Annuity income riders are optional add-ons to an annuity contract that provide policyholders with additional guarantees, benefits, or features. They are designed to help protect policyholders' retirement income from various risks, such as market volatility or outliving their savings. Annuity income riders come with additional fees that are charged on top of the base annuity fees. These fees vary depending on the specific rider and insurance company. There are several types of annuity income riders, each with unique features and benefits. The most common ones include: This rider guarantees a minimum annual income for life, regardless of market performance or the annuity's account value. Policyholders can make withdrawals up to a certain percentage of the guaranteed income without depleting their account value. This rider guarantees a minimum income stream regardless of market performance, provided that the policyholder annuitize a contract after a certain waiting period. This rider allows policyholders to convert their annuity into a guaranteed lifetime income stream at any time, with the payout amount determined by factors such as age, gender, and current interest rates. One of the primary benefits of annuity income riders is the guaranteed income stream they provide. By adding an income rider to an annuity contract, policyholders can ensure a consistent income throughout their retirement, regardless of market performance. Annuity income riders offer protection from market volatility by guaranteeing a minimum income regardless of the annuity's investment performance. This can provide retirees peace of mind and financial stability during turbulent economic times. Annuity income riders offer flexibility in retirement planning by allowing policyholders to choose when to start their guaranteed income stream and how much income they want to receive. This enables retirees to tailor their retirement income to meet their specific needs and goals. In addition to the guaranteed income, annuity income riders can also provide optional benefits, such as: Inflation Protection: Some income riders offer the option to increase the guaranteed income to keep up with inflation, ensuring that the purchasing power of the income remains consistent over time. Spousal Coverage: Certain income riders can be extended to cover a spouse, providing a guaranteed income for both partners throughout their lifetimes. Enhanced Death Benefits: Some income riders offer enhanced death benefits, allowing the remaining account value or a guaranteed amount to be passed on to beneficiaries upon the policyholder's death. Annuity income riders often come with higher fees than other investment options, impacting your overall returns. It is crucial to weigh the benefits of the guaranteed income against the potential impact on your investment performance. Annuities generally have limited liquidity, which the addition of an income rider can further restrict. Ensure you have sufficient liquid assets to cover unexpected expenses or emergencies before committing to an annuity with an income rider. Annuity income riders can be complex, and understanding the various features, benefits, and fees can be challenging. Working with a knowledgeable financial advisor is essential to comprehend the rider's details fully and how it fits into your retirement plan. The additional fees associated with annuity income riders can negatively impact your overall investment returns. It is crucial to compare the costs and benefits of adding a rider to your annuity to ensure that it aligns with your financial goals and risk tolerance. When selecting an annuity income rider, it is essential to consider your financial goals and risk tolerance. Different riders offer varying guarantees, benefits, and costs, so choosing one that aligns with your retirement objectives and risk appetite is crucial. Your age and planned retirement timeline play a significant role in deciding which annuity income rider is suitable for you. Some riders require a specific waiting period before the guaranteed income starts, while others offer more flexibility in choosing when to begin receiving payments. Selecting a rider that aligns with your desired retirement timeline is essential. Consider your current and future financial resources when selecting an annuity income rider. Evaluate the fees associated with the rider and ensure that you can afford the additional cost without compromising other aspects of your retirement plan. Annuity income riders come with additional fees and expenses, which can impact your overall investment returns. It is essential to compare the fees of various riders and choose one that provides the desired benefits at a reasonable cost. The financial stability and reputation of the insurance company offering the annuity income rider are crucial factors to consider. Look for companies with strong financial ratings and a positive track record in the industry to ensure that they can fulfill their contractual obligations. Consulting with a financial advisor and an insurance broker can be invaluable when considering annuity income riders. They can help you understand the various rider options, assess your financial needs and goals, and guide you in selecting the most suitable rider for your situation. Before purchasing an annuity income rider, it is essential to research and compare different insurance companies. Look for companies with strong financial ratings, competitive fees, and a positive reputation in the industry. Carefully evaluate the different annuity income rider options available and consider factors such as guaranteed income amounts, fees, optional benefits, and waiting periods. Choose a rider that best meets your retirement income needs and financial goals. Once you have selected an annuity income rider, you will need to complete an application with the insurance company. This process typically involves providing personal and financial information, selecting the desired rider features, and making the necessary premium payments. Annuity income riders offer valuable benefits and guarantees for retirees, such as a consistent income stream, protection from market volatility, and flexibility in retirement planning. To make an informed decision and optimize your retirement strategy, it is essential to thoroughly research and understand the various rider options, fees, and potential drawbacks. By considering factors such as your financial goals, risk tolerance, and retirement timeline, you can choose the right annuity income rider for your needs. To ensure the best possible outcome, consider hiring an insurance broker to guide you through the process and tailor a solution that aligns with your financial objectives. What Are Annuity Income Riders?

