Domestic Asset Protection Trusts are specialized legal instruments used for asset protection in the field of estate planning. Also known as self-settled asset protection trusts, DAPTs provide a means for individuals to safeguard their assets from potential creditors while retaining some level of control and benefit from those assets. Unlike traditional trusts, where the grantor transfers assets to the trust for the benefit of others, a DAPT allows the grantor to be both the creator of the trust and one of its beneficiaries. This unique feature sets DAPTs apart, as it enables individuals to protect their assets while still enjoying certain benefits and control over them.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. I once assisted a client in establishing a Domestic Asset Protection Trust to shield their assets from potential lawsuits and creditors. By transferring their high-risk assets into the trust, we effectively minimized their exposure while maintaining a level of control and financial security. This strategic move not only safeguarded their wealth but also provided peace of mind. Ready to protect your assets with precision and foresight? Let's secure your financial future together. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth PreservationDefinition of Domestic Asset Protection Trusts (DAPTs)

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Purpose of DAPTs

The primary purpose of DAPTs is to protect the assets of the settlor from potential creditors, lawsuits, and other financial risks. By placing assets in a DAPT, the settlor can limit the ability of creditors to reach those assets while still retaining some control over their use and distribution.

Benefits of DAPTs

Some key benefits of DAPTs include asset protection, privacy, and potential tax advantages.

DAPTs can provide a level of protection against creditors and legal claims, as well as offer privacy by keeping the trust's assets and transactions confidential. In some cases, DAPTs may also offer tax advantages, depending on the jurisdiction and the specific trust structure.

History of Domestic Asset Protection Trusts

The Emergence of DAPTs in the United States

DAPTs first emerged in the United States in the late 20th century, with states like Alaska and Delaware leading the way in adopting legislation that allowed for the creation of such trusts.

Since then, a growing number of states have enacted similar legislation, making DAPTs an increasingly popular option for asset protection.

Evolution of DAPT Laws and Regulations

Over time, DAPT laws and regulations have evolved to provide greater protection and flexibility for settlers. States have adopted various approaches to DAPTs, with some offering stronger asset protection and privacy provisions than others.

As a result, selecting the appropriate jurisdiction for a DAPT is a critical decision for individuals considering this form of asset protection.

Formation of DAPTs

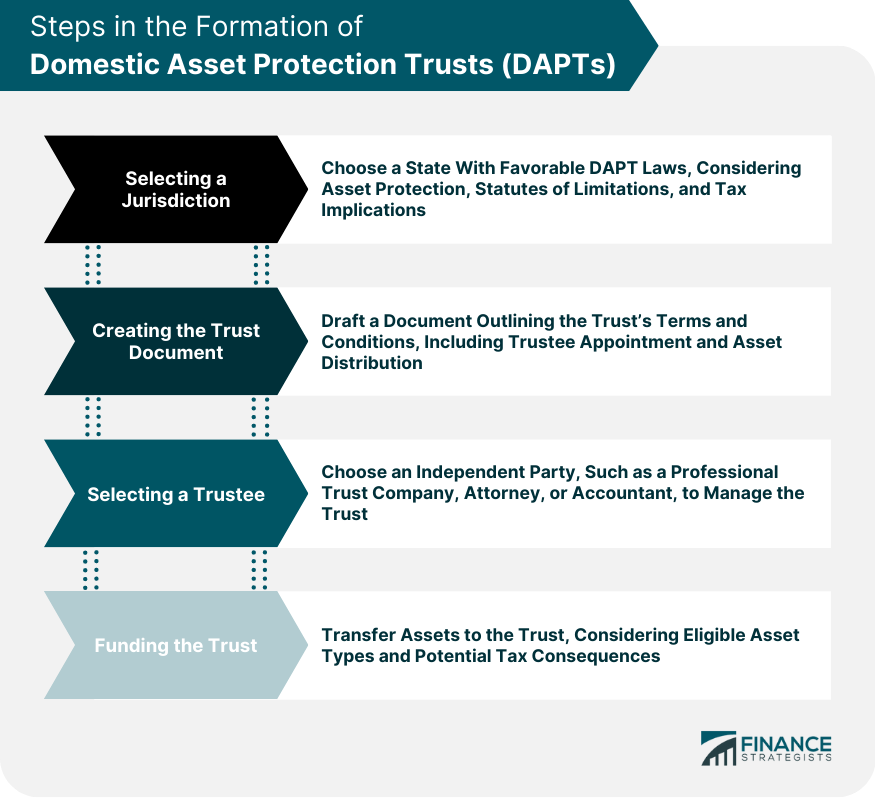

Selecting a Jurisdiction

Favorable DAPT States

Some states, such as Alaska, Delaware, Nevada, and South Dakota, are known for their favorable DAPT laws. These states typically offer strong asset protection provisions, privacy, and potential tax advantages.

