Trust Investment Management refers to the management of assets held in trust by a trustee, with the objective of achieving the trust's financial goals and objectives while adhering to fiduciary responsibilities. Trust investment management plays a crucial role in wealth preservation, growth, and the effective distribution of assets among beneficiaries. The primary objectives of trust investment management are to preserve and grow the trust assets, generate income, and fulfill the long-term financial goals and obligations outlined in the trust agreement. Trust investment managers, often professional financial advisors or institutional entities, are responsible for executing investment strategies and making investment decisions that align with the trust's specific requirements and the beneficiaries' needs. A revocable trust, also known as a living trust, can be altered, amended, or revoked by the grantor during their lifetime. This type of trust provides flexibility for the grantor, as they can make changes according to their needs and preferences. An irrevocable trust is a permanent arrangement where the grantor relinquishes control over the assets placed in the trust. Once established, the trust's terms cannot be altered, and the assets are no longer considered part of the grantor's estate. A living trust is created during the grantor's lifetime and can be either revocable or irrevocable. The primary purpose of a living trust is to avoid probate, maintain privacy, and provide for the efficient management of assets during the grantor's life and after their death. A testamentary trust is established through a will and comes into effect only after the grantor's death. This type of trust is commonly used to provide for minor children, ensure responsible distribution of assets, and protect assets from beneficiaries' creditors. A charitable trust is created for philanthropic purposes, benefiting one or more charitable organizations. These trusts offer tax benefits to the grantor and help support causes they are passionate about. A special needs trust is designed to provide financial support for individuals with disabilities without jeopardizing their eligibility for government benefits, such as Medicaid and Supplemental Security Income (SSI). Determining the grantor's and beneficiaries' risk tolerance is essential for creating a suitable investment strategy. Risk tolerance considers the ability and willingness to accept fluctuations in investment returns and potential losses. The time horizon refers to the length of time the trust's assets will be invested before they are distributed to the beneficiaries. A longer time horizon allows for more aggressive investment strategies, while a shorter time horizon requires a more conservative approach. Liquidity needs are the trust's requirements for readily available cash to cover expenses, taxes, and distributions. A trust's investment strategy should account for both anticipated and unanticipated liquidity needs. Trust investment management should consider the tax implications of investment decisions, including the trust's income taxation, estate and gift taxes, and generation-skipping transfer taxes. Asset allocation is the process of dividing the trust's assets among different asset classes, such as equities, fixed income, alternative investments, and cash. A well-diversified asset allocation helps manage risk and achieve the trust's investment objectives. Diversification involves investing in a wide range of assets and industries to minimize risk. A well-diversified portfolio helps protect the trust's assets from market volatility and specific investment risks. Rebalancing is the process of adjusting the trust's portfolio to maintain the target asset allocation. Regular rebalancing ensures that the trust's investment strategy remains aligned with its objectives and risk tolerance. Choosing the right investment managers and custodians is crucial for the successful management of trust assets. Investment managers should have a proven track record, relevant expertise, and a compatible investment philosophy. Custodians must provide secure asset custody and efficient administration services. Equities, also known as stocks, represent ownership shares in companies. Investing in equities provides capital appreciation and potential dividend income. Equities should be included in a trust's portfolio based on the trust's risk tolerance, time horizon, and investment objectives. Fixed income investments, such as bonds and notes, provide regular interest payments and return the principal at maturity. These investments can offer stability and income to a trust's portfolio, especially during periods of market volatility. Alternative investments include assets such as real estate, private equity, hedge funds, and commodities. These investments can provide diversification, risk management, and potential for higher returns. However, they may also involve higher fees, limited liquidity, and more complex investment strategies. Cash and cash equivalents, such as money market funds and short-term government bonds, offer liquidity and capital preservation. They should be included in a trust's portfolio to meet its liquidity needs and provide a buffer during periods of market uncertainty. Benchmarking involves comparing the trust's investment performance against a relevant market index or a group of similar trusts. It helps assess the effectiveness of the trust's investment strategy and identify areas for improvement. Performance attribution analyzes the sources of the trust's investment returns, such as asset allocation, security selection, and market timing. Understanding the drivers of performance can help refine the trust's investment strategy and