An annuity is a financial product typically offered by insurance companies to individuals seeking regular, secure income payments for a specified period, often throughout retirement. It is structured as a contract where the annuitant (the investor) makes either a single large payment or series of payments to the insurance company. In return, the company promises to make periodic payments to the annuitant, either immediately or at some point in the future. Annuities can provide financial stability and predictability, making them a popular choice for retirement planning. Individuals can have a consistent source of funds to cover living expenses during retirement. A guaranteed annuity rate is a feature that may be offered within a pension annuity contract. This rate determines the amount of regular income the annuitant will receive from the annuity. A guaranteed annuity rate is typically a fixed rate, providing a reliable, steady income regardless of market conditions. This feature is attractive to individuals who prioritize stability and certainty in their retirement income. Guaranteed annuity rates are particularly valuable for investors due to their income stability and protection against market volatility. Given the inherent uncertainties in financial markets, a guaranteed annuity rate can provide a buffer against potential downturns, ensuring the annuitant receives a steady income. It can act as a form of insurance, protecting the retiree's income from market risks and providing peace of mind. One of the key features of guaranteed annuity rates is the fixed interest rate. Once the annuity contract is signed, the interest rate is set and will not change throughout the duration of the annuity, regardless of market fluctuations. This fixed rate helps ensure consistent income, making budgeting and financial planning easier for annuitants. Guaranteed annuity rates come with specific terms and conditions. These can include the period of guarantee, penalties for early withdrawal, and terms for rate renewal. It is crucial for investors to understand these terms and conditions before investing in an annuity with a guaranteed rate. Guaranteed annuity rates often come with a guaranteed period, a specific time during which the insurer promises to pay the agreed-upon interest rate. After this period, the rate may be reassessed based on current market conditions. The calculation of guaranteed annuity rates can be influenced by several factors. These can include the investor's age, the term of the annuity, the amount of investment, and the current interest rate environment. Additionally, the insurer's financial strength and profitability can also impact the offered guaranteed annuity rate. The actual calculation formula for a guaranteed annuity rate can vary between providers. However, generally, it involves dividing the initial investment amount by the number of payment periods and adding the guaranteed interest rate to determine the annuity payment. Consider an example where an investor purchases an annuity for $100,000 with a guaranteed annuity rate of 5% per year for a 10-year term. The annual income from the annuity would be $10,000 (5% of $100,000) for a decade, regardless of the performance of financial markets. The primary benefit of guaranteed annuity rates is their stability and predictability. Investors can plan their post-retirement life with certainty, knowing exactly how much income they will receive every payment period. This predictability can help manage budgeting and reduce the stress often associated with financial planning in retirement. Guaranteed annuity rates offer a degree of protection against market volatility. Unlike variable or indexed annuities, whose returns can fluctuate based on market performance, guaranteed annuity rates ensure a steady income regardless of market conditions. This feature is particularly valuable in turbulent or bear markets. Investors who opt for guaranteed annuity rates receive a reliable income stream that can be essential during retirement. The regular payments from the annuity can be used to cover everyday expenses, healthcare costs, leisure activities, and more. Despite their many benefits, guaranteed annuity rates carry some risks, the most significant being inflation risk. Since the income from a guaranteed annuity is fixed, it does not increase with inflation. Over time, the purchasing power of the annuity income can erode, affecting the investor's standard of living. Interest rate risk is another challenge associated with guaranteed annuity rates. If interest rates rise significantly after the purchase of an annuity, the fixed income from the annuity might seem relatively less attractive. However, some annuities offer features to counteract this risk, such as rate resets or inflation adjustments. Other potential drawbacks include the possibility of the insurance company's insolvency and penalties for early withdrawal. As such, it's essential to consider these risks and consult with a financial advisor before investing in an annuity with a guaranteed rate. Unlike guaranteed annuity rates, variable annuities offer returns based on the performance of an investment portfolio. This provides potential for higher returns, but it also introduces more risk as income can fluctuate with market performance. Indexed annuities offer a return based on a specific market index, combined with a guaranteed minimum return. While this provides some level of income certainty, the return can still vary depending on the performance of the chosen index. Immediate annuities begin payments right after purchase, while deferred annuities start payments at a later date. Both can offer guaranteed annuity rates, providing a predictable income stream immediately or in the future. Annuities, particularly those with guaranteed annuity rates, offer financial stability and predictability for individuals seeking regular income throughout retirement. These annuities provide a fixed interest rate, ensuring a consistent income regardless of market fluctuations. Guaranteed annuity rates protect against market volatility and offer a reliable income stream, allowing retirees to plan their finances with certainty. However, there are limitations, such as inflation risk and interest rate risk, which can affect the purchasing power of the fixed income. It's crucial to consider the terms, potential risks, and consult with a financial advisor before investing in annuities with guaranteed rates. Additionally, when comparing annuity types, variable annuities offer higher potential returns but come with increased risk, while indexed annuities combine market index returns with a guaranteed minimum return. Immediate and deferred annuities can also have guaranteed annuity rates, providing immediate or future predictable income streams.Definition of Annuities

