Errors and Omissions Insurance, also known as professional liability insurance, is a type of coverage designed to protect professionals and businesses from financial losses arising from claims of negligence, mistakes, or inadequate work. This type of insurance is particularly important for professionals who provide advice, services, or expertise to clients, as it can help safeguard against the costs associated with legal disputes. Some of the key industries and professionals who may require E&O coverage include lawyers, consultants, architects, engineers, and financial advisors. E&O insurance typically covers a range of professional errors and omissions, such as: This includes errors or oversights made by professionals while performing their duties, leading to financial losses for their clients. E&O insurance can cover claims stemming from allegations that a professional misrepresented information or provided incorrect advice. This refers to instances where a professional is accused of acting in bad faith or unfairly, leading to harm or financial loss to their client. E&O insurance policies usually have limits on the amount of coverage provided and may require policyholders to pay a deductible before the insurer covers the remaining costs of a claim. E&O policies can be either claims-made or occurrence-based. Claims-made policies cover incidents that occur and are reported during the policy period, whereas occurrence policies cover incidents that take place during the policy period, regardless of when they are reported. E&O insurance policies typically exclude certain types of claims or situations from coverage, such as: E&O insurance does not cover claims arising from intentional wrongdoing or fraudulent activities. E&O policies generally exclude claims related to bodily injury or property damage, which are typically covered under general liability insurance. E&O insurance usually does not cover liabilities assumed under contracts, such as indemnification or warranty agreements. Claims related to wrongful termination, discrimination, or harassment are typically excluded from E&O coverage and are instead addressed by employment practices liability insurance. Having E&O insurance can provide several benefits to professionals and businesses, including: E&O insurance can help cover the costs of legal defense and potential damages in the event of a lawsuit, protecting the financial stability of a business. By demonstrating that a business has E&O coverage, clients may be more likely to trust the professional's services, knowing that they have a means to address any potential issues. Certain industries or clients may require professionals to carry E&O insurance as a legal or contractual requirement, making it essential for compliance purposes. E&O insurance providers typically have access to legal expertise and resources, which can be invaluable when defending against professional liability claims. Several factors can impact the cost of E&O insurance premiums, such as: Professions with higher risks of errors or omissions may have higher insurance premiums. Larger companies with higher revenues may face increased premiums, as they often have greater exposure to potential claims. Insurance premiums may vary based on the location of the business and the specific regulations and legal environment in the area. A history of previous claims can result in higher insurance premiums, as insurers may view the business as a higher risk. Organizations with effective risk management strategies in place may benefit from lower insurance premiums, as they are seen as less likely to encounter claims. To obtain E&O insurance, professionals and businesses should follow these steps: Research and compare different insurance providers to find one with a solid reputation and experience in the specific industry or profession. Evaluate the unique risks and coverage needs of the business and consider various policy options, such as limits, deductibles, and claims-made or occurrence-based policies. Fill out the required application forms, providing accurate and complete information to ensure the appropriate coverage is obtained. Regularly review the E&O policy and update coverage as needed to reflect changes in the business or industry landscape. In addition to having E&O insurance, organizations should also implement various risk management strategies to further protect themselves, such as: Ensure employees receive proper training and education on industry best practices, relevant regulations, and company procedures to minimize the risk of errors and omissions. Establish and enforce standard operating procedures to maintain consistency and quality in the services provided by the organization. Maintain accurate and detailed records of all work performed, client communications, and agreements to help defend against potential claims. Conduct regular audits and reviews of the organization's processes and procedures to identify and address potential areas of risk. Maintain clear and open communication with clients, setting realistic expectations to minimize the likelihood of disputes and dissatisfaction. In summary, Errors and Omissions Insurance is a vital component of risk management for professionals and businesses, protecting against the financial and reputational consequences of negligence, mistakes, or inadequate work. However, it is essential for organizations to be aware of the scope and limitations of their E&O coverage, as well as the factors that can influence their insurance premiums. Obtaining appropriate coverage and implementing risk management strategies can help businesses minimize their exposure to potential claims and safeguard their financial stability. The future of E&O insurance will likely be shaped by emerging risks, technological advancements, and changes in the legal and regulatory environment. As such, professionals and businesses must stay informed about these developments and continuously review and adapt their E&O coverage to ensure that it remains adequate and relevant. By doing so, they can effectively manage their professional liability risks and maintain a competitive edge in their respective industries.What Is Errors and Omissions Insurance (E&O)?

