Unemployment insurance is a government program that provides monetary assistance to eligible workers who become involuntarily unemployed. It is designed to replace a portion of lost wages and help job seekers remain financially stable as they look for new employment opportunities. The program is typically funded by mandatory contributions from employers, and in some cases employees, and is often administered by national or regional governments. Eligibility for unemployment insurance generally requires that individuals meet certain conditions, such as having worked for a minimum period, being actively seeking work, and not having left their job voluntarily or due to misconduct. The amount and duration of benefits can vary depending on the individual's previous earnings and the specific regulations of the unemployment insurance program. Unemployment insurance serves several essential purposes: 1. Economic stability: It helps maintain overall economic stability during times of high unemployment by providing a temporary income to jobless workers, allowing them to continue spending on goods and services. 2. Income support: It provides a vital safety net for workers who lose their jobs, helping them meet their basic needs and maintain a decent standard of living. 3. Job search facilitation: It offers financial support while workers search for new employment, allowing them to focus on finding a suitable job instead of being forced to accept the first available opportunity. To qualify for unemployment insurance benefits, individuals must typically meet the following criteria: 1. Be unemployed through no fault of their own, such as due to a layoff or company closure 2. Have a sufficient work history and earned enough wages within a specified period (known as the "base period") 3. Be actively seeking new employment and available to work Unemployment insurance typically covers various types of unemployment, including: 1. Job loss due to layoffs, downsizing, or company closures 2. Temporary unemployment resulting from a natural disaster or other external event 3. Seasonal unemployment experienced by workers in industries with cyclical employment patterns, such as construction or tourism Certain factors may disqualify an individual from receiving unemployment insurance benefits, such as 1. Voluntary resignation from a job without good cause 2. Discharge for misconduct or criminal activity 3. Refusal to accept suitable employment without good reason Unemployment insurance is funded primarily through payroll taxes levied on employers at both the federal and state levels. Unemployment insurance is a joint federal-state program, with each state responsible for administering its unemployment insurance system. States determine eligibility criteria, benefit amounts, and the duration of benefits, subject to federal guidelines. The duration and amount of unemployment insurance benefits vary by state and depend on factors such as an individual's prior earnings, the state's unemployment rate, and the availability of federal extensions. Typically, unemployment insurance benefits last for up to 26 weeks, with some states offering extended benefits during periods of high unemployment. The weekly benefit amount is usually a percentage of the worker's previous earnings, up to a maximum limit set by the state. To apply for unemployment insurance benefits, individuals should follow these steps: 1. Contact their state's unemployment insurance agency, either online, by phone, or in person. 2. Gather the necessary documentation, such as social security number, employment history, and wage information. 3. Complete the application, providing accurate and truthful information. 4. Submit the application and wait for a determination of eligibility. 5. If approved, individuals must continue to certify their ongoing eligibility, typically on a weekly or biweekly basis. Applicants need to provide several pieces of information when applying for unemployment insurance, including: 1. Personal identification, such as a social security number or driver's license 2. Contact information, including a mailing address, phone number, and email address 3. Employment history, including the names and addresses of employers, dates of employment, and reasons for separation 4. Wage information, such as W-2 forms, pay stubs, or other evidence of earnings Providing accurate and truthful information during the unemployment insurance application process is essential. Providing false or misleading information may result in denial of benefits, repayment of any benefits received, and potential criminal prosecution for fraud. The primary benefit of unemployment insurance is the temporary replacement of a portion of lost wages. These monetary benefits help jobless workers maintain a decent standard of living, meet their basic needs, and continue to participate in the economy. In addition to monetary benefits, unemployment insurance may also provide non-monetary support to job seekers, such as: 1. Job search assistance, including access to job listings, workshops, and career counseling 2. Training and education programs, which help workers upgrade their skills or acquire new ones 3. Support services, such as transportation assistance, childcare, and referrals to other social service programs Unemployment insurance benefits are considered taxable income and must be reported on federal and state income tax returns. Recipients may choose to have taxes withheld from their benefits or make estimated tax payments to avoid owing taxes at the end of the year. Some critics argue that unemployment insurance can create disincentives to work by providing financial support to jobless workers, potentially reducing the urgency of finding new employment. However, research has shown that the effect on job search efforts is generally modest, and the overall benefits of unemployment insurance outweigh these potential drawbacks. Fraudulent claims and abuse of the unemployment insurance system are ongoing challenges. Examples include individuals who continue to collect benefits while working or those who misrepresent their work history or earnings. To combat fraud, state agencies have implemented various measures, such as data matching, audits, and increased penalties for fraudulent behavior. Unemployment insurance has long been a subject of economic and political debate, with discussions focusing on the appropriate level of benefits, the duration of benefits, and the overall cost of the program. Policymakers must balance the need to provide a robust safety net for jobless workers with concerns about fiscal responsibility and potential negative labor market effects. Technology has played an increasingly significant role in the administration of unemployment insurance programs. Many states have adopted online systems for filing claims, certifying ongoing eligibility, and accessing job search resources. These advancements have streamlined the application process, reduced administrative costs, and improved access to services for jobless workers. Various proposals have been put forth to enhance the unemployment insurance system, including: 1. Modernizing state unemployment insurance systems to improve efficiency, reduce fraud, and better serve claimants. 2. Expanding coverage to include more workers, such as those in non-traditional employment arrangements or those who have not accumulated sufficient work history. 3. Adjusting benefit levels and duration to better reflect the needs of workers and the realities of the labor market, such as increasing the maximum benefit amount or offering extended benefits during periods of high unemployment. Unemployment insurance plays a vital role in providing financial support to jobless workers, helping them maintain a decent standard of living while searching for new employment opportunities. By offering a temporary safety net, unemployment insurance contributes to overall economic stability and helps to mitigate the negative consequences of job loss. However, challenges such as potential disincentives to work, fraudulent claims, and the ongoing economic and political debates surrounding the program highlight the need for continued policy development and discussion. As the labor market and economic conditions evolve, so too must the unemployment insurance system to ensure that it remains an effective and equitable tool for supporting workers in times of need. Understanding the definition, role, and implications of unemployment insurance is essential in appreciating its significance and the benefits it brings to both individuals and the broader economy.Definition of Unemployment Insurance

