The Terminal Capitalization Rate (TCR) is a financial metric used in investment analysis and valuation to determine the value of an asset at the end of its projected holding period. It represents the expected rate of return an investor would require to purchase the asset at its estimated future income stream. The TCR is typically determined by considering factors such as market conditions, risk factors, comparable property sales, and investor expectations. It plays a crucial role in estimating the property's future worth and is often used in conjunction with other valuation methods, such as the income approach. It helps investors assess the long-term income potential and profitability of an asset, providing insights into its financial performance and attractiveness as an investment opportunity. By understanding the TCR, investors and appraisers can make informed decisions about property investments, assess potential returns, and determine if a property aligns with their investment objectives. Economic conditions, such as interest rates, inflation rates, and overall market stability, can significantly impact the TCR. In times of economic growth and stability, the TCR may be lower due to higher investor confidence and lower perceived risk. Conversely, during economic downturns or periods of uncertainty, the TCR may be higher to compensate for increased risk. Market trends, including supply and demand dynamics, market saturation, and emerging industry trends, can influence the TCR. If a market is experiencing high demand and limited supply, the TCR may be lower as investors are willing to accept a lower return on investment. Conversely, in a market with oversupply or declining demand, the TCR may be higher to attract investors. Risk factors associated with the asset or investment, such as location, market volatility, and tenant stability, can impact the TCR. Higher-risk assets or investments typically command a higher TCR to compensate investors for the additional risk they assume. Conversely, lower-risk assets may have a lower TCR due to their perceived stability and predictability. The TCR plays a vital role in assessing investment opportunities by providing a measure of the potential return on investment. It allows investors to compare different assets and make informed decisions based on their expected future income streams. The TCR is an essential tool for valuing assets, particularly in real estate and business valuation. By estimating the future income stream and applying the appropriate TCR, investors can determine the present value of an asset, helping them make accurate and informed valuation decisions. The TCR assists in estimating future cash flows from an investment. By considering the projected income stream and applying the TCR, investors can forecast the expected cash flows over the holding period, enabling them to assess the asset's profitability and potential return on investment. By incorporating the TCR into financial models and investment analyses, they can provide clients with a clear understanding of the expected returns on their investments, helping them make informed decisions and manage their wealth effectively. The direct capitalization approach is a common method for determining the TCR. It involves dividing the projected net operating income (NOI) of an asset by its estimated value at the end of the holding period to derive the TCR. This approach assumes that the income and value of the asset remain relatively stable throughout the holding period. The yield capitalization approach is another method for determining the TCR, particularly for assets with varying income streams over time. It takes into account the projected cash flows from an asset, including rental income and potential sales proceeds, and discounts them to present value using an appropriate discount rate to derive the TCR. The TCR relies heavily on assumptions, such as projected income streams, market conditions, and investor preferences. Any inaccuracies or uncertainties in these assumptions can impact the reliability of the TCR as a valuation metric. The TCR is sensitive to changes in market conditions, such as interest rate fluctuations, economic shifts, or changes in supply and demand dynamics. Therefore, it is essential to regularly review and update the TCR to reflect current market conditions accurately. Inaccurate projections of future income or property values can significantly impact the reliability of the TCR. Investors and wealth managers should conduct thorough due diligence and utilize reliable data sources to minimize the risk of inaccurate projections. The TCR is widely used in real estate investment analysis to assess the potential returns and value of properties. It helps investors determine the viability of real estate investments, compare different properties, and make informed decisions regarding acquisition or disposal. In business valuation, the TCR can be utilized to estimate the value of a business based on its projected future cash flows. By applying the appropriate TCR to the projected income stream, wealth managers can provide clients with an understanding of the value of their business interests. The TCR is also relevant in merger and acquisition transactions, where it is used to assess the value of target companies. It helps investors and acquirers determine the financial viability of the target company and evaluate the potential returns on their investment. Thorough market research is crucial when determining the TCR. It is essential to analyze market trends, economic conditions, and risk factors specific to the asset or investment to ensure the TCR reflects the current market reality. To derive an accurate TCR, it is important to use accurate data and reliable sources for projecting income streams, market conditions, and other relevant factors. Relying on outdated or unreliable information can lead to inaccurate TCR calculations and valuation results. Given the dynamic nature of markets and the potential impact of changing conditions, it is advisable to regularly review and update TCR calculations. By reassessing assumptions, analyzing updated market data, and adjusting projections, wealth managers can maintain the accuracy and relevance of the TCR in investment decision-making. The Terminal Capitalization Rate (TCR) is a crucial metric in investment analysis and valuation. It factors in economic conditions, market trends, and risk considerations to determine the value of an asset at the end of its projected holding period. The TCR plays a vital role in assessing investment opportunities, valuing assets, estimating future cash flows, and projecting investment returns. However, it is important to acknowledge the limitations of the TCR, such as reliance on assumptions and sensitivity to market changes. By utilizing appropriate methods, conducting thorough research, and regularly updating TCR calculations, investors and wealth managers can effectively leverage the TCR in their investment decision-making process.What Is the Terminal Capitalization Rate (TCR)?

