An annuity table is a mathematical tool that helps individuals calculate the present or future value of an annuity based on various factors such as time period and interest rate. It is a compilation of factors known as annuity factors, which simplify the calculation process by providing predetermined values for specific scenarios. An annuity table includes information related to time periods and interest rates. The time period indicates the duration over which the annuity payments are made or evaluated. The interest rate represents the rate at which the annuity grows or the discount rate used to determine its present value. Present value annuity tables help individuals determine the current worth of a future stream of annuity payments. By multiplying the annuity factor from the table with the payment amount, individuals can calculate the present value of their annuity. For example, if a person wants to know the present value of receiving $1,000 annually for 10 years, they can refer to the present value annuity table to find the corresponding annuity factor for a 10-year payout period and applicable interest rate. Future value annuity tables assist individuals in estimating the accumulated value of an annuity at a specific point in the future. By multiplying the annuity factor from the table with the payment amount, individuals can calculate the future value of their annuity. For instance, if a person plans to invest $500 monthly for 20 years and wants to determine the future value of their investment, they can refer to the future value annuity table to find the annuity factor for a 20-year term and the relevant interest rate. Payment period annuity tables are used to calculate the regular payment amount required to achieve a specific future value or accumulate a particular sum over time. By dividing the desired future value by the annuity factor from the table, individuals can determine the required periodic payment amount. This is particularly useful for individuals who have a specific financial goal and want to determine the necessary contributions to reach that goal. Annuity tables provide a convenient way to calculate the future or present value of annuities. By referring to the tables and applying the appropriate annuity factors, individuals can quickly obtain accurate values, facilitating effective financial planning and decision-making. Whether individuals need to know the future value of an investment or the present value of a retirement income stream, annuity tables serve as valuable resources. Annuity tables can also assist in determining the regular payment amounts required to achieve specific financial goals. By utilizing the annuity factors from the tables and inputting the desired future value or accumulated sum, individuals can calculate the periodic contributions necessary to reach their targets. This enables individuals to plan their savings or investment strategies accordingly and stay on track towards their financial objectives. Interest rates and time periods are critical variables in annuity calculations. Annuity tables allow individuals to observe the relationship between these factors and the value of their annuity. By examining different interest rates and time periods in the table, individuals can assess the impact on the future or present value of their annuity. This knowledge helps in understanding the potential fluctuations in annuity values and allows for better financial planning. Annuity tables are essential tools for individuals considering various investment or retirement options. By comparing the values provided in the tables for different scenarios, individuals can evaluate the potential outcomes of different investment strategies or retirement plans. This information assists in making informed decisions regarding which option aligns best with their financial goals and risk tolerance. Annuity tables are based on certain assumptions, such as constant interest rates and regular payment intervals. While these assumptions simplify the calculations, they may not reflect real-world scenarios accurately. Individuals should be aware of these assumptions and consider them when interpreting the values obtained from annuity tables. Annuity tables provide generalized values based on specific interest rates and time periods. However, individual circumstances may deviate from the assumptions made in the tables. Factors such as variable interest rates, irregular payment intervals, or additional fees can affect the accuracy of the calculations derived from annuity tables. It is important to consult financial professionals or utilize advanced financial tools to obtain more precise and tailored results. While annuity tables provide valuable information, it is essential to consider other factors that may impact the financial situation. Factors like inflation, taxes, and fees can significantly influence the actual value and purchasing power of annuity payments. Individuals should take these factors into account and adjust their financial plans accordingly to ensure a comprehensive and accurate analysis of their annuity's true worth. Financial calculators and specialized software provide more flexibility and accuracy in annuity calculations compared to annuity tables. These tools consider a wider range of variables, allowing individuals to customize their inputs and obtain more precise results. Additionally, they often incorporate features like inflation adjustments, tax considerations, and varying interest rates, enhancing the comprehensiveness of the analysis. Spreadsheet applications, such as Microsoft Excel or Google Sheets, offer built-in functions and formulas to perform annuity calculations. These applications provide individuals with the ability to create customized annuity tables and automate complex calculations. By leveraging the computational power and versatility of spreadsheets, individuals can generate more detailed and tailored analyses of their annuities. Numerous online resources and annuity calculators are available, offering convenient and user-friendly interfaces to calculate annuity values. These resources often include advanced features, such as graphical representations of data, interactive scenarios, and the ability to save and compare multiple calculations. Individuals can utilize these tools to gain further insights into their annuity values and explore different scenarios and options. Annuity tables serve as indispensable tools in the realm of financial planning. They provide individuals with the means to calculate the present and future values of annuities, determine regular payment amounts, and assess the impact of interest rates and time periods. By utilizing annuity tables, individuals can make informed decisions regarding their investments, retirement plans, and financial goals. However, it is important to acknowledge the limitations of annuity tables. They are based on specific assumptions and may not accurately reflect real-world scenarios. Factors such as inflation, taxes, and fees should be considered to obtain a more comprehensive understanding of the annuity's true value. In addition to annuity tables, alternative methods and tools, such as financial calculators, spreadsheet applications, and online resources, offer enhanced flexibility and accuracy in annuity calculations. These tools allow for customization, incorporate various variables, and provide a more detailed analysis of annuity values. By staying informed about advancements in financial technology, individuals can stay ahead of the curve and make the most of their financial planning endeavors.What Is an Annuity Table?

