The Nikkei, short for Nikkei 225, is a price-weighted equity index and is one of the most recognized and referenced indices of Japanese stocks. The Nikkei gets its name from Nihon Keizai Shimbun, Japan's leading financial newspaper, which calculates the index. The number 225 refers to the number of large, publicly-owned companies selected from a broad spectrum of industries included in the index. The origin of the Nikkei dates back to September 1950, making it the oldest stock index in Japan. As Japan's premier stock index, the Nikkei plays a critical role in global financial markets. It is seen as a barometer for Japan's economic health, providing investors around the world with an understanding of the country's economic condition and business cycle. The performance of the Nikkei also influences other Asian stock markets due to Japan's economic significance in the region. The Nikkei index comprises 225 blue-chip companies listed on the Tokyo Stock Exchange. To be included in the index, a company must meet specific criteria in terms of liquidity and market capitalization. These criteria ensure that the index is representative of the Japanese stock market and is easily investable for both domestic and international investors. To ensure that the companies included in the index are easily traded, they must demonstrate a certain level of liquidity. This means that there is enough trading volume in the market, allowing investors to buy or sell shares without significantly impacting the share price. Market capitalization is another essential criterion for inclusion in the Nikkei index. Companies with a larger market capitalization are typically more stable, making them ideal for representing the broader market. The index includes both large-cap and mid-cap stocks to capture a comprehensive picture of the Japanese economy. The Nikkei index covers a wide range of sectors, reflecting the diverse nature of the Japanese economy. Some of the key sectors represented in the index include: The technology sector is well-represented in the Nikkei index, with global giants like Sony and Panasonic as well as other innovative tech companies making up a significant portion of the index. Japanese consumer goods companies, such as Uniqlo's parent company Fast Retailing and Kao Corporation, are also part of the Nikkei index. These companies play an essential role in the domestic and international consumer markets. Major banks and financial institutions, such as Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group, contribute to the financial services sector's representation in the Nikkei index. Their performance can often be indicative of the overall health of the Japanese economy. The healthcare sector is another crucial component of the Nikkei index, with leading pharmaceutical companies like Takeda Pharmaceutical and Daiichi Sankyo featuring in the index. The construction sector also plays a significant role in the index, with prominent companies like Kajima Corporation and Obayashi Corporation contributing to the sector's performance in the index. Some of Japan's largest and most well-known corporations are part of the Nikkei index, including: Toyota: The world's largest automaker by sales volume, Toyota is a key component of the Nikkei index. Sony: A multinational conglomerate, Sony's diverse product range, and global footprint make it a significant player in the index. SoftBank Group: As one of the world's largest technology investors, SoftBank Group's performance has a considerable impact on the Nikkei index. The Nikkei Index, or Nikkei 225, uses a unique calculation methodology to determine its value. As a price-weighted index, it primarily considers the stock prices of its component companies, as opposed to market capitalization. A price-weighted index assigns weight to each component company based on its stock price. This means that companies with higher stock prices have a more significant influence on the index's value, regardless of their total market capitalization. This methodology differs from other indices, such as the S&P 500, which are market-capitalization-weighted and consider the size of a company based on its market capitalization rather than its stock price. The value of the Nikkei Index is calculated by following these steps: 1. Summing the stock prices: The stock prices of all 225 component companies are added together to form a cumulative sum. 2. Applying the divisor: The sum is then divided by a divisor, which is a unique constant value that adjusts for stock splits, new issuances, and other corporate actions, such as mergers and acquisitions. The divisor ensures that the index's value remains consistent and comparable over time, despite any changes in the individual stocks. The formula for calculating the Nikkei Index value is: The price-weighted methodology has certain implications for the Nikkei Index: Companies with higher stock prices exert more significant influence on the index's value, even if their overall market capitalization is smaller than other companies in the index. Unlike market-capitalization-weighted indices, the Nikkei Index does not give more weight to larger companies based on their market capitalization. This means that the index may not always accurately represent the overall market's performance, as smaller companies with higher stock prices can have a disproportionate effect on the index's value. The Nikkei Index is more sensitive to stock price fluctuations, as changes in individual stock prices have a direct impact on the index's value. In contrast, market-capitalization-weighted indices are less sensitive to stock price changes, as the weights are determined by market capitalization, which is less prone to short-term fluctuations. The Nikkei 225 and the Nikkei 500 are both important stock market indices in Japan, but they differ in several key aspects. Here are the main differences between the two: As the name suggests, Nikkei 225 comprises 225 of the largest and most liquid companies listed on the Tokyo Stock Exchange. It is a price-weighted index, meaning that the stock prices of the constituent companies determine their influence on the index. Nikkei 500 consists of 500 companies from various