Understanding Errors and Omissions Insurance Coverage

Scope of Coverage

Negligence and Professional Mistakes

Misrepresentation

Violation of Good Faith and Fair Dealing

Policy Limits and Deductibles

Claims-Made vs Occurrence Policies

Exclusions in Errors and Omissions Insurance Policies

Intentional Acts and Fraud

Bodily Injury and Property Damage

Contractual Liabilities

Employment Practices Liability

Benefits of Errors and Omissions Insurance

Financial Protection Against Lawsuits

Reputation Management and Customer Trust

Compliance With Legal and Contractual Requirements

Access to Legal Expertise and Defense

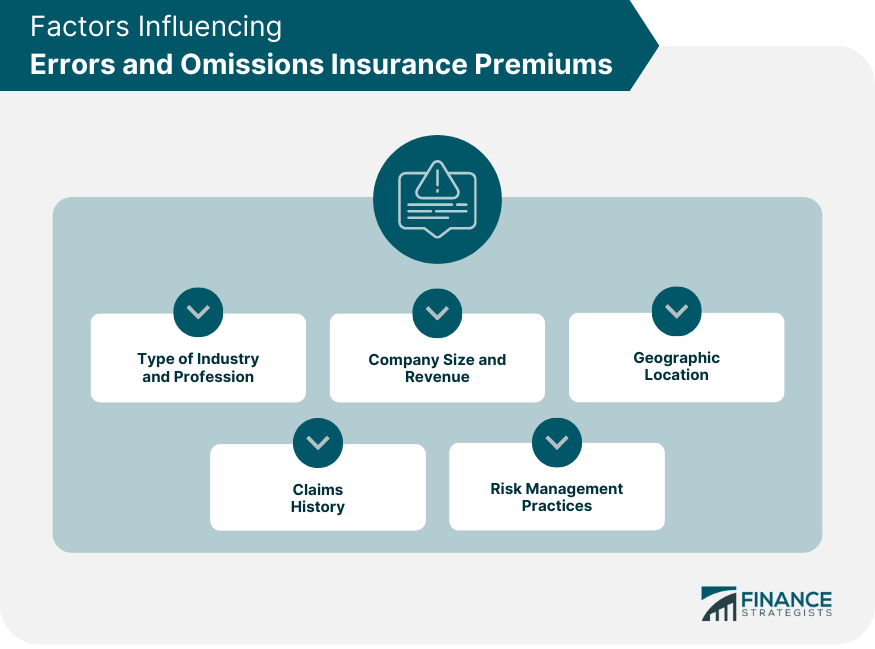

Factors Influencing Errors and Omissions Insurance Premiums

Type of Industry and Profession

Company Size and Revenue

Geographic Location

Claims History

Risk Management Practices

How to Obtain Errors and Omissions Insurance

Selecting an Insurance Provider

Assessing Coverage Needs and Policy Options

Completing the Application Process

Periodic Review and Updates to Coverage

Risk Management Strategies to Complement Errors and Omissions Insurance

Employee Training and Education

Implementation of Standard Operating Procedures

Documentation and Record-Keeping

Regular Audits and Reviews

Client Communication and Expectation Management

Conclusion

Errors and Omissions Insurance (E&O) FAQs

Errors and Omissions Insurance is a type of liability insurance that protects professionals and businesses from claims of negligence, errors, and omissions in the services they provide.

Professionals and businesses that provide advice, expertise, or services to clients should consider getting Errors and Omissions Insurance. This includes doctors, lawyers, accountants, architects, engineers, consultants, and other service providers.

Errors and Omissions Insurance covers claims of negligence, errors, and omissions in the services provided by a professional or business. It covers the cost of legal defense and any damages awarded to the claimant, up to the policy limit.

The cost of Errors and Omissions Insurance depends on the type of business or profession, the level of risk involved, the policy limit, and other factors. Generally, premiums can range from a few hundred to several thousand dollars per year.

Errors and Omissions Insurance is not mandatory for all businesses or professions. However, some industries or regulatory bodies may require it as a condition of licensing or certification. Even if it is not mandatory, having Errors and Omissions Insurance can provide peace of mind and protection against potential claims.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.