VIX options are derivative securities that provide investors with the right, but not the obligation, to buy (call option) or sell (put option) VIX futures contracts at a predetermined price within a specific time period. VIX options allow investors to speculate on the expected future volatility of the VIX index itself. These options are cash-settled, and their prices are determined by the expected volatility of the S&P 500 index, which the VIX represents. Investors use VIX options to hedge against market volatility, gain exposure to volatility as an asset class, or take positions based on their expectations of future market volatility. VIX options are European-style options, which means they can only be exercised at expiration. This is different from American-style options, which can be exercised at any time before expiration. This characteristic limits the potential for early assignment, which can be advantageous for option sellers. VIX options are cash-settled, meaning that no physical delivery of an underlying asset is required. Instead, the option's value is determined by the difference between the VIX settlement value and the option's strike price at expiration. This cash settlement process simplifies the exercise and assignment process and eliminates the need to trade or hold the underlying VIX futures. VIX options are closely related to VIX futures, as they both derive their value from the VIX Index. VIX options are priced based on the corresponding VIX futures contract rather than the VIX index itself. This relationship is important for understanding the pricing dynamics and trading strategies involving VIX options. There are several factors that can influence the pricing of VIX options, including: Time to Expiration: As with any option, the time remaining until expiration affects the option's value. Generally, the more time until expiration, the higher the option premium. VIX Level: The current level of the VIX index influences VIX option prices. When the VIX is high, option premiums tend to be higher, reflecting the increased expectation of market volatility. Volatility: The volatility of the VIX index itself also affects options pricing. Greater volatility in the VIX can lead to higher option premiums, as it indicates a higher probability of significant price movements. The Black-Scholes model is a widely used option pricing model that calculates the theoretical value of an option based on factors such as the underlying asset's price, volatility, and time to expiration. While the Black-Scholes model is not directly applicable to VIX options due to their unique characteristics, it can be modified to accommodate the specific pricing dynamics of VIX options. This modified model is often used by traders and market makers to estimate VIX option prices and manage risk. The Greeks are a set of risk measures that help investors understand the sensitivity of an option's price to various factors. The main Greeks for VIX options are: 1. Delta: Delta measures the change in the option's price for a one-point change in the VIX index. For example, a VIX option with a delta of 0.5 will increase in value by $0.50 for every one-point increase in the VIX index. 2. Gamma: Gamma measures the rate of change of an option's delta for a one-point change in the VIX index. It is useful for understanding the potential change in an option's value as the VIX index moves. 3. Theta: Theta measures the change in the option's price for a one-day decrease in time to expiration. It represents the time decay of an option's value, which tends to accelerate as expiration approaches. 4. Vega: Vega measures the change in the option's price for a one-point change in the implied volatility of the VIX index. It is particularly important for VIX options, as they are sensitive to changes in market expectations of future volatility. 5. Rho: Rho measures the change in the option's price for a one-percentage-point change in interest rates. It is generally less important for VIX options, as they are more influenced by changes in market volatility than interest rates. Various market participants trade VIX options, including institutional investors, hedge funds, proprietary trading firms, and retail traders. Each participant has different objectives and risk tolerance levels, contributing to the diverse strategies and perspectives in the VIX options market. There are several strategies for trading VIX options, including: Investors can use VIX options to hedge against market volatility, protecting their portfolios from large declines. By purchasing VIX call options, investors can profit from an increase in market volatility, offsetting potential losses in their stock or bond portfolios. Traders can use VIX options