A Certified Financial Planner (CFP) is a professional who has attained a high level of expertise and certification in the field of financial planning. They are distinguished by their rigorous training and adherence to a strict ethical standard. To earn the CFP designation, an individual must complete a comprehensive course of study at a college or university offering a financial planning curriculum approved by the Certified Financial Planner Board of Standards (CFP Board). Additionally, they must pass the CFP Board's comprehensive certification exam, which tests their ability to apply financial planning knowledge in real-life situations. Apart from their academic and examination requirements, they also need to accrue several years of experience in the financial planning process before they can bear the title. The average cost of a CFP can vary considerably based on several factors, including the CFP's experience, geographic location, and the specific pricing model they adopt. Hourly Rates: Hourly rates for CFPs, especially for those addressing specific financial inquiries, commonly range between $100 to $400 per hour. Fixed Fees: For tasks like comprehensive financial planning, fixed fees generally range between $1,00 to $3,000. This elevation can be attributed to the increasing complexity of financial environments and tools. Assets Under Management (AUM): As for CFPs overseeing investment portfolios, the prevalent fee remains a percentage of the managed assets, now averaging between 1% to 2%. Retainer Fees: The fee model of regular charges, be it monthly or quarterly, has seen fees ranging from $500 to several thousands annually. Commission-Based: CFPs, particularly those aligned with broker-dealers, may receive commissions on the financial tools they recommend or sell. In metropolitan areas like Boston or Seattle, CFP costs can be notably higher due to the higher living standards, as opposed to smaller towns where rates may hover between $150 to $300. However, the rise of virtual consultations has made geographic pricing a bit more competitive, with many clients opting for expert services regardless of physical location. A newly-certified CFP may charge hourly rates ranging from $150 to $300, while a CFP with over 10 years of experience or expertise in a specialized area, such as international tax planning, might command fees between $350 to $600 per hour. The value proposition in such cases is the planner's deep knowledge, which can provide nuanced and tailored advice suitable for complex financial scenarios. These can range from charges for specific services to the intangible aspects of the relationship with a CFP. Initial Consultation Fees: Many CFPs charge for the initial consultation, with costs ranging from $150 to $350. This is usually a one-time fee to assess your current financial landscape and identify primary goals. Some professionals might offer a free initial consultation as a promotional strategy to attract clients. Software or Platform Fees: These software tools might come with associated costs, either as one-time charges or recurring subscription fees. Transaction Fees: If a CFP makes trades or adjustments within your portfolio, there might be associated transaction fees. These can either be a flat fee per transaction or a percentage of the transaction's value. Implementation Fees: CFPs might charge additional fees for implementing specific strategies, such as setting up trusts, initiating investment strategies, or coordinating with other professionals like lawyers or tax consultants. Exit Fees: If you decide to terminate the relationship with a CFP or shift your assets elsewhere, there might be fees associated with the transition or termination process. Ongoing Communication & Updates: Regular updates, meetings, and communication with your CFP might come at an added cost, especially if they exceed what's stipulated in your agreement. Review of Previous Financial Plans: If you've had financial plans prepared by other professionals in the past and you want the new CFP to review and integrate them, there could be additional charges for this analysis and integration. Potential Conflicts of Interest: Some CFPs might have incentives to recommend specific financial products or investments. It's essential to understand these potential conflicts of interest and discuss them upfront. Estate, Tax, and Legal Coordination: If your financial planning involves coordinating with other professionals, there might be additional costs either from the CFP or the other professionals involved. Inflation and Economic Considerations: The fees you start with might be subject to adjustments due to inflation, changes in economic conditions, or shifts in the financial industry. Choosing a CFP based on cost and specific needs is a critical decision. The right professional can help navigate the complexities of financial planning and ensure that your monetary goals align with your life objectives. Scope of Advice: Are you looking for a one-time financial review, ongoing investment advice, retirement planning, or comprehensive financial planning? Complexity: If you have multiple investment accounts, real estate holdings, or are dealing with intricate tax situations, you may need a CFP with specialized expertise. Hourly Rate: Suitable for specific questions or a one-time review. Ensure the hourly rate aligns with your budget. Fixed Fees: Ideal for a comprehensive financial plan or particular projects. Check the inclusivity of the service package offered for the fee. Assets Under Management (AUM): Apt for ongoing investment management. Ensure the percentage charge aligns with industry standards and offers value for the amount. Retainer Fees: For regular financial advice and check-ins. Weigh the retainer fee against the frequency and depth of the consultations. Commission-Based: Understand potential conflicts of interest if your CFP earns commissions from selling specific products. Get Recommendations: Ask friends, family, or colleagues for referrals. Personal experiences can provide insights into a CFP's approach and reliability. Online Reviews: Check websites, forums, or platforms for feedback on potential CFPs. Interview Multiple CFPs: Discuss your needs, ask about their fee structure, and get a sense of their approach. This helps in comparing offerings and identifying who resonates with your financial goals. Ensure the professional holds a valid CFP designation, which implies they've met rigorous standards of education, examination, and ethics. Visit the Certified Financial Planner Board of Standards website to check for any disciplinary actions or complaints against a potential planner. Frequency: Determine how often you'll meet or communicate. It should match your comfort level and the complexity of your financial situation. Clarity: Ensure the CFP provides clear explanations, avoids excessive jargon, and is upfront about all costs. Digital Access: If you prefer online communication or digital tools, check if the CFP offers such platforms. Your financial situation and needs might evolve. As major life events such as marriage, children, career changes, or retirement approach, your financial landscape and priorities can shift dramatically. Choose a CFP who can cater to both your current requirements and potential future complexities. It's essential that they demonstrate adaptability and possess the breadth of knowledge to guide you through various financial stages and scenarios over time. A Certified Financial Planner (CFP) is a highly qualified professional in the realm of financial planning. The average cost of hiring one is influenced by factors like experience, location, and the chosen pricing model. Pricing models, including hourly rates, fixed fees, percentage of managed assets, retainer fees, and commission-based compensation, offer flexibility to clients. Geographic variation has diminished due to virtual consultations, allowing clients to access expert services across borders. Experience and specialization bring added value, enabling tailored advice for intricate financial situations. Considering additional costs, such as initial consultation fees, software subscriptions, transaction fees, implementation costs, and ongoing communication charges, is crucial when engaging with a CFP. Choosing a CFP who aligns with your current requirements and future financial journey ensures a successful partnership in navigating the complexities of financial planning.What Is a Certified Financial Planner (CFP)?