Key Factors to Consider

When selecting a jurisdiction for a DAPT, it is essential to consider factors such as the state's asset protection laws, statutes of limitations for creditor claims, and potential tax implications.

Establishing the Trust

Creating the Trust Document

To establish a DAPT, the settlor must create a trust document that outlines the terms and conditions of the trust, including the appointment of a trustee and the distribution of trust assets.

Identifying and Selecting a Trustee

A crucial aspect of creating a DAPT is the selection of a trustee who will be responsible for managing the trust assets and ensuring compliance with the trust document and applicable laws.

The trustee must be an independent party, often a professional trust company, attorney, or accountant.

Funding the Trust

Assets Eligible for DAPTs

A wide range of assets can be placed in a DAPT, including real estate, cash, securities, and business interests. The settlor must carefully consider which assets to include in the trust, as transferring certain assets may have tax implications or other legal consequences.

Timing and Tax Considerations

The timing of transferring assets to a DAPT is essential, as transferring assets during an ongoing lawsuit or with the intent to defraud creditors can result in the trust being disregarded. Additionally, the settlor must consider the potential tax consequences of transferring assets to a DAPT.

Legal Considerations for DAPTs

Asset Protection Strategies

Fraudulent Transfer Laws

DAPTs are subject Fraudulent Transfer Laws to fraudulent transfer laws, which aim to prevent individuals from transferring assets to a trust with the intent to defraud creditors.

If a court determines that a transfer was fraudulent, it may set aside the transfer, allowing creditors to access the trust's assets. To avoid this, the settlor should establish the DAPT well in advance of any potential legal claims.

Statutes of Limitations

Each state has a statute of limitations for creditors to bring a claim against a DAPT. The duration of this period varies by state, and the settlor should be aware of the relevant statute of limitations in the chosen jurisdiction.

Bankruptcy Implications

Bankruptcy Court Treatment of DAPTs

In bankruptcy proceedings, the treatment of DAPTs may vary depending on the jurisdiction and the specific circumstances of the case. Bankruptcy courts may scrutinize DAPTs more closely and, in some instances, may disregard the trust and allow creditors to access its assets.

Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA)

The BAPCPA includes provisions that impact the treatment of DAPTs in bankruptcy cases.

Under the act, a transfer to a self-settled trust, like a DAPT, may be considered a fraudulent transfer if it occurred within ten years before the bankruptcy filing and the settlor intended to hinder, delay, or defraud a creditor.

Tax Implications of Domestic Asset Protection Trusts

Federal Income Tax Considerations

DAPTs are generally treated as grantor trusts for federal income tax purposes, meaning the settlor is responsible for reporting and paying income tax on the trust's income. However, the specific tax treatment may vary depending on the trust's structure and the assets held.

State Income Tax Considerations

State income tax treatment of DAPTs varies by jurisdiction. Some states, such as Nevada and South Dakota, do not impose a state income tax on trusts. It is crucial for the settlor to understand the tax implications of their chosen jurisdiction when establishing a DAPT.

Gift and Estate Tax Considerations

Transfers to a DAPT may be subject to federal gift and estate tax rules. The settlor should consult with a tax professional to ensure compliance with these rules and to minimize potential tax liabilities.

Generation-Skipping Transfer Tax Implications

If a DAPT includes provisions for distributions to skip-generation beneficiaries, such as grandchildren, it may be subject to the federal Generation-Skipping Transfer (GST) tax. The settlor should consider the GST tax implications when structuring the trust and making distributions.

Comparing DAPTs to Offshore Asset Protection Trusts

Advantages of DAPTs

DAPTs offer several advantages over offshore trusts, including reduced complexity, lower costs, and greater regulatory oversight. Additionally, DAPTs are subject to U.S. law, which may provide the settlor with greater confidence in the trust's legal standing.

Advantages of Offshore Trusts

Offshore trusts may offer stronger asset protection and privacy provisions compared to DAPTs. In some cases, offshore trusts may also provide tax advantages, depending on the jurisdiction and the specific trust structure.