Purpose and Significance of Unemployment Insurance

Eligibility for Unemployment Insurance

General Requirements for Receiving Unemployment Insurance

Types of Unemployment Covered by Unemployment Insurance

Factors That May Disqualify an Individual from Receiving Unemployment Insurance

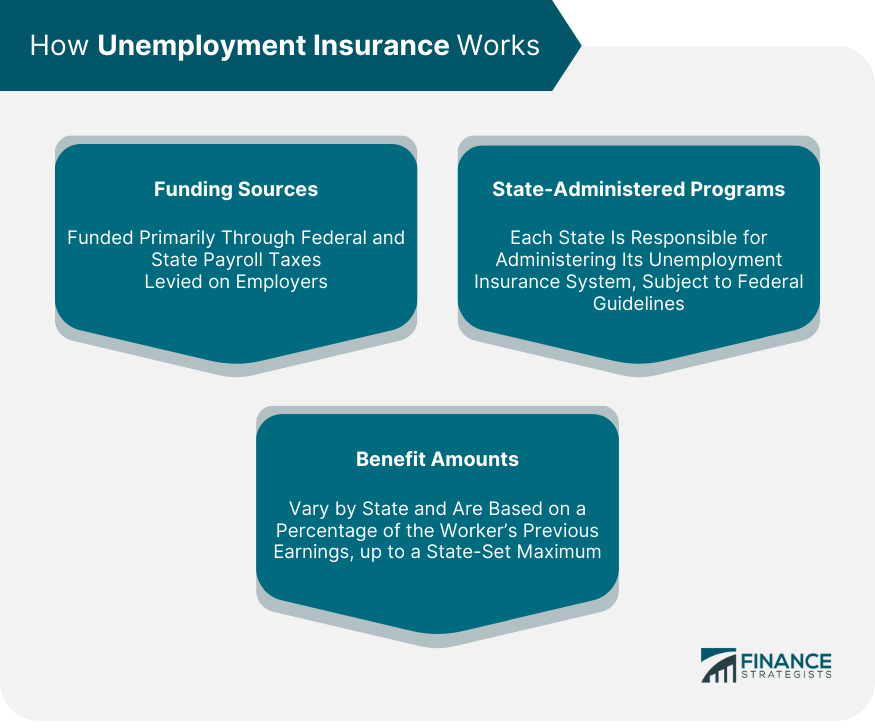

How Unemployment Insurance Works

Funding Sources for Unemployment Insurance

The federal government uses these funds to administer the program and support state unemployment insurance agencies. States also have their unemployment insurance trust funds, which finance the payment of benefits to eligible workers.State-Administered Unemployment Insurance Programs

