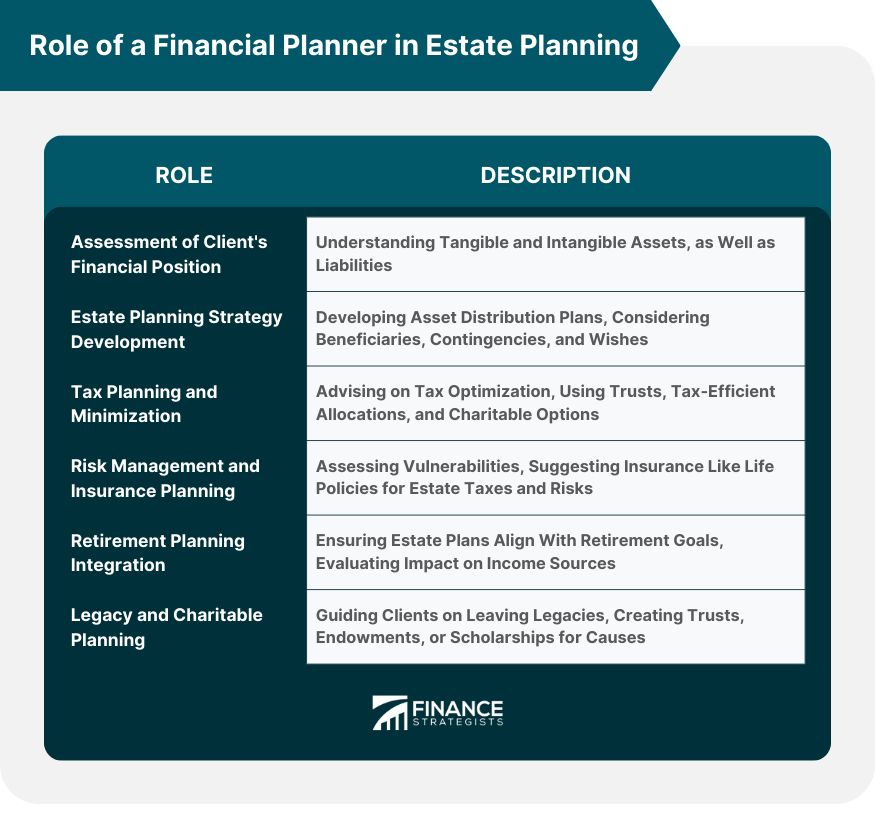

Estate planning is the deliberate process of organizing and preparing for the distribution and management of an individual's assets upon their incapacity or death. This comprehensive endeavor not only encompasses the allocation of assets such as property, investments, and personal belongings but also addresses liabilities, ensuring that debts and obligations are properly taken care of. The primary goal is to ensure that one's wealth is transferred according to their wishes, and in the most efficient manner, while also considering the potential tax implications and any legal constraints. Thus, the lack of an estate plan can lead to financial burdens due to unplanned tax liabilities or probate costs. To safeguard one's legacy and ensure that beneficiaries are adequately cared for, proper estate planning is indispensable. This encompasses understanding both tangible and intangible assets, from real estate and investment portfolios to intellectual properties and personal valuables. Concurrently, it's equally crucial to understand the client's liabilities, which may range from personal loans and mortgages to other financial commitments. A clear understanding of where a client stands financially is foundational to every subsequent step in estate planning. This involves delineating how assets will be distributed, who the beneficiaries will be, and any specific desires or stipulations the client may have. This strategy also takes into consideration various scenarios, such as incapacitation, and includes contingencies for such events. One of the main objectives in estate planning is ensuring assets are transferred with minimal tax implications. The financial planner advises on mechanisms to optimize tax, keeping in line with the latest regulations and laws. This could involve using trusts, allocating assets in tax-efficient manners, or setting up charitable contributions to reduce the taxable estate. Protecting the estate's value from unforeseen risks is essential. Financial planners assess the vulnerabilities associated with a client's assets and advise on suitable insurance products. This could range from life insurance policies, which can offer liquidity for estate taxes, to specialized insurance products protecting against specific risks like market downturns or asset devaluations. Financial planners ensure that strategies implemented for estate planning harmonize with the client's retirement plans. For instance, gifting assets shouldn't compromise the client's retirement lifestyle. Similarly, planners evaluate how estate planning choices might impact retirement income sources and vice versa. For clients who are keen on leaving behind a lasting legacy or making significant charitable contributions, the planner guides on best practices. This could involve setting up endowments, creating scholarships, or structuring trusts that serve a charitable cause, ensuring the client's wishes are met while optimizing for tax and legal considerations. Hiring a financial planner for estate planning is an investment in clarity, expertise, and future security, ensuring that one's assets and legacy are managed and passed on in alignment with their wishes. Navigating the intricacies of estate planning can be complex, especially with ever-evolving tax laws and regulations. Financial planners bring a wealth of expertise to the table, ensuring that clients are not only compliant with current laws but are also positioned to capitalize on opportunities and minimize liabilities. Financial planners take into account the entirety of a client's financial situation. This