Indemnity insurance is a type of insurance policy designed to protect businesses and professionals from potential financial losses due to claims made against them by clients or third parties. It covers the insured party for legal costs, settlements, and judgments resulting from claims alleging negligence, errors, or omissions in the provision of their professional services. Indemnity insurance operates on the principle of indemnification, which means that the insurer compensates the insured for any financial loss sustained due to covered claims. This ensures that the insured party's financial stability is maintained, allowing them to continue their operations without interruption. The importance of indemnity insurance lies in its ability to protect businesses and professionals from the financial risks associated with claims made against them. In today's litigious society, even a small mistake or oversight can lead to significant financial repercussions, including costly legal fees and damage to one's reputation. Having indemnity insurance in place can safeguard against these risks, providing the necessary resources to handle claims and maintain a positive reputation. Moreover, many clients and professional organizations require businesses and professionals to have indemnity insurance in place as a condition of providing their services. This ensures that the client is protected in case the professional makes a mistake that results in financial harm. Without adequate indemnity insurance, a business or professional may struggle to attract clients or meet industry requirements. Professional liability insurance, also known as errors and omissions (E&O) insurance, covers professionals for claims related to errors, omissions, or negligence in the provision of their services. This type of indemnity insurance is especially important for professionals who provide advice or services that could potentially cause financial harm to clients if not performed correctly, such as lawyers, accountants, and consultants. Profession and the individual policyholder's needs are some of the factors that need to be considered in determining the coverage and limits of this insurance. General liability insurance covers businesses for claims related to bodily injury, property damage, and personal or advertising injury caused by the business's operations, products, or services. This type of indemnity insurance is essential for most businesses, as it helps protect against the financial impact of lawsuits and other claims arising from accidents or injuries that occur on their premises or as a result of their products or services. General liability policies typically cover legal defense costs, settlements, and judgments arising from covered claims. The coverage and limits of this policy will be based on the nature of the business and the level of risk it faces. Product liability insurance covers businesses for claims related to defects, malfunctions, or other issues with the products they manufacture, distribute, or sell. This is particularly important for businesses that deal with consumer products, as they may face significant financial liability if a product causes injury or damage to a customer. The specific coverage and limits of a product liability policy will depend on the nature of the products in question and the level of risk associated with their manufacture, distribution, or sale. Legal Costs: Indemnity insurance policies cover significant legal expenses, including attorney fees, expert witness fees, and court costs, ensuring insured parties can defend themselves without incurring substantial financial losses. Settlements and Judgments: Indemnity insurance protects businesses and professionals by covering the costs of settlements and judgments, safeguarding their financial stability in the face of liability claims. Damage to Property: Some indemnity insurance policies, like general liability insurance, provide coverage for property damage caused by business operations, products, or services. This coverage protects businesses from financial losses and provides peace of mind to affected clients and third parties. By covering legal costs, settlements, and judgments, indemnity insurance helps to protect the insured party's financial stability, allowing them to continue their operations without interruption. This financial security is vital in today's litigious society, where even a small mistake or oversight can lead to significant financial repercussions. Having indemnity insurance in place can help to safeguard against these risks and ensure the continued success of a business or professional. Knowing that they are protected from the financial risks associated with claims made against them allows the insured party to focus on providing their services or running their business without constant worry about potential lawsuits or other claims. This peace of mind can also extend to clients and other third parties, who can be confident that the business or professional they are working with is adequately insured and able to handle any claims that may arise. This protection can help to safeguard the insured party's reputation and ensure that they can continue their operations without being negatively impacted by claims or litigation. In some cases, indemnity insurance may also deter potential claimants from pursuing legal action, as they may be less likely to file a lawsuit against a business or professional who is adequately insured and able to defend themselves against claims. The cost of indemnity insurance can be significant, particularly for businesses and professionals in high-risk industries or with a history of claims. These premium costs can be a burden for some businesses, especially smaller ones with limited financial resources. However, it is essential to weigh the cost of premiums against the potential financial risks associated with not having indemnity insurance. In many cases, the financial losses resulting from a single claim can far exceed the cost of insurance premiums. Another drawback of indemnity insurance is that policies often have coverage limitations, such as policy limits or deductibles. These limitations can result in the insured party being responsible for a portion of the costs associated with a claim, even if they have insurance in place. To address these coverage limitations, insured parties may need to purchase additional coverage or consider other risk management strategies to mitigate potential financial losses. These exclusions can limit the protection offered by indemnity insurance and may leave businesses and professionals exposed to financial risks. It is crucial for businesses and professionals to understand the exclusions in their indemnity insurance policies and, if necessary, seek additional coverage to address any potential gaps in protection. Failure to do so can result in significant financial losses due to claims that are not covered by their insurance policy. When selecting indemnity insurance, businesses and professionals should consider the specific risks and requirements associated with their industry. Different industries may have unique risks, regulatory requirements, and professional standards that may influence the type and level of indemnity insurance needed. For example, professionals in the healthcare industry may require medical malpractice insurance, while those in the construction industry may need specific coverage for risks associated with construction projects. Understanding the industry-specific risks and requirements can help businesses and professionals select the appropriate indemnity insurance for their needs. Smaller businesses may have different risk profiles and financial resources compared to larger organizations, which can impact their indemnity insurance requirements. Small businesses should carefully consider their specific risks and needs when selecting indemnity insurance, ensuring that they have adequate coverage to protect their financial stability without overpaying for unnecessary coverage. Businesses and professionals that face higher levels of risk, either due to the nature of their services or their client base, may require more comprehensive indemnity insurance coverage to protect against potential claims. Evaluating the level of risk associated with a business or professional's services can help them make informed decisions about the type and amount of indemnity insurance needed to safeguard their financial stability and reputation. Indemnity insurance is a crucial tool for businesses and professionals seeking to protect themselves from the financial risks associated with claims made against them. It offers numerous benefits, such as financial security, peace of mind, and protection against lawsuits. However, there are also drawbacks, including premium costs, coverage limitations, and insurance policy exclusions. When choosing indemnity insurance, businesses and professionals should consider factors such as industry, business size, and level of risk. These factors can help them make informed decisions about the type and amount of indemnity insurance needed to protect their financial stability and reputation in the face of potential claims.What Is Indemnity Insurance?

