An annuity is a financial product that provides a stream of income for a specified period of time, usually in retirement. An annuity is typically purchased from an insurance company and can be funded with a lump sum payment or a series of payments over time. The income stream provided by an annuity can be either fixed or variable, depending on the type of annuity. An annuity can provide a sense of financial security in retirement, as it provides a guaranteed income stream. One important aspect of annuities is the insurance coverage they offer. Insurance coverage for annuities is designed to protect investors from the risk of loss due to the insolvency of the insurance company. Understanding the insurance coverage for annuities is important for investors, as it can help them evaluate the level of risk associated with their investment. Annuities are insurance products offered by insurance companies, so they are not insured in the same way as bank accounts or other financial instruments. However, annuities have some protections in place to provide a level of security to policyholders. It is important to understand that annuities are not insured by the Federal Deposit Insurance Corporation (FDIC) or the Securities Investor Protection Corporation (SIPC), which provide protections for bank deposits and certain investments, respectively. As a result, it is crucial to carefully research the financial strength of insurance companies and consider diversification when purchasing annuities. In the United States, each state has a guaranty association that provides a safety net for policyholders in case an insurance company becomes insolvent. The coverage limits for annuities vary by state, but typically range from $100,000 to $300,000 per individual per insurance company for the present value of annuity benefits. When purchasing an annuity, it is important to consider the financial strength and credit rating of the insurance company. Independent agencies, such as A.M. Best, Standard & Poor's, Moody's, and Fitch Ratings, evaluate the financial strength of insurance companies and assign them ratings. A higher rating indicates a lower risk of the company becoming insolvent. To mitigate the risk associated with a single insurance company, some investors choose to diversify by purchasing annuities from multiple providers. This reduces the likelihood that their entire investment would be affected if one company were to face financial troubles. Annuity insurance coverage is provided through a process called risk pooling. Insurance companies pool the premiums paid by annuity owners and use the funds to invest in a variety of assets. If an insurance company becomes insolvent, the state insurance guaranty association or private insurance company will step in to provide protection for the annuity owner's investment. The insurance company pools the premiums paid by all of its annuity investors and invests the funds in a variety of assets to generate income. If the insurance company becomes insolvent, the annuity insurance coverage can help protect the investor's investment. In exchange for the investor's premium payments, the insurance company provides a guaranteed income stream to the investor over a specified period of time. The programs are typically funded by the insurance companies themselves, and they provide protection up to a certain dollar amount. The specific dollar amount of protection varies by state and by the type of annuity. State insurance guaranty programs pool the premiums paid by insurance companies and invest the funds in a variety of assets. The state guaranty association will provide protection for the annuity owner's investment, up to the maximum dollar amount specified by the state. The dollar amount of protection may be lower for certain types of annuities, such as variable annuities, which are considered to be higher risk. In addition, a state insurance guaranty may not cover all of the features of an annuity, such as certain riders or benefits. State insurance guaranty typically covers a variety of annuity types, including fixed annuities, fixed indexed annuities, and variable annuities. These guarantees are typically offered by insurance companies that are highly rated and have a strong financial standing. Private insurance guaranty may offer greater protection than state insurance guarantees, but they may also come with higher fees. Private insurance guaranty works in a similar way to state insurance guarantees, with insurance companies pooling premiums paid by annuity owners and investing the funds in a variety of assets. In the event of insolvency, the private insurance guaranty will step in to provide protection for the annuity owner's investment. Private insurance guaranty typically offers protection up to the full value of the annuity, but they may come with higher fees than state insurance guaranty. In addition, the financial standing of the insurance company providing the guarantee is an important factor to consider, as the guarantee is only as strong as the financial standing of the insurance company providing it. Private insurance guaranty typically covers a variety of annuity types, including fixed annuities, fixed indexed annuities, and variable annuities. However, not all insurance companies offer private insurance guaranty, and the level of protection offered may vary by insurance company. The primary differences between private and state insurance for annuity are: One key difference is the provider. State insurance guarantees for annuities are provided by state-run programs, while private insurance guarantees are provided by private insurance companies. When it comes to funding, state insurance guarantees are typically funded by the insurance companies themselves, while private insurance guarantees are funded by the private insurance company providing the guarantee. State insurance guarantees typically provide coverage up to a certain dollar amount, depending on the state in which the annuity was purchased and the type of annuity. Private insurance guarantees may provide coverage up to the full value of the annuity. The financial standing of the insurance company providing the guarantee is an important factor to consider when evaluating the strength of the insurance coverage. State insurance guarantees are typically backed by state funds, while private insurance guarantees are backed by the financial strength of the insurance company. Private insurance guarantees may come with higher fees than state insurance guarantees, as the private insurance company is providing the guarantee as a for-profit business. State insurance guarantees may have lower fees, as they are typically provided as a service to the insurance companies. State insurance guarantees for annuities are typically subject to state consumer protection laws, which can provide additional protections for investors. Private insurance guarantees may be subject to different regulations and consumer protections, depending on the state in which the insurance company is located. Annuities are financial products that provide investors with a guaranteed income stream over a specified period of time. Understanding how annuity insurance coverage works is important for investors, as it can help protect their investment in the event of an insurance company's insolvency. Annuity insurance coverage is provided by both state insurance guaranty associations and private insurance companies, each with its own unique features and limitations. State insurance guarantee programs typically provide coverage up to a certain dollar amount, depending on the state in which the annuity was purchased and the type of annuity. Private insurance companies may provide coverage up to the full value of the annuity, but may come with higher fees. The financial standing of the insurance company providing the guarantee is also an important factor to consider when evaluating the strength of the insurance coverage. With the right level of coverage, annuities can provide investors with a reliable source of income in retirement, helping to ensure financial security and peace of mind. In order to navigate the complexities of annuity insurance coverage and decisions regarding your investment, it may be beneficial to seek the advice of a qualified insurance broker.Overview of Annuities

