A qualified annuity is a type of retirement savings plan purchased with pre-tax dollars. It is considered "qualified" because it is eligible for favorable tax treatment under the Internal Revenue Code. Contributions to a qualified annuity are tax-deductible, and taxes on earnings are deferred until withdrawal, typically during retirement when many individuals fall into a lower tax bracket. Qualified annuities play a crucial role in retirement planning due to their tax benefits and the steady income they provide. They are particularly beneficial for individuals who want to supplement their retirement income beyond the limits of traditional retirement vehicles, such as 401(k)s and IRAs. Contributions to a qualified annuity are typically made with pre-tax dollars, which means that the individual does not pay taxes on the contributed amount in the year of contribution. Additionally, the earnings on the annuity investment grow on a tax-deferred basis, allowing for potential compounding of investment returns over time. Taxes are typically paid upon withdrawal or distribution from the annuity, at which point the earnings are subject to ordinary income tax rates. This tax deferral feature can provide individuals with potential tax savings and the opportunity for greater long-term growth. Qualified annuities are subject to contribution limits set by the Internal Revenue Service (IRS). These limits are designed to prevent individuals from sheltering excessive amounts of income from taxation. The contribution limits for qualified annuities may vary depending on the type of retirement account or plan used to fund the annuity, such as 401(k)s, IRAs, or employer-sponsored pension plans. It is crucial to be aware of these contribution limits to ensure compliance with IRS regulations. Another key feature of qualified annuities is the requirement to take minimum distributions once the annuitant reaches a certain age. The IRS mandates that individuals begin withdrawing a minimum amount from their qualified annuities each year, generally starting at age 72. These RMDs are calculated based on the individual's life expectancy and the account balance. Failing to take the required minimum distributions can result in significant penalties. RMDs ensure that qualified annuities serve their intended purpose as a retirement income source and prevent individuals from indefinitely deferring taxes on the funds. Qualified annuities may offer varying levels of creditor protection, depending on state laws and the specific circumstances. In some cases, the cash value of a qualified annuity may be protected from creditors. This feature can provide individuals with an added layer of asset protection in the event of legal or financial challenges. Individuals can designate beneficiaries for their annuity, ensuring a smooth transfer of assets upon their death. This beneficiary designation helps to avoid the probate process and allows for a direct transfer of the annuity proceeds to the named beneficiaries. Qualified annuities can play a significant role in estate planning strategies, allowing individuals to pass on their assets efficiently and according to their wishes. An immediate qualified annuity provides income payments that start soon after the annuity is purchased, typically within a year. This type of annuity is often purchased by individuals who are already in retirement and want to secure a steady stream of income. A deferred qualified annuity accumulates savings over a period of time before the income payments begin. The start of the payments can be postponed to a specific date in the future, such as the date of retirement. This type of annuity is often used by individuals who want to grow their savings tax-deferred for a future steady income stream. As mentioned above, the contributions to a qualified annuity are made with pre-tax dollars, reducing the individual's taxable income. Additionally, the growth within the annuity is tax-deferred, allowing the investment to compound more quickly than if taxes were deducted annually. When distributions are taken from a qualified annuity, they are taxed as ordinary income. This is beneficial for many retirees as they typically fall into a lower tax bracket in retirement than they were in during their working years. Like other retirement savings plans, early withdrawals from a qualified annuity before the age of 59½ are subject to a 10% early withdrawal penalty in addition to regular income tax. Qualified annuities provide tax-deferred growth, meaning the earnings on the annuity investment accumulate without immediate taxation. This allows for potentially higher overall returns as the money compounds over time. Qualified annuities offer a reliable stream of income during retirement. By converting a lump sum or regular contributions into an annuity, individuals can ensure a steady flow of payments for a specified period or even for their lifetime. Qualified annuities provide a range of investment options to suit individual preferences and risk