Duration and Amount of Unemployment Insurance Benefits

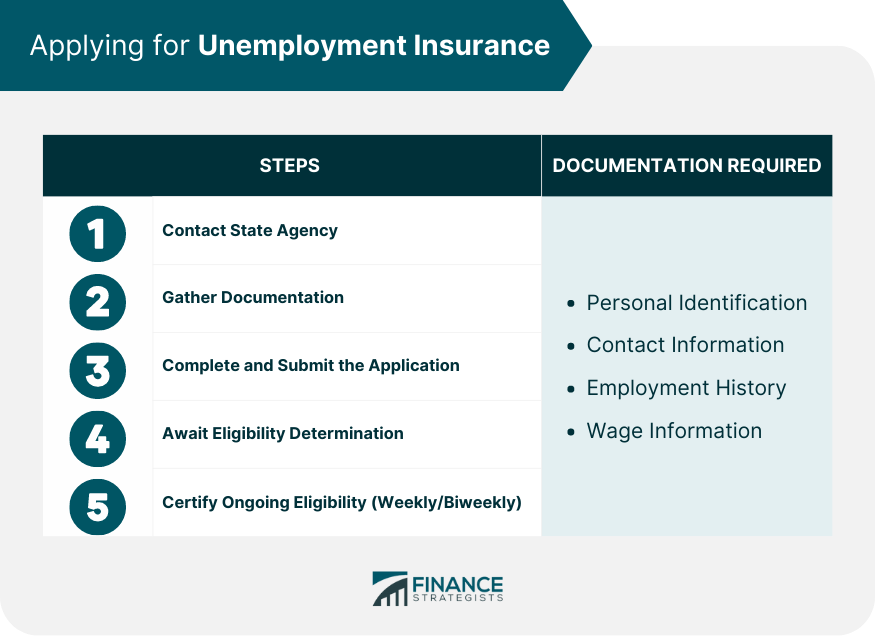

Applying for Unemployment Insurance

Steps to File an Unemployment Insurance Claim

Documentation Required for Unemployment Insurance Application

Importance of Accurate and Truthful Information During the Application Process

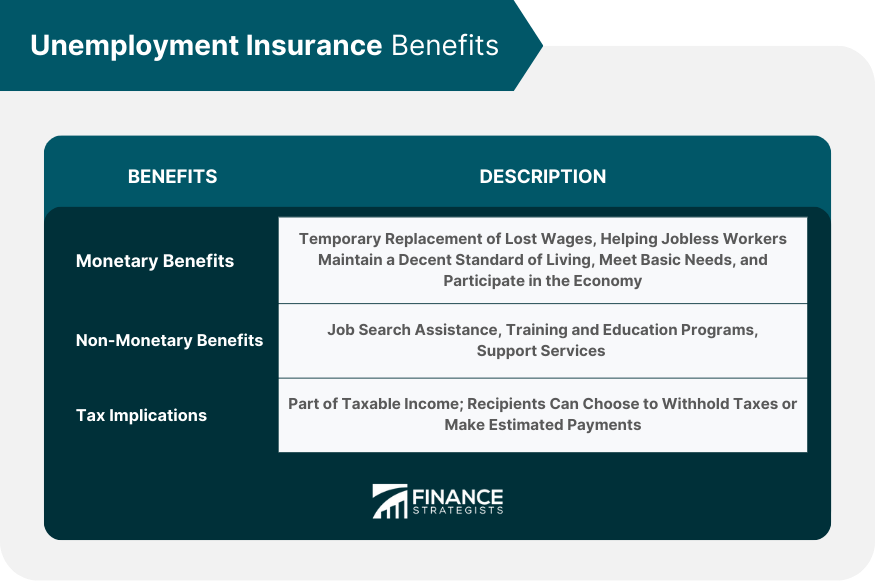

Unemployment Insurance Benefits

Monetary Benefits of Unemployment Insurance

Non-Monetary Benefits of Unemployment Insurance

Tax Implications of Unemployment Insurance Benefits

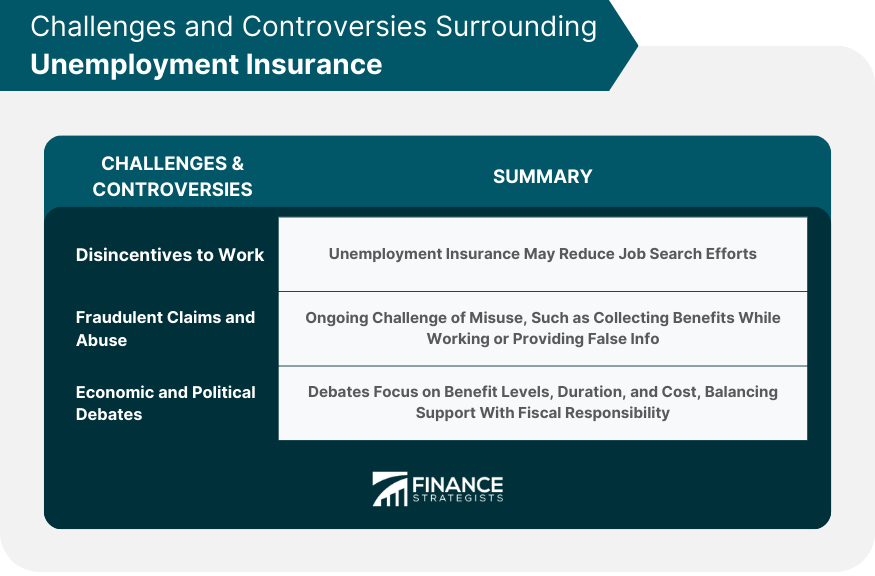

Challenges and Controversies Surrounding Unemployment Insurance

Potential Disincentives to Work Caused by Unemployment Insurance

Fraudulent Claims and Abuse of the Unemployment Insurance System

Economic and Political Debates Around Unemployment Insurance

Unemployment Insurance Reforms and Future Trends

Technological Advancements in Unemployment Insurance Administration

Proposals for Future Improvements to the Unemployment Insurance System

Conclusion

Unemployment Insurance FAQs

Unemployment Insurance is a government program that provides temporary financial assistance to eligible workers who become involuntarily unemployed. To qualify, individuals must meet certain criteria, such as being unemployed through no fault of their own, having sufficient work history, and actively seeking new employment.

Unemployment Insurance benefits are funded primarily through payroll taxes levied on employers at both federal and state levels. The federal government uses these funds to administer the program and support state unemployment insurance agencies, while states maintain their unemployment insurance trust funds to finance benefit payments.

The duration and amount of Unemployment Insurance benefits vary by state, typically lasting up to 26 weeks. The weekly benefit amount is usually a percentage of your previous earnings, up to a maximum limit set by the state. Some states may offer extended benefits during periods of high unemployment.

To apply for Unemployment Insurance benefits, contact your state's unemployment insurance agency, either online, by phone, or in person. You will need to provide personal identification, contact information, employment history, and wage information. After submitting the application, you will receive a determination of eligibility.

Yes, Unemployment Insurance benefits are considered taxable income and must be reported on your federal and state income tax returns. You can choose to have taxes withheld from your benefits or make estimated tax payments to avoid owing taxes at the end of the year.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.