Forbearance is a temporary postponement of mortgage payments. It is a form of repayment relief granted by the lender or creditor in lieu of forcing a property into foreclosure. "Forbearance" means "holding back." It refers to holding back from taking legal action due to missed mortgage payments. Lenders might offer forbearance plans when they believe that the borrower might be able to catch up on their payments in the near future. It's essential to understand that forbearance doesn't erase what you owe. Instead, it temporarily suspends payments or reduces the monthly payment for a specific period. Forbearance plans serve two main purposes. Firstly, they provide borrowers facing temporary financial hardships with a breathing space, allowing them to restructure their finances without the threat of imminent foreclosure. Secondly, they can be beneficial for lenders. By offering a forbearance plan, lenders can avoid these costs while helping borrowers maintain their homes. A forbearance plan starts with a mutual agreement between the borrower and the lender. Both parties negotiate to determine the plan's specifics. While the lender agrees not to initiate foreclosure during the forbearance period, the borrower commits to a new payment plan to address the missed payments. Every situation is unique, so these agreements tend to be customized to the borrower's specific financial situation, addressing the challenges faced and providing a structured way forward. Forbearance plans are generally short-term solutions. They can last from a few months up to a year, depending on individual circumstances and the lender's policies. The specific terms, like the length of the forbearance and new payment arrangements, are detailed in the agreement. Even though payments might be paused, it's crucial for borrowers to remember that interest typically continues to accumulate, which could increase the overall loan amount. To qualify for a forbearance plan, borrowers often need to meet certain criteria set by the lender. This might include proof of a temporary financial hardship, such as a job loss or medical emergency. Some lenders might also have stipulations like a minimum loan duration or not having used a forbearance plan previously. While these criteria exist, lenders also appreciate proactive communication. Reaching out early, when financial difficulties first arise, can make the process smoother. At the end of the forbearance period, borrowers must get back on track. This means resuming regular payments and addressing the deferred amount. Depending on the agreement, this could involve larger monthly payments for a set period, a one-time lump sum payment, or even an extension of the loan term. It's essential to be prepared for this transition and have a financial strategy in place. Natural disasters can wreak havoc on a community, causing not only physical damage but also significant financial strain. Recognizing the challenges homeowners face in such times, lenders often offer forbearance plans tailored for disaster recovery. This allows homeowners to prioritize their immediate needs, such as repairs or temporary housing, without the added pressure of mortgage payments. Higher education is an investment, but many graduates face financial challenges, especially at the beginning of their careers. Some might struggle to find employment, while others might start in lower-paying roles. Loan providers, understanding these unique challenges, offer forbearance options to ease the financial burden temporarily, allowing graduates to find their footing in the professional world. The unexpected loss of a job can be a significant blow, both emotionally and financially. With regular income interrupted, meeting monthly obligations like mortgage payments can become a daunting task. Lenders, recognizing the temporary nature of such hardships, might offer forbearance specifically designed for those in between jobs. This gesture not only provides financial relief but also gives borrowers the time they need to secure new employment. The unprecedented global pandemic disrupted economies worldwide, leading to job losses and reduced incomes for millions. In response, many lending institutions stepped up, introducing forbearance programs to support borrowers affected by the pandemic. These programs showcased the financial sector's adaptability and commitment to helping individuals navigate unforeseen challenges. When health crises arise, the primary concern is recovery and well-being. The financial burden of medical bills, coupled with potential lost wages, can compound the stress. Understanding this, lenders might offer forbearance plans to those dealing with medical emergencies. This allows individuals and families to focus on health and recovery first, providing peace of mind during trying times. For those facing unexpected financial challenges, a forbearance plan can be a lifeline. It offers immediate relief by temporarily reducing or pausing payments. This short-term support can help borrowers manage immediate costs, ensuring