An installment sale to a grantor trust is a unique transaction that combines elements of an installment sale and a trust arrangement. It involves the sale of assets by an individual or entity (referred to as the grantor) to a trust established by the grantor for the benefit of designated beneficiaries. This type of transaction has gained popularity due to its potential benefits in estate planning, tax deferral, and wealth transfer strategies. In an installment sale to a grantor trust, the grantor transfers assets, such as real estate, securities, or business interests, to the trust in exchange for a promissory note or installment obligation. The trust is structured as a grantor trust for income tax purposes, meaning that the grantor is treated as the owner of the trust assets for tax purposes while the trust operates independently for legal purposes. The grantor receives installment payments from the trust over a predetermined period, typically in the form of principal and interest payments. The terms of the installment sale, including the interest rate, payment schedule, and duration, are established through a formal agreement between the grantor and the trust. A grantor trust is a type of irrevocable trust in which the grantor retains certain powers, allowing them to be treated as the owner of the trust assets for income tax purposes. To create a grantor trust, a legal document is drafted and executed, outlining the trust's terms and conditions. The trust is then funded with assets, such as cash, securities, or real estate. Once the grantor trust is funded, the grantor can sell assets to the trust using an installment sale. In this transaction, the grantor transfers ownership of the assets to the trust in exchange for a promissory note. The promissory note outlines the payment schedule, interest rate, and other terms of the installment sale. The terms and conditions of the installment sale should be carefully negotiated and documented. They typically include the sale price, interest rate, payment schedule, and any collateral or security provisions. The sale price should reflect the fair market value of the assets being sold to avoid potential gift tax consequences. The payment schedule for an installment sale to a grantor trust can be customized to meet the needs of the grantor and the trust beneficiaries. Payments can be structured as level payments, balloon payments, or a combination of both. The interest rate on the promissory note should be set at or above the Applicable Federal Rate (AFR) to avoid imputed interest income and potential gift tax issues. The income tax implications of an installment sale to a grantor trust are unique. Because the grantor is treated as the owner of the trust assets for income tax purposes, any interest income received on the promissory note is not taxable to the grantor. Additionally, the trust is not required to pay income taxes on the assets sold to the trust or the income generated by those assets. This arrangement can result in significant income tax savings for the grantor. By transferring assets to a grantor trust through an installment sale, the grantor can protect those assets from potential creditors and lawsuits. Additionally, the grantor can retain control over the trust assets by serving as the trustee or by appointing a trusted individual or institution to act as the trustee. Installment sales to grantor trusts can help minimize estate taxes by removing the assets from the grantor's taxable estate. The value of the promissory note received in exchange for the assets is included in the grantor's estate, but any appreciation in the value of the assets after the sale is excluded. As mentioned earlier, the unique tax treatment of grantor trusts can result in significant income tax savings for the grantor. The trust itself is not taxed on the income generated by the assets sold to the trust, and the grantor does not pay tax on the interest income received on the promissory note. Installment sales to grantor trusts offer flexibility in structuring the terms of the sale and the trust provisions. This flexibility allows the grantor and their advisors to create a customized plan that meets their specific financial and estate planning objectives. An installment sale to a grantor trust can facilitate the transfer of wealth to future generations while minimizing estate and gift tax consequences. The trust can be structured to benefit the grantor's children, grandchildren, or other descendants, ensuring that the assets are managed and distributed according to the grantor's wishes. The process of creating a grantor trust and executing an installment sale can be complex, requiring the guidance of experienced legal and financial advisors. Additionally, the ongoing administration and management of the trust may be time-consuming and require specialized knowledge. If the grantor trust status is lost due to changes in the tax laws or the trust's provisions, the income tax benefits of the installment sale may be eliminated. Furthermore, the loss of grantor trust status could result in adverse estate and gift tax consequences. Installment sales to grantor trusts are subject to economic and market risks, such as fluctuations in interest rates, asset values, and investment performance. These risks can impact the overall success of the strategy and should be carefully considered and monitored. Installment sales to grantor trusts must comply with all applicable laws and regulations, including federal and state tax laws and trust laws. Failure to comply with these requirements could result in penalties, tax liabilities, and other adverse consequences. Given the complexity and specialized nature of installment sales to grantor trusts, it is essential to engage experienced legal and financial advisors who can guide the grantor through the process and ensure that the strategy is properly structured and administered. It is crucial to obtain accurate and up-to-date valuations of the assets being sold to the grantor trust to ensure that the sale price reflects the fair market value and avoids potential gift tax consequences. The grantor and the trust must comply with all reporting and compliance requirements associated with the installment sale and the ongoing administration of the trust. This includes filing any necessary tax returns, and information returns, and maintaining accurate records of the trust's activities. To ensure the success of an installment sale to a grantor trust, it is essential to monitor the trust's investment performance, economic and market conditions, and any changes in the applicable laws and regulations. This ongoing monitoring will allow the grantor and their advisors to make any necessary adjustments to the strategy. Utilizing installment sales to grantor trusts offers a powerful estate planning strategy for individuals and families aiming to protect their assets, minimize estate and income taxes, and facilitate wealth transfer to future generations. The key elements of this approach include grantor trust creation and funding, the sale of assets to the trust, and the careful negotiation of terms and conditions. Despite its potential benefits, this strategy also comes with challenges such as complex structuring, risks associated with grantor trust status, and economic and market uncertainties. By adhering to best practices, engaging experienced legal and financial advisors, and conducting ongoing monitoring and adjustments, installment sales to grantor trusts can be a valuable tool in achieving one's financial and estate planning objectives.Definition of Installment Sales to Grantor Trusts