tolerance. Individuals can choose from fixed annuities, which offer a guaranteed rate of return, variable annuities that allow investment in underlying portfolios, or indexed annuities tied to the performance of a specific index. Fixed annuities provide stability and protection from market volatility since they offer a guaranteed rate of return. This can be beneficial for individuals who prefer a more conservative approach to retirement savings. Qualified annuities allow for efficient estate planning by allowing individuals to designate beneficiaries. In the event of the annuitant's death, the remaining balance can be passed on to beneficiaries without going through probate, which can save time and expenses. Qualified annuities offer various features and options that can be customized to suit individual needs. Optional riders, such as long-term care or income guarantees, can be added to provide additional benefits and protection. Qualified annuities typically have restrictions on withdrawals and surrender charges for early access to funds. These charges can be substantial, especially if withdrawals are made before a specified surrender period has elapsed. Although qualified annuities offer tax-deferred growth, withdrawals or distributions from the annuity are subject to ordinary income tax. Depending on the individual's tax bracket at the time of withdrawal, this tax liability can significantly impact the net amount received. Once funds are allocated to a qualified annuity, they are generally tied up for the long term. Changes to the annuity contract or adjusting the investment strategy may be limited or subject to additional costs or penalties. This lack of flexibility can be restrictive, especially for individuals who anticipate needing access to their funds for unexpected expenses or changing financial circumstances. Qualified annuities can be complex financial products, with various features, riders, and contract terms. It's important to fully understand the terms and conditions of the annuity, including any potential limitations or restrictions, before making a commitment. Seeking professional guidance from a qualified financial advisor can help navigate the complexities and ensure informed decision-making. Start by assessing your retirement goals and financial needs. Consider factors such as your desired retirement income, the length of the annuity payout period, and any specific features or benefits you are seeking from the annuity. Understanding your retirement objectives will help you select the most suitable qualified annuity. Conduct thorough research on annuity providers to identify reputable and reliable companies. Look for providers with a strong financial standing, a range of annuity options, competitive rates, and good customer service. Reading reviews, seeking recommendations, and consulting with a financial advisor can assist in selecting the right annuity provider. Determine the type of annuity that best aligns with your goals. Qualified annuities come in various forms, such as fixed annuities, variable annuities, and indexed annuities. Understand the features, benefits, investment options, and potential risks associated with each type of annuity. Consider factors like guaranteed interest rates, potential for investment growth, and flexibility in accessing funds. Request annuity quotes from multiple providers and compare the rates and terms offered. Take into account factors such as initial investment requirements, surrender charges, fees, and any optional riders or additional features. Pay attention to the annuity's potential for growth and the payout options available to determine the best fit for your financial situation. Consult with a financial advisor who specializes in retirement planning and annuities. An advisor can help evaluate your financial situation, guide you through the annuity selection process, and provide personalized recommendations based on your specific needs. They can also clarify any questions you may have regarding taxation, withdrawal options, and potential risks. In conclusion, a qualified annuity is a retirement savings plan that offers tax advantages and provides individuals with a reliable income stream during their retirement years. By contributing pre-tax dollars and allowing tax-deferred growth, qualified annuities help individuals maximize their savings potential and potentially lower their tax burden. The key features of qualified annuities include tax-advantaged status, contribution limits, required minimum distributions, creditor protection, and estate planning benefits. It is important to carefully evaluate the benefits and drawbacks of qualified annuities, considering factors such as limited liquidity, potential taxation upon withdrawal, lack of flexibility, and complexity. Seeking professional advice and conducting thorough research are crucial steps in the process of purchasing a qualified annuity to ensure it aligns with one's retirement goals and financial circumstances.What Is a Qualified Annuity?

