A credit freeze is a security measure that allows you to restrict access to your credit report. Doing so prevents unauthorized parties from opening new credit accounts, taking out loans, or otherwise using your credit without your permission. Credit freezes, also known as security freezes, work by blocking access to your credit report from third parties, such as lenders and creditors. When a credit freeze is in place, lenders cannot pull your credit report, making it impossible to open new accounts. It is important to note that a credit freeze does not affect your credit score or credit history. It simply restricts access to your credit report, which lenders use to evaluate your creditworthiness. To initiate a credit freeze, you must contact each of the three credit bureaus: Equifax, Experian, and TransUnion. Once your request is processed, the bureaus will block access to your credit report unless you provide a PIN or password to unlock it. This prevents anyone from opening new credit accounts or performing other activities that require a credit check. Credit freezes are free for identity theft victims and may also be free for residents of certain states. However, in some states, there may be a fee to initiate a credit freeze. Credit freezes also differ from credit locks, allowing you to lock and unlock your credit report. Credit monitoring services often offer credit locks and typically require a monthly subscription fee. Credit freezes provide several benefits: A credit freeze is an effective way to prevent identity thieves from opening new accounts in your name. Even if a thief has your personal information, they cannot take out a loan or credit card without your permission. According to the FTC, credit freezes are one of the most effective ways to prevent identity theft. Restricting access to your credit report reduces the risk of someone opening new accounts or taking out loans in your name. When your credit report is frozen, no one can access it without your permission. This can prevent unauthorized parties from reviewing your credit history and using it to make decisions that could harm your credit score. For example, if a lender were to review your credit report and see that you have a lot of recent inquiries or high credit card balances, they may be less likely to approve your application. By freezing your credit report, you can prevent this from happening. A credit freeze provides an additional layer of security when you are making financial transactions. Restricting access to your credit report reduces the chances of fraud and other unauthorized activities. For example, if you are applying for a mortgage, you will need to provide a lot of personal and financial information to the lender. By freezing your credit report, you can reduce the risk of this information falling into the wrong hands. Knowing that your credit is safe from unauthorized access can provide peace of mind. You will not have to worry about someone using your identity to take out loans or credit cards without your permission. While credit freezes offer many benefits, they also have some limitations: If you need to apply for a loan or credit card, you will need to lift your credit freeze temporarily. This can be a time-consuming process and may delay your application. For example, if you are applying for a new credit card, you will need to unfreeze your credit report so the issuer can evaluate your creditworthiness. This process can take several days, which may delay your application. A credit freeze does not protect against all types of identity theft. For example, it will allow thieves to use your existing credit accounts to make purchases. If someone has access to your credit card number, they can still use it to make purchases, even if your credit report is frozen. Similarly, someone with your Social Security number may be able to use it to file a fraudulent tax return. A credit freeze does not prevent identity theft from other sources, such as stolen mail or online account information. For example, if someone steals your mail and uses the information to open a new credit account, a credit freeze will not prevent this from happening. Similarly, a credit freeze will not protect you if someone hacks into your online account and steals your personal information. If you need to apply for credit, you must temporarily lift the credit freeze, which can take time and may delay your application. For example, if you are applying for a mortgage, you will need to unfreeze your credit report so the lender can evaluate your creditworthiness. This process can take several days, which may delay your application. Implementing a credit freeze is a straightforward process: 1. Contact each of the three credit bureaus and request a credit freeze. Once your credit freeze is in place, you will receive a confirmation from each credit bureau. You can unlock your credit report when you need to apply for credit and refreeze it when you are finished. It is important to note that you will need to initiate a credit freeze with each of the three credit bureaus separately. Each bureau may have different requirements and fees, so be sure to check with each one. Here are a few additional tips to keep in mind when using credit freezes: While a credit freeze is an effective way to prevent identity theft, monitoring your credit report regularly is still important. You can do this by ordering a free credit report from each credit bureau once a year. Review your credit report for any inaccuracies or fraudulent activity. If you see something suspicious, report it immediately to the credit bureau. Consider using a password manager to ensure you remember your credit freeze PIN or password. A password manager is a tool that helps you create and store secure passwords for all your online accounts. By using a password manager, you can generate a strong, unique password for your credit freeze that is difficult to guess or hack. Finally, be cautious when sharing personal information, especially online. Scammers and identity thieves often use phishing emails and fake websites to steal personal information. Be wary of emails or phone calls asking for personal information, such as your Social Security or credit card number. If you are not sure if an email or website is legitimate, contact the company directly to verify. Credit freezes are an effective way to protect your credit from unauthorized access and identity theft. While they have some limitations, they provide many benefits, including peace of mind and secure financial transactions. To implement a credit freeze, contact each of the three credit bureaus and follow their procedures. Remember to monitor your credit report regularly, use a password manager, and be cautious when sharing personal information. By taking these steps, you can reduce your risk of identity theft and protect your financial future. Consider consulting with a banking professional to help you develop a personalized plan that meets your unique needs and goals. By working with a professional, you can gain a deeper understanding of your options and make informed decisions that will help you achieve financial success.What Are Credit Freezes?