Average Cost of a CFP

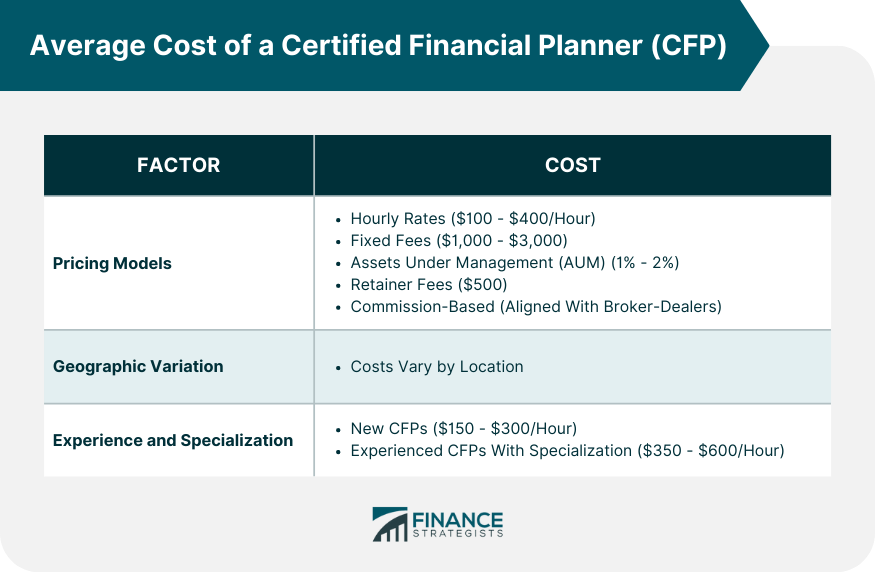

Pricing Models

Geographic Variation

Experience and Specialization

Additional Costs and Considerations

How to Choose a CFP Based on Cost and Needs

Define Your Financial Needs

Understand Fee Structures

Research and Compare

Check Credentials and Disciplinary History

Evaluate Communication and Transparency

Consider Future Scalability

Conclusion

Average Cost of a Certified Financial Planner FAQs

The average cost of a Certified Financial Planner varies based on factors like experience, location, and pricing model.

The average cost varies by pricing model – hourly rates range from $100 to $400, fixed fees for comprehensive planning are $1,000 to $3,000, and assets managed are charged at 1% to 2%.

Yes, metropolitan areas often have higher costs due to living standards, but virtual consultations have increased competition and reduced geographic pricing discrepancies.

Yes, CFPs with extensive expertise or specialization, such as international tax planning, can command higher fees due to their in-depth knowledge.

Additional costs include initial consultation fees, software subscriptions, transaction fees, implementation fees, ongoing communication charges, and potential inflation adjustments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.