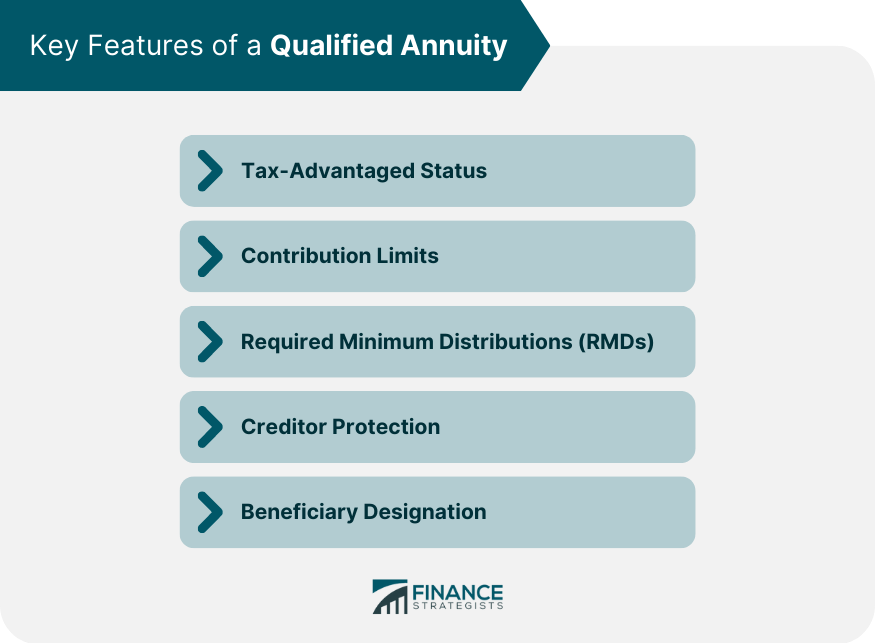

Key Features of a Qualified Annuity

Tax-Advantaged Status

Contribution Limits

Required Minimum Distributions (RMDs)

