A Qualified Personal Residence Trust is a type of irrevocable trust designed to help individuals minimize federal estate taxes by transferring ownership of their primary or secondary residence into the trust. This legal arrangement allows the property owner, or grantor, to continue living in the residence for a specified period of time.

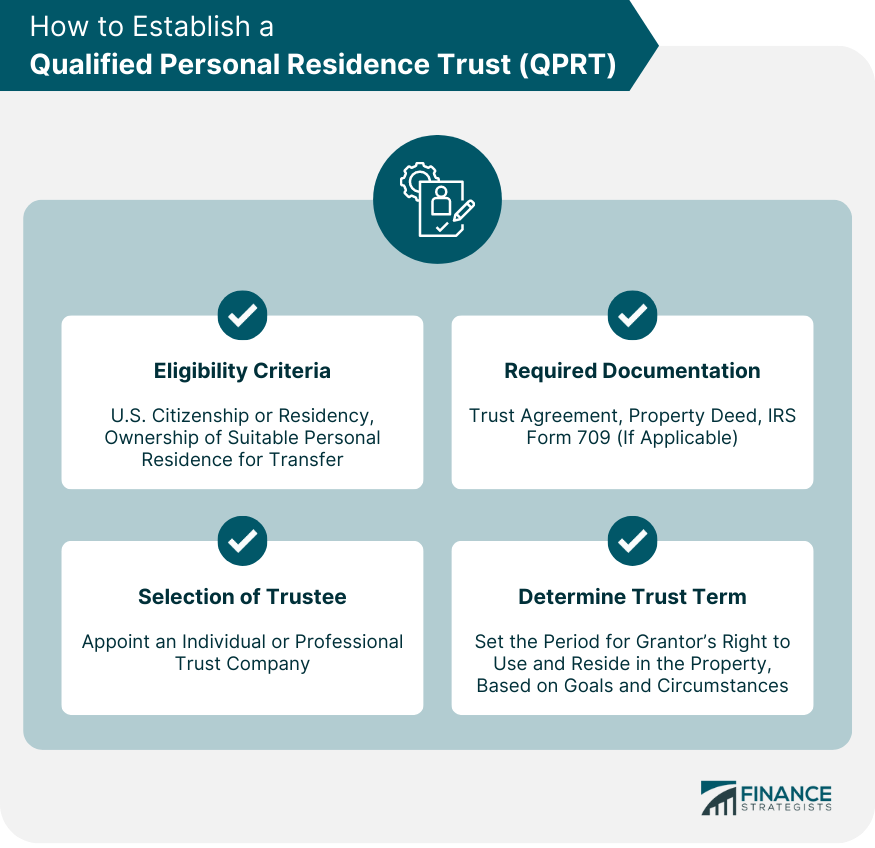

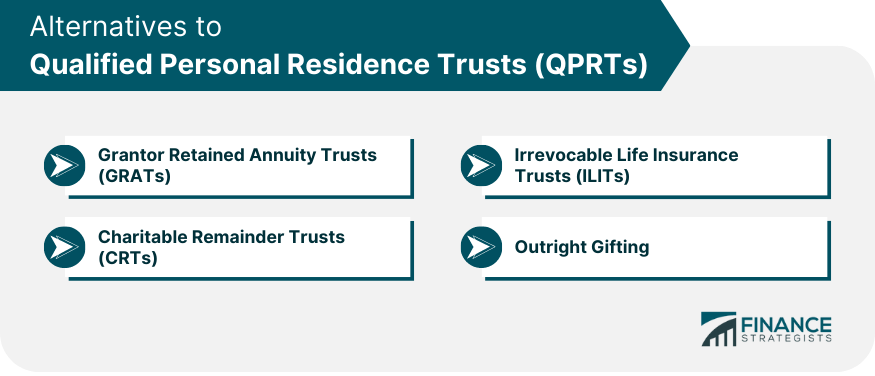

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. I once helped a client establish a Qualified Personal Residence Trust (QPRT), significantly reducing their estate tax by transferring a valuable property to heirs at a lower tax rate. This move safeguarded the asset for future generations and leveraged the property's appreciation outside their taxable estate. Explore how a QPRT can benefit you today. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation The primary objective of a QPRT is to reduce the value of an individual's taxable estate, thereby minimizing the potential estate tax burden upon their death. By transferring the property into a trust, the grantor essentially removes it from their estate and reduces the overall value of their taxable assets. To establish a QPRT, the grantor must meet certain eligibility criteria, including U.S. citizenship or residency and owning a personal residence suitable for transfer into the trust. Creating a QPRT requires several documents, including: 1. Trust Agreement: A legal document outlining the terms and conditions of the trust. 2. Property Deed: A document transferring ownership of the property to the trust. 3. IRS Form 709 (if applicable): A gift tax return may be required if the gift's value exceeds the annual gift tax exclusion. The grantor must appoint a trustee to manage and oversee the trust's operation. This can be an individual or a professional trust company. The grantor must establish a trust term, which is the period during which they retain the right to use and reside in the property. The term is typically set in years and can vary based on the grantor's goals and circumstances. To create a QPRT, the grantor transfers ownership of their primary or secondary residence to the trust. This is accomplished through a property deed. An appraisal is required to determine the property's fair market value at the time of the transfer. The retained interest is the value of the grantor's right to use and occupy the property during the trust term. This value is calculated using applicable federal rates and the property's fair market value. The taxable gift value is calculated by subtracting the retained interest value from the property's fair market value. This determines the gift amount that may be subject to gift tax and should be reported on IRS Form 709, if applicable. When transferring property into a QPRT, the grantor may be subject to gift tax if the taxable gift value exceeds the annual gift tax exclusion. However, the gift's value is often lower than the property's fair market value, potentially minimizing the gift tax liability. If the grantor survives the trust term, the property will not be included in their estate for estate tax purposes, resulting in potential estate tax savings. If the grantor dies during the trust term, the property will be included in their estate, and the potential estate tax benefits will be lost. The grantor is responsible for paying income tax on any income generated by the property during the trust term. Additionally, the grantor remains responsible for property taxes and other expenses related to the property. QPRTs may present certain tax risks, such as changes in estate tax laws, increased property values, or premature death of the grantor, which could impact the trust's effectiveness in achieving estate tax savings. A QPRT can be integrated with other estate planning tools, such as wills, revocable living trusts, and other types of irrevocable trusts, to create a comprehensive estate plan tailored to the grantor's needs and objectives. At the end of the trust term, the property ownership transfers to the designated