Annuities are financial products that can provide a steady income stream during retirement. It is a contract between an individual and an insurance company, where the individual invests a lump sum or series of payments in return for regular income payments in the future. There are two main types of annuities, immediate and deferred, each with its own unique features and benefits. An immediate annuity is a type of annuity that begins paying income to the annuitant shortly after the initial investment. These annuities are typically purchased with a single, lump-sum payment and provide a guaranteed income stream for life or a set period. A deferred annuity is a long-term investment that accumulates earnings on a tax-deferred basis until the investor decides to start receiving income payments. These annuities can be funded with a lump sum or a series of payments and offer a variety of investment options. Immediate annuities offer a simple and straightforward approach to securing retirement income. An immediate annuity is a contract between an individual and an insurance company that provides a guaranteed income stream in exchange for a lump-sum payment. The income payments begin shortly after the initial investment, typically within 30 days to a year. When purchasing an immediate annuity, the investor selects an income payout option based on their needs and goals. The insurance company then provides regular income payments based on the invested amount, the chosen payout option, and the annuitant's age and life expectancy. Immediate annuities offer guaranteed income for life, providing financial security and peace of mind. They also provide a predictable income stream that is not subject to market fluctuations, reducing the risk of investment losses. The main drawback of immediate annuities is their susceptibility to inflation, which can erode the purchasing power of the fixed income payments over time. Additionally, access to the principal is limited, and the annuitant may lose some or all of their principal if they die early in the payout period. Deferred annuities provide a long-term, tax-deferred investment option for retirement planning. A deferred annuity is a contract between an individual and an insurance company that accumulates earnings on a tax-deferred basis until the investor decides to start receiving income payments. The annuity can be funded with a lump sum or a series of payments. Deferred annuities have two phases: the accumulation phase, where the investor's funds grow on a tax-deferred basis, and the payout phase, when the investor begins receiving income payments. The investor can choose when to start the payout phase, typically during retirement. Deferred annuities offer tax-deferred growth, allowing investors to accumulate wealth more quickly. They also provide flexible investment options and, in some cases, optional guaranteed income riders, which can ensure a steady income stream during retirement. One of the main drawbacks of deferred annuities is their complexity and associated fees, which can be higher than other investment options. Additionally, they offer limited liquidity, as withdrawing funds early can result in penalties and taxes. Lastly, variable and indexed annuities expose the investor to market risk, which can lead to investment losses. When deciding between immediate and deferred annuities, consider factors such as time horizon, risk tolerance, and income needs. Your time horizon, or the amount of time until you need income from your annuity, plays a significant role in determining whether an immediate or deferred annuity is more suitable. Additionally, consider your risk tolerance, as immediate annuities offer more stability, while deferred annuities may have higher growth potential but also increased risk. Lastly, consider your income needs and goals, as this will influence the type of annuity and payout options that are most appropriate for your situation. By carefully evaluating your personal financial situation and goals, you can determine whether an immediate or deferred annuity is the best fit for your retirement plan. Consult with a financial professional to ensure you make the best decision for your unique circumstances. Understanding the differences between immediate and deferred annuities is crucial when planning for retirement. By considering your time horizon, risk tolerance, and income needs, you can make an informed decision about which type of annuity is best suited to your financial situation. It is important to recognize that annuities are just one piece of a comprehensive retirement plan. They can help provide stability and predictability, but should be combined with other investment strategies and sources of income. Taking the time to understand immediate and deferred annuities, their features, advantages, and disadvantages, will empower you to make educated choices for your retirement planning. Remember to seek the guidance of a trusted insurance broker, as their expertise can greatly assist you in securing a comfortable and enjoyable retirement.Overview of Immediate and Deferred Annuities