comprehensive approach ensures that estate planning is integrated seamlessly with other financial aspects such as retirement planning, investments, and tax planning. This integration avoids potential conflicts and ensures that all financial elements work cohesively towards the client's goals. Estate planning often deals with sensitive topics, including incapacitation and death. Knowing that a professional has meticulously planned and organized one's estate can bring immeasurable peace of mind to clients. They can be assured that their wishes will be respected and that their loved ones will be provided for without unnecessary complications or disputes. Financial planners are equipped with strategies and tools to ensure that assets are transferred to beneficiaries in the most tax-efficient manner. Through techniques like gifting, trusts, and charitable donations, they can often reduce the tax burden on inheritances, ensuring that beneficiaries receive a larger portion of the estate. A well-rounded estate plan often requires the expertise of multiple professionals, from lawyers to tax advisors. Financial planners typically have a network of trusted professionals and can coordinate with them effectively. This collaborative approach ensures that every aspect of the estate plan is coherent, legally sound, and optimized for the client's objectives. As assets and guardianship decisions come into play, families can experience conflicts over perceived fairness or the intentions behind certain allocations. These disagreements can sometimes lead to legal battles or strained familial relationships. As governments adjust their tax policies and regulations, estate planning strategies may need to change. Staying updated on tax laws, especially those related to inheritances and gifts, can be a continuous challenge that affects the efficient transfer of wealth. If an individual has outstanding debts or potential liabilities, there's a risk that creditors might claim a portion of their estate, reducing the inheritance for beneficiaries. Beyond preparing for death, estate planning also has to consider the possibility of the individual becoming mentally or physically incapacitated. Designing a plan that ensures the right decisions are made on their behalf, both financially and medically, can be complex. In the digital age, many people have significant online assets, ranging from digital currencies to social media accounts and online businesses. Accounting for and managing the transition of these assets upon one's death or incapacitation can be a challenging and often overlooked aspect of estate planning. Estate planning stands as a vital process that demands careful consideration and strategic foresight. It ensures the seamless transfer of assets and the preservation of one's legacy, encompassing aspects ranging from financial assessment to tax optimization. The involvement of a financial planner brings indispensable benefits, as their expertise navigates complex tax laws, a holistic financial landscape, and provides peace of mind during sensitive matters. Through collaborative coordination with legal and tax professionals, financial planners ensure a coherent and optimized estate plan. However, challenges persist, from potential family conflicts and evolving tax regulations to safeguarding digital assets and preparing for incapacity. In essence, estate planning is a dynamic endeavor that, when approached with diligence and the right guidance, secures not only financial assets but also the wishes of individuals, ultimately creating a legacy that endures beyond their lifetime.What Is Estate Planning?