to speculate on changes in market volatility. For example, if a trader believes that market volatility will increase, they can buy VIX call options. Conversely, if they expect a decline in volatility, they can sell VIX call options or buy VIX put options. A calendar spread involves selling a near-term VIX option and buying a longer-term VIX option with the same strike price. This strategy can profit from the time decay of the near-term option, as well as changes in the term structure of VIX futures. Vertical spreads involve buying and selling VIX options with the same expiration date but different strike prices. This strategy can be used to profit from a specific range of expected VIX index levels while limiting potential losses. VIX options are settled through a cash settlement process based on the VIX Special Opening Quotation (SOQ), which is calculated using the opening prices of S&P 500 index options on the morning of VIX options expiration. The cash settlement amount is equal to the difference between the VIX SOQ and the option's strike price, multiplied by the contract multiplier (usually $100). Margin requirements for VIX options depend on the specific trading strategy and the trader's brokerage firm. Generally, long VIX option positions require the payment of the full option premium, while short VIX option positions require a higher margin to account for the potential risk of large losses due to changes in market volatility. Portfolio Diversification: VIX options can provide portfolio diversification, as their performance is generally less correlated with traditional asset classes such as stocks and bonds. Effective Hedging Tool: VIX options can be an effective tool for hedging against market volatility, allowing investors to protect their portfolios from large market swings. Unique Trading Opportunities: VIX options offer unique trading opportunities based on market sentiment and volatility expectations, enabling traders to profit from a variety of market scenarios. Complexity: VIX options can be complex financial instruments, requiring a thorough understanding of the VIX index, option pricing dynamics, and trading strategies. Liquidity: Although VIX options are generally liquid, market conditions can change rapidly, potentially leading to wider bid-ask spreads and reduced liquidity. Volatility: VIX options are inherently sensitive to changes in market volatility, which can lead to large price swings and potential losses. Counterparty Risk: As with any financial derivative, VIX options carry counterparty risk, which is the risk that the other party to the contract will default on their obligations. VIX futures are contracts that allow investors to gain exposure to the VIX index through a standardized futures contract. While VIX options derive their value from the corresponding VIX futures contract, they provide more flexibility in terms of strike prices and expiration dates, enabling a wider range of trading strategies. Volatility ETPs are financial products that track the performance of volatility indices, such as the VIX index. These products can provide a more accessible way for investors to gain exposure to market volatility, but they may be subject to tracking errors, liquidity issues, and other risks not present with VIX options. Volatility swaps are over-the-counter (OTC) financial instruments that allow investors to trade on the realized volatility of an underlying asset, such as the VIX index. While volatility swaps can offer customized exposure to market volatility, they may carry additional counterparty and credit risks compared to exchange-traded VIX options. VIX options are financial instruments that enable investors to trade on the implied volatility of the stock market, as represented by the CBOE Volatility Index (VIX). These derivatives offer unique characteristics, such as European-style exercise, cash settlement, and a close relationship with VIX futures, which set them apart from other financial instruments. Understanding the pricing dynamics of VIX options, influenced by factors like time to expiration, VIX level, and volatility, is crucial for effectively navigating this market. Moreover, it is essential to consider the risks and benefits associated with VIX options. They provide opportunities for portfolio diversification, effective hedging against market volatility, and unique trading strategies. However, investors must also be aware of the complexity, liquidity risks, and potential volatility associated with these instruments. By developing a comprehensive understanding of VIX options and their associated risks and benefits, investors can enhance their investment strategies and capitalize on market opportunities.Definition of VIX Options