beneficiaries, typically the grantor's heirs. It's essential to consider the implications of this transfer, such as potential capital gains tax liabilities, and the beneficiaries' ability to maintain the property. When selecting beneficiaries, the grantor should consider the potential impact of the property transfer on the beneficiaries' financial situation, as well as their ability and willingness to manage the property upon the trust term's end. One of the primary advantages of a QPRT is the potential to significantly reduce estate taxes. By transferring property ownership to the trust, the grantor's estate value is lowered, which can result in substantial tax savings. QPRTs provide an additional layer of asset protection, as the property is owned by the trust and not the grantor. This can help safeguard the property from potential creditors and legal claims against the grantor. When transferring property into a QPRT, the value of the taxable gift is often lower than the property's fair market value. This is because the gift's value is calculated based on the grantor's retained interest, which is discounted due to the trust's terms and applicable federal rates. The grantor retains the right to use and reside in the property during the trust's term. This ensures that the grantor can maintain their current lifestyle and residence without disruption. One of the primary risks associated with QPRTs is the grantor's premature death. If the grantor dies during the trust term, the property will be included in their estate, negating the potential estate tax savings. If the property's value declines during the trust term, the potential estate tax savings may be reduced or eliminated. QPRTs are irrevocable trusts, which means that they cannot be easily modified or terminated once established. This inflexibility can limit the grantor's options if their circumstances change. The transfer of property ownership at the end of the trust term may create challenges for the beneficiaries, such as increased financial responsibilities, potential capital gains tax liabilities, and managing the property. GRATs are another type of irrevocable trust that can be used to minimize estate taxes by transferring assets to beneficiaries while retaining an income stream for the grantor. ILITs can be used to hold life insurance policies and help minimize estate taxes by removing the death benefit proceeds from the grantor's taxable estate. CRTs provide the grantor with an income stream while also benefiting a charity, potentially reducing estate and income taxes. Outright gifting is another alternative to QPRTs, where the grantor can directly transfer ownership of assets, including property, to their beneficiaries. This strategy may result in immediate gift tax consequences but can help reduce the grantor's taxable estate and provide immediate benefits to the beneficiaries. Qualified Personal Residence Trusts are a valuable tool in estate planning to minimize federal estate taxes by transferring ownership of a residence into an irrevocable trust. Establishing a QPRT requires meeting eligibility criteria, preparing necessary documentation, and selecting a trustee. Tax implications include potential gift tax liability, exclusion from the grantor's estate for estate tax purposes if they survive the trust term, and responsibility for income tax and property expenses. QPRTs offer benefits such as estate tax reduction, asset protection, gift tax exclusion, and the ability to retain property use. However, potential drawbacks include mortality risk, changes in property value, inflexibility, and impacts on beneficiaries. Alternatives to QPRTs include Grantor Retained Annuity Trusts, Irrevocable Life Insurance Trusts, Charitable Remainder Trusts, and outright gifting. Given the complexity of QPRTs and their potential tax implications, it's highly recommended that individuals consult with experienced estate planning professionals, such as attorneys, accountants, and financial advisors, to ensure that a QPRT is an appropriate strategy.Definition of Qualified Personal Residence Trusts (QPRTs)

