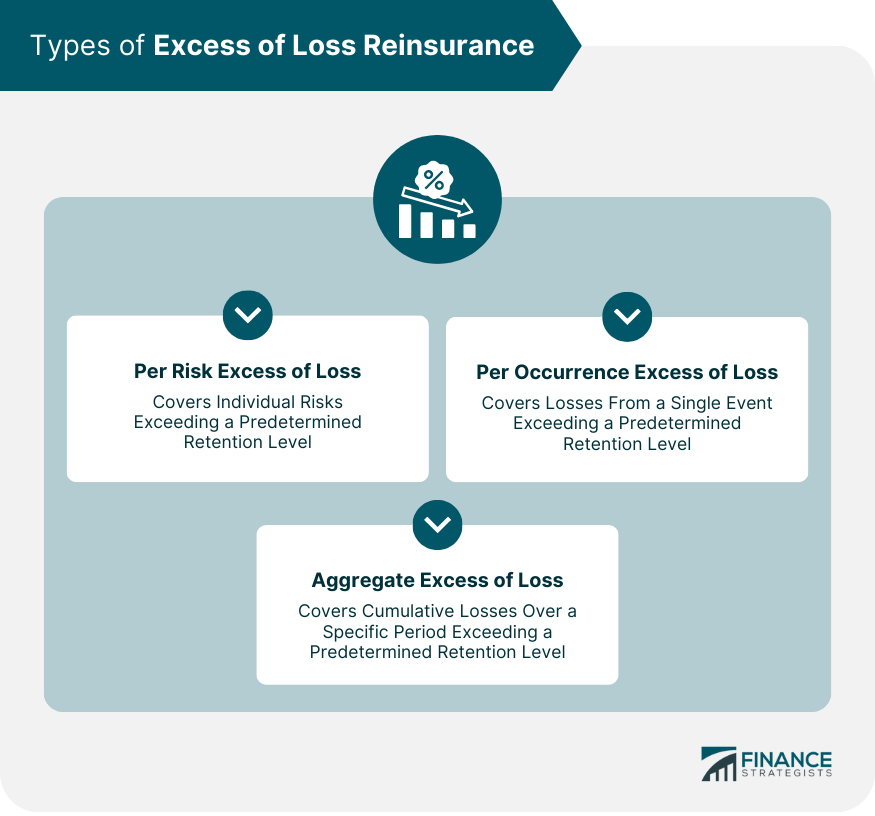

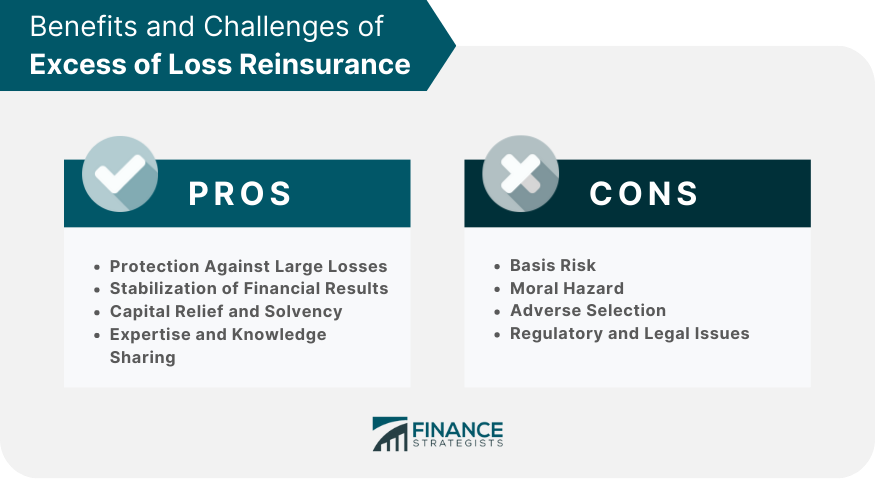

Excess of loss reinsurance is a crucial financial instrument in the insurance industry that helps insurers manage their risk exposure. This type of reinsurance is designed to protect insurance companies from significant losses that could threaten their financial stability. To better understand the role of excess of loss reinsurance in risk management, it is essential to differentiate between proportional and non-proportional reinsurance types. Proportional reinsurance is an arrangement in which the reinsurer and the insurer share the premiums and claims proportionally. The reinsurer's share of the premiums and claims is determined by a pre-agreed percentage. In contrast, non-proportional reinsurance, such as excess of loss reinsurance, involves the reinsurer providing coverage only when the insurer's losses exceed a specific threshold or retention level. This type of reinsurance is more focused on protecting insurers from large, unexpected losses rather than sharing the risk on a proportional basis. There are three main types of excess of loss reinsurance: per risk, per occurrence, and aggregate. Each type is structured differently to address specific needs and risk management objectives of insurers. Per risk excess of loss reinsurance provides coverage for individual risks. The reinsurer covers the insurer's losses exceeding a predetermined retention level for each risk. This type of reinsurance is commonly used in property and casualty insurance to protect insurers from large losses on a per-risk basis. For example, an insurance company may have a per risk excess of loss reinsurance contract with a $1 million retention level. If the company incurs a $1.5 million loss on a single risk, the reinsurer would cover the $500,000 exceeding the retention level. Per occurrence excess of loss reinsurance provides coverage for losses stemming from a single event or occurrence. The reinsurer covers the insurer's losses exceeding a predetermined retention level for each occurrence, regardless of the number of individual risks involved. This type of reinsurance is often used in catastrophe insurance to protect insurers from substantial losses resulting from events such as hurricanes, earthquakes, or floods. For instance, an insurer may have a per occurrence excess of loss reinsurance contract with a $5 million retention level. If a hurricane causes $7 million in losses, the reinsurer would cover the $2 million exceeding the retention level. Aggregate excess of loss reinsurance provides coverage for an insurer's cumulative losses over a specific period, usually one year. The reinsurer covers the insurer's losses exceeding a predetermined aggregate retention level during the policy period. This type of reinsurance is designed to protect insurers from the accumulation of multiple losses over time, which can undermine their financial stability. For example, an insurer may have an aggregate excess of loss reinsurance contract with a $10 million retention level. If the insurer's total losses for the year reach $12 million, the reinsurer would cover the $2 million exceeding the aggregate retention level. Several key terms and concepts are essential to understanding excess of loss reinsurance arrangements: The retention limit is the maximum amount of loss that the insurer is responsible for before the reinsurance coverage kicks in. This limit can be set on a per risk, per occurrence, or aggregate basis, depending on the type of excess of loss reinsurance contract. The reinsurance limit is the maximum amount the reinsurer will cover for losses exceeding the insurer's retention level. The limit can be set for each risk, occurrence, or policy period, depending on the type of excess of loss reinsurance contract. Excess of loss reinsurance contracts can be structured with multiple layers of coverage. Each layer has its retention level and reinsurance limit. Insurers may purchase coverage from different reinsurers for each layer to diversify their risk and optimize their reinsurance program's cost. Reinstatement provisions allow an insurer to reinstate their reinsurance coverage after it has been exhausted due to a loss. These provisions typically require the insurer to pay an additional premium to the reinsurer for the reinstatement. Pricing and negotiation of excess of loss reinsurance contracts involve several factors and considerations. Several factors can impact the pricing of excess of loss reinsurance contracts: 1. Historical loss experience: Reinsurers will consider the insurer's historical loss experience when determining the premium for a contract. Insurers with a favorable loss history may be able to negotiate lower premiums. 