Medicare Part A is the hospital insurance component of the Medicare program, a federal health insurance plan for individuals aged 65 and older, as well as certain younger individuals with disabilities. Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and home health care services. Medicare Part A is essential for providing financial protection against high-cost hospitalization and other related medical services. It helps beneficiaries access necessary inpatient care and maintain their health and well-being. Below are some criteria for determining Medicare Part A eligibility. Individuals aged 65 or older are eligible for Medicare Part A coverage. They must be a U.S. citizen or a legal resident who has lived in the United States for at least five years. Younger individuals with disabilities may qualify for Medicare Part A if they have received Social Security Disability Insurance (SSDI) benefits for at least 24 months or have been diagnosed with Amyotrophic Lateral Sclerosis (ALS). People with End-Stage Renal Disease (ESRD) who require regular dialysis or a kidney transplant are also eligible for Medicare Part A coverage, regardless of their age. Medicare Part A provides coverage for the following: Medicare Part A covers inpatient hospital stays, including a semi-private room, meals, and nursing services. It also covers necessary lab tests, medications, and medical supplies during the hospitalization. Part A provides coverage for skilled nursing facility care, including rehabilitation services and nursing care, following a qualifying hospital stay of at least three days. The coverage is limited to a maximum of 100 days per benefit period. Hospice care for individuals with a terminal illness and a life expectancy of six months or less is covered by Medicare Part A. The coverage includes pain relief and symptom management, as well as support services for the patient and their family. Part A covers home health care services, including skilled nursing care, physical therapy, occupational therapy, and speech-language pathology services, for beneficiaries who are homebound and require intermittent skilled care. There are several costs involved in Medicare Part A. Most individuals qualify for premium-free Medicare Part A based on their work history or their spouse's work history. However, those who do not qualify for premium-free Part A can purchase coverage by paying a monthly premium. Beneficiaries are responsible for a deductible amount for each benefit period in which they use inpatient hospital or skilled nursing facility services under Medicare Part A. This deductible covers the first 60 days of hospitalization. After the deductible is met, beneficiaries may be responsible for coinsurance payments for extended hospital stays or skilled nursing facility care beyond the initial coverage period. There are several limitations to Medicare Part A, including the following: Medicare Part A does not cover all inpatient care costs. For example, it does not cover private rooms in a hospital, unless medically necessary, or personal care items like razors or toothpaste. Certain services, such as long-term care, custodial care, and dental care, are not covered by Medicare Part A. Beneficiaries may need to seek alternative coverage options or pay for these services out-of-pocket. Medicare Part A beneficiaries are responsible for meeting deductibles and making co-payments for certain services. These out-of-pocket costs can be financially burdensome for some individuals. There are several enrollment period options under Medicare Part A. The Initial Enrollment Period (IEP) is a seven-month window that begins three months before an individual's 65th birthday, includes their birth month, and extends three months after their birth month. This is the best time to enroll in Medicare Part A to ensure timely coverage. If an individual misses their Initial Enrollment Period, they can enroll in Medicare Part A during the General Enrollment Period, which runs from January 1 to March 31 each year. However, late enrollment may result in penalties and delayed coverage. Certain life events or circumstances, such as loss of employer-sponsored coverage, may qualify an individual for a Special Enrollment Period (SEP). During an SEP, beneficiaries can enroll in Medicare Part A without incurring penalties or experiencing a delay in coverage. Medicare Part A is a crucial component of the Medicare program, providing hospital insurance coverage for eligible individuals. Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and home health care services. Medicare Part A has some limitations, including coverage gaps, services not covered, and out-of-pocket costs, which may be financially burdensome for some individuals. It is crucial to enroll in Part A during the Initial Enrollment Period or a Special Enrollment Period to avoid penalties and delays in coverage. As the U.S. population ages and health care costs continue to rise, policymakers must consider potential improvements or changes to the program to ensure it remains a valuable resource for beneficiaries in the future.Definition of Medicare Part A

Eligibility for Medicare Part A

Age Eligibility

Disability Eligibility

End-Stage Renal Disease Eligibility

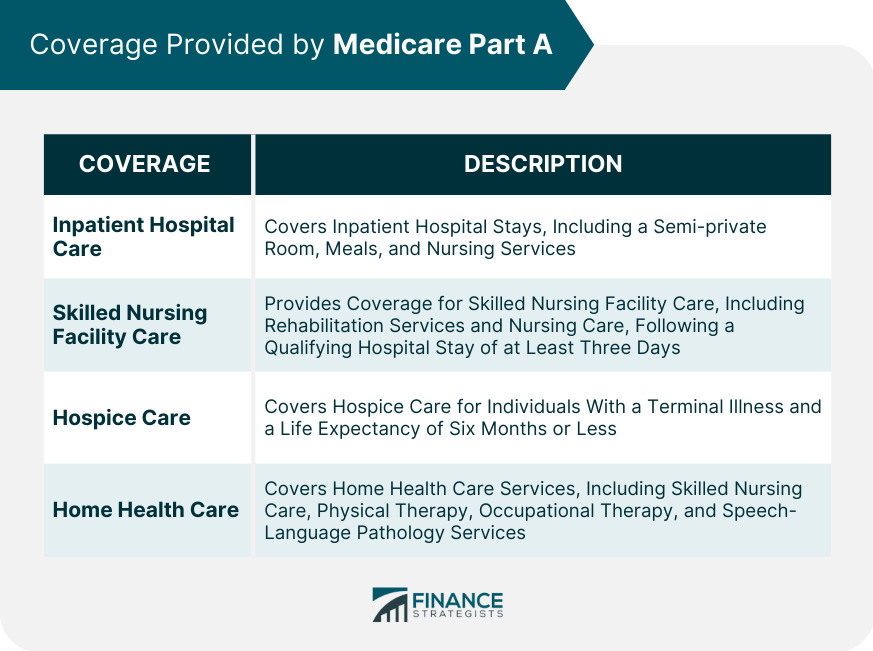

Coverage Provided by Medicare Part A

Inpatient Hospital Care

Skilled Nursing Facility Care

Hospice Care

Home Health Care

Costs of Medicare Part A

Premiums

Deductibles

Coinsurance

Limitations of Medicare Part A

Coverage Gaps

Services Not Covered

Co-Payments and Deductibles

Enrollment in Medicare Part A

Initial Enrollment Period

General Enrollment Period

Special Enrollment Period

Conclusion

Eligibility for Part A is based on age, disability, or End-Stage Renal Disease. While most individuals qualify for premium-free Part A, those who don't can purchase coverage by paying a monthly premium.

However, beneficiaries are responsible for deductibles and coinsurance payments for certain services.

Medicare Part A FAQs

Medicare Part A is a federal health insurance program that covers inpatient hospital care, hospice care, and skilled nursing facility care.

Individuals who are 65 or older, or those who have a qualifying disability, may be eligible for Medicare Part A.

Medicare Part A covers inpatient hospital care, hospice care, and skilled nursing facility care. It may also cover some home health care services.

Most people do not pay a premium for Medicare Part A if they have paid Medicare taxes while working. However, there may be costs for deductibles, coinsurance, and other services.

Yes, there are limits to the coverage provided by Medicare Part A. For example, there may be limits on the number of days covered for inpatient hospital care or skilled nursing facility care.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.