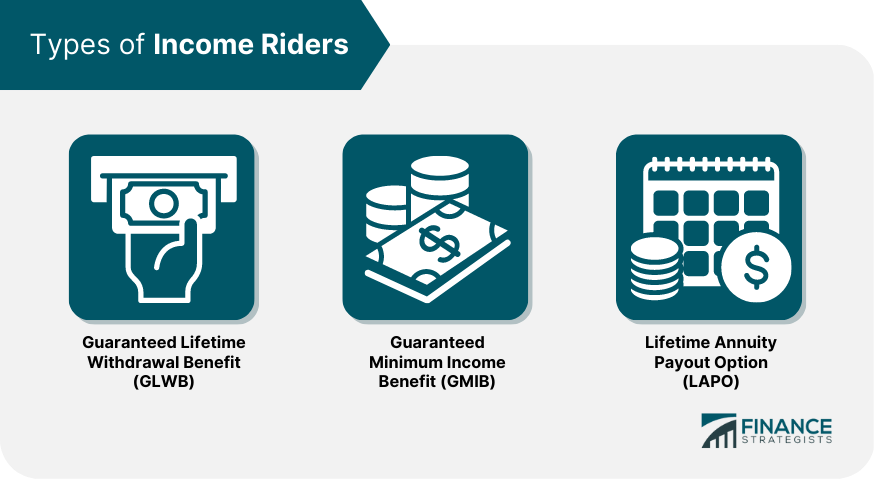

Types of Income Riders

Guaranteed Lifetime Withdrawal Benefit (GLWB)

Guaranteed Minimum Income Benefit (GMIB)

Lifetime Annuity Payout Option (LAPO)

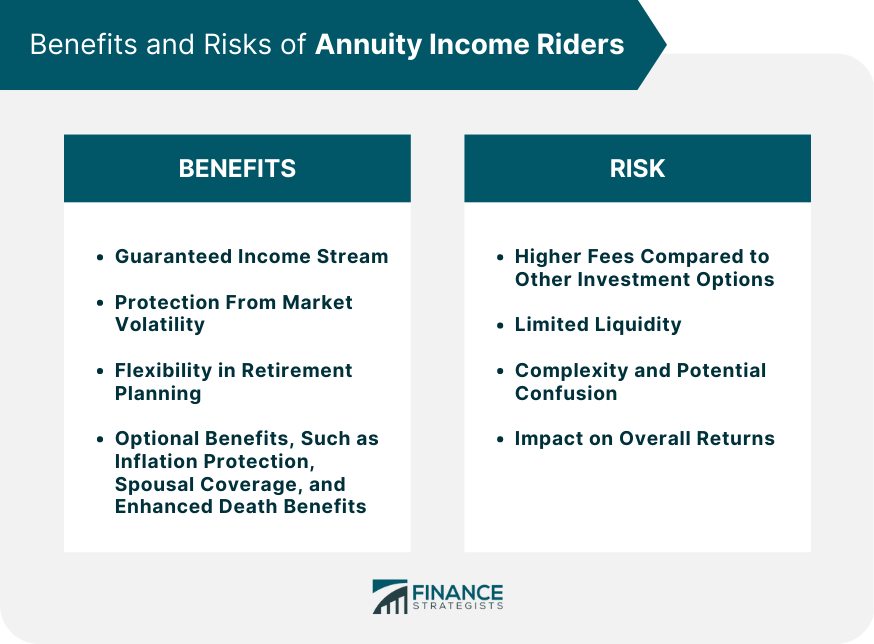

Benefits of Annuity Income Riders

Guaranteed Income Stream

Protection From Market Volatility

Flexibility in Retirement Planning

Optional Benefits

Risks and Drawbacks of Annuity Income Riders

Higher Fees Compared to Other Investment Options

Limited Liquidity

Complexity and Potential Confusion

Impact on Overall Returns

Factors to Consider When Choosing Annuity Income Riders

Financial Goals and Risk Tolerance

Age and Retirement Timeline

Available Financial Resources

Fees and Expenses

Insurance Company Ratings and Reputation

How to Purchase Annuity Income Riders

Working With a Financial Advisor

Researching and Comparing Insurance Companies

Evaluating Different Rider Options

The Application Process

Conclusion

Annuity Income Riders FAQs

Annuity income riders are optional add-ons to an annuity contract that provide policyholders additional guarantees, benefits, or features. They are essential for retirement planning as they can offer a guaranteed income stream, protection from market volatility, and flexibility to tailor retirement income according to individual needs.

There are several types of annuity income riders, including Guaranteed Lifetime Withdrawal Benefit (GLWB), Guaranteed Minimum Income Benefit (GMIB), and Lifetime Annuity Payout Option (LAPO). Each type offers unique features and benefits, such as guaranteed income for life, minimum income regardless of market performance, or the option to convert the annuity into a lifetime income stream.

The cost of annuity income riders varies depending on the specific rider and insurance company but typically ranges from 0.25% to 1.0% of the account value annually. These fees are charged on top of the base annuity fees.

When choosing annuity income riders, consider factors such as your financial goals, risk tolerance, age, retirement timeline, available financial resources, fees, and expenses, and the insurance company's ratings and reputation. These factors will help you select the most suitable rider for your retirement planning needs.

Some potential risks and drawbacks of annuity income riders include higher fees compared to other investment options, limited liquidity, complexity and potential confusion, and impact on overall returns. It is essential to weigh the benefits of the guaranteed income against these potential drawbacks and consult with a financial advisor to ensure the rider aligns with your financial goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.