2. Exposure and risk profile: The insurer's exposure and risk profile will also influence the pricing of excess of loss reinsurance contracts. Insurers with higher risk exposures may be charged higher premiums. 3. Reinsurer's capacity: The reinsurer's capacity, or willingness to assume risk, can affect pricing. If a reinsurer has limited capacity, they may charge higher premiums or be unwilling to provide coverage at all. The negotiation process for excess of loss reinsurance contracts often involves brokers and intermediaries who help insurers and reinsurers establish the terms and conditions of the contract. The negotiation process aims to reach an agreement that balances the insurer's risk management needs and the reinsurer's capacity and pricing requirements. Excess of loss reinsurance provides several benefits to insurers, including: 1. Protection against large losses: This type of reinsurance protects insurers from significant losses that could threaten their financial stability and solvency. 2. Stabilization of financial results: Excess of loss reinsurance helps stabilize insurers' financial results by limiting the impact of large losses on their balance sheets. 3. Capital relief and solvency: By transferring a portion of their risk to reinsurers, insurers can improve their capital position and solvency ratios. 4. Expertise and knowledge sharing: Reinsurers often have specialized expertise in specific lines of business or risk management techniques, which can be shared with insurers to improve their underwriting and risk management practices. There are several challenges and considerations in implementing and managing excess of loss reinsurance programs: 1. Basis risk: There is a possibility that the reinsurance contract may not adequately cover the insurer's actual losses due to differences in the contract's structure and the insurer's risk profile. 2. Moral hazard: Insurers with excess of loss reinsurance coverage may be more likely to take on higher risks or relax their underwriting standards, as they know that the reinsurer will cover their losses above the retention level. 3. Adverse selection: Reinsurers may be more exposed to adverse selection if they only cover losses above a certain threshold, as insurers are more likely to seek reinsurance for their riskiest policies. 4. Regulatory and legal issues: Insurers and reinsurers must comply with the regulatory and legal requirements in the jurisdictions in which they operate, which can add complexity and cost to excess of loss reinsurance arrangements. Excess of loss reinsurance plays a critical role in the insurance industry by safeguarding insurers from substantial losses that could undermine their financial stability. It effectively allows insurers to manage their risk exposures, which contributes to the overall stability and resilience of the insurance market. As the risk landscape evolves due to factors like technological advancements, climate change, and emerging threats, the demand for excess of loss reinsurance may continue to grow, further emphasizing its importance in the industry. Insurers and reinsurers must adapt their excess of loss reinsurance programs by continually refining their risk models and pricing, diversifying their reinsurance programs, and leveraging technological advancements in big data and predictive analytics. By staying informed about new developments and adjusting their strategies, insurers and reinsurers can continue to benefit from the opportunities and protection offered by excess of loss reinsurance, ensuring the long-term success and sustainability of the insurance industry.What Is Excess Loss Reinsurance?

