A Hospital Insurance Trust Fund is a financial reserve created by the government to provide funding for specific healthcare services, typically covering expenses related to hospital care, skilled nursing facility care, home health care, and hospice care. This trust fund ensures that eligible beneficiaries have access to the necessary healthcare services without the burden of excessive out-of-pocket costs. The Hospital Insurance Trust Fund operates as a pay-as-you-go system, where the fund's revenues primarily come from payroll taxes paid by employers and employees. The accumulated funds are then used to cover the healthcare expenses of eligible beneficiaries, such as seniors and disabled individuals. By creating a dedicated funding source, the government can ensure that these vital healthcare services remain available to those in need, even during times of economic hardship or when public funds are scarce. In addition, the trust fund helps to spread the cost of healthcare among the working population, reducing the financial burden on individual beneficiaries and their families. The long-term goal of the trust fund is to guarantee the sustainability of essential healthcare services for current and future generations. The Hospital Insurance Trust Fund plays a crucial role in providing financial support for essential healthcare services, ensuring that eligible beneficiaries receive the care they need without facing undue financial hardship. By pooling resources and distributing costs among taxpayers, the trust fund helps to maintain the affordability and accessibility of healthcare services for millions of individuals. Moreover, the trust fund acts as a safety net, guaranteeing that healthcare services will remain available during economic downturns or periods of fiscal uncertainty. In this way, the Hospital Insurance Trust Fund is a vital component of the nation's healthcare infrastructure, promoting the health and well-being of its citizens. The concept of the Hospital Insurance Trust Fund originated in the United States with the passage of the Social Security Act of 1965, which established Medicare as a national health insurance program for seniors and certain disabled individuals. The trust fund was created to finance Medicare Part A, the hospital insurance component of the program, which covers inpatient hospital care, skilled nursing facility care, home health care, and hospice care. Over the years, the Hospital Insurance Trust Fund has evolved in response to changes in the healthcare landscape, demographic shifts, and economic factors. Despite these changes, the trust fund remains a cornerstone of the nation's healthcare system, ensuring access to vital services for millions of Americans. Since its inception, the Hospital Insurance Trust Fund has been subject to various legislative actions aimed at improving its financial stability, expanding coverage, and addressing emerging healthcare needs. Key legislative actions include the Balanced Budget Act of 1997, which implemented measures to control Medicare spending, and the Affordable Care Act of 2010, which introduced reforms designed to improve the efficiency and effectiveness of the healthcare system. These legislative actions have shaped the trust fund's operations and influenced its ability to meet the healthcare needs of eligible beneficiaries. As the healthcare landscape continues to change, further legislative action will be necessary to ensure the long-term viability of the Hospital Insurance Trust Fund. The primary source of funding for the Hospital Insurance Trust Fund is payroll taxes paid by employers and employees under the Federal Insurance Contributions Act (FICA). These taxes are levied on wages and self-employment income, with the revenue generated being allocated to the trust fund. In addition to payroll taxes, the trust fund receives income from the taxation of Social Security benefits, interest earned on trust fund investments, and premiums paid by voluntary enrollees in the Medicare program. These diverse funding sources help to ensure the financial stability of the trust fund and its ability to support the healthcare needs of eligible beneficiaries. The Hospital Insurance Trust Fund is overseen by a Board of Trustees, which is responsible for managing the fund's assets, evaluating its financial status, and ensuring its long-term solvency. The board is composed of six members, including the Secretary of the Treasury, the Secretary of Labor, the Secretary of Health and Human Services, and three public representatives appointed by the President and confirmed by the Senate. The Board of Trustees is charged with ensuring the proper administration and financial management of the trust fund, providing guidance on its operations, and making recommendations for legislative action when necessary to protect the fund's solvency. The day-to-day administration of the Hospital Insurance Trust Fund is carried out by the Centers for Medicare & Medicaid Services (CMS), an agency within the Department of Health and Human Services. CMS is responsible for implementing policies and procedures that govern the operation of the trust fund, including the disbursement of funds to healthcare providers, the collection of payroll taxes and premiums, and the management of trust fund investments. In addition, CMS works closely with other government agencies, private insurers, and healthcare providers to coordinate benefits, detect and prevent fraud and abuse, and ensure the efficient delivery of healthcare services to beneficiaries. The financial oversight of the Hospital Insurance Trust Fund involves ongoing monitoring and assessment of the fund's financial status to ensure its long-term solvency. This includes the preparation of annual reports by the Board of Trustees, which provide detailed information on the fund's financial operations, projected revenues and expenditures, and the overall health of the trust fund. These reports serve as an essential tool for policymakers, helping them to identify potential financial challenges and develop strategies to address them. Financial oversight also involves periodic audits and assessments by external organizations, such as the Government Accountability Office and the Office of the Inspector General, to ensure the proper management of trust fund resources. The Hospital Insurance Trust Fund is primarily funded through payroll taxes paid by employers and employees under the Federal Insurance Contributions Act. Additional sources of funding include the taxation of Social Security benefits, interest earned on trust fund investments, and premiums paid by voluntary enrollees in the Medicare program. These diverse sources of funding help to maintain the financial stability of the trust fund, ensuring its ability to meet the healthcare needs of eligible beneficiaries. The sustainability of the Hospital Insurance Trust Fund is a key concern for policymakers and healthcare stakeholders, as the fund's ability to meet the healthcare needs of current and future beneficiaries depends on its financial health. Factors that impact the sustainability of the trust fund include demographic trends, such as the aging population, and changes in healthcare costs and utilization. To ensure the long-term sustainability of the trust fund, it is essential for policymakers to closely monitor its financial status, implement strategies to control healthcare costs, and consider potential reforms to address emerging challenges. The Hospital Insurance Trust Fund provides coverage for inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services through the Medicare program. This coverage can be particularly important for individuals who require frequent medical care or have chronic health conditions that require ongoing treatment. The Hospital Insurance Trust Fund provides financial protection for eligible individuals in the event of a hospitalization or other eligible medical expenses. This protection can help to prevent individuals from incurring significant medical debt or going bankrupt due to the cost of medical care. The Hospital Insurance Trust Fund covers a portion of eligible medical expenses, which can help to reduce the out-of-pocket costs for individuals. This cost-sharing can be particularly important for individuals who have limited financial resources or who require extensive medical care. One of the most significant challenges facing the Hospital Insurance Trust Fund is its long-term financial stability. Factors such as the aging population, increasing healthcare costs, and economic fluctuations can strain the trust fund's resources and threaten its ability to provide adequate support to beneficiaries. To address these challenges, policymakers must explore various strategies, including cost-containment measures, revenue-enhancing initiatives, and systemic reforms that can improve the efficiency and effectiveness of healthcare services. The Hospital Insurance Trust Fund is also subject to political challenges, as decisions regarding its funding, benefits, and administration often become entangled in broader debates over healthcare policy, fiscal responsibility, and the role of government. These political challenges can create uncertainty and instability for the trust fund, making it difficult to plan for the future and ensure the continuity of essential healthcare services for beneficiaries. To overcome these political challenges, it is crucial for policymakers to engage in constructive dialogue, build consensus around shared goals and priorities, and develop bipartisan solutions that promote the long-term sustainability of the trust fund. Various reform proposals have been put forward to address the challenges facing the Hospital Insurance Trust Fund, ranging from incremental changes to more comprehensive overhauls of the healthcare system. Some of the proposed reforms include raising payroll taxes, increasing the Medicare eligibility age, implementing value-based payment models, and expanding the role of private insurers in the Medicare program. While there is no one-size-fits-all solution to the challenges facing the trust fund, it is essential for policymakers to carefully consider the potential impact of these reforms on beneficiaries, healthcare providers, and the broader healthcare system. The Hospital Insurance Trust Fund is a vital component of the nation's healthcare infrastructure, providing financial support for essential healthcare services and ensuring that eligible beneficiaries have access to the care they need without facing undue financial hardship. The trust fund offers numerous benefits to beneficiaries and the broader healthcare system, promoting access to care, enhancing the quality of services, and encouraging the adoption of innovative healthcare practices and technologies. At the same time, the trust fund faces significant challenges, including financial pressures, political debates, and the need for ongoing reform. By addressing these challenges and working collaboratively to develop effective solutions, policymakers and healthcare stakeholders can help to ensure its long-term sustainability, preserving its essential role in promoting the health and well-being of millions of Americans.What Is a Hospital Insurance Trust Fund?

