The MSCI EAFE Index is a widely recognized benchmark for international equities, representing the performance of large- and mid-cap stocks across developed markets in Europe, Australasia, and the Far East. The index offers investors a comprehensive view of these markets, excluding North America, and serves as a portfolio construction and performance evaluation reference. The MSCI EAFE Index plays a critical role in the global investment landscape, as it allows investors to assess the performance of developed international equity markets and make informed investment decisions. The index helps investors diversify their portfolios beyond domestic markets, identify investment opportunities, and evaluate the performance of investment managers. The MSCI EAFE Index was launched in 1969 by Morgan Stanley Capital International (MSCI), aiming to provide a comprehensive and transparent benchmark for international equity investments. The index has since become an essential tool for global investors, and its constituents and methodology have evolved over time to reflect changes in the investment landscape. The MSCI EAFE Index includes a diverse range of European markets, with countries such as the United Kingdom, France, Germany, and Switzerland among its largest constituents. These countries represent a significant portion of the index's overall market capitalization, offering exposure to various sectors and economic conditions. Australasia is another key component of the MSCI EAFE Index, with countries like Australia and New Zealand providing exposure to developed markets in the Asia-Pacific region. These markets contribute to the index's diversification and offer investment opportunities in sectors such as natural resources, finance, and technology. The Far East component of the MSCI EAFE Index includes developed markets like Japan, Hong Kong, and Singapore. These countries offer investors exposure to the growth and dynamism of the Asian region, with industries such as electronics, manufacturing, and financial services playing a significant role in their economies. Large-cap stocks, or companies with a high market capitalization, represent a significant portion of the MSCI EAFE Index. These companies tend to be well-established and often operate across multiple countries, providing investors with stability and exposure to a variety of industries and sectors. Mid-cap stocks, or companies with a medium market capitalization, also form a part of the MSCI EAFE Index. These companies typically exhibit higher growth potential compared to large-cap stocks, offering investors the opportunity for higher returns while still providing some level of stability and diversification. The MSCI EAFE Index specifically excludes the United States, as it aims to provide investors with exposure to international developed markets outside of North America. Investors looking for exposure to US equities can consider other indices, such as the S&P 500 or the MSCI USA Index. Similarly, the MSCI EAFE Index does not include Canadian equities, as it focuses on markets in Europe, Australasia, and the Far East. Investors seeking exposure to Canadian stocks can explore indices like the S&P/TSX Composite or the MSCI Canada Index. The MSCI EAFE Index employs a selection process based on market capitalization, liquidity, and free float criteria. This process ensures that the index components are representative of the broader market, investable, and easily tradable. The MSCI EAFE Index uses a market capitalization-weighting approach, meaning that each component's weight is determined by its market capitalization relative to the index's total market capitalization. This approach ensures that larger companies have a greater influence on the index's performance than smaller companies. The MSCI EAFE Index undergoes regular rebalancing and reconstitution to ensure it remains representative of the underlying markets. Rebalancing occurs quarterly, while reconstitution, which involves adding or removing components, occurs annually. This process helps maintain the index's accuracy and relevance over time. The MSCI EAFE Small Cap Index is a subset of the MSCI EAFE Index, focusing on small-cap stocks within the same geographic regions. This index offers investors exposure to smaller companies with potentially higher growth potential compared to their large- and mid-cap counterparts. The MSCI EAFE Growth Index is another subset of the MSCI EAFE Index, targeting companies that exhibit strong growth characteristics, such as high earnings growth and return on equity. This index enables investors to focus on growth-oriented stocks within the international developed markets. The MSCI EAFE Value Index is a subset of the MSCI EAFE Index that targets value-oriented stocks within the international developed markets. These stocks typically trade at lower valuations relative to their fundamentals, offering investors the potential for long-term value appreciation. Exchange Traded Funds (ETFs) tracking the MSCI EAFE Index offer investors a straightforward way to gain exposure to international developed markets. These funds seek to replicate the index's performance by holding the same components in the same proportions as the index. Index funds are another passive investment option for investors looking to track the MSCI EAFE Index. These funds are similar to ETFs but are structured as mutual funds, typically with lower trading flexibility but offering automatic reinvestment of dividends and capital gains. Active mutual funds focusing on international developed markets can offer investors the potential for outperformance relative to