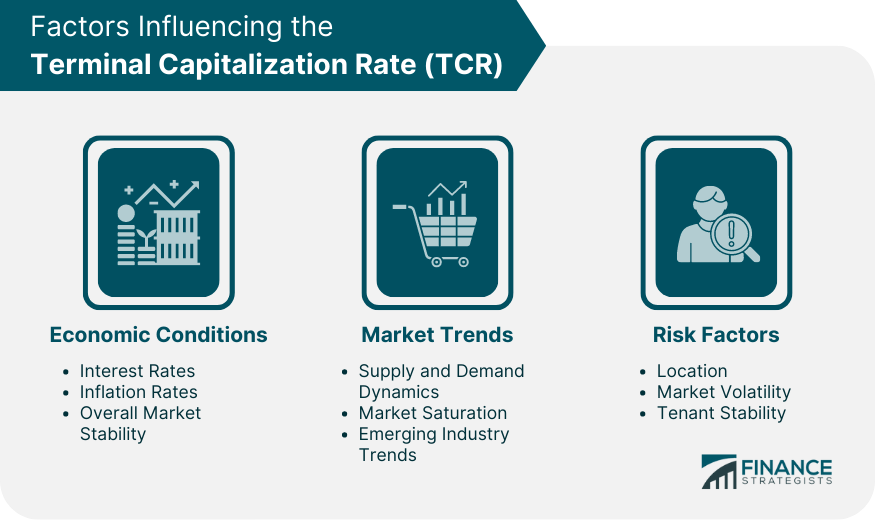

Factors Influencing the Terminal Capitalization Rate (TCR)

Economic Conditions

Market Trends

Risk Factors

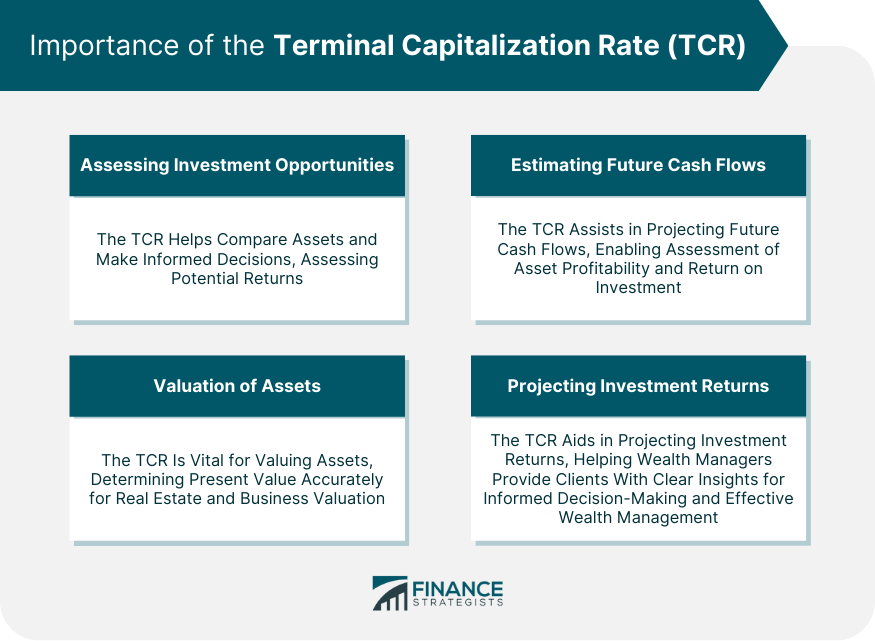

Importance of the Terminal Capitalization Rate

Assessing Investment Opportunities

Valuation of Assets

Estimating Future Cash Flows

Projecting Investment Returns

Methods for Determining the Terminal Capitalization Rate

Direct Capitalization Approach

Yield Capitalization Approach

Limitations of the Terminal Capitalization Rate

Reliance on Assumptions

Sensitivity to Market Changes

Impact of Inaccurate Projections

Applications of the Terminal Capitalization Rate

Real Estate Investment Analysis

Business Valuation

Merger and Acquisition Transactions

Best Practices for Using the Terminal Capitalization Rate

Conducting Thorough Market Research

Utilizing Accurate Data and Reliable Sources

Regularly Reviewing and Updating TCR Calculations

Final Thoughts

Terminal Capitalization Rate (TCR) FAQs

The Terminal Capitalization Rate (TCR) is a financial metric used to determine the value of an asset at the end of its projected holding period. It represents the expected rate of return an investor would require to purchase the asset based on its future income stream.

The initial capitalization rate is used to determine the value of an asset at the beginning of the holding period, considering the projected income stream. The TCR, on the other hand, focuses on the value at the end of the holding period, factoring in the expected rate of return.

Factors influencing the TCR include economic conditions, market trends, and risk factors associated with the asset or investment. These factors can impact the required rate of return and the valuation of the asset.

The TCR can be determined using the direct capitalization approach, which divides the projected net operating income by the estimated value at the end of the holding period. Another method is the yield capitalization approach, which discounts the projected cash flows to present value using an appropriate discount rate.

The TCR should be regularly reviewed and updated to reflect current market conditions accurately. Changes in economic conditions, market trends, or the asset itself may require adjustments to the TCR calculations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.