Concept of Guaranteed Annuity Rates

Role in Annuities

Importance for Investors

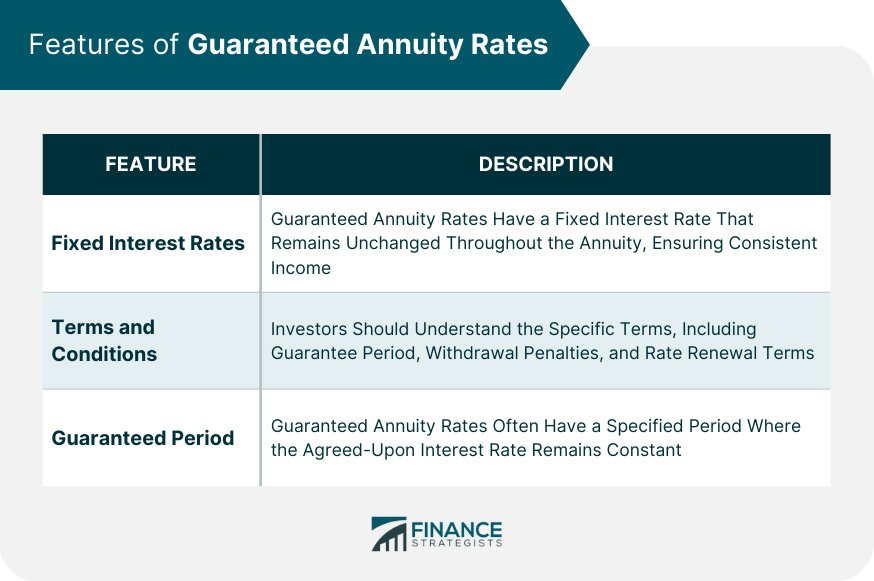

Features of Guaranteed Annuity Rates

Fixed Interest Rates

Terms and Conditions

Guaranteed Period

Calculation of Guaranteed Annuity Rates

Factors Influencing Calculation

Calculation Formula

Examples

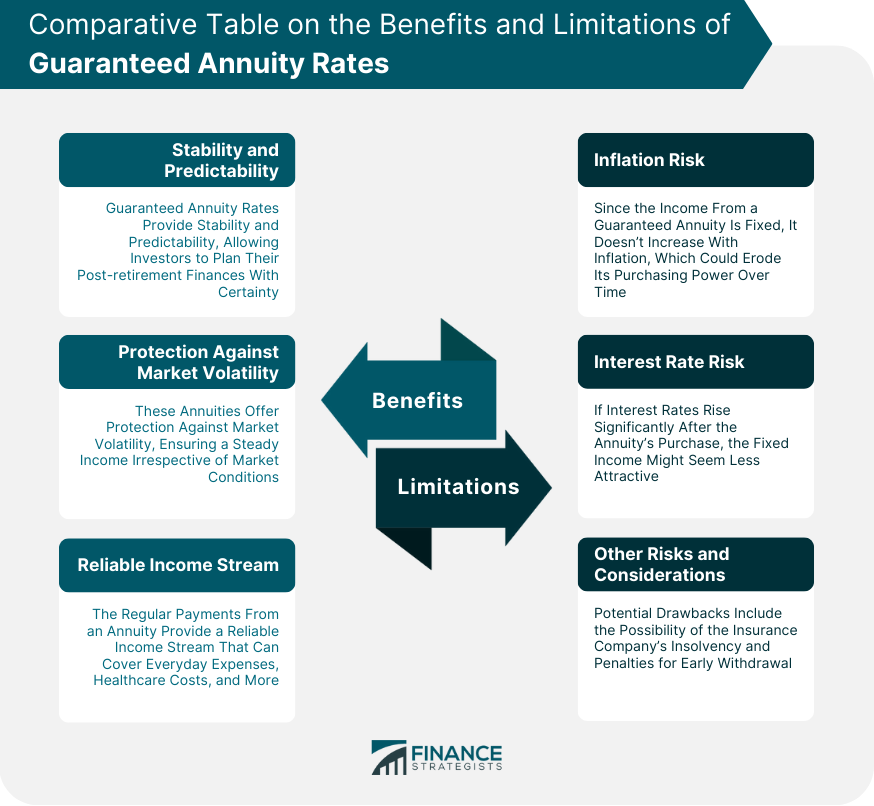

Benefits of Guaranteed Annuity Rates

Stability and Predictability

Protection Against Market Volatility

Reliable Income Stream

Limitations and Risks of Guaranteed Annuity Rates

Inflation Risk

Interest Rate Risk

Other Risks and Considerations

Comparison of Guaranteed Annuity Rates With Other Annuity Types

Variable Annuities

Indexed Annuities

Immediate and Deferred Annuities

Conclusion

Guaranteed Annuity Rates FAQs

Guaranteed annuity rates are fixed interest rates offered on certain types of annuities. They provide the annuity holder with a guaranteed, steady income stream for a specified period or for life, regardless of market fluctuations.

When you invest in an annuity with a guaranteed rate, the insurance company promises to pay you a fixed income for a certain period or for life. The rate is agreed upon when you purchase the annuity and does not change over time, hence the term "guaranteed".

The primary benefit of guaranteed annuity rates is their predictability. They provide a steady, reliable income, which can be beneficial for retirement planning. Additionally, they protect against market volatility, as your income from the annuity doesn't fluctuate with the financial markets.

Yes, there are risks associated with guaranteed annuity rates. One of the main risks is inflation, as the fixed income might not keep up with rising living costs over time. Also, there's the risk of the insurance company's insolvency, and potential penalties for early withdrawal.

Choosing an annuity involves considering your financial goals, risk tolerance, and retirement plans. Consult a financial advisor who can help navigate the various options and consider factors like the reputation of the insurance company, the specific terms of the annuity contract, the guaranteed rate offered, and any associated fees or charges.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.