they can meet other crucial obligations and avoid further financial pitfalls. The most significant advantage of a forbearance plan is the protection it offers against foreclosure. Foreclosure can have long-lasting repercussions, not only in terms of credit scores but also emotional and psychological stress. By opting for forbearance, borrowers get a window to restructure their finances and find solutions without the looming threat of losing their home. Forbearance plans aren't one-size-fits-all. They offer a variety of repayment options once the forbearance period ends. Whether it's higher monthly payments for a while, a lump sum arrangement, or even extending the loan duration, borrowers have options to choose what best suits their revamped financial situation. If both the lender and borrower adhere to the terms of the forbearance agreement, there's typically no negative impact on the borrower's credit score. It's a testament to the mutual benefit of the plan. Borrowers maintain their credit health, while lenders receive the assurance of repayment. One of the primary drawbacks of forbearance is the continuing accrual of interest. Even if payments are paused, the interest usually isn't. This means the overall amount owed can grow during the forbearance period, leading to potentially higher future payments. With accumulated interest and deferred payments, the repayment amount after the forbearance can be substantial. This means monthly payments might increase, or borrowers could face a hefty lump sum payment, both scenarios demanding additional financial planning. In some cases, to address the deferred payments, the loan term might be extended. This means borrowers could end up paying more in interest over the life of the loan. It's a trade-off for the immediate relief provided by the forbearance. Forbearance agreements can be complex. If not understood correctly, borrowers might inadvertently default, leading to penalties or, in the worst-case scenario, foreclosure. It underscores the importance of thoroughly reviewing and understanding the terms of any agreement. Loan modification involves changing the terms of the original loan. This could mean a reduced interest rate, an extended loan term, or even changing the loan type. It's a more permanent solution than forbearance and can make a loan more manageable in the long run. Refinancing involves replacing the existing loan with a new one, typically at a lower interest rate. This can lead to reduced monthly payments and potential savings over the life of the loan. It's especially worth considering if current market interest rates are significantly lower than the original loan's rate. If forbearance isn't the right fit, borrowers might opt for a structured repayment plan. This involves catching up on missed payments over time, integrating them into the regular monthly payments. It's a way to address short-term financial hiccups without drastically altering the loan terms. A more drastic alternative, a short sale involves selling the property for less than the remaining loan amount. While this does mean giving up the property, it can be a way to avoid foreclosure and its associated negative credit implications. Before negotiating any financial agreement, it's essential to have a clear understanding of your financial standing. Assess your current income, expenses, and potential changes in the near future. A well-informed borrower is in a stronger position to negotiate favorable terms. Building a rapport with the lender is crucial. By being open about challenges and demonstrating a genuine intent to repay, you're more likely to secure a forbearance plan that's beneficial for both parties. It's paramount to thoroughly understand any agreement you're entering. This means asking questions, seeking clarifications, and perhaps even getting a second opinion. Remember, the goal is to find a solution that's both manageable and fair. Navigating financial decisions can be daunting. If in doubt, seek guidance from a professional financial counselor. They can offer tailored advice, ensuring you make decisions that are in your best interest both now and in the future. In navigating the challenges of financial hardships, understanding the nuances of a forbearance plan can be pivotal. This mechanism provides a temporary suspension or reduction in mortgage payments, creating a buffer against immediate financial strains and possible foreclosure. By fostering open communication with lenders and proactively seeking feasible terms, borrowers can safeguard their financial health and home stability. However, while it offers immediate relief, it's essential to recognize its accompanying responsibilities like the accumulation of interest and future payment commitments. For those uncertain about forbearance, there are alternatives such as refinancing or loan modifications. Ultimately, in times of financial turbulence, being informed, proactive, and seeking expert guidance can be the cornerstone of finding the most appropriate solution.What Is a Forbearance Plan?