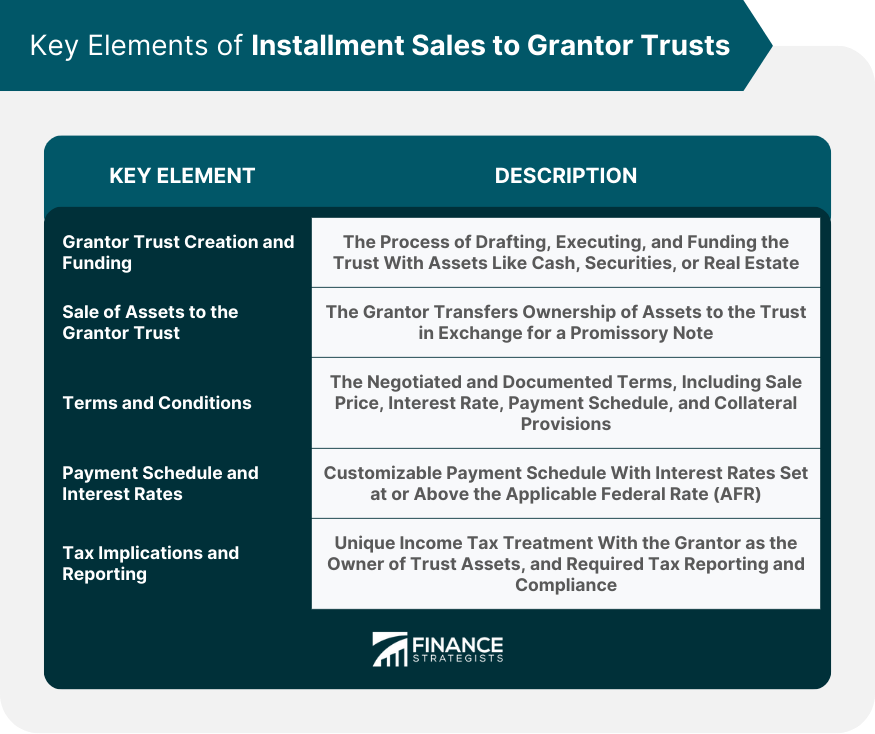

Key Elements of Installment Sales to Grantor Trusts

Grantor Trust Creation and Funding

Sale of Assets to the Grantor Trust

Terms and Conditions of the Installment Sale

Payment Schedule and Interest Rates

Tax Implications and Reporting Requirements

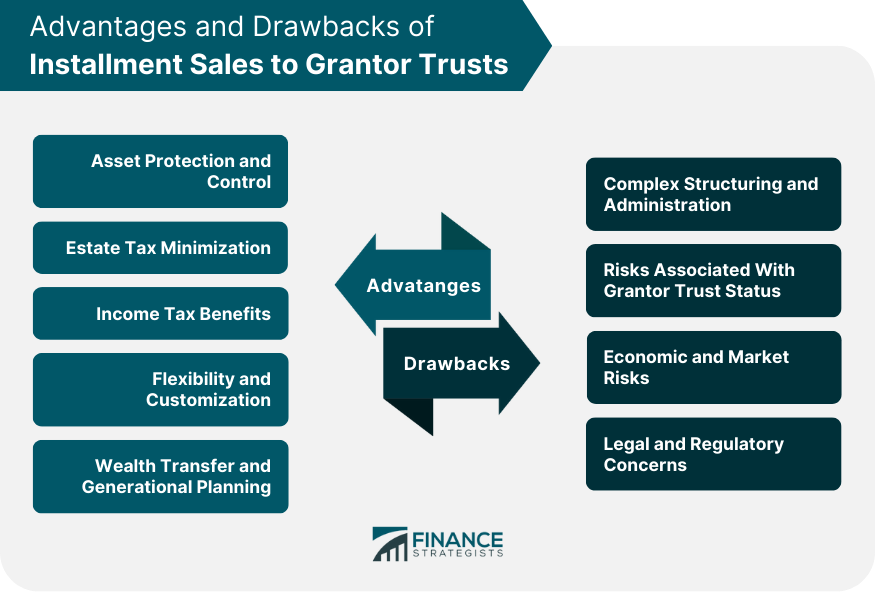

Advantages of Installment Sales to Grantor Trusts

Asset Protection and Control

Estate Tax Minimization

Income Tax Benefits

Flexibility and Customization

Wealth Transfer and Generational Planning

Potential Drawbacks and Challenges

Complex Structuring and Administration

Risks Associated With Grantor Trust Status

Economic and Market Risks

Legal and Regulatory Concerns

Best Practices for Implementing Installment Sales to Grantor Trusts

Engaging Experienced Legal and Financial Advisors

Proper Valuation of Assets

Timely and Accurate Reporting and Compliance

Ongoing Monitoring and Adjustments

Conclusion

Installment Sales to Grantor Trusts FAQs

The primary benefits of using installment sales to grantor trusts include asset protection and control, estate tax minimization, income tax benefits, flexibility and customization, and wealth transfer and generational planning.

Installment sales to grantor trusts provide income tax benefits because the grantor is treated as the owner of the trust assets for income tax purposes. As a result, any interest income received on the promissory note is not taxable to the grantor, and the trust is not required to pay income taxes on the assets sold to the trust or the income generated by those assets.

Potential drawbacks and challenges of using installment sales to grantor trusts include complex structuring and administration, risks associated with grantor trust status, economic and market risks, and legal and regulatory concerns.

The best practices for implementing installment sales to grantor trusts include engaging experienced legal and financial advisors, obtaining a proper valuation of assets, ensuring timely and accurate reporting and compliance, and conducting ongoing monitoring and adjustments.

Yes, installment sales to grantor trusts can be an effective tool for generational wealth transfer. The trust can be structured to benefit the grantor's children, grandchildren, or other descendants, ensuring that the assets are managed and distributed according to the grantor's wishes while minimizing estate and gift tax consequences.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.