sectors, making it a more diverse and broader representation of the Japanese stock market. Like the Nikkei 225, it is also price-weighted. Nikkei 225 is heavily influenced by companies from the manufacturing, technology, and financial sectors. As a result, it may not provide a comprehensive picture of the entire Japanese economy. With 500 companies from different sectors, Nikkei 500 offers a more diversified view of the Japanese market. It includes not only the major industries but also smaller sectors, providing a more accurate representation of the overall economy. Nikkei 225 primarily consists of large-cap companies, with the majority having a high market capitalization. Consequently, it mainly reflects the performance of Japan's most prominent firms. Although it also includes large-cap companies, the Nikkei 500 covers a broader range of market capitalizations, from large to mid and small-cap firms. This wider coverage offers a more comprehensive view of the market's performance. Often referred to as the "Japanese Dow Jones," the Nikkei 225 is considered the leading benchmark for the Japanese stock market. It is widely followed by investors and financial professionals to gauge the performance of the Japanese economy. While not as widely known as the Nikkei 225, the Nikkei 500 is gaining recognition for its broader coverage and more balanced sector representation. Some market participants argue that it provides a more accurate picture of the overall Japanese market performance. The Nikkei index has seen several key milestones in its history. In December 1989, the index reached an all-time high of nearly 39,000 points, fueled by an asset price bubble. However, the bubble's burst led to a prolonged period of stagnation and decline known as the "Lost Decades". Since the 2008 global financial crisis, the Nikkei has been on a generally upward trajectory, albeit with periods of volatility. The most significant crash in the history of the Nikkei occurred in the early 1990s when the Japanese asset price bubble burst. The index lost over 60% of its value in less than three years. The recovery was slow and painful, with the index only starting to show consistent gains from 2012 onwards. Other notable crashes include the dot-com bust in 2000 and the global financial crisis in 2008, both of which were followed by robust recoveries. The performance of the Nikkei has often diverged from other major global indices. For example, during the 1980s, while other major indices saw moderate growth, the Nikkei surged due to the asset price bubble. On the other hand, during the "Lost Decades" of the 1990s and early 2000s, while indices like the S&P 500 experienced significant growth, the Nikkei was mired in stagnation. More recently, since 2012, the Nikkei has largely moved in tandem with other global indices, reflecting the increasingly interconnected nature of global financial markets. Japanese economic policies have had a profound impact on the Nikkei. For example, the introduction of "Abenomics" in 2012, a set of economic policies implemented by former Prime Minister Shinzo Abe, helped to drive a multi-year bull market in the Nikkei. These policies, which included aggressive monetary easing, fiscal stimulus, and structural reforms, were designed to break Japan out of its decades-long deflationary cycle. The announcement and subsequent implementation of these policies resulted in a significant rally in the Nikkei. The Nikkei, like all major indices, is also influenced by global economic events. The global financial crisis of 2008 caused a sharp fall in the Nikkei, reflecting the severe economic downturn that followed. Similarly, events such as the European debt crisis and the US-China trade war have caused periods of volatility in the Nikkei. The Japanese Yen's value can significantly influence the Nikkei. A weaker Yen generally boosts the Nikkei because it makes Japanese exports more competitive, thereby improving the earnings prospects of Japanese multinational companies. Conversely, a stronger Yen can weigh on the Nikkei as it makes Japanese goods more expensive in international markets, potentially hurting sales and profits. Investors can gain exposure to Nikkei in several ways. These include buying shares in individual companies included in the Nikkei, purchasing a Nikkei index fund or exchange-traded fund (ETF), or trading futures and options contracts based on the Nikkei index. Investing in the Nikkei comes with both risks and rewards. On the reward side, the Nikkei offers exposure to some of the world's largest and most innovative companies and has shown strong growth potential in recent years. However, risks include exposure to the Japanese economy's unique challenges, including its aging population and high public debt levels. Additionally, because of the price-weighted nature of the Nikkei, it can be more volatile than other indices. The Nikkei can play a crucial role in a diversified investment portfolio. Investing in the Nikkei provides exposure to the Japanese economy and offers diversification benefits, given Japan's unique economic and demographic characteristics. Moreover, given the global reach of many Japanese companies, the Nikkei also offers indirect exposure to global economic trends. The Nikkei, also known as the Nikkei 225, is Japan's most prominent stock index and serves as a crucial barometer of the country's economic health. It comprises 225 of the largest, most liquid companies listed on the Tokyo Stock Exchange across a diverse range of sectors. Unlike many other indices that are market-capitalization-weighted, the Nikkei is price-weighted, giving greater influence to higher-priced stocks. This unique calculation makes it more sensitive to stock price fluctuations. The broader Nikkei 500 includes 500 companies, providing a more comprehensive picture of the Japanese economy. Investing in the Nikkei offers exposure to major Japanese industries and diversification, albeit with unique risks tied to Japan's economy and the index's price-weighted nature. Understanding these indices helps global investors make informed decisions, illustrating the intricate interplay of economic factors and corporate performance.What Is Nikkei?