the MSCI EAFE Index. These funds are managed by professional portfolio managers who make investment decisions based on research and analysis, aiming to generate higher returns than the index. Investors who prefer a more hands-on approach can select individual stocks from the MSCI EAFE Index components. This strategy allows for greater customization and control over portfolio holdings but requires a thorough understanding of the companies and markets involved. Investing in the MSCI EAFE Index exposes investors to geographic and economic risks associated with international developed markets, such as political instability, economic downturns, and regulatory changes. It's essential to understand these risks and monitor developments that could impact portfolio performance. Despite the risks, investing in the MSCI EAFE Index offers diversification benefits by providing exposure to a broad range of international developed markets. This diversification can help reduce portfolio volatility and enhance risk-adjusted returns. The MSCI EAFE Index has exhibited long-term growth since its inception, reflecting the overall expansion and development of international equity markets. However, the index's performance has experienced periods of volatility and fluctuations due to market events and economic cycles. The MSCI EAFE Index's performance has been influenced by key periods and events, such as the dot-com bubble, the global financial crisis, and the European sovereign debt crisis. These events highlight the importance of understanding the factors driving index performance and their potential impact on investment decisions. Comparing the MSCI EAFE Index to the MSCI World Index offers insight into the relative performance of international developed markets versus the broader global equity market. While both indices have experienced growth over time, their performance can diverge due to differences in regional exposure and market conditions. Comparing the MSCI EAFE Index to the S&P 500 sheds light on the performance of international developed markets relative to the US equity market. There have been periods when the MSCI EAFE outperformed the S&P 500 and vice versa, highlighting the potential benefits of diversification and the importance of monitoring market trends. Global economic events, such as recessions, financial crises, and trade disputes, can significantly impact the performance of the MSCI EAFE Index. Investors should stay informed about these events and consider their potential effects on portfolio performance. Currency fluctuations can influence the performance of the MSCI EAFE Index, as the index components are denominated in various currencies. Changes in exchange rates can affect the value of investments in international markets, adding an additional layer of risk and potential return. Political developments, such as changes in government policies, international relations, and geopolitical tensions, can also impact the performance of the MSCI EAFE Index. Investors should monitor these developments and assess their potential implications for their investment strategy. Including the MSCI EAFE Index in a portfolio provides international exposure, helping investors diversify their holdings beyond domestic markets. This exposure can improve portfolio risk-adjusted returns and reduce the impact of country-specific risks. Investing in the MSCI EAFE Index also helps balance regional risks by offering exposure to a wide range of international developed markets. This diversification can mitigate the impact of regional economic downturns and political instability on portfolio performance. When choosing between passive and active management, investors should consider the historical performance of passive investments, such as index funds and ETFs, relative to actively managed funds. While some active managers may outperform the MSCI EAFE Index, passive investments generally offer lower costs and more consistent performance. Passive investments, like index funds and ETFs, typically have lower expense ratios than actively managed funds. This cost advantage can translate into higher net returns for investors, especially over the long term. The MSCI EAFE Index serves as a valuable benchmark for assessing the performance of international developed market investments. By comparing their portfolio's performance to the index, investors can evaluate their investment strategy's effectiveness and make necessary adjustments. Attribution analysis helps investors understand the factors driving their portfolio's performance relative to the MSCI EAFE Index. This analysis can reveal the impact of asset allocation, security selection, and other factors on portfolio returns, enabling investors to refine their investment strategy. The MSCI EAFE Index is a critical tool for global investors, offering insights into the performance of international developed markets. Understanding the index's components, construction, and performance is essential for informed investment decision-making and effective portfolio management. The MSCI EAFE Index plays a vital role in global investing, enabling investors to diversify their portfolios, manage risks, and assess the effectiveness of their investment strategies. By incorporating the MSCI EAFE Index into their investment approach, investors can better navigate the complex world of international investing and enhance their potential for long-term financial success. To fully capitalize on the benefits of the MSCI EAFE Index and build a well-diversified portfolio, consider seeking the guidance of professional wealth management services.What Is MSCI EAFE Index?

