Group term life insurance is a type of life insurance policy offered by an employer, organization, or association to its members or employees as part of a comprehensive benefits package. It provides coverage for a specified term and pays out a death benefit to the designated beneficiaries in the event of the policyholder's death during the term. Group term life insurance plays a crucial role in employee benefits packages, offering financial protection and peace of mind for employees and their families. It can also serve as an essential recruitment and retention tool, helping employers attract and maintain a talented and committed workforce. Basic coverage is the minimum amount of life insurance provided to all eligible employees, typically determined as a multiple of the employee's salary or a fixed amount. This coverage is often provided at no cost to the employee and serves as a foundational level of financial protection. Supplemental coverage allows employees to purchase additional life insurance beyond the basic coverage provided by the employer. This extra coverage is usually available at group rates, offering a more affordable option for employees seeking higher levels of protection. Policy duration refers to the length of time during which the group term life insurance policy remains in effect. Typically, coverage is provided on an annual basis and is renewable as long as the employee remains with the company and the group policy remains active. Beneficiaries are the individuals designated by the policyholder to receive the death benefit payout in the event of the policyholder's death. Employees can usually select multiple beneficiaries and can update their beneficiary designations as needed throughout the policy term. Conversion options allow employees to convert their group term life insurance coverage to an individual policy if they leave the company or lose coverage for another reason. This conversion is typically available without the need for additional medical underwriting but may result in higher premiums. Group term life insurance policies are typically more cost-effective for employers compared to individual policies. This is because group rates are often lower due to the spreading of risk across a larger pool of insured individuals, resulting in lower premiums for the employer. Employees benefit from group term life insurance through lower premium costs compared to individual policies. The group rates and employer subsidies often make coverage more accessible and affordable for employees, enabling them to secure financial protection for their families. The underwriting process for group term life insurance is typically simpler and less time-consuming than for individual policies. Employees are often not required to undergo medical exams or provide detailed health information, making the enrollment process more straightforward and convenient. Group term life insurance policies often come with tax benefits for both employers and employees. Premiums paid by the employer for basic coverage are generally tax-deductible, while the death benefits paid to beneficiaries are typically not subject to income tax. Group term life insurance policies often have coverage limits, which may not fully meet the financial needs of employees and their families. Employees with higher income levels or specific financial obligations may require additional coverage through supplemental policies or individual policies. One significant limitation of group term life insurance is its lack of portability. When an employee leaves the company, they may lose their coverage, leaving them without life insurance protection unless they convert to an individual policy or secure coverage through a new employer. Group term life insurance policies usually offer limited customization options compared to individual policies. Employees may have less flexibility in tailoring their coverage amounts, term lengths, and policy features to meet their specific needs and preferences. When an employee's employment status changes, such as through termination or resignation, their group term life insurance coverage may end. This can leave the employee without life insurance protection, highlighting the importance of considering portability and conversion options. Group term life insurance policies generally have lower premiums compared to individual policies due to group rates and employer subsidies. However, individual policies may offer more competitive rates for healthier individuals or those seeking higher coverage amounts. Individual term life insurance policies typically offer more extensive coverage options and customization possibilities than group policies. This allows policyholders to tailor their coverage to meet their unique needs and financial objectives more effectively. The underwriting process for individual term life insurance policies is generally more rigorous than for group policies. Applicants may be required to undergo medical exams, provide health history information, and face more stringent underwriting criteria. Individual term life insurance policies offer greater portability and flexibility compared to group policies. Policyholders can maintain their coverage regardless of their employment status or changes in their employer's benefit offerings, providing continuous protection for their families. The size and demographics of a company play a crucial role in determining the appropriate group term life insurance offerings. Smaller companies may face higher per-employee costs, while larger organizations can benefit from economies of scale and lower overall premiums. Understanding the diverse needs and preferences of employees is essential when selecting group term life insurance offerings. Employers should consider factors such as coverage amounts, policy features, and supplemental coverage options to meet the financial protection needs of their workforce. Budget constraints can influence the extent and scope of group term life insurance benefits offered by employers. Balancing the cost of premiums with the value of the coverage provided is critical to ensuring a sustainable and attractive benefits package. Group term life insurance should be integrated seamlessly with other employee benefits, such as health insurance, disability insurance, and retirement plans. This comprehensive approach can help create a well-rounded and competitive benefits package that supports employee well-being and satisfaction. ERISA sets federal standards for private sector employee benefit plans, including group term life insurance. Employers offering group term life insurance must comply with ERISA requirements regarding plan administration, reporting, and disclosure. IRS guidelines dictate the tax treatment of group term life insurance premiums and benefits, impacting both employers and employees. Compliance with IRS regulations is crucial to ensure the appropriate tax treatment of the policy. Group term life insurance is subject to state insurance regulations, which may vary across jurisdictions. Employers must ensure their group term life insurance offerings comply with the specific rules and requirements of the states in which they operate. Group term life insurance is an essential component of employee benefits packages, offering financial protection and peace of mind to employees and their families. Understanding the features, advantages, and limitations of group term life insurance can help employers make informed decisions when designing and implementing these programs. Factors such as company size, employee needs, budget constraints, and regulatory compliance play a critical role in shaping the success of group term life insurance programs. Evaluating employee needs and aligning them with company goals is crucial when selecting and implementing group term life insurance offerings. A well-designed and carefully managed group term life insurance program can promote employee satisfaction, retention, and overall well-being, contributing to a more engaged and committed workforce.What Is Group Term Life Insurance?

