Split-dollar life insurance is a unique arrangement in which two parties, typically an employer and employee, share the costs, benefits, and ownership interests of a permanent life insurance policy. This type of arrangement can provide an affordable method for employees to obtain life insurance coverage while also serving as a valuable employee retention and reward strategy for employers. Split-dollar life insurance agreements are typically structured in one of two ways: the endorsement method or the collateral assignment method. These arrangements dictate how premiums, death benefits, and policy cash values are shared between the employer and the employee. Split-dollar life insurance arrangements offer several benefits to both employers and employees, including cost-sharing, flexibility in policy design, and potential cash value growth. These arrangements can provide financial security to employees while offering employers an attractive means of retaining and rewarding key personnel. Under the endorsement method, the employer owns the life insurance policy and is responsible for paying the premiums. The employer designates a portion of the policy's death benefit to be paid to the employee's designated beneficiary, while the remainder goes to the employer or another designated beneficiary. In this arrangement, the employer and employee agree on the allocation of policy benefits, with the employer typically retaining a portion of the death benefit and any accumulated cash value. The employee is responsible for paying income tax on the economic benefit associated with their share of the death benefit. With the collateral assignment method, the employee owns the life insurance policy and assigns a portion of the death benefit and cash value to the employer as collateral for the employer's premium payments. In this arrangement, the employer and employee agree on the allocation of policy benefits, with the employer typically recouping their premium payments from the policy's death benefit or cash value. The employee is responsible for paying income tax on the value of the employer's premium payments. In a split-dollar arrangement, the employer and employee share the cost of the life insurance premiums. This cost-sharing structure can make life insurance more affordable for employees, especially for those seeking permanent life insurance coverage. The death benefit of a split-dollar life insurance policy is divided between the employer and employee, based on the terms of the agreement. This allocation provides financial protection for both parties and can be customized to meet their respective needs. Permanent life insurance policies, such as whole or universal life, accumulate cash value over time. In a split-dollar arrangement, the cash value growth can be shared between the employer and employee, providing an additional financial benefit to both parties. Employers can generally deduct their premium payments for split-dollar life insurance arrangements, subject to certain limitations. The tax treatment of policy proceeds, such as death benefits and cash values, will depend on the specific structure of the arrangement and the employer's ownership interest in the policy. Employees may be subject to income tax on the economic benefit associated with their share of the policy's death benefit or the value of the employer's premium payments, depending on the structure of the split-dollar arrangement. The tax treatment of policy proceeds, such as death benefits and cash values, will also depend on the employee's ownership interest in the policy. Split-dollar life insurance arrangements can make permanent life insurance coverage more affordable for employees, Split-dollar life insurance arrangements serve as a valuable tool for employers to retain and reward key employees. By offering shared benefits and cost-sharing arrangements, employers can create a strong incentive for employees to remain with the company and contribute to its success. Split-dollar life insurance agreements offer flexibility in designing the policy to meet the specific needs of both the employer and employee. This includes selecting the type of life insurance policy, determining the allocation of premiums and benefits, and adjusting the agreement over time as circumstances change. In addition to the death benefit, permanent life insurance policies accumulate cash value over time. Split-dollar life insurance arrangements allow both the employer and employee to benefit from this cash value growth, providing an additional financial incentive for both parties. Split-dollar life insurance arrangements can be complex and may require the assistance of legal and financial professionals to establish and maintain. The costs associated with drafting and managing the agreement should be weighed against the potential benefits. The tax implications of split-dollar life insurance arrangements can be complex, and both employers and employees must carefully consider the tax consequences of the arrangement. Ensuring compliance with tax regulations may require the assistance of tax professionals and may result in additional costs. Split-dollar life insurance arrangements are typically only available to key employees of a company, limiting their availability to a small group of individuals. Additionally, not all insurance providers offer split-dollar life insurance arrangements, which may limit the options for employers and employees seeking this type of coverage. Split-dollar life insurance arrangements create a financial relationship between the employer and employee, which may lead to potential conflicts of interest. Both parties should carefully consider this relationship and establish clear guidelines to avoid potential issues. Employers should consider split-dollar life insurance arrangements when they are seeking a cost-effective way to provide life insurance coverage for key employees while also creating a strong retention and reward strategy. Employees should consider split-dollar life insurance arrangements when they need life insurance coverage but find the cost of permanent life insurance policies prohibitive. Additionally, employees should evaluate the potential tax implications and weigh the benefits against any potential drawbacks. Before committing to a split-dollar life insurance arrangement, both employers and employees should evaluate alternative strategies, such as group life insurance plans or supplemental life insurance policies, to determine the most appropriate and cost-effective solution for their needs. When establishing a split-dollar life insurance arrangement, both parties should carefully consider the type of life insurance policy and the insurer to ensure they are selecting the most suitable option for their needs. A split-dollar life insurance agreement must be carefully drafted to outline the terms of the arrangement, including premium sharing, death benefit allocation, and cash value accumulation. Legal and financial professionals should be consulted to ensure the agreement is structured properly and complies with relevant regulations. Both parties should regularly review and update the split-dollar life insurance arrangement to ensure it continues to meet their respective needs. Changes in life circumstances or financial goals may necessitate adjustments to the agreement. Split-dollar life insurance arrangements can play a critical role in financial planning for both employers and employees. By providing affordable life insurance coverage and serving as a retention and reward strategy, these arrangements offer several benefits to both parties. While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability. Both employers and employees must carefully weigh the benefits and disadvantages of this type of arrangement before deciding to pursue it. Given the complexities of split-dollar life insurance arrangements, it is essential to work with knowledgeable legal, financial, and tax professionals when establishing and maintaining the agreement. This will help ensure that the arrangement is properly structured, compliant with relevant regulations, and optimized to meet the needs of both parties. Finally, before committing to a split-dollar life insurance arrangement, employers and employees should consider alternative life insurance options, such as group life insurance plans or supplemental life insurance policies. This will ensure that they are choosing the most appropriate and cost-effective solution to meet their life insurance needs.What Is Split-Dollar Life Insurance?

