash value may have tax implications and can reduce the policy's overall death benefit.

The amount of Paid-up Additional Insurance on your policy is determined by the dividends you receive from the insurer and your decision to reinvest those dividends into additional coverage. While you cannot directly change the amount of paid-up additional insurance, you can choose how to use your dividends each year, either by purchasing more paid-up additional insurance or allocating them to other options such as premium reductions or cash payouts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.