Military student loan forgiveness refers to programs designed to alleviate the financial burden of student loans for eligible service members. These programs recognize the importance of supporting military personnel in their pursuit of higher education and financial stability. This article provides an overview of available military student loan forgiveness programs and their respective eligibility requirements. Eligibility for military student loan forgiveness programs may vary between active duty and reserve component service members. Some programs are available to both groups, while others may be exclusive to active duty personnel. Many military student loan forgiveness programs require a minimum length of service to qualify. The required service commitment may vary depending on the program and the specific terms of the individual's enlistment contract. Deployment status can also affect eligibility for certain military student loan forgiveness programs. Some programs may require participants to have served in a combat zone or specific deployment to qualify. Generally, military student loan forgiveness programs are applicable to federal loans, while private loans are typically not eligible. It is important to understand the type of loan you have before pursuing forgiveness options. The types of loans eligible for forgiveness vary depending on the program. Some programs may cover a broad range of federal loans, while others may be limited to specific loan types. To qualify for military student loan forgiveness programs, your loans must be in good standing. Delinquent or defaulted loans may not be eligible for forgiveness until they are brought back into good standing. The documentation and application process for military student loan forgiveness programs typically involves submitting proof of service, loan information, and any other required documentation. Each program may have a unique application process and timeline. To qualify for PSLF, military personnel must be employed full-time in a qualifying public service position, such as the military, and make 120 qualifying monthly payments under a qualifying repayment plan. Under PSLF, the remaining balance of the eligible federal loans is forgiven after 120 qualifying monthly payments have been made, and the forgiven amount is not considered taxable income. To apply for PSLF, borrowers must submit the PSLF application form and provide proof of qualifying employment, loan information, and payment history. The NDSLD program is available to service members who have served in a qualifying hostile area or imminent danger area, as designated by the Department of Defense. NDSLD can provide up to 100% loan forgiveness for eligible federal loans, depending on the length and type of qualifying service. To apply for NDSLD, borrowers must submit the necessary documentation to their loan servicer, including proof of qualifying service in a hostile or imminent danger area. Active duty military personnel are eligible for the SCRA interest rate cap, which provides an interest rate reduction on eligible loans. Under the SCRA, interest rates on eligible loans are capped at 6% during active duty service, reducing the overall cost of borrowing and potentially making loan repayment more manageable. To apply for the SCRA interest rate cap, borrowers must submit a written request and proof of active duty service to their loan servicer. CLRP is available to eligible active duty, reserve, and National Guard service members. Specific eligibility criteria vary by branch and may include enlistment requirements, military occupational specialty, and service commitment. The CLRP program can repay a portion of eligible federal student loans, with the maximum repayment amount varying by branch and service commitment. The benefit is generally paid annually over a specified period. To apply for CLRP, service members must contact their respective military branch's education or personnel office and complete any required paperwork and documentation. Several states offer military student loan forgiveness programs or benefits for eligible service members. These programs vary by state and may provide additional assistance beyond federal forgiveness options. Eligibility requirements for state-specific programs depend on the individual program and may include residency, service commitment, and loan qualifications. Forgiveness terms for state-specific programs vary, with some offering full or partial loan forgiveness while others may provide repayment assistance or interest rate reductions. Military student loan forgiveness programs can significantly reduce the financial burden of student loan debt for service members, making repayment more manageable and sustainable. By alleviating the burden of student loan debt, military personnel can focus on building savings, investing in their future, and achieving long-term financial stability. Military student loan forgiveness programs can help make higher education more accessible for service members by reducing the financial barriers to obtaining a degree. Loan forgiveness programs can encourage military personnel to pursue further education, enhancing their skills and career prospects both within and outside the military. Student loan forgiveness programs can serve as an incentive for qualified individuals to join the military, providing a valuable recruitment tool for the armed forces. Loan forgiveness programs can contribute to retaining skilled servicemembers by demonstrating the military's commitment to supporting their education and financial well-being. Some military personnel may not be eligible for existing student loan forgiveness programs due to factors such as loan type, service commitment, or deployment status. Processing times for military student loan forgiveness applications can be lengthy, resulting in delays for service members seeking forgiveness. There is potential for individuals to misrepresent their service or loan status in an attempt to fraudulently obtain student loan forgiveness benefits. Some unethical service providers may exploit service members seeking loan forgiveness by charging unnecessary fees or providing misleading information about forgiveness options. Military student loan forgiveness programs play a vital role in supporting the financial well-being of service members and their families. There is a continued need for improvement and expansion of these programs to ensure all eligible military personnel can access the benefits they deserve. Service members are encouraged to research and utilize available forgiveness programs to help manage their student loan debt and achieve financial stability. Military student loan forgiveness programs can greatly impact the financial well-being of service members and their families. To make the most of these programs, it is essential to seek guidance from a qualified financial advisor who understands the unique financial challenges and opportunities faced by military personnel.What Is Military Student Loan Forgiveness?

