A Years Certain Annuity, also known as a term certain annuity, is a type of annuity that guarantees regular payments over a defined period, typically ranging from 5 to 30 years. The annuitant, or the person receiving the payments, chooses this period when they purchase the annuity. The primary purpose of a Years Certain Annuity is to provide a secure and predictable income for a set period. This can be particularly beneficial for individuals who need a fixed income stream for a specific time frame. For example, someone planning to retire at 65 but expecting to receive other benefits starting at 70 might choose a 5-year certain annuity to bridge the income gap. Unlike whole life annuities, which provide lifelong income, a Years Certain Annuity only offers guaranteed income for a specified term. However, if the annuitant dies before the end of the term, the remaining payments typically go to a designated beneficiary. A Years Certain Annuity provides consistent payments over the term of the annuity. The amount of each payment depends on several factors, including the amount invested, the term length, and the prevailing interest rate at the time of purchase. The annuitant can usually choose the payment frequency, which could be monthly, quarterly, semi-annually, or annually. A Years Certain Annuity can either be immediate or deferred. An immediate annuity begins payments soon after purchase, while a deferred annuity starts payments at a later date chosen by the annuitant. Regardless of what happens in the financial markets, a Years Certain Annuity guarantees payments for the chosen term. This feature provides income certainty for the annuitant. The tax treatment of a Years Certain Annuity depends on whether it was purchased with pre-tax or after-tax dollars. Generally, if the annuity was funded with after-tax dollars, a portion of each payment is a tax-free return of principal. While the annuitant's age doesn't affect the payments directly as it does with a lifetime annuity, it can influence the chosen term of the annuity. The length of the guarantee period directly impacts the size of the payments. A shorter period results in larger payments, while a longer period results in smaller payments. Interest rates at the time of purchase can significantly affect the annuity payments. Higher interest rates generally lead to larger annuity payments. The larger the amount invested in the annuity, the larger the payments will be. One of the main advantages of a Years Certain Annuity is the guaranteed income for a specific period. This can provide a sense of financial security, especially during uncertain economic times. If the annuitant dies before the end of the term, the remaining payments typically go to a named beneficiary. This feature can provide financial support to loved ones. With a Years Certain Annuity, the annuitant is not directly exposed to market volatility, as the payments are guaranteed for the term of the annuity. Unlike a whole life annuity, a Years Certain Annuity does not provide guaranteed income for the remainder of the annuitant's life. As the payments of a Years Certain Annuity are fixed, there is no potential for growth due to positive market performance. Inflation can erode the purchasing power of the fixed payments from a Years Certain Annuity over time. It's essential to select a reputable and financially stable insurance company or financial institution when purchasing a Years Certain Annuity. Financial strength and ratings of providers can give insights into their ability to fulfill their contractual obligations. These ratings can be obtained from independent agencies like A.M. Best, Moody's, Standard & Poor's, and Fitch Ratings. Understanding the fees and charges associated with a Years Certain Annuity is crucial. These can include surrender charges, administrative fees, mortality and expense risk charges, and investment management fees. A financial advisor can provide invaluable assistance when purchasing a Years Certain Annuity. They can help explain complex terms and conditions and guide you in making decisions that align with your financial goals and circumstances. Whole life annuities provide guaranteed income for the remainder of the annuitant's life. This can be a better option for those concerned about outliving their savings. Variable annuities offer the potential for higher returns, as payments can vary based on the performance of a chosen investment portfolio. However, they also come with higher risk. Indexed annuities provide returns based on the performance of a specific market index. They offer a balance between risk and return. A systematic withdrawal plan allows for regular withdrawals from an investment portfolio. This offers flexibility and control over the income stream. A Years Certain Annuity is a financial product designed to provide a steady income for a specified term. It guarantees regular payments over a chosen period, typically between 5 to 30 years, and these payments remain unaffected by fluctuations in the financial markets. This type of annuity can be an invaluable tool for individuals needing a fixed income stream for a specific duration, and it offers the advantage of potentially benefiting a designated beneficiary should the annuitant pass away before the term ends. However, the decision to purchase a Years Certain Annuity should be made with careful consideration of personal financial goals, risk tolerance, and income needs. It offers certain benefits but also comes with potential drawbacks such as limited growth potential and susceptibility to inflation risk. Moreover, while a Years Certain Annuity can play a crucial role in retirement planning, it is just one aspect of a comprehensive financial strategy. Other factors such as healthcare costs, estate planning, and other potential income sources during retirement should also be taken into account. Collaborating with a financial advisor can be beneficial in creating a holistic retirement plan that aligns with an individual's unique needs and aspirations.What Is a Years Certain Annuity?