Creditor Protection

Beneficiary Designation

Types of Qualified Annuities

Immediate Qualified Annuity

Deferred Qualified Annuity

The Tax Implications of Qualified Annuities

Tax Advantages of Qualified Annuity

Taxation at Withdrawal

Early Withdrawal Penalties

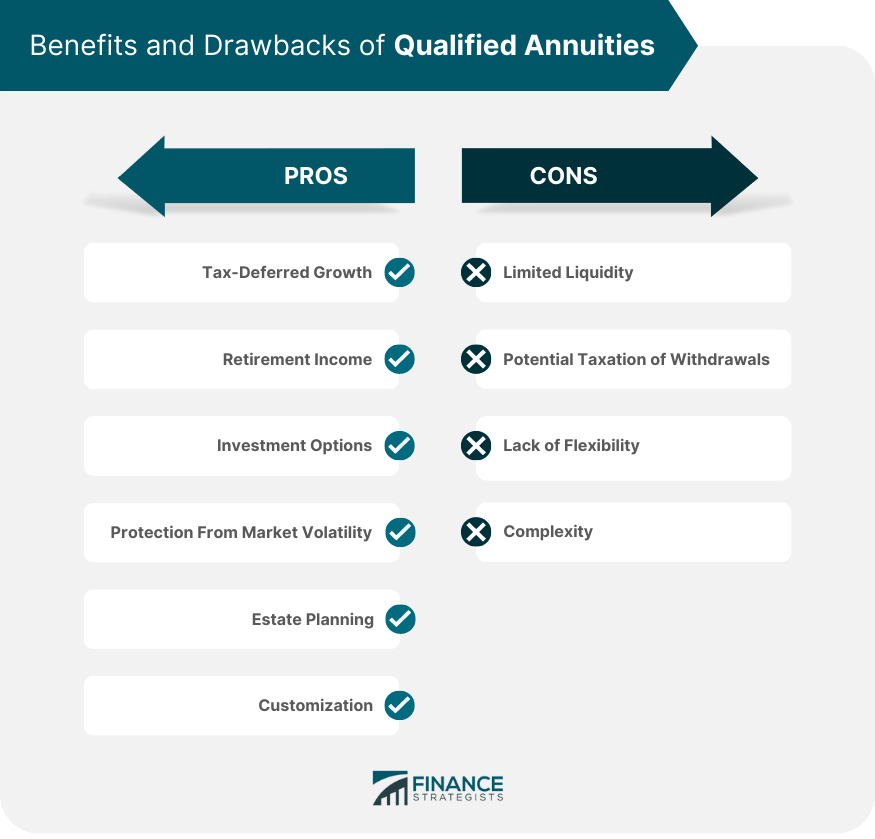

Benefits of Investing in a Qualified Annuity

Tax-Deferred Growth

Retirement Income

Investment Options

Protection From Market Volatility

Estate Planning

Customization

Potential Drawbacks and Risks of a Qualified Annuity

Limited Liquidity

Potential Taxation of Withdrawals

Lack of Flexibility

Complexity

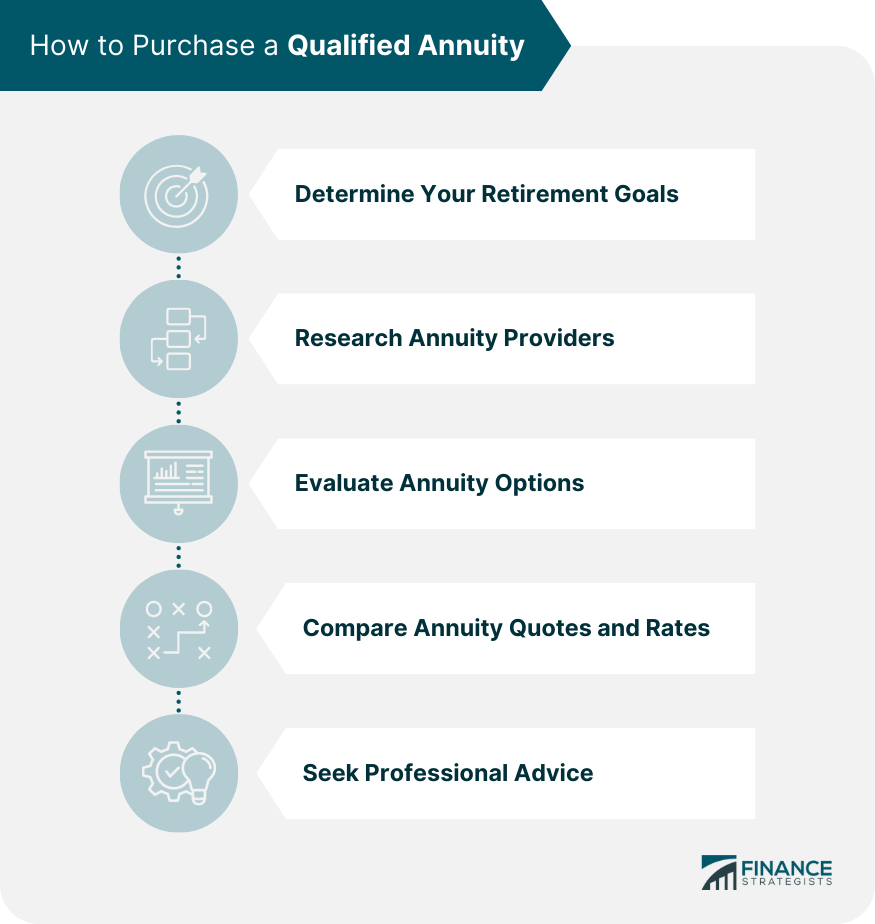

How to Purchase a Qualified Annuity

Determine Your Retirement Goals

Research Annuity Providers

Evaluate Annuity Options

Compare Annuity Quotes and Rates

Seek Professional Advice

Final Thoughts

Qualified Annuity FAQs

A qualified annuity is an annuity purchased with funds from a qualified retirement plan or individual retirement account (IRA). These funds are typically subject to tax-deferred growth and are only taxed when withdrawn, usually after retirement age.

The benefits of a qualified annuity include tax-deferred growth, which allows your funds to accumulate more quickly, and the ability to receive a steady stream of income during retirement. Qualified annuities are also protected from creditors, providing a safe way to save for retirement.

One potential drawback of a qualified annuity is the lack of liquidity. Because funds are typically locked up until retirement age, you may not be able to access them in case of an emergency. Additionally, withdrawals from a qualified annuity are subject to ordinary income tax, which can be higher than capital gains tax.

Individuals with qualified retirement plans, such as 401(k)s or IRAs, are eligible to purchase a qualified annuity with those funds. However, there may be restrictions or limitations depending on the specific plan or account.

Examples of qualified annuities include variable annuities, fixed annuities, and fixed-indexed annuities. Each type of annuity has its own unique features and benefits, so it's important to research and understand which one is right for your financial goals and needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.