Importance of Indemnity Insurance

Types of Indemnity Insurance

Professional Liability Insurance

General Liability Insurance

Product Liability Insurance

Coverage Offered by Indemnity Insurance

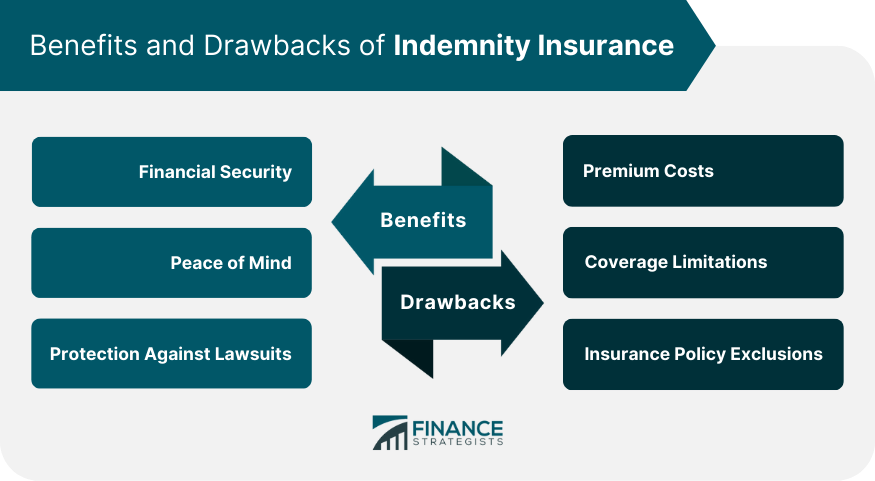

Benefits of Indemnity Insurance

Financial Security

Peace of Mind

Protection Against Lawsuits

Drawbacks of Indemnity Insurance

Premium Costs

Coverage Limitations

Insurance Policy Exclusions

Factors to Consider When Choosing Indemnity Insurance

Industry

Business Size

Level of Risk

Final Thoughts

Indemnity Insurance FAQs

Indemnity insurance is a policy that protects an individual or business from financial loss due to legal claims or lawsuits.

Indemnity insurance typically covers legal costs, settlements and judgments, and damage to property.

Professionals such as doctors, lawyers, and architects typically require indemnity insurance, as well as businesses that offer services to clients.

Indemnity insurance provides financial security, peace of mind, and protection against lawsuits.

The premium costs for indemnity insurance can be high, and there may be coverage limitations and policy exclusions to consider.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.