Importance of the Trust Fund

Background of the Hospital Insurance Trust Fund

Historical Background

Legislative Action

Funding Sources

Management of the Hospital Insurance Trust Fund

Board of Trustees

Administration of the Trust Fund

Financial Oversight

Funding the Hospital Insurance Trust Fund

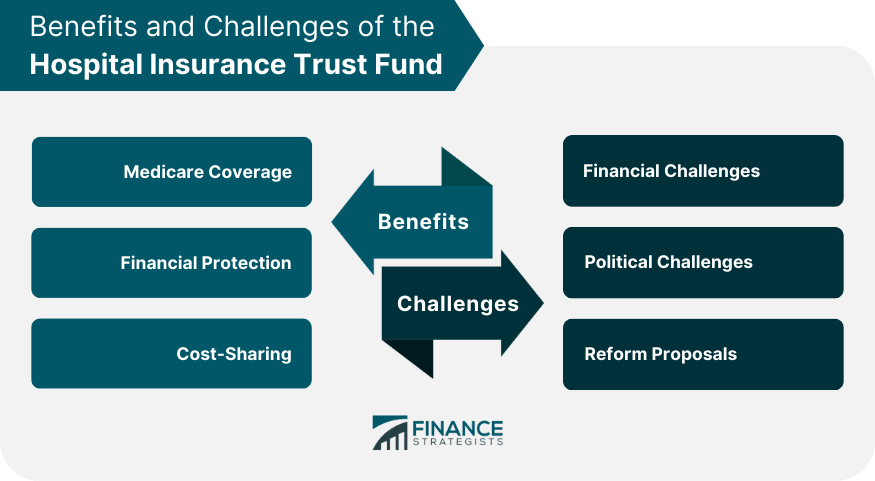

Benefits of the Hospital Insurance Trust Fund

Medicare Coverage

Financial Protection

Cost-Sharing

Challenges of the Hospital Insurance Trust Fund

Financial Challenges

Political Challenges

Reform Proposals

Final Thoughts

Hospital Insurance Trust Fund FAQs

The Hospital Insurance Trust Fund is a federal trust fund that finances Medicare Part A benefits, including hospital insurance.

The Hospital Insurance Trust Fund is managed by a Board of Trustees, consisting of six members appointed by the President and approved by the Senate.

The Hospital Insurance Trust Fund is funded through payroll taxes, taxes on Social Security benefits, and other revenue sources.

The Hospital Insurance Trust Fund provides coverage for inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services.

The Hospital Insurance Trust Fund is facing financial challenges due to demographic changes, rising healthcare costs, and political debates over healthcare policy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.