Types of Excess of Loss Reinsurance

Per Risk Excess of Loss Reinsurance

Per Occurrence Excess of Loss Reinsurance

Aggregate Excess of Loss Reinsurance

Key Terms and Concepts in Excess of Loss Reinsurance

Retention Limit

Reinsurance Limit

Layers of Coverage

Reinstatement Provisions

Pricing and Negotiation of Excess of Loss Reinsurance Contracts

Factors Influencing Pricing

Negotiation Process

Benefits of Excess of Loss Reinsurance

Challenges and Considerations in Excess of Loss Reinsurance

Conclusion

Excess of Loss Reinsurance FAQs

Excess loss of reinsurance, also known as catastrophic or per risk reinsurance, is a type of reinsurance coverage that provides protection to the insurance company against large and catastrophic losses.

Excess loss of reinsurance provides protection to the insurance company by paying claims in excess of a predetermined amount. For example, an insurance company may purchase excess loss reinsurance coverage with a limit of $10 million. If a claim exceeds this limit, the reinsurer pays the excess amount.

Excess loss reinsurance benefits both the insurance company and policyholders. It helps to reduce the risk of catastrophic losses for the insurance company, which can lead to financial instability. This, in turn, helps to maintain the company's ability to pay claims to policyholders.

The two most common types of excess loss reinsurance are per-risk and catastrophe reinsurance. Per-risk reinsurance provides coverage for each individual risk, while catastrophe reinsurance provides protection for losses resulting from a single catastrophic event.

The cost of excess loss reinsurance is typically based on the amount of coverage purchased, the type of reinsurance, the level of risk, and the financial strength of the insurance company. The cost is usually expressed as a percentage of the insurance company's premiums.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.