How Credit Freezes Work

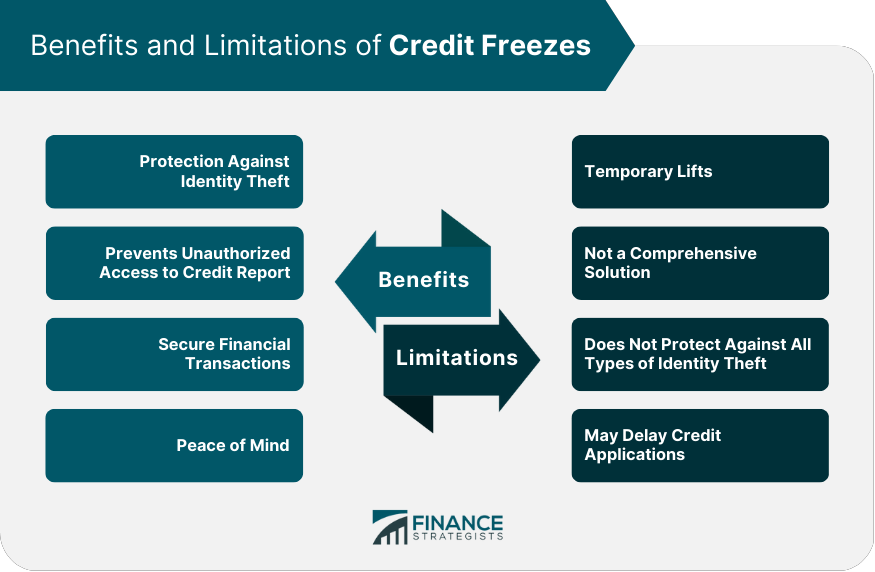

Benefits of Credit Freezes

Protection Against Identity Theft

Prevents Unauthorized Access to Credit Reports

Secure Financial Transactions

Peace of Mind

Limitations of Credit Freezes

Temporary Lifts

Not a Comprehensive Solution

Does Not Protect Against All Types of Identity Theft

May Delay Credit Applications

How to Implement a Credit Freeze

2. Provide identification to verify your identity.

3. Pay any applicable fees (although some states offer free credit freezes).Additional Tips for Using Credit Freezes

Monitor Your Credit Report Regularly

Use a Password Manager

Be Cautious When Sharing Personal Information

Conclusion

Credit Freezes FAQs

A credit freeze is a security measure that allows you to restrict access to your credit report to prevent unauthorized parties from opening new credit accounts or taking out loans in your name.

To initiate a credit freeze, you must contact each of the three credit bureaus: Equifax, Experian, and TransUnion. Once your request is processed, the bureaus will block access to your credit report unless you provide a PIN or password to unlock it.

A credit freeze provides several benefits, including protection against identity theft, preventing unauthorized access to your credit report, secure financial transactions, and peace of mind.

A credit freeze does not protect against all types of identity theft, may delay credit applications, and may require temporary lifts for credit inquiries. Additionally, a credit freeze does not prevent thieves from using your existing credit accounts to make purchases.

To implement a credit freeze, contact each of the three credit bureaus and request a credit freeze. You will need to provide identification to verify your identity and may need to pay any applicable fees. Once the credit freeze is in place, you can unlock your credit report when you need to apply for credit and refreeze it when you finish.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.