The S&P 500 Dividend Aristocrats Index is an elite benchmark that includes companies within the S&P 500 that have consistently increased their dividends for at least 25 consecutive years. This index represents a distinctive blend of high-quality companies that have demonstrated growth and stability in dividend payouts. The Dividend Aristocrats Index is a crucial tool for investors, particularly those focusing on income generation and long-term growth. It offers a reliable snapshot of companies with a strong financial position and a demonstrated commitment to returning capital to their shareholders. Understanding the S&P 500 Dividend Aristocrats Index can guide investors toward companies that consistently pay robust dividends, thus providing a steady income stream. These financially strong companies offer the potential for long-term capital appreciation, thereby enhancing overall investment strategies. To be considered for the S&P 500 Dividend Aristocrats Index, a company must first be a member of the S&P 500. This ensures the company is among the largest and most established in the U.S. market, contributing to the Index's stability and reliability. Companies must have a minimum market capitalization of $3 billion. This criterion provides additional assurance regarding the size and financial stability of the companies included in the Index. One of the most significant criteria is the requirement for a company to have increased its dividend payout every year for at least 25 consecutive years. This demonstrates the company's commitment to returning capital to shareholders and its ability to sustain and grow profits over long periods. The composition of the S&P 500 Dividend Aristocrats Index is reviewed annually every January. This review is essential to ensure that the companies in the Index continue to meet the stringent criteria for inclusion. While the central review happens annually, adjustments may be made yearly to reflect changes in the composition of the S&P 500. This could include adding a new company to the Index if it joins the S&P 500 and meets the other criteria or removing a company if it no longer meets the requirements. This ongoing adjustment ensures that the Index accurately represents the performance of S&P 500 companies that consistently increase their dividends. Historically, the S&P 500 Dividend Aristocrats Index has demonstrated strong performance. Due to the stringent criteria for inclusion, the index comprises high-quality companies with stable earnings and robust financial health. These companies have generally shown resilience in various market conditions, often outperforming the broader market during periods of volatility. During periods of market instability, the Dividend Aristocrats Index often performs well relative to other market indices. Companies with a long history of stable and increasing dividend payments are typically considered safer investments. These companies often have stable, predictable cash flows and are less susceptible to market downturns, helping to reduce the index's volatility. In periods of bull markets, the Dividend Aristocrats Index may not always outperform the broader market. This is because in times of rapid growth, sectors like technology and consumer discretionary, which might not be heavily represented in the Dividend Aristocrats Index, often lead the market. However, Dividend Aristocrats tend to provide consistent returns and income, contributing to total return even if they do not lead to capital appreciation. During bear markets, the Dividend Aristocrats Index often performs better than the broader market. Companies that consistently pay and grow dividends are generally more mature and financially stable, thus better equipped to weather economic downturns. Reliable dividends can also provide a steady income stream for investors during these periods, which is particularly valuable when other sources of return may be underperforming. The S&P 500 Dividend Aristocrats Index tends to offer a higher dividend yield than the broader S&P 500, and the requirement for consistent dividend growth means that this yield generally increases over time. This makes it an attractive option for income-focused investors. Dividends are central to the S&P 500 Dividend Aristocrats Index. The index only includes companies that have consistently increased their dividends for at least 25 consecutive years, setting them apart from the broader S&P 500. Companies that consistently pay and increase dividends are often financially robust and stable. This consistent dividend growth showcases their ability to generate growing profits, which they then distribute to shareholders as dividends. Dividends act as a regular income stream for investors. The consistent dividend increase characteristic of the Dividend Aristocrats means this income can grow over time, making it valuable for income-focused investors and providing an effective hedge against inflation. In addition to capital appreciation, dividends are a critical component of total return. Particularly during periods of lower market growth, dividends can make up a substantial portion of a portfolio's total return. The Dividend Aristocrats' consistent dividend growth contributes reliably to total return, even during challenging market conditions. Dividends can also mitigate risk. Companies that maintain dividend payments are often considered safer investments during market volatility, offering potential downside protection. The consistent income from dividends can help offset potential losses from share price declines, enhancing the appeal of Dividend Aristocrats during bear markets. Procter & Gamble is a multinational consumer goods corporation. Its vast portfolio of products spans health care, beauty, grooming, and home care. Procter & Gamble has an impressive track record of paying dividends for over a century and increasing its dividend annually for over 60 years. This showcases its commitment to delivering consistent shareholder returns. Coca-Cola, a leading beverage company, has a long-standing history of paying quarterly dividends since 1920 and has increased dividends for over 50 consecutive years. Its ability to maintain