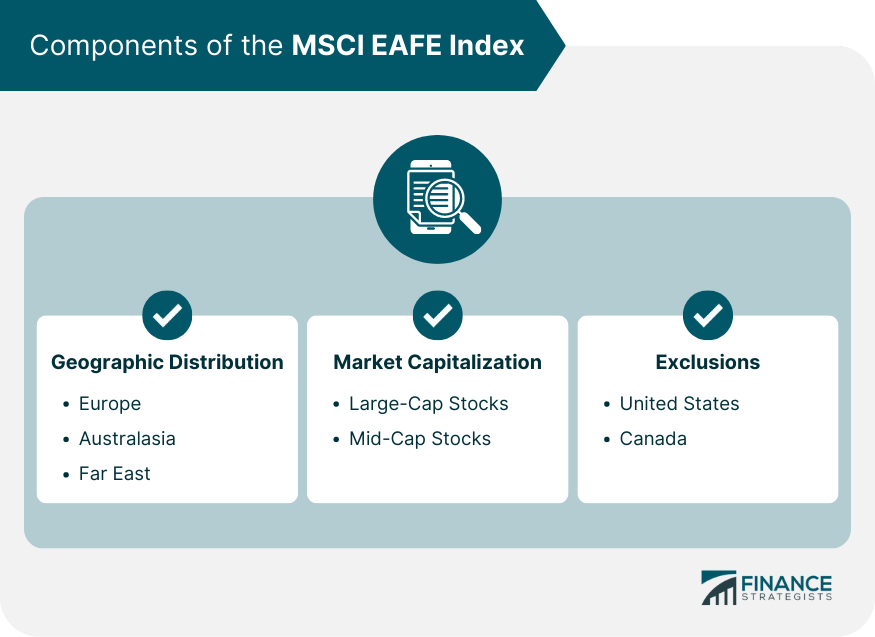

Components of the MSCI EAFE Index

Geographic Distribution

Europe

Australasia

Far East

Market Capitalization

Large-Cap Stocks

Mid-Cap Stocks

Exclusions

United States

Canada

MSCI EAFE Index Construction

Methodology

Selection Criteria

Weighting of Components

Rebalancing and Reconstitution

Benchmark Family

MSCI EAFE Small Cap Index

MSCI EAFE Growth Index

MSCI EAFE Value Index

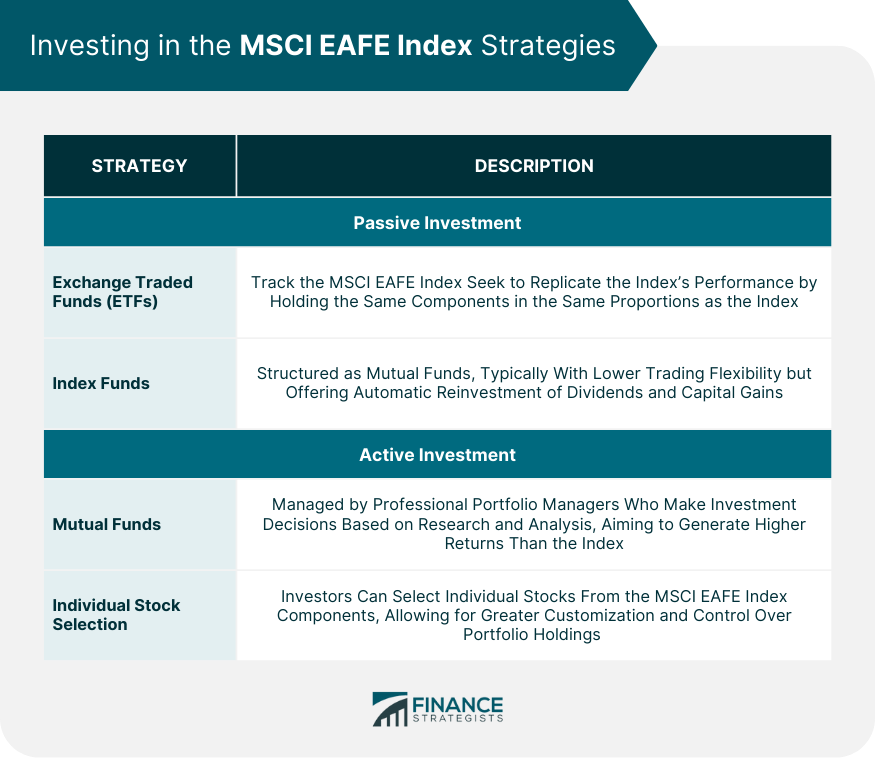

Investing in the MSCI EAFE Index

Passive Investment Strategies

Exchange Traded Funds (ETFs)