Types of Split-Dollar Life Insurance Arrangements

Endorsement Method

Employer-Owned Policy

Allocation of Policy Benefits and Premiums

Collateral Assignment Method

Employee-Owned Policy

Allocation of Policy Benefits and Premiums

Key Features of Split-Dollar Life Insurance

Premium Sharing

Death Benefit Allocation

Cash Value Accumulation

Tax Implications

Tax Treatment for Employers

Tax Treatment for Employees

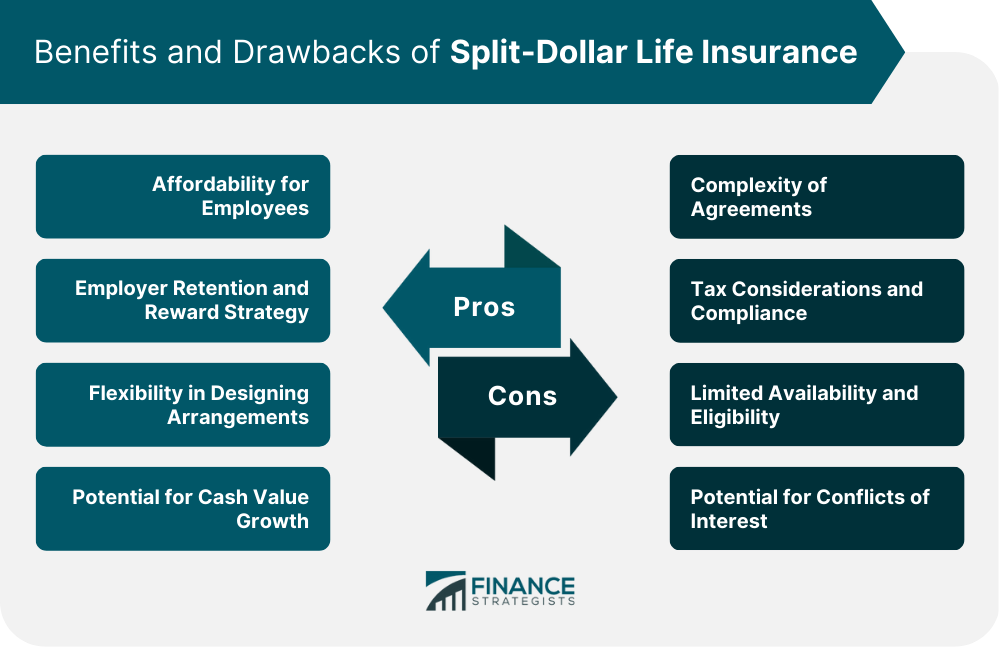

Advantages of Split-dollar Life Insurance

Affordability for Employees

Employer Retention and Reward Strategy

Flexibility in Designing Arrangements

Potential for Cash Value Growth

Disadvantages of Split-dollar Life Insurance

Complexity of Agreements

Tax Considerations and Compliance

Limited Availability and Eligibility

Potential for Conflicts of Interest

When to Consider Split-dollar Life Insurance

Key Factors for Employers

Key Factors for Employees

Evaluating Alternative Strategies

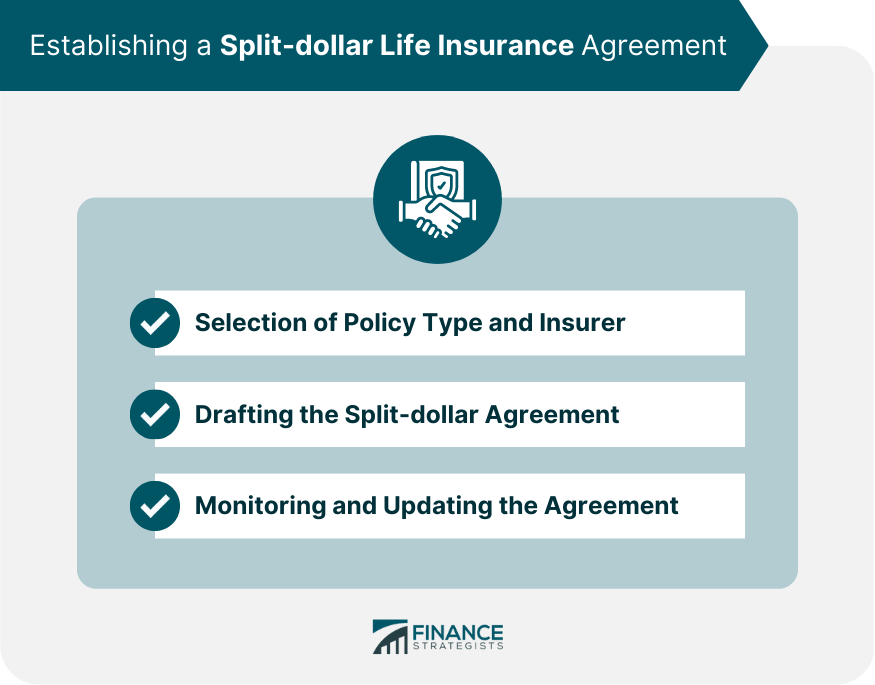

Establishing a Split-dollar Life Insurance Agreement

Selection of Policy Type and Insurer

Drafting the Split-dollar Agreement

Monitoring and Updating the Agreement

Conclusion

Split-Dollar Life Insurance FAQs

Split-dollar life insurance is an arrangement where two parties share the costs and benefits of a life insurance policy. Typically, an employer and employee, or two business partners, split the premium payments and death benefit.

In a split-dollar life insurance arrangement, the employer or business partner pays a portion of the premium, and the employee or other partner pays the remaining portion. The policy's death benefit is split between the two parties based on the agreement.

Split-dollar life insurance can provide several benefits, including cost-sharing for the premium payments, tax benefits, and flexibility in how the death benefit is allocated. It can also be used as an estate planning tool.

The tax implications of split-dollar life insurance can be complex and depend on several factors, such as who pays the premiums, who owns the policy, and who receives the death benefit. Consult a tax professional for advice on how split-dollar life insurance may impact your taxes.

Split-dollar life insurance can be a good option for business partners who want to provide a benefit to each other's families in the event of death. It can also be useful for employers who want to provide life insurance coverage to key employees. However, it's important to understand the tax and legal implications of this type of arrangement before entering into it. Consult a financial advisor or attorney for guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.