Are Annuities Insured?

State Guaranty Associations

Financial Strength of the Insurance Company

Diversification

How Does Annuity Insurance Work?

State Insurance Guaranty for Annuities

Private Insurance Guaranty for Annuities

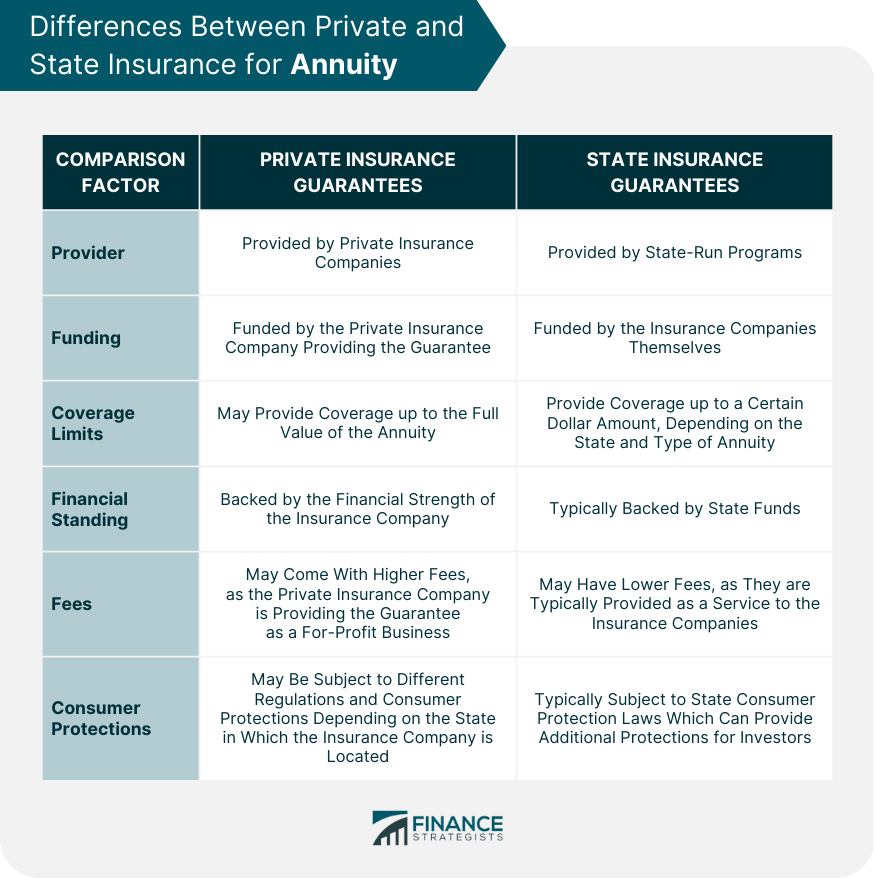

Differences Between Private and State Insurance for Annuity

Provider

Funding

Coverage Limits

Financial Standing

Fees

Consumer Protections

Final Thoughts

Are Annuities Insured? FAQs

Annuities are not directly insured by the government, but they may be protected by state insurance guaranty associations or private insurance companies.

Annuity insurance coverage is designed to protect investors in the event of an insurance company's insolvency. The level of protection provided varies depending on the type of coverage, whether provided by state or private insurance companies.

State insurance guarantees typically provide coverage up to a certain dollar amount, while private insurance guarantees may offer full coverage. Private insurance guarantees may come with higher fees than state insurance guarantees.

The types of annuities covered by state insurance guarantees vary by state, but they generally include fixed annuities, variable annuities, and indexed annuities.

Understanding annuity insurance coverage is important because it can help protect your investment in the event of an insurance company's insolvency. Selecting an annuity with the appropriate insurance coverage can provide long-term financial benefits and ensure financial security in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.