Index Funds

Active Investment Strategies

Mutual Funds

Individual Stock Selection

Risks and Rewards

Geographic and Economic Risks

Diversification Benefits

Performance of the MSCI EAFE Index

Historical Performance

Long-Term Trends

Key Periods and Events

Performance Comparison

MSCI EAFE vs MSCI World Index

MSCI EAFE vs S&P 500

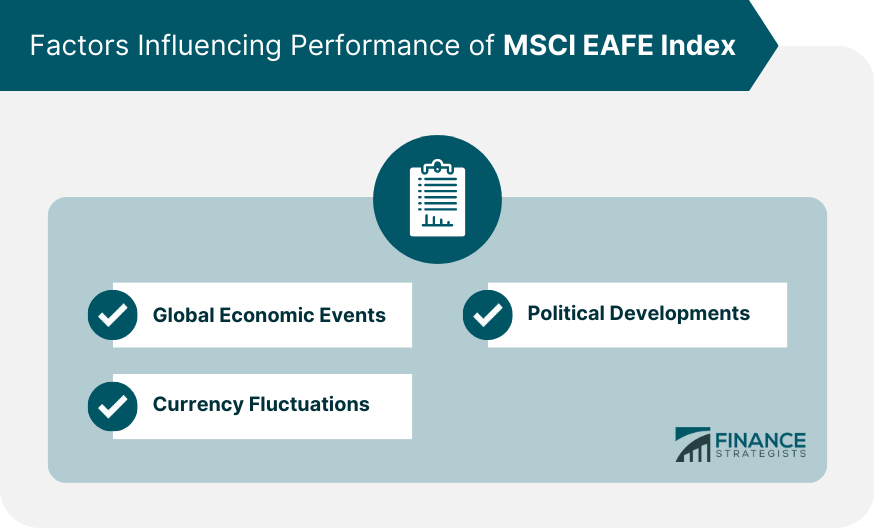

Factors Influencing Performance of MSCI EAFE Index

Global Economic Events

Currency Fluctuations

Political Developments

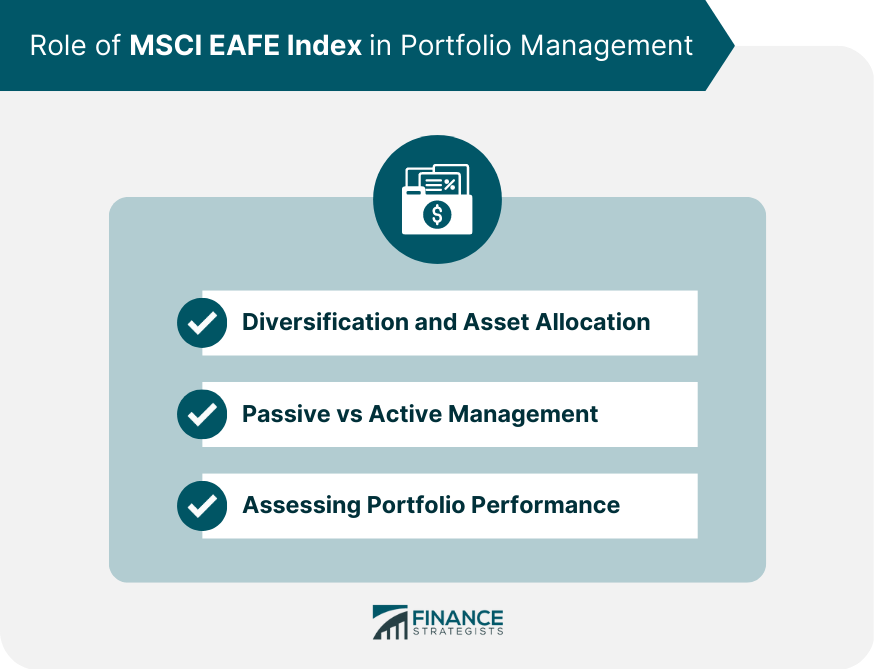

Role of MSCI EAFE Index in Portfolio Management

Diversification and Asset Allocation

International Exposure

Balancing Regional Risks

Passive vs Active Management

Performance Comparison

Cost Considerations

Assessing Portfolio Performance

Benchmarking

Attribution Analysis

Final Thoughts

MSCI EAFE Index FAQs

The MSCI EAFE Index is a widely followed benchmark that represents the performance of large- and mid-cap stocks in developed markets across Europe, Australasia, and the Far East, excluding the United States and Canada. It is important for investors as it provides a means to gain exposure to international equities, helping them diversify their portfolios and manage risks.

The MSCI EAFE Index is constructed using a market capitalization-weighted methodology, meaning that each component's weight is determined by its market capitalization relative to the total market capitalization of the index. The index undergoes regular rebalancing and annual reconstitution to ensure it remains representative of the underlying markets.

Investors can gain exposure to the MSCI EAFE Index through passive investment strategies, such as Exchange Traded Funds (ETFs) and index funds, which aim to replicate the index's performance. Alternatively, they can opt for actively managed mutual funds or individual stock selection focused on international developed markets.

The MSCI EAFE Index provides a narrower focus on international developed markets, whereas the MSCI World Index covers both developed and emerging markets worldwide, and the S&P 500 focuses on the US equity market. Comparing the performance of the MSCI EAFE Index to these indices can help investors understand the relative performance of international developed markets and the potential benefits of diversification.

The MSCI EAFE Index serves as a valuable tool for portfolio management by providing diversification through international exposure and balancing regional risks. It can also be used as a benchmark for assessing the performance of international developed market investments and conducting attribution analysis to evaluate the effectiveness of investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.