and grow dividends stems from its strong brand presence, diversified product line, and vast global distribution network. Johnson & Johnson, a global healthcare firm, is known for its broad array of healthcare products. It has a proud history of providing dividends since 1944 and has consistently increased its dividends for over 50 consecutive years. This is a testament to the company's robust financial health and its resilience in various market conditions. Long-term dividend payers like Procter & Gamble, Coca-Cola, and Johnson & Johnson exemplify the attributes that income-focused investors seek. They are characterized by: These companies have a history of reliable dividend payments. They have managed to maintain and even increase their dividends over the years, including during challenging economic periods. This reliability is often due to their solid financials, strong market positions, and resilient business models. Predicting dividend payouts can be crucial for income-focused investors, particularly those who rely on dividends for a portion of their living expenses. The steady dividend growth of these companies provides a level of predictability, which can be comforting to investors. The companies in the Dividend Aristocrats Index have demonstrated the ability to generate and grow income over time. This is often due to their strategic business decisions, efficient operations, and commitment to returning capital to shareholders. Companies in the S&P 500 Dividend Aristocrats Index have a proven track record of consistently paying dividends and increasing them annually for at least 25 consecutive years. This means investors can expect a steady and growing income stream, which can be particularly attractive for income-focused investors. The rigorous criteria to be included in the Dividend Aristocrats Index ensure that it comprises high-quality, financially stable companies. These companies are often industry leaders with a strong history of profitability and a commitment to returning capital to shareholders. The Dividend Aristocrats Index has historically exhibited less volatility than the broader market. This is because dividend-paying companies are often less susceptible to market fluctuations, making this index a safer choice in turbulent markets. In addition to dividend income, these companies can also offer the potential for capital appreciation. While the focus is on the dividend, successful and growing companies can also see their share price increase over time. While investing in the Dividend Aristocrats Index offers a degree of diversification, it may also lead to concentrated exposure to certain sectors. The index may be heavily weighted in sectors like consumer staples or industrials, which historically have more consistent dividends. While rare for Dividend Aristocrats, dividends can be reduced or eliminated if a company faces financial difficulties. This could lead to decreased income for investors and a drop in the company's share price. The Dividend Aristocrats Index may underperform the broader market in strong bull markets, particularly those led by non-dividend paying sectors like technology. While the index offers steady returns, it may need to capture the full upside during periods of rapid market growth. While the Dividend Aristocrats have historically performed well, past performance does not guarantee future results. It's always important for investors to conduct thorough research and consider their risk tolerance when investing. Economic factors considerably influence all financial markets, including the S&P 500 Dividend Aristocrats Index. However, given the unique characteristics of the companies that form this index, some economic factors may have specific implications. The state of the overall economy has significant implications on the S&P 500 Dividend Aristocrats Index. During periods of robust economic growth, companies within the index may enjoy increased profitability, enabling them to raise their dividends further. Conversely, their capacity to increase dividends may be challenged during economic slowdowns or recessions. Inflation and interest rates significantly influence the performance of Dividend Aristocrats. In a rising interest rate environment, dividend-paying stocks may become less appealing than fixed-income investments, potentially depressing their stock prices. Companies consistently growing their dividends can offer an effective hedge against inflation as the income they provide to investors increases over time. Sector-specific economic factors can also notably affect the Dividend Aristocrats Index, often due to its sector concentration. For example, economic elements affecting commodity prices, consumer sentiment, or regulatory changes may impact companies in the consumer staples sector. Industrial companies may be more sensitive to economic cycles, trade policies, or technological changes. Market volatility, often driven by broader economic factors, can also shape the performance of the Dividend Aristocrats Index. During times of increased volatility, the index can provide stability due to the consistent dividends offered by its constituent companies. This steady dividend income can buffer against price swings, potentially mitigating losses during market downturns. The S&P 500 Dividend Aristocrats Index is a prestigious group of S&P 500 companies known for their strong financial health and consistent record of increasing dividends for at least 25 consecutive years. Understanding the Dividend Aristocrats Index involves appreciating the importance of dividends, the performance of the Index, and the factors influencing its composition and performance. It represents a unique blend of companies that have demonstrated growth and consistency in dividend payments. Investing in the S&P 500 Dividend Aristocrats Index can be a strategic move for wealth management. Whether you're looking for regular income, portfolio diversification, or a lower-risk investment, this Index may be worth considering. Always consult with a financial advisor to ensure your investment strategy aligns with your financial goals and risk tolerance.What Is the S&P 500 Dividend Aristocrats Index?