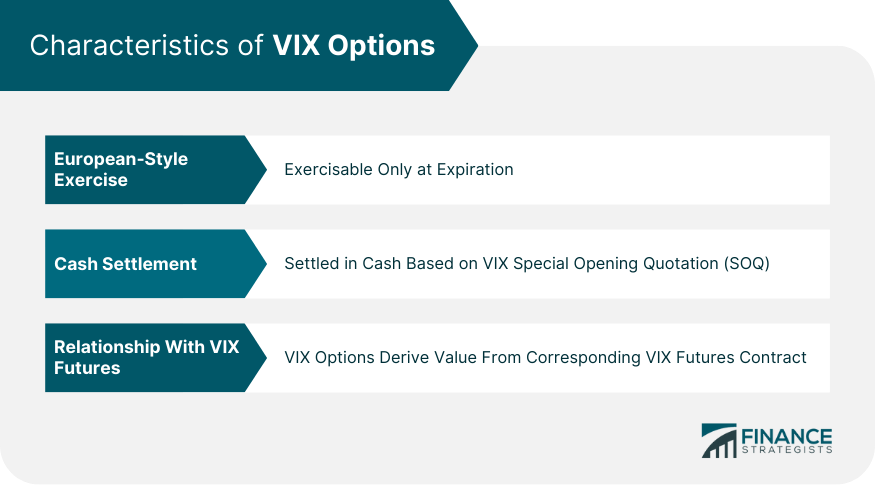

Characteristics of VIX Options

European-Style Exercise

Cash Settlement

Relationship With VIX Futures

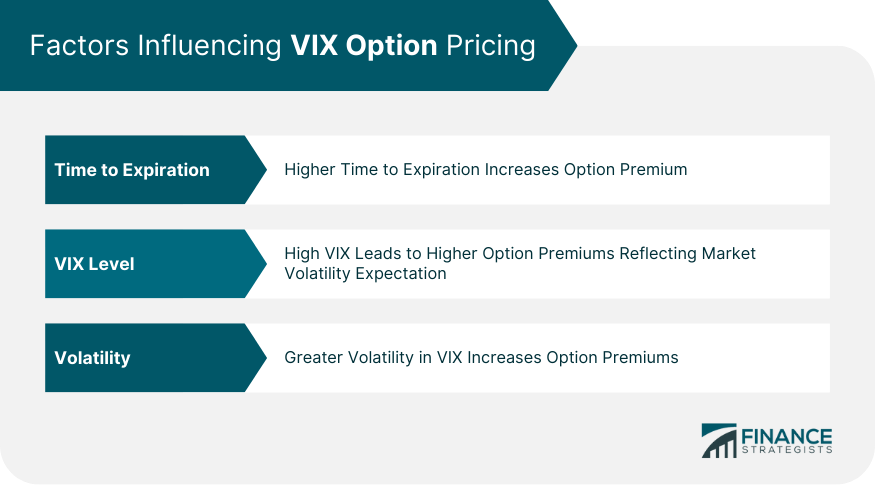

Pricing of VIX Options

Factors Influencing VIX Option Pricing

Black-Scholes Model and VIX Options

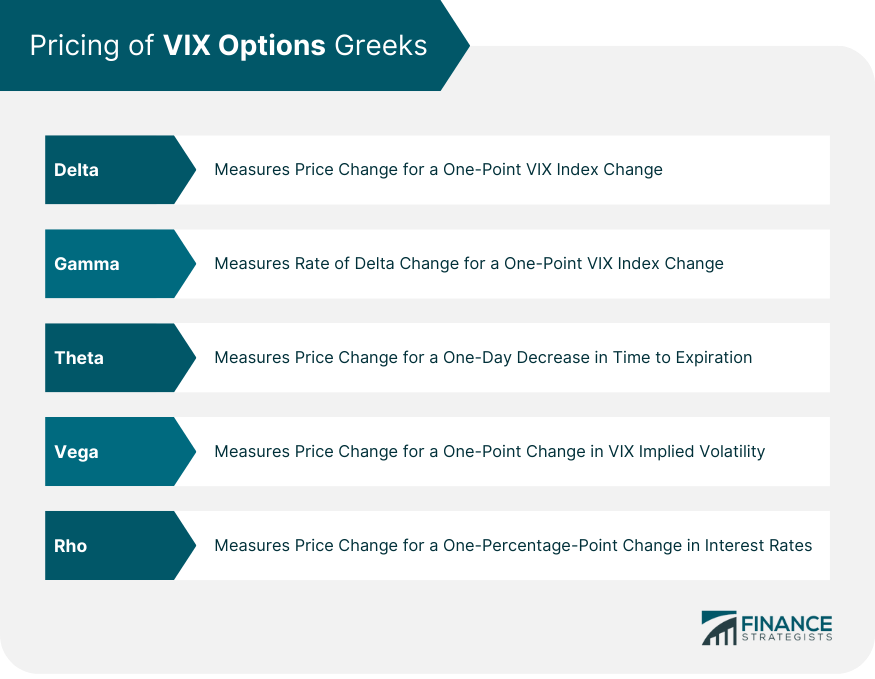

VIX Options Greeks

Trading VIX Options

Market Participants

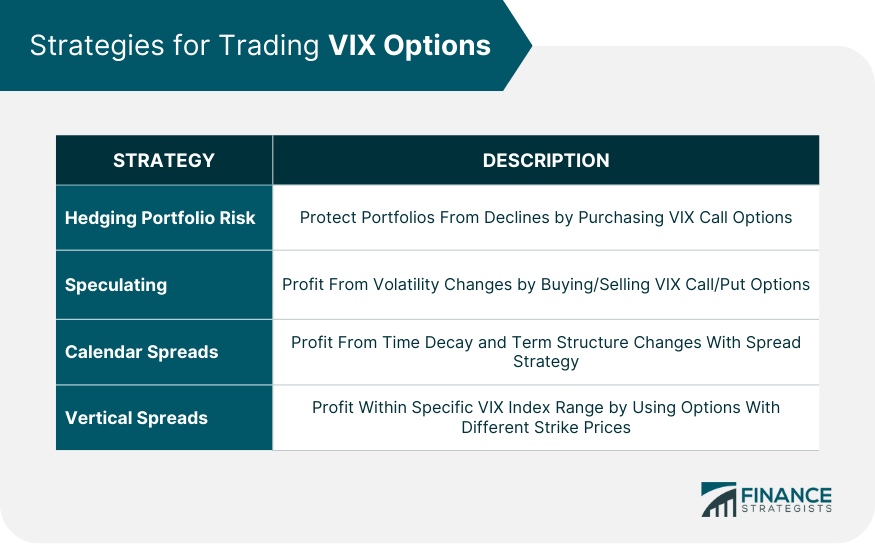

Strategies for Trading VIX Options

Hedging Portfolio Risk

Speculating on Market Volatility

Calendar Spreads

Vertical Spreads

VIX Options Settlement Process

Margin Requirements for VIX Options

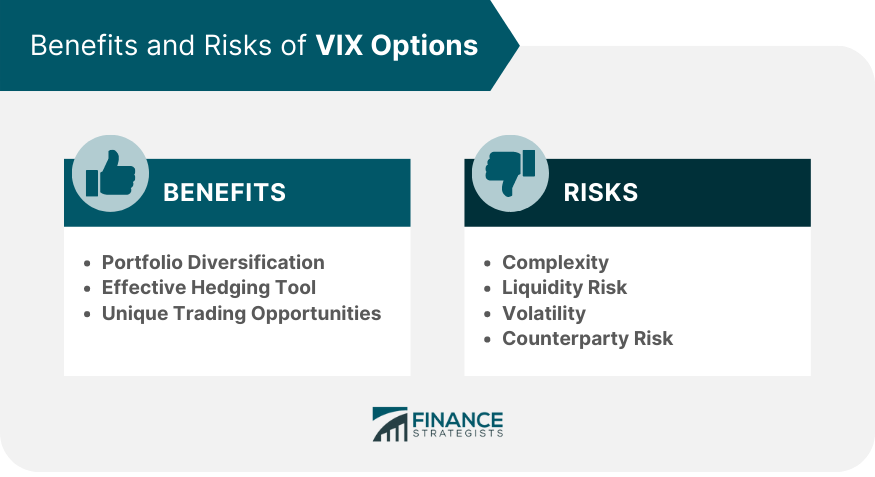

Benefits and Risks of VIX Options

Benefits of VIX Options

Risks Associated With VIX Options

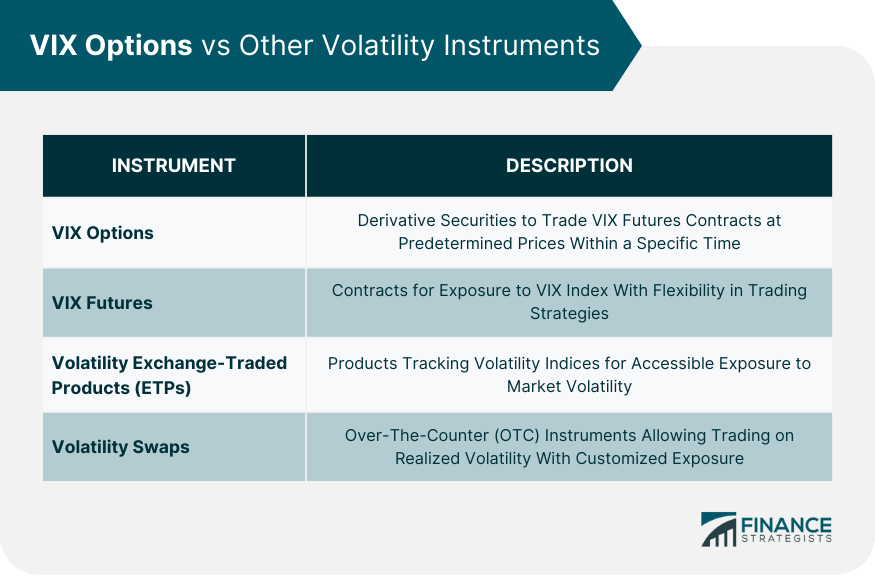

VIX Options vs Other Volatility Instruments

VIX Futures

Volatility Exchange-Traded Products (ETPs)

Volatility Swaps

Conclusion

VIX Options FAQs

VIX options are financial derivatives that allow investors to trade on the implied volatility of the stock market, as represented by the CBOE Volatility Index (VIX). Unlike other financial instruments, VIX options have unique characteristics, such as European-style exercise, cash settlement, and a close relationship with VIX futures.

The pricing of VIX options is influenced by factors such as time to expiration, VIX level, and volatility. VIX options are priced based on the corresponding VIX futures contract rather than the VIX index itself. Traders often use modified versions of the Black-Scholes model to estimate VIX option prices.

The benefits of trading VIX options include portfolio diversification, effective hedging against market volatility, and unique trading opportunities. However, the risks associated with VIX options involve complexity, liquidity risks, potential volatility, and counterparty risk.

Both retail and institutional investors can trade VIX options. Many online brokerages offer access to VIX options trading, enabling individual investors to participate in this market alongside institutional investors such as hedge funds and pension funds.

Several strategies can be employed when trading VIX options, including hedging portfolio risk, speculating on market volatility, calendar spreads, and vertical spreads. These strategies can help investors profit from various market scenarios and manage risk in their investment portfolios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.