enhance its risk management. Risk management aims to identify, measure, and mitigate the various risks that can impact the trust's investment performance. Effective risk management includes regular portfolio reviews, stress testing, and adherence to the investment policy statement. The duty of loyalty requires that trustees and investment managers act solely in the best interests of the trust's beneficiaries. This includes avoiding conflicts of interest and making investment decisions that align with the trust's objectives. The duty of care mandates that trustees and investment managers exercise prudence, diligence, and skill in managing the trust's assets. This involves conducting thorough research, monitoring investments, and seeking professional advice when necessary. Trustees and investment managers must treat all beneficiaries fairly and impartially, balancing the needs and interests of current and future beneficiaries. This requires careful consideration of investment strategies, asset allocation, and distribution policies. Trustees and investment managers have a responsibility to preserve and protect the trust's assets for the benefit of the beneficiaries. This includes implementing appropriate risk management strategies, maintaining adequate insurance coverage, and ensuring proper custody of assets. Trustees and investment managers must maintain accurate records of the trust's financial transactions and provide regular reports to the beneficiaries. These reports should include information on the trust's investments, performance, expenses, and distributions. Trust investment management is subject to various federal and state laws, which govern the formation, administration, and taxation of trusts. Trustees and investment managers must ensure compliance with all applicable laws and regulations. It is a model law that provides guidelines for trustees and investment managers in making investment decisions. It emphasizes the importance of diversification, risk management, and the overall investment strategy, rather than focusing on individual investments. It is another model law that addresses the allocation of trust income and principal between income and remainder beneficiaries. It aims to balance the interests of current and future beneficiaries, while ensuring the trust's assets are invested prudently. Trust officers and advisors play a vital role in trust investment management, assisting with the development of investment strategies, providing guidance on fiduciary responsibilities, and ensuring compliance with legal and regulatory requirements. Trusts are subject to income taxation on their net income, which may include interest, dividends, capital gains, and rental income. The tax rates for trusts can be higher than individual tax rates, making it essential to consider tax-efficient investment strategies. Trusts can help minimize estate and gift taxes by removing assets from the grantor's taxable estate. Trusts can also be structured to take advantage of annual gift tax exclusions and lifetime exemptions, reducing the overall tax burden on the grantor and beneficiaries. Generation-skipping transfer taxes apply to transfers of assets to beneficiaries who are more than one generation younger than the grantor, such as grandchildren. Properly structured trusts, like dynasty trusts, can help mitigate these taxes and preserve wealth for future generations. Charitable trusts offer the grantor tax deductions for charitable contributions, reducing their taxable income. The trust can also provide tax-free growth for the assets, benefiting the charitable organizations in the long run. Real estate assets within a trust require specialized management, including property maintenance, leasing, and potential sale or exchange. Trustees and investment managers should consider the unique risks and benefits associated with real estate investments, as well as their impact on the trust's overall portfolio. Closely held businesses can be challenging to manage within a trust due to their illiquidity, valuation complexities, and potential conflicts of interest among family members. Trustees and investment managers must navigate these challenges while ensuring the business's growth and preservation for the beneficiaries. Tangible personal property, such as artwork, jewelry, and collectibles, may have significant value and require special care and management within a trust. This includes proper storage, insurance, valuation, and potential sale or disposition of the assets. Life insurance policies held within a trust, often called an irrevocable life insurance trust (ILIT), can provide liquidity for estate taxes and other expenses, while also keeping the proceeds outside the grantor's taxable estate. Trustees must ensure that premiums are paid, beneficiaries are updated, and the policy remains in force to fulfill its intended purpose. Trust investment management is essential for wealth preservation, growth, and efficient asset distribution among beneficiaries. By understanding the various types of trusts, the trust investment management process, fiduciary responsibilities, legal and regulatory environment, tax considerations, and the management of special assets, trustees and investment managers can successfully navigate the complex world of trust investment management to secure the financial future of the beneficiaries. Additionally, by engaging professional expertise in trust investment management, trustees and beneficiaries can ensure that the trust's assets are prudently managed, effectively diversified, and aligned with the beneficiaries' best interests, providing a solid foundation for long-term financial security and wealth preservation.What Is Trust Investment Management?