Features of Group Term Life Insurance

Coverage and Benefits

Basic Coverage

Supplemental Coverage

Policy Duration

Beneficiaries

Conversion Options

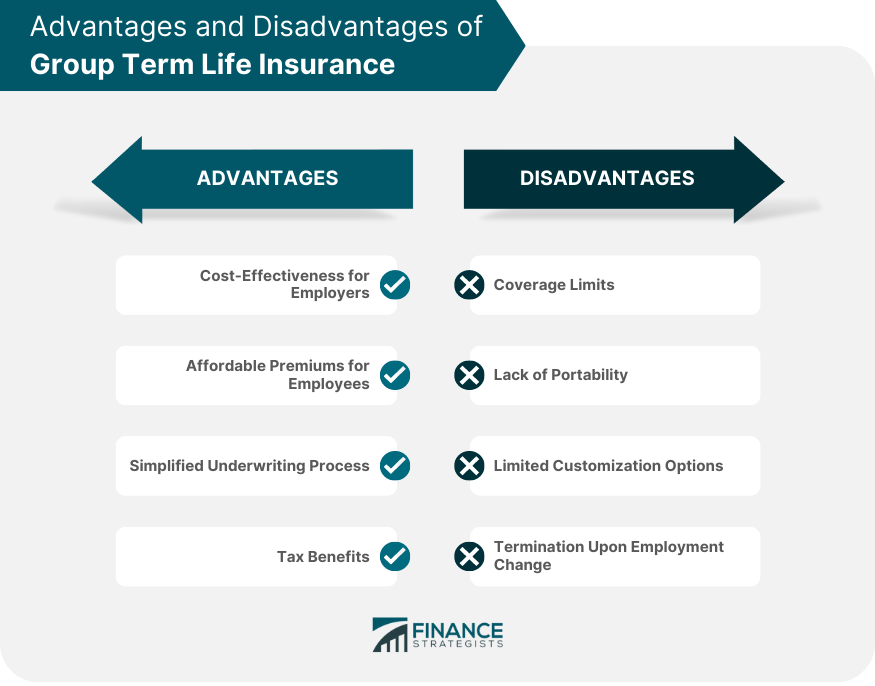

Advantages of Group Term Life Insurance

Cost-Effectiveness for Employers

Affordable Premiums for Employees

Simplified Underwriting Process

Tax Benefits

Disadvantages of Group Term Life Insurance

Coverage Limits

Lack of Portability

Limited Customization Options

Termination Upon Employment Change

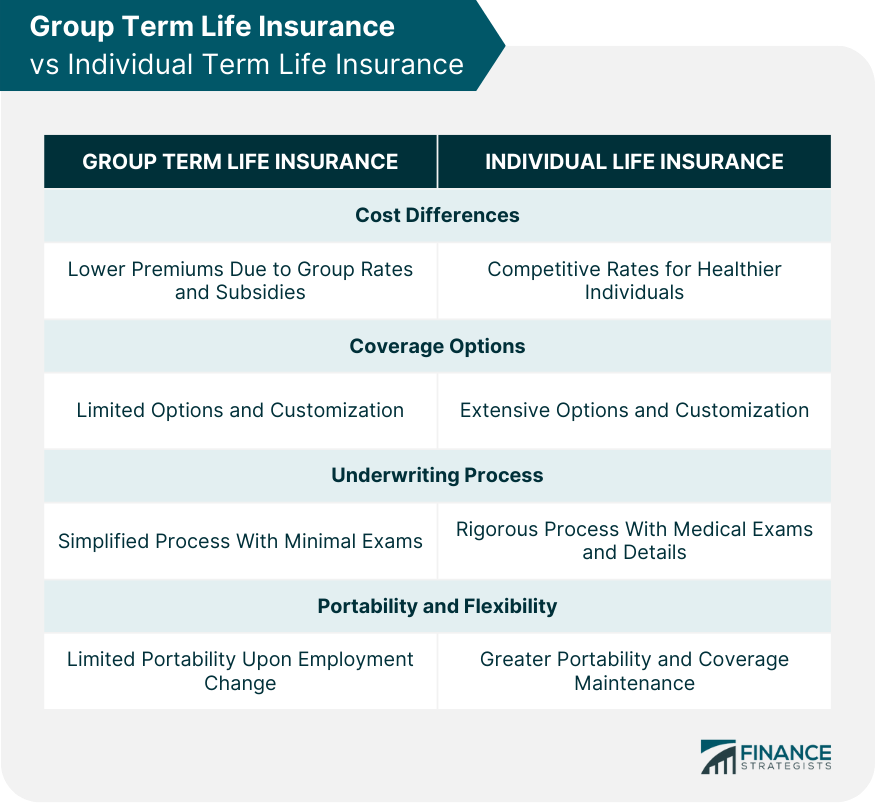

Comparing Group Term Life Insurance to Individual Term Life Insurance

Cost Differences

Coverage Options

Underwriting Process

Portability and Flexibility

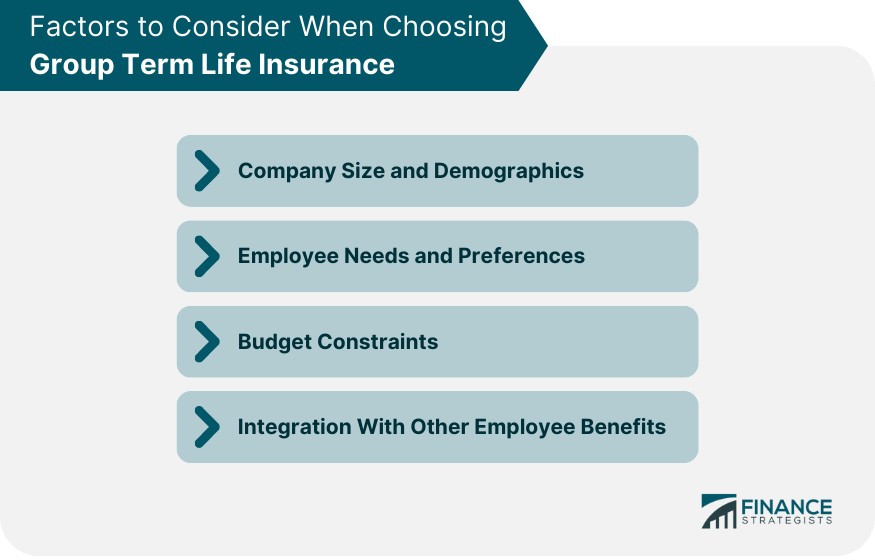

Factors to Consider When Choosing Group Term Life Insurance

Company Size and Demographics

Employee Needs and Preferences

Budget Constraints

Integration With Other Employee Benefits

Legal and Regulatory Considerations

Employee Retirement Income Security Act (ERISA)

Internal Revenue Service (IRS) Guidelines

State Insurance Regulations

Final Thoughts

Group Term Life Insurance FAQs

The primary purpose of group term life insurance is to provide financial protection and support to an employee's family or designated beneficiaries in the event of the employee's death during the policy term. This type of insurance is typically offered by employers as part of a comprehensive benefits package, and it helps to attract and retain talent while ensuring the well-being of employees and their families.

Group term life insurance is provided by an employer or organization to a group of employees or members, while individual term life insurance is purchased by an individual directly from an insurance company. Group policies often have lower premiums, simplified underwriting processes, and limited customization options compared to individual policies. Additionally, group term life insurance is generally not portable, meaning coverage may cease if an employee leaves the company or organization.

Yes, employees may have the option to purchase supplemental coverage in addition to the basic coverage provided by their employer's group term life insurance policy. Supplemental coverage allows employees to increase their coverage amounts, usually at group rates, to better meet their financial protection needs.

The tax treatment of group term life insurance premiums and benefits depends on various factors, such as the amount of coverage and the employer's contribution. Generally, employer-paid premiums for basic coverage are tax-deductible for the employer, while the death benefits paid to beneficiaries are not subject to income tax. However, it is essential to consult with a tax professional or refer to IRS guidelines for specific tax implications based on individual circumstances.

When an employee leaves a company or experiences a change in employment status, their group term life insurance coverage may end. However, some policies offer conversion options, allowing the employee to convert their group coverage to an individual policy without undergoing additional medical underwriting. This conversion typically results in higher premiums but ensures continued life insurance protection for the employee and their family.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.