Selecting the Appropriate Trust Structure

Choosing between a DAPT and an offshore trust depends on the settlor's individual circumstances, including risk tolerance, asset types, and financial goals.

A thorough analysis and consultation with legal and financial professionals can help determine the best trust structure for a given situation.

Ethical Considerations for DAPTs

Potential Misuse of DAPTs

Although DAPTs serve a legitimate purpose in asset protection, they can be misused to defraud creditors or evade legal obligations. It is essential for both the settlor and the trustee to act in good faith and adhere to all legal and ethical requirements when establishing and administering a DAPT.

Balancing Asset Protection With Creditor Rights

DAPTs must strike a balance between protecting the settlor's assets and preserving the rights of legitimate creditors. By adhering to the appropriate laws and regulations, DAPTs can serve as an effective tool for asset protection without unfairly disadvantaging creditors.

Responsibilities of the Trustee and Trust Settlor

The trustee and trust settlor both have responsibilities to ensure the proper establishment and management of the DAPT.

The trustee must act in the best interests of the beneficiaries, while the settlor must provide accurate and complete information to the trustee and follow all applicable laws and regulations.

Best Practices for Domestic Asset Protection Trusts

Regular Trust Review and Maintenance

It is essential for the settlor and trustee to regularly review and maintain the DAPT to ensure compliance with changing laws and regulations and to adapt to the settlor's evolving financial situation.

Diversifying Asset Protection Strategies

A well-rounded asset protection plan should include a variety of strategies, not just a DAPT. Settlors should consider incorporating other asset protection tools, such as limited liability companies, insurance, and investment diversification, to create a comprehensive protection plan.

Seeking Professional Advice and Guidance

Establishing and maintaining a DAPT can be a complex process that requires expertise in various legal, financial, and tax areas.

Settlors should seek the advice and guidance of experienced professionals, such as attorneys, accountants, and financial planners, to ensure the proper establishment and management of a DAPT.

Conclusion

As more states adopt legislation allowing for the creation of Domestic Asset Protection Trusts, their popularity as an asset protection tool continues to grow.

By offering a combination of asset protection, privacy, and potential tax advantages, DAPTs have become an attractive option for individuals seeking to safeguard their wealth.

Not all individuals will benefit from a DAPT, and it is crucial to evaluate the suitability of a DAPT based on individual circumstances, financial goals, and risk tolerance.

A comprehensive analysis, coupled with professional advice, can help determine whether a DAPT is the right asset protection strategy for a given situation.

As DAPTs continue to evolve and gain popularity, it is likely that further developments in legislation and regulation will occur. Individuals considering a DAPT should stay informed about changes in the legal landscape and consult with professionals to ensure their trust remains compliant and effective.

Domestic Asset Protection Trusts (DAPTs) FAQs

A Domestic Asset Protection Trust (DAPT) is a type of self-settled spendthrift trust established in the United States that protects an individual's assets from potential creditors or lawsuits. The settlor (the person creating the trust) can be a discretionary beneficiary, retaining some access to the assets while ensuring protection from future claims.

Selecting the right jurisdiction for your DAPT involves considering factors such as the state's asset protection laws, statutes of limitations for creditor claims, and potential tax implications. Some states, like Alaska, Delaware, Nevada, and South Dakota, are known for their favorable DAPT laws and may offer stronger asset protection provisions, privacy, and potential tax advantages.

The tax implications of establishing a DAPT can vary depending on the trust's structure and the assets held. For federal income tax purposes, DAPTs are generally treated as grantor trusts, with the settlor being responsible for reporting and paying income tax on the trust's income. State income tax treatment varies by jurisdiction, and transfers to a DAPT may be subject to federal gift and estate tax rules. Consult with a tax professional to ensure compliance with these rules and minimize potential tax liabilities.

DAPTs are established within the United States and are subject to U.S. law, while offshore trusts are established in foreign jurisdictions with potentially more favorable asset protection and privacy provisions. DAPTs typically offer reduced complexity, lower costs, and greater regulatory oversight compared to offshore trusts. However, offshore trusts may provide stronger asset protection and privacy, as well as potential tax advantages, depending on the jurisdiction and trust structure.

Best practices for managing a DAPT include regular trust review and maintenance to ensure compliance with changing laws and regulations, diversifying asset protection strategies by incorporating additional tools such as limited liability companies and insurance and seeking professional advice and guidance from experienced attorneys, accountants, and financial planners to ensure proper establishment and management of the trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.