Components of the Nikkei Index

Selection Criteria

Liquidity

Market Capitalization

Diverse Sectors

Technology

Consumer Goods

Financial Services

Healthcare

Construction

Prominent Companies in the Nikkei Index

Calculation Methodology of the Nikkei Index

Price-Weighted Index: The Basics

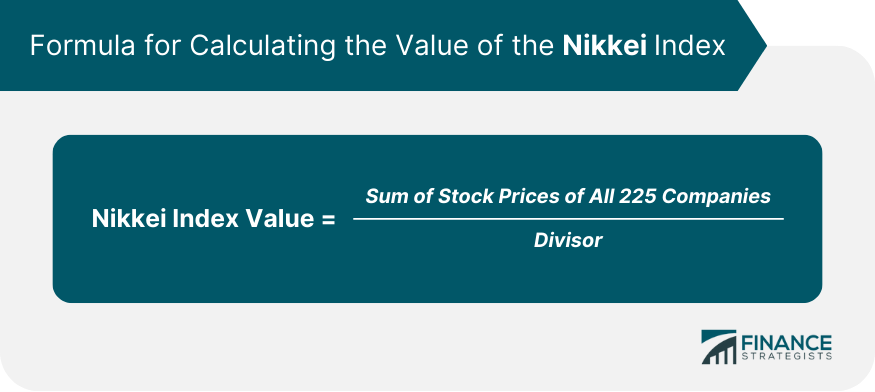

Calculating the Value of the Nikkei Index

Implications of the Price-Weighted Methodology

Higher-Priced Stocks Have Greater Influence

Less Emphasis on Market Capitalization

Sensitivity to Stock Price Changes

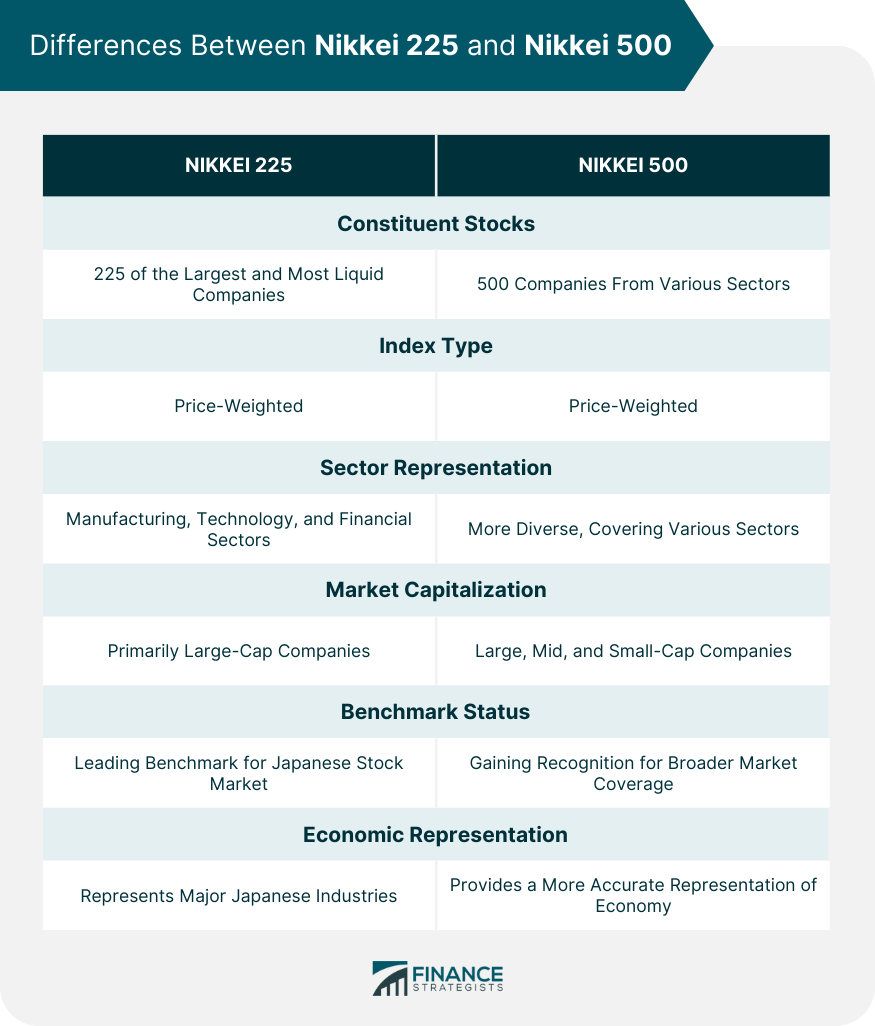

Differences Between Nikkei 225 and Nikkei 500

Constituent Stocks

Sector Representation

Market Capitalization

Benchmark

Historical Performance of Nikkei

Key Milestones in the History of Nikkei

Major Crashes and Recoveries in Nikkei

Comparison of Nikkei Performance With Other Global Indices

Influence of Economic Factors on Nikkei

Impact of Japanese Economic Policies on Nikkei

Effect of Global Economic Events on Nikkei

Role of Japanese Yen Fluctuations on Nikkei

Investing in the Nikkei

Different Ways to Invest in Nikkei

Risks and Rewards of Investing in Nikkei

Role of Nikkei in a Diversified Portfolio

Final Thoughts

Nikkei FAQs

The Nikkei, also known as the Nikkei 225, is a stock index for the Tokyo Stock Exchange. It comprises 225 of the most prominent companies in Japan.

The Nikkei is a price-weighted index, meaning it's calculated based on the stock prices of its component companies. The total value of the index is the sum of the stock prices of all 225 companies, adjusted by a divisor for stock splits and other corporate actions.

The Nikkei 225 comprises 225 large, publicly-owned companies in Japan, while the Nikkei 500 includes a broader range of 500 companies, offering a more comprehensive picture of the Japanese economy.

You can invest in the Nikkei by purchasing shares of individual companies in the index, buying a Nikkei index fund or exchange-traded fund (ETF), or trading futures and options contracts based on the Nikkei.

The Nikkei is influenced by a variety of factors, including Japanese economic policies, global economic events, fluctuations in the Japanese Yen, and the performance of its constituent companies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.