Eligibility Requirements for Military Student Loan Forgiveness

Service Requirements

Active Duty vs Reserve Components

Length of Service

Deployment Status

Loan Qualifications

Federal vs Private Loans

Loan Types Eligible for Forgiveness

Current Loan Status

Documentation and Application Process

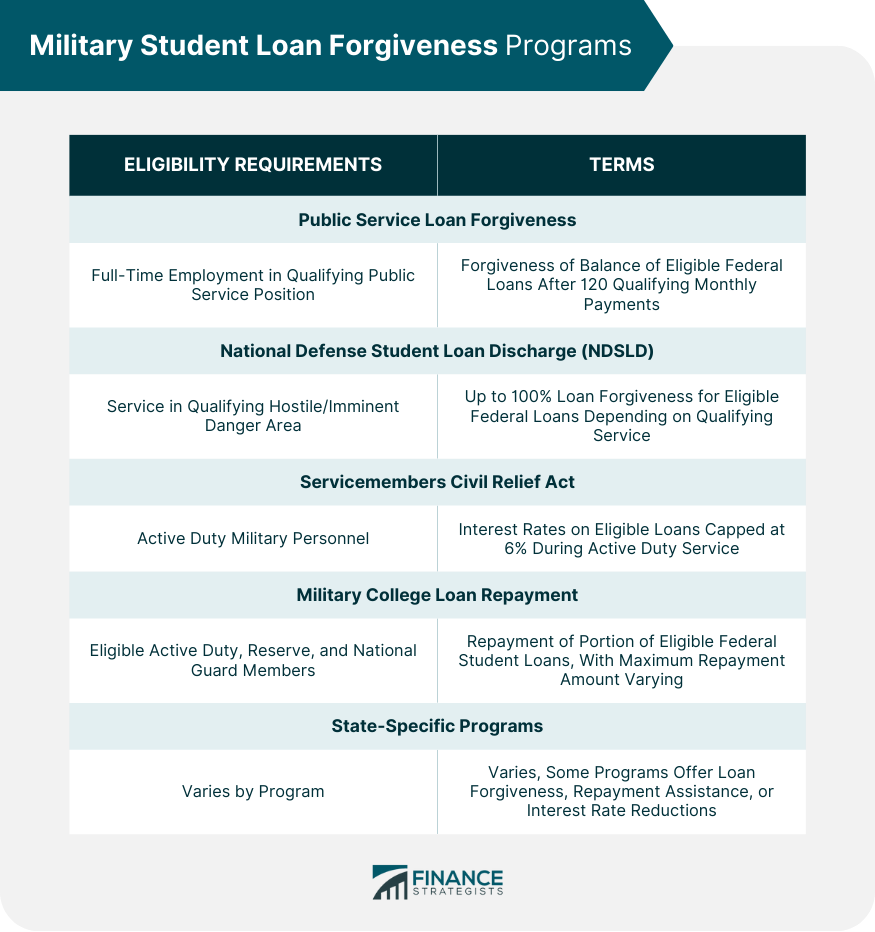

Military Student Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF)

Eligibility Requirements

Forgiveness Terms

Application Process

National Defense Student Loan Discharge (NDSLD)

Eligibility Requirements

Forgiveness Terms

Application Process

Servicemembers Civil Relief Act (SCRA) Interest Rate Cap

Eligibility Requirements

Interest Rate Reduction Benefits

Application Process

Military College Loan Repayment Program (CLRP)

Eligibility Requirements

Repayment Terms

Application Process

State-Specific Programs

State-Based Benefits and Programs

Eligibility Requirements

Forgiveness Terms

Impact of Military Student Loan Forgiveness

Financial Benefits for Military Personnel

Reduced Financial Burden

Increased Savings Potential

Educational Benefits

Increased Access to Higher Education

Encouragement for Continued Education

Military Recruitment and Retention

Attracting Qualified Candidates

Retaining Skilled Servicemembers

Challenges and Controversies of Military Student Loan Forgiveness

Limitations of Existing Programs

Coverage Gaps

Delays in Forgiveness Processing

Potential for Fraud and Abuse

Misrepresentation of Service or Loan Status

Unethical Service Providers

Final Thoughts

Military Student Loan Forgiveness FAQs

Military student loan forgiveness refers to programs designed to alleviate the financial burden of student loans for eligible service members. It is important because it supports military personnel in their pursuit of higher education and financial stability.

Eligibility for military student loan forgiveness programs varies depending on factors such as active duty or reserve status, length of service, deployment status, loan type, and current loan status. Each program has specific eligibility criteria that must be met.

Some common military student loan forgiveness programs include Public Service Loan Forgiveness (PSLF), National Defense Student Loan Discharge (NDSLD), Servicemembers Civil Relief Act (SCRA) Interest Rate Cap, Military College Loan Repayment Program (CLRP), and state-specific programs.

Military student loan forgiveness programs can provide significant financial benefits to service members by reducing their student loan debt, increasing savings potential, and promoting access to higher education. These programs can also serve as an incentive for recruitment and retention in the military.

To apply for military student loan forgiveness programs, service members should research the specific eligibility requirements and application processes for each program. It is also beneficial to consult with a financial advisor familiar with military student loan forgiveness options to ensure the best possible outcome

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.