Features of Years Certain Annuities

Payment Structure

Regular Payments

Payment Frequency

Immediate or Deferred Annuity

Guaranteed Payments for a Certain Period

Tax Implications

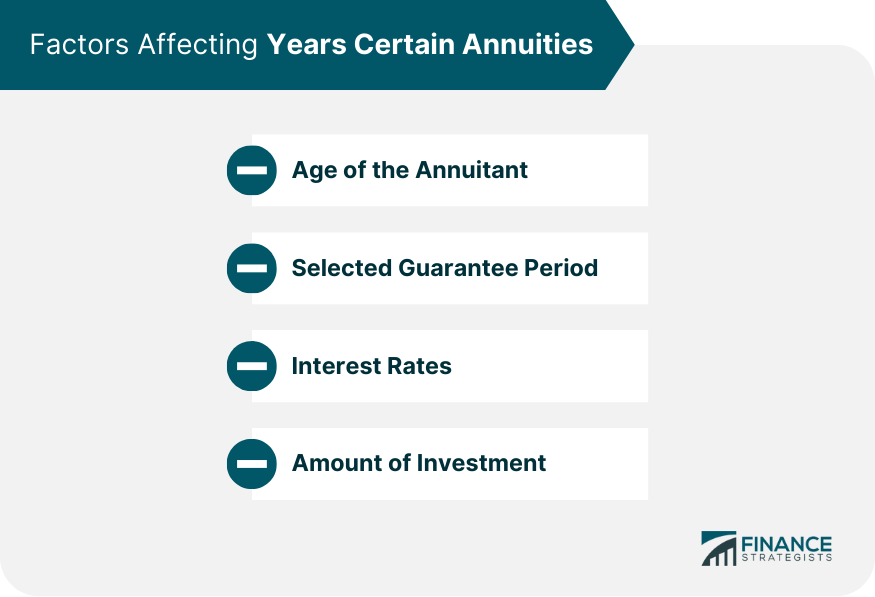

Factors Affecting Years Certain Annuities

Age of the Annuitant

Selected Guarantee Period

Interest Rates

Amount of Investment

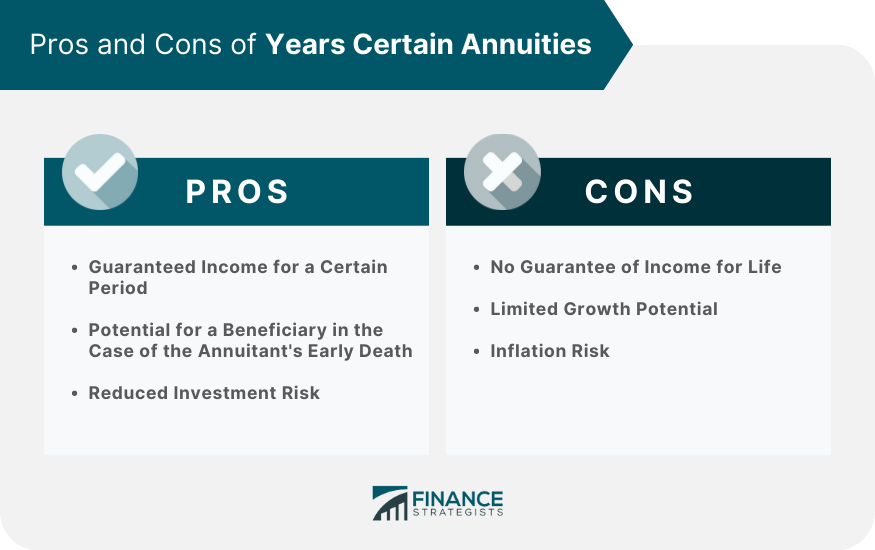

Pros and Cons of Years Certain Annuities

Advantages

Guaranteed Income for a Certain Period

Potential for a Beneficiary in the Case of the Annuitant's Early Death

Reduced Investment Risk

Disadvantages

No Guarantee of Income for Life

Limited Growth Potential

Inflation Risk

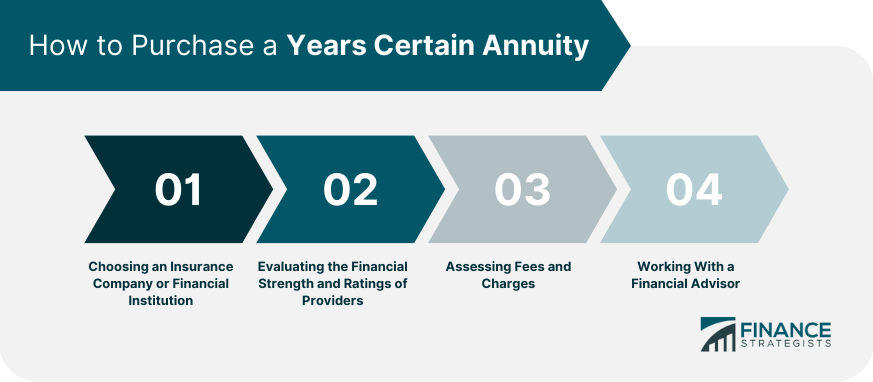

How to Purchase a Years Certain Annuity

Choosing an Insurance Company or Financial Institution

Evaluating the Financial Strength and Ratings of Providers

Assessing Fees and Charges

Working With a Financial Advisor

Alternatives to Years Certain Annuities

Whole Life Annuities

Variable Annuities

Indexed Annuities

Systematic Withdrawal Plans

Final Thoughts

Years Certain Annuity FAQs

A Years Certain Annuity is a type of annuity contract that guarantees a fixed payment for a specific number of years, regardless of whether the annuitant is alive or not. This means that the annuitant will receive a guaranteed income stream for a specific number of years, regardless of their life expectancy.

When an individual purchases a Years Certain Annuity, they agree to make a lump sum payment or a series of payments to the insurance company. In return, the insurance company guarantees to pay a fixed amount of income to the annuitant for a specific number of years, regardless of their life expectancy. The payment amount is determined by a variety of factors, including the annuitant's age, gender, and life expectancy.

Years Certain Annuities are suitable for individuals who want a guaranteed income stream for a specific number of years, regardless of their life expectancy. They may be particularly attractive to individuals who are close to retirement age and want to ensure a guaranteed income stream during their early retirement years.

The primary advantage of a Years Certain Annuity is that it provides a guaranteed income stream for a specific number of years. This can provide peace of mind for individuals who are concerned about outliving their retirement savings. Additionally, Years Certain Annuities may provide a higher payout rate than other annuity products because the payment period is limited to a specific number of years.

One of the main drawbacks of a Years Certain Annuity is that it only guarantees payments for a specific number of years. If the annuitant outlives the payment period, they will no longer receive income from the annuity. Additionally, Years Certain Annuities may not provide as much flexibility as other annuity products, as the payment period is fixed and cannot be changed once the contract is signed. Finally, Years Certain Annuities may not keep pace with inflation, which can erode the purchasing power of the annuitant's income over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.