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Purpose of QPRTs

Establishing a QPRT

Eligibility Criteria

Required Documentation

Selection of a Trustee

Determining the Trust Term

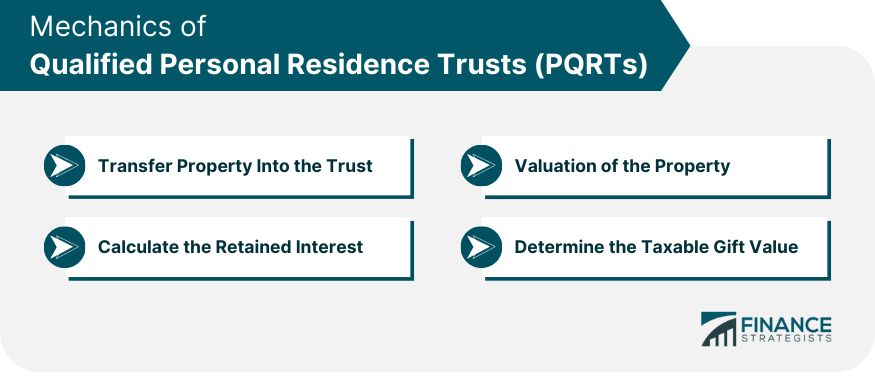

Mechanics of QPRTs

Transferring Property into the Trust

Valuation of the Property

Calculating the Retained Interest

Determining the Taxable Gift Value

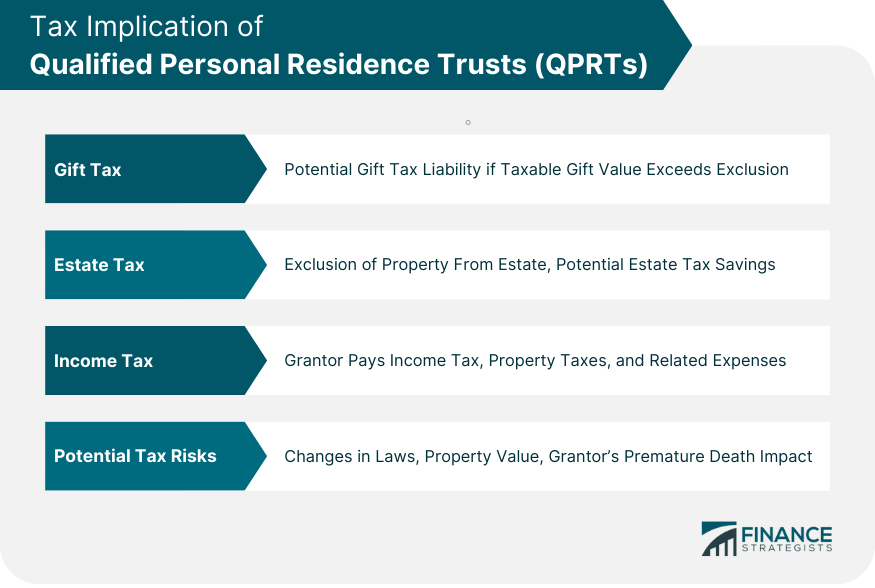

Tax Implications of QPRTs

Gift Tax Considerations

Estate Tax Implications

Income Tax Implications

Potential Tax Risks

QPRTs and Estate Planning

Integration With Other Estate Planning Strategies

Planning for the Trust Term's End

Considerations for Beneficiaries

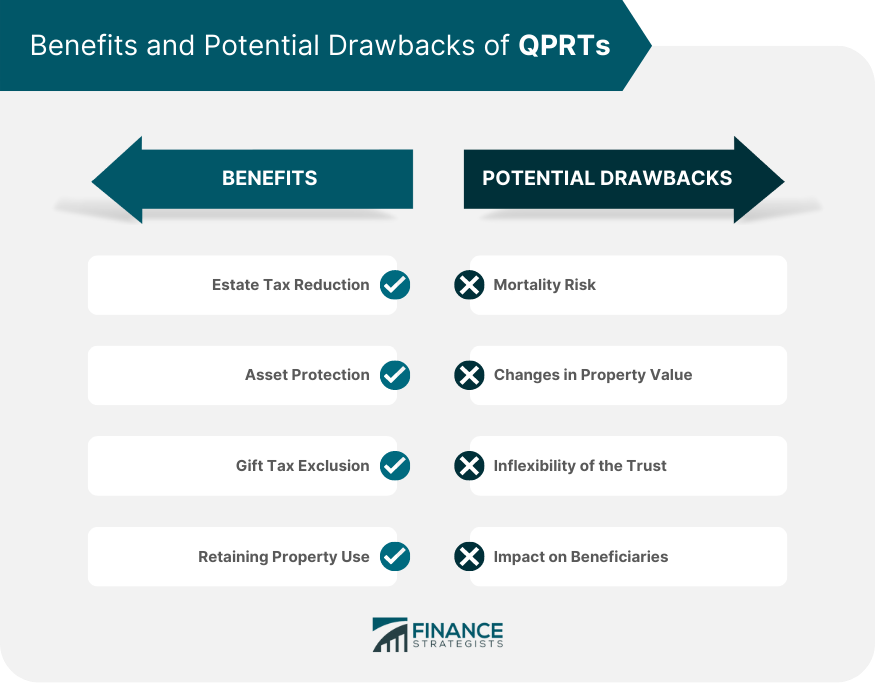

Benefits of QPRTs

Estate Tax Reduction

Asset Protection

Gift Tax Exclusion

Retaining Property Use

Potential Drawbacks of QPRTs

Mortality Risk

Changes in Property Value

Inflexibility of the Trust

Impact on Beneficiaries

Alternatives to QPRTs

Grantor Retained Annuity Trusts (GRATs)

Irrevocable Life Insurance Trusts (ILITs)

Charitable Remainder Trusts (CRTs)

Outright Gifting

Conclusion

Qualified Personal Residence Trusts (QPRTs) FAQs

The primary purpose of Qualified Personal Residence Trusts (QPRTs) is to help individuals minimize federal estate taxes by transferring ownership of their primary or secondary residence into the trust while retaining the right to use and reside in the property during the trust term.

QPRTs provide estate tax savings by removing the property's value from the grantor's taxable estate. When the property is transferred into the trust, it is no longer considered part of the grantor's estate, which can result in a reduction of potential estate tax liability.

Potential drawbacks of establishing QPRTs include mortality risk (if the grantor dies during the trust term), changes in property value, inflexibility of the trust, and the impact on beneficiaries, such as increased financial responsibilities and potential capital gains tax liabilities.

QPRTs are irrevocable trusts, which means they cannot be easily modified or terminated once established. This inflexibility can limit the grantor's options if their circumstances change.

Some alternatives to QPRTs for estate planning include Grantor Retained Annuity Trusts (GRATs), Irrevocable Life Insurance Trusts (ILITs), Charitable Remainder Trusts (CRTs), and outright gifting. Each of these strategies has its own advantages and disadvantages, and individuals should consult with estate planning professionals to determine the best approach for their specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.