Role of a Financial Planner in Estate Planning

Assessment of Client's Financial Position

Estate Planning Strategy Development

Tax Planning and Minimization

Risk Management and Insurance Planning

Retirement Planning Integration

Legacy and Charitable Planning

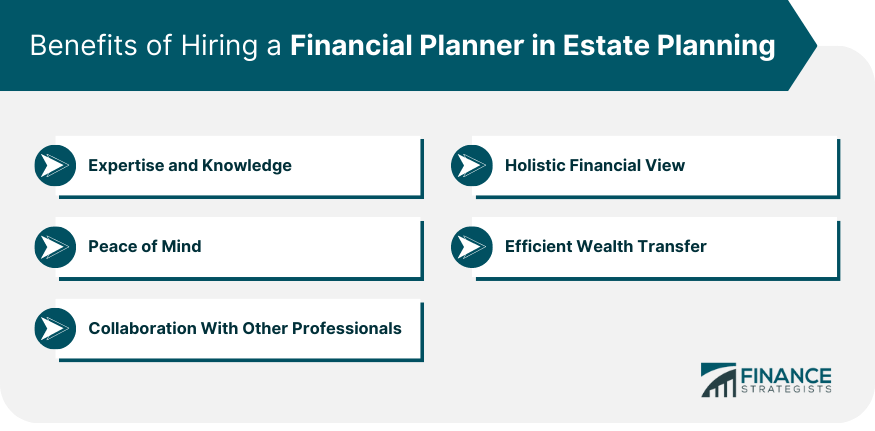

Benefits of Hiring a Financial Planner in Estate Planning

Expertise and Knowledge

Holistic Financial View

Peace of Mind

Efficient Wealth Transfer

Collaboration With Other Professionals

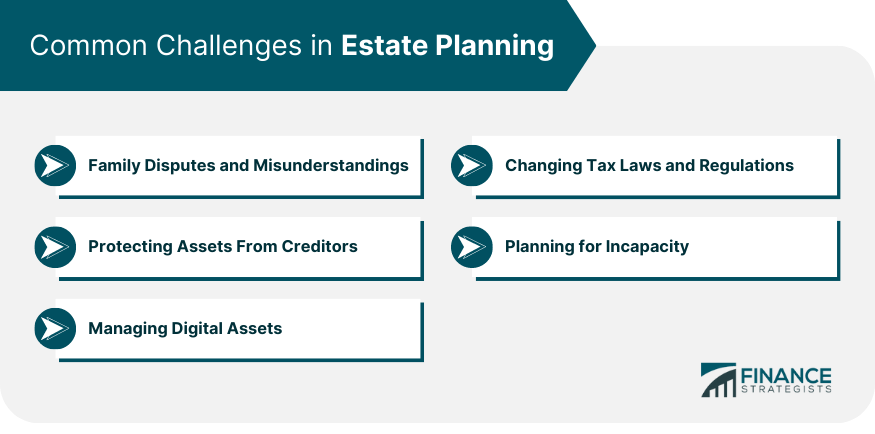

Common Challenges in Estate Planning

Family Disputes and Misunderstandings

Changing Tax Laws and Regulations

Protecting Assets From Creditors

Planning for Incapacity

Managing Digital Assets

Conclusion

Role of Financial Planner in Estate Planning FAQs

A financial planner in estate planning helps individuals strategize the distribution of assets upon their passing. They ensure efficient wealth transfer, minimize tax implications, and consider factors like retirement integration and charitable desires.

A financial planner devises strategies for asset distribution, addresses tax concerns, and coordinates plans with retirement goals. They offer expertise in legal nuances and collaborate with other professionals to create a comprehensive estate plan.

Engaging a financial planner brings clarity, expert insights, and ensures assets are managed and passed on according to one's wishes. Their holistic approach integrates estate planning with broader financial aspects, promoting peace of mind.

A financial planner guides clients in optimizing tax strategies through tools like trusts, charitable contributions, and tax-efficient asset allocation. They stay updated on tax laws, ensuring assets are transferred with minimal tax burdens.

Financial planners help navigate challenges like family conflicts, changing tax regulations, safeguarding digital assets, and planning for incapacity. They provide tailored solutions to ensure a smooth transition of wealth and uphold an individual's intentions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.