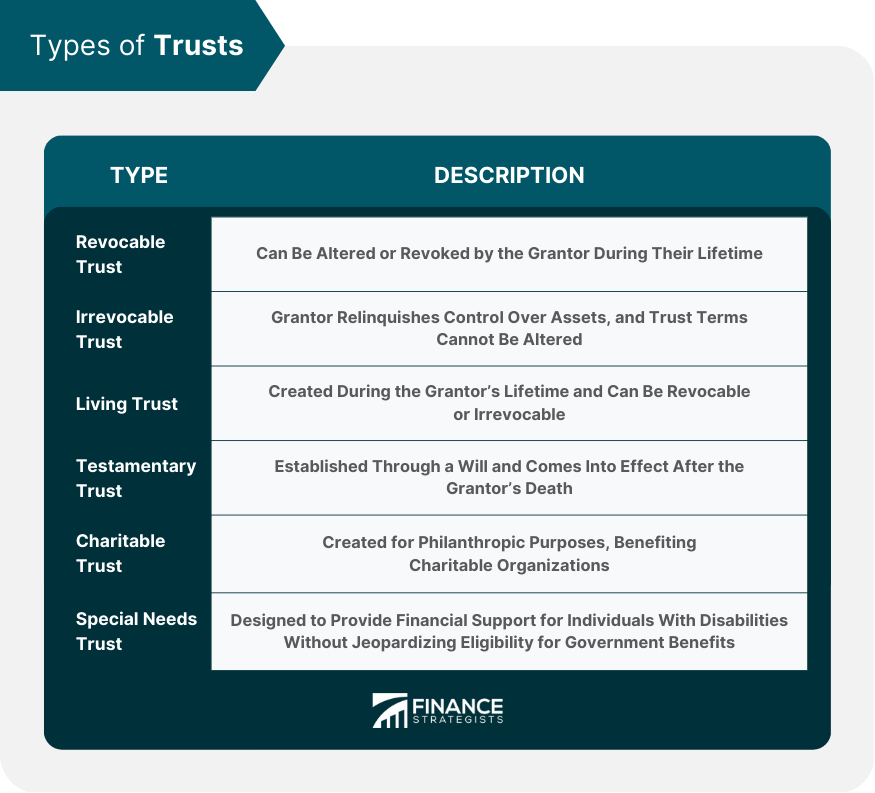

Types of Trusts

Revocable Trust

Irrevocable Trust

Living Trust

Testamentary Trust

Charitable Trust

Special Needs Trust

Trust Investment Management Process

Identification of Trust Objectives and Constraints

Risk Tolerance

Time Horizon

Liquidity Needs

Tax Considerations

Development of an Investment Policy Statement (IPS)

Asset Allocation

Diversification

Rebalancing

Selection of Investment Managers and Custodians

Portfolio Construction

Equities

Fixed Income

Alternative Investments

Cash and Cash Equivalents

Ongoing Monitoring and Performance Evaluation

Benchmarking

Performance Attribution

Risk Management

Fiduciary Responsibilities

Duty of Loyalty

Duty of Care

Duty of Impartiality

Duty to Preserve Trust Property

Duty to Account and Report

Legal and Regulatory Environment

Federal and State Laws

Uniform Prudent Investor Act of 1992

Uniform Principal and Income Act of 1997

Role of Trust Officers and Advisors

Tax Considerations

Trust Income Taxation

Estate and Gift Taxes

Generation-Skipping Transfer Taxes

Charitable Deductions

Managing Special Assets in Trusts

Real Estate

Closely Held Businesses

Tangible Personal Property

Life Insurance Policies

Conclusion

Trust Investment Management FAQs

Trust investment management refers to the management of investments held within a trust account. It involves managing and growing the assets within the trust, ensuring that they align with the trust's objectives, and maintaining compliance with legal and regulatory requirements.

The benefits of trust investment management include professional management of assets, diversification of investments, tax advantages, and adherence to fiduciary standards.

Trust investment management services are offered by professional trust companies, banks, and financial advisors. These professionals are trained and experienced in managing trust assets and are typically subject to strict regulatory oversight.

Trust investment management is different from other forms of investment management in that it focuses specifically on the management of assets held within a trust. It involves a more comprehensive approach to investment management that takes into account the specific goals and objectives of the trust.

Investment decisions in trust investment management are made by the trustee or trustees responsible for managing the trust. These decisions are typically guided by the trust's investment policy statement, which outlines the investment objectives, risk tolerance, and other important factors that should be considered when making investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.