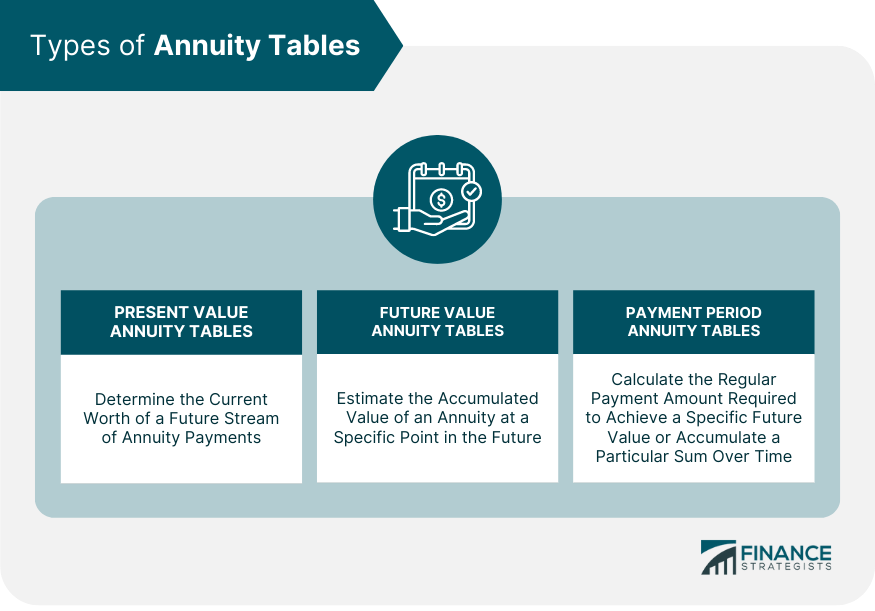

Types of Annuity Tables

Present Value Annuity Tables

Future Value Annuity Tables

Payment Period Annuity Tables

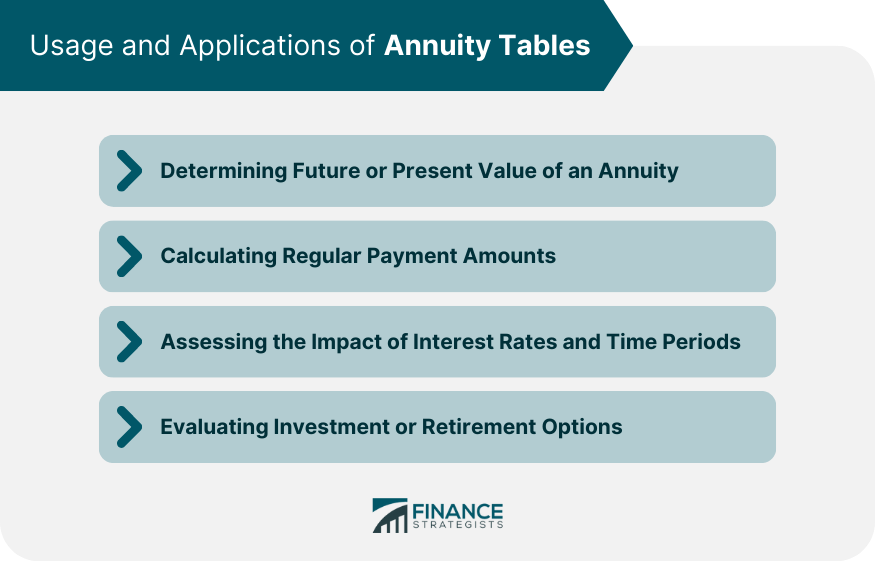

Usage and Applications of Annuity Tables

Determining Future or Present Value of an Annuity

Calculating Regular Payment Amounts

Assessing the Impact of Interest Rates and Time Periods

Evaluating Investment or Retirement Options

Limitations and Considerations of Annuity Tables

Assumptions Made in Annuity Tables

Potential Inaccuracies and Variations

Incorporating Other Factors

Annuity Table Alternative Methods and Tools

Financial Calculators and Software

Spreadsheet Applications

Online Resources and Annuity Calculators

Final Thoughts

Annuity Table FAQs

An annuity table is a mathematical tool that provides predetermined values, known as annuity factors, for calculating the present or future value of an annuity based on various factors such as time period and interest rate.

To use an annuity table, you need to identify the relevant factors, such as the time period and interest rate associated with your annuity. Locate the corresponding values in the table, and then multiply the annuity factor by the payment amount to calculate the present or future value of your annuity.

Annuity tables simplify complex calculations and provide quick and accurate values for annuities. They enable individuals to determine the present or future value of their annuity, calculate regular payment amounts, and evaluate different investment or retirement options with ease.

While annuity tables are valuable tools, they have certain limitations. They are based on specific assumptions and may not account for real-world variables such as inflation, taxes, or fees. It is advisable to consider additional factors and consult with financial professionals or utilize advanced financial tools for a more comprehensive analysis.

Yes, there are alternative methods to annuity tables. Financial calculators, spreadsheet applications, and online resources offer more flexibility and customization in annuity calculations. These tools incorporate a wider range of variables and can provide more detailed and tailored analyses of annuity values.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.