Composition of the S&P 500 Dividend Aristocrats Index

Criteria for Inclusion

S&P 500 Membership

Minimum Market Capitalization

Dividend Increase Record

Frequency of Evaluation and Rebalancing

Annual Review

Adjustments Throughout the Year

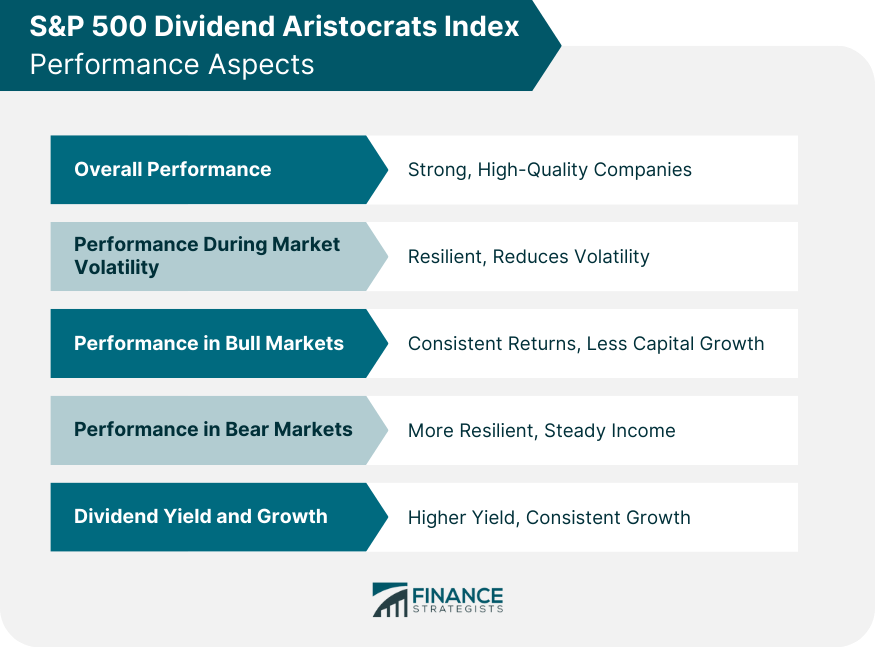

Performance of the S&P 500 Dividend Aristocrats Index

Overall Performance

Performance During Market Volatility

Performance in Bull Markets

Performance in Bear Markets

Dividend Yield and Growth

Role of Dividends in the S&P 500 Dividend Aristocrats Index

Dividends as a Signal of Company Health

Dividends as a Source of Investor Income

Dividends as a Contributor to Total Return

Dividends as a Risk Mitigation Tool

Examples of Companies in the S&P 500 Dividend Aristocrats Index

Procter & Gamble

Coca-Cola

Johnson & Johnson

Analysis of Long-Term Dividend Payers

Reliability

Predictability

Ability to Generate and Grow Income Over Time

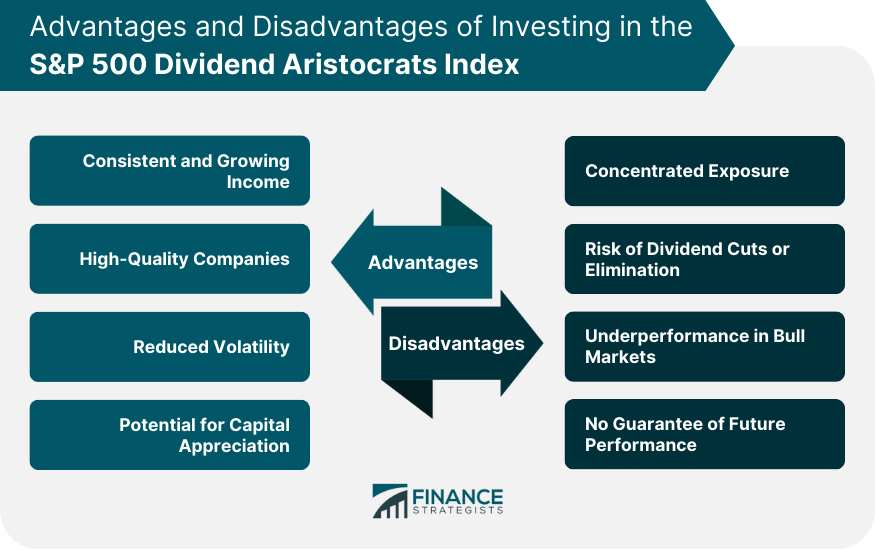

Benefits and Risks of Investing in the S&P 500 Dividend Aristocrats Index

Benefits of Investing

Consistent and Growing Income

High-Quality Companies

Reduced Volatility

Potential for Capital Appreciation

Risks of Investing

Concentrated Exposure

Risk of Dividend Cuts or Elimination

Underperformance in Bull Markets

No Guarantee of Future Performance

Influence of Economic Factors on the S&P 500 Dividend Aristocrats Index

Influence of Economic Growth

Impact of Inflation and Interest Rates

Role of Sector-Specific Economic Factors

Influence of Market Volatility

Conclusion

S&P 500 Dividend Aristocrats Index FAQs

The S&P 500 Dividend Aristocrats Index is a benchmark index that includes companies within the S&P 500 that have consistently increased their dividends for at least 25 consecutive years. These companies are typically known for their financial stability and commitment to returning capital to shareholders.

To be included in the S&P 500 Dividend Aristocrats Index, a company must be part of the S&P 500, have a minimum market capitalization of $3 billion, and have increased its dividend payout yearly for at least 25 consecutive years. The index is reviewed and rebalanced annually.

The S&P 500 Dividend Aristocrats Index has historically outperformed the broader S&P 500 over extended periods. This is largely due to the consistent and growing dividends of the constituent companies, which can provide stable returns, especially during volatile market conditions.

Companies in the S&P 500 Dividend Aristocrats Index include well-known firms such as Procter & Gamble, Coca-Cola, and Johnson & Johnson. These companies have a long history of consistently increasing their dividends, demonstrating strong financial health and stability.

An investor might be interested in the S&P 500 Dividend Aristocrats Index for its potential to provide a steady income stream and lower volatility compared to the broader market. The index's focus on companies that have consistently raised dividends makes it particularly appealing for income-focused investors or those looking for more conservative growth strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.