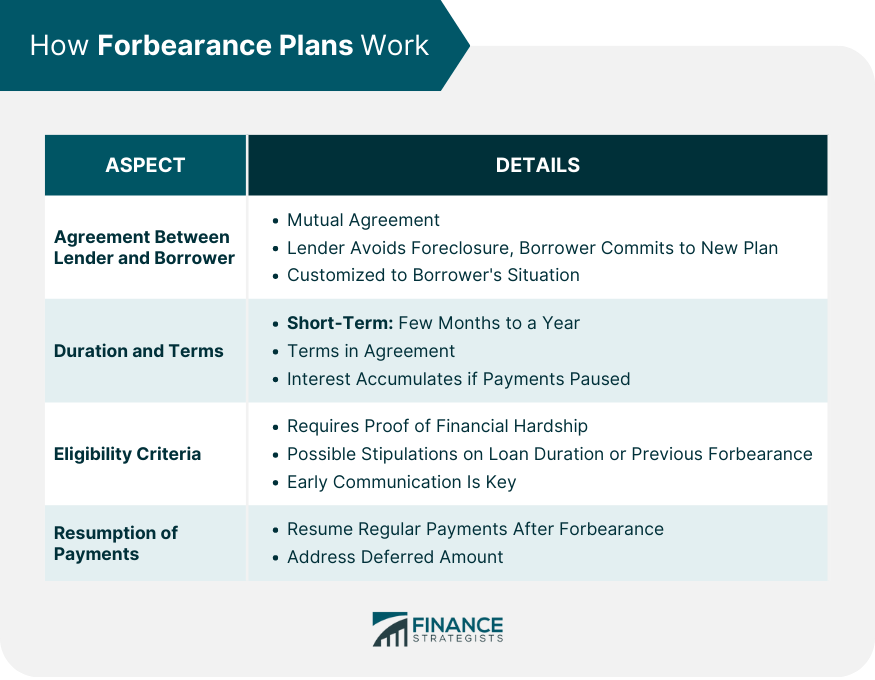

How Forbearance Plans Work

Agreement Between Lender and Borrower

Duration and Terms

Eligibility Criteria

Resumption of Payments

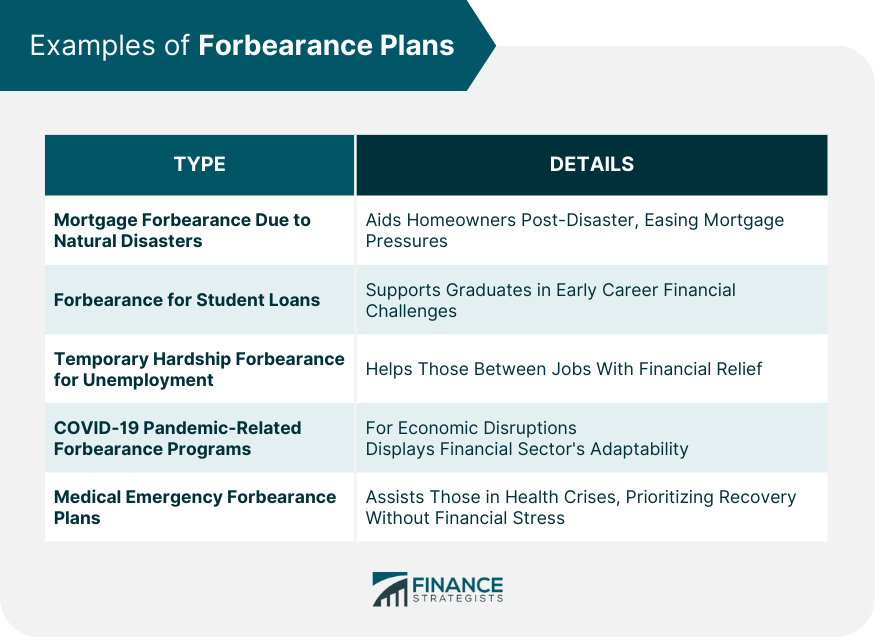

Examples of Forbearance Plans

Mortgage Forbearance Due to Natural Disasters

Forbearance for Student Loans

Temporary Hardship Forbearance for Unemployment

COVID-19 Pandemic-related Forbearance Programs

Medical Emergency Forbearance Plans

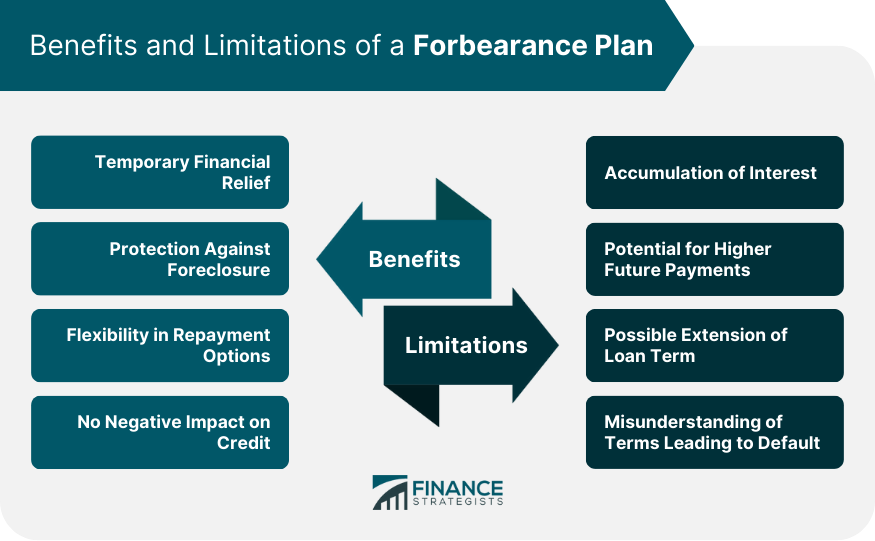

Benefits of a Forbearance Plan

Temporary Financial Relief

Protection Against Foreclosure

Flexibility in Repayment Options

No Negative Impact on Credit if Managed Properly

Limitations of a Forbearance Plan

Accumulation of Interest

Potential for Higher Future Payments

Possible Extension of Loan Term

Misunderstanding of Terms Leading to Default

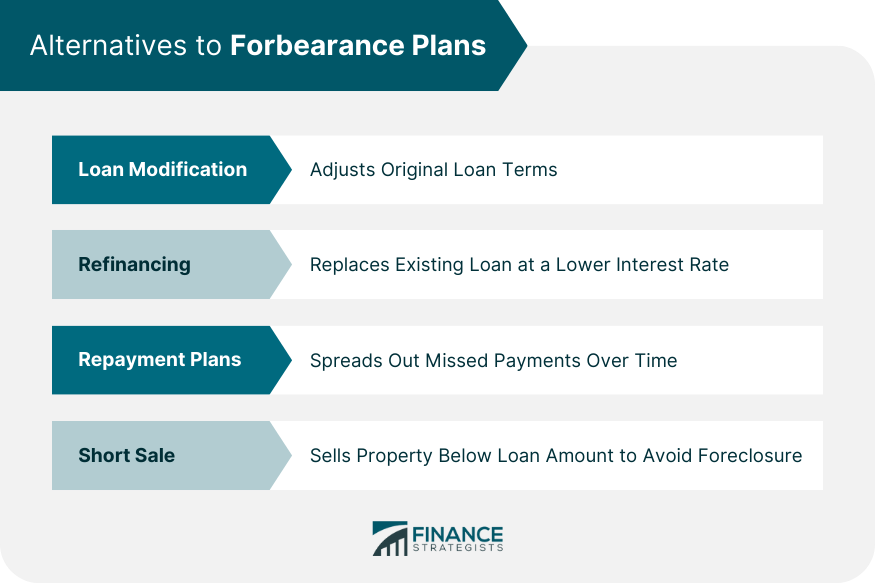

Alternatives to Forbearance Plans

Loan Modification

Refinancing

Repayment Plans

Short Sale

Tips for Negotiating a Forbearance Plan

Understand Your Financial Situation

Communicate With the Lender

Review and Understand Terms

Seek Financial Counseling

Final Thoughts

Forbearance Plan FAQs

A forbearance plan is a temporary postponement of loan payments, granted by lenders to provide relief during financial hardships.

They involve an agreement between the borrower and lender to temporarily reduce or pause payments, usually with terms to address deferred payments later.

Yes, drawbacks include the accumulation of interest, potential for higher future payments, and possible extension of the loan term.

Situations can include natural disasters, medical emergencies, unemployment, and pandemic-related financial challenges.

Yes, alternatives include loan modification, refinancing, repayment plans, and short sales.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.