Immediate Annuities: Overview and Features

Definition of Immediate Annuities

How Immediate Annuities Work

Advantages of Immediate Annuities

Disadvantages of Immediate Annuities

Deferred Annuities: Overview and Features

Definition of Deferred Annuities

How Deferred Annuities Work

Advantages of Deferred Annuities

Disadvantages of Deferred Annuities

Choosing the Right Annuity for Your Retirement Plan

Conclusion

Immediate vs Deferred Annuities FAQs

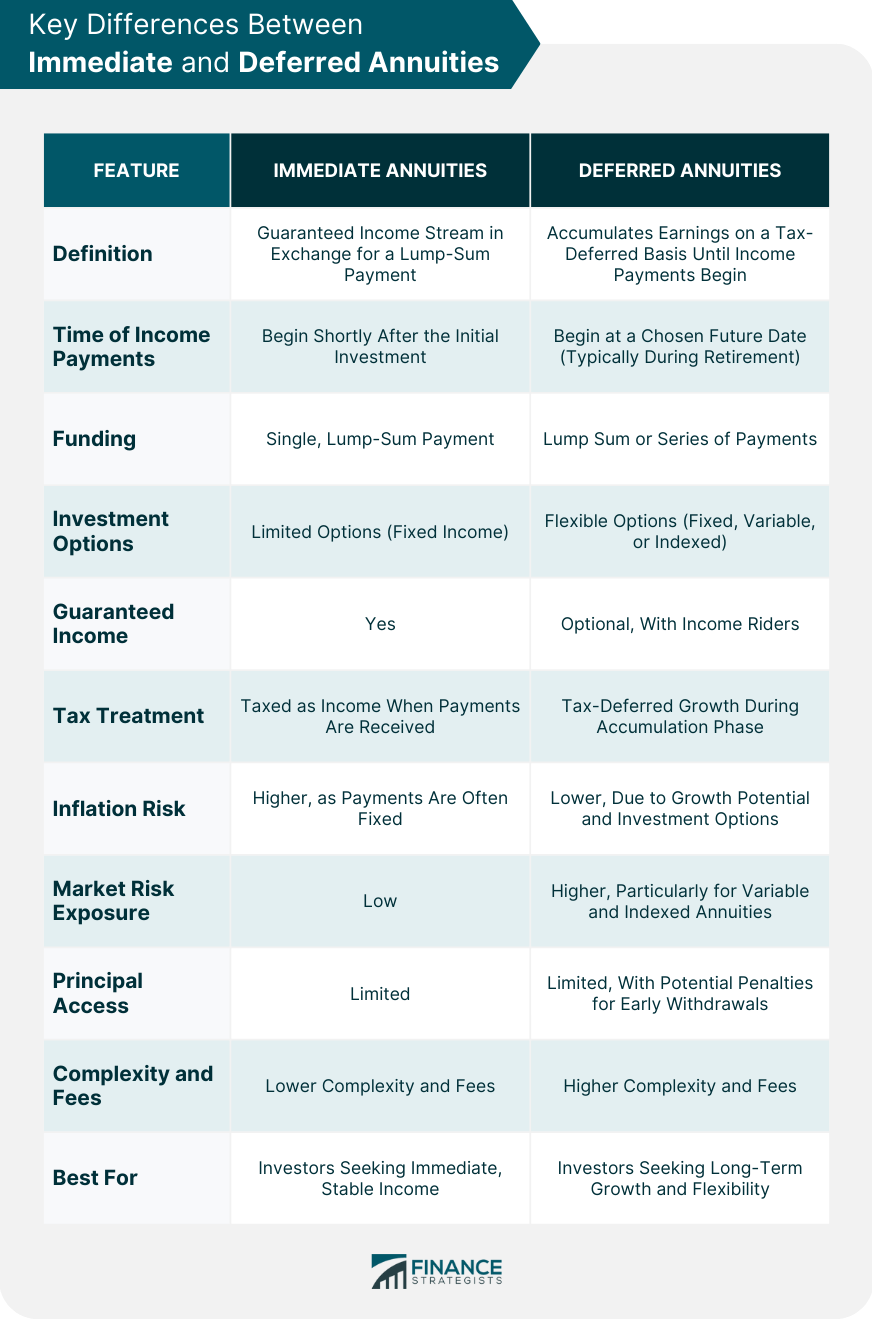

The main differences between immediate and deferred annuities lie in their payment timing and investment options. Immediate annuities provide a guaranteed income stream shortly after the initial investment, while deferred annuities accumulate earnings on a tax-deferred basis until income payments begin at a chosen future date. Deferred annuities also offer more flexible investment options compared to immediate annuities.

When choosing between immediate and deferred annuities, consider factors such as your time horizon, risk tolerance, and income needs. Immediate annuities may be suitable for those seeking immediate, stable income, while deferred annuities are better for investors looking for long-term growth and flexibility in their retirement planning.

It is generally difficult to switch between immediate and deferred annuities after the initial investment has been made. However, some deferred annuities offer income riders that can provide a guaranteed income stream similar to immediate annuities. Consult with an insurance broker or financial professional to discuss your options and potential strategies for adjusting your annuity investments.

Immediate annuities are taxed as income when payments are received, while deferred annuities offer tax-deferred growth during the accumulation phase. Income payments from deferred annuities are also taxed as income when received. It is important to consider the tax implications of your annuity choices and consult with a tax professional to ensure compliance and optimize your tax strategy.

Immediate and deferred annuities can both play a significant role in a comprehensive retirement plan by providing a steady income stream and helping to mitigate the risk of outliving one's savings. Immediate annuities are well-suited for investors seeking immediate, stable income, while deferred annuities can offer long-term growth and flexibility. It is essential to evaluate your personal financial situation, goals, and preferences when incorporating annuities into your retirement planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.