Risk propensity refers to an individual's or organization's inclination or willingness to take on risks. It is a measure of the level of comfort or preference for uncertain outcomes. People or entities with high-risk propensity are more likely to engage in activities or make decisions that involve higher levels of risk. On the other hand, individuals or organizations with low-risk propensity tend to be more risk-averse and prefer safer options with predictable outcomes. Risk propensity can be influenced by various factors such as personal traits, past experiences, financial situations, and cultural backgrounds. Understanding and assessing risk propensity is crucial in financial management and decision-making processes, as it helps determine the appropriate level of risk tolerance and guides the allocation of resources. By considering risk propensity, individuals and organizations can make informed choices that align with their risk preferences and overall objectives. Traditionally, financial advisors have assessed risk propensity through questionnaires and interviews. These methods seek to understand an investor's financial goals, tolerance for potential loss, and time horizon for investment. These factors are then used to categorize investors into risk profiles, such as conservative, moderate, or aggressive. Behavioral finance has revolutionized the way to understand and assess risk propensity. It takes into consideration cognitive biases and emotional tendencies that can influence financial decision-making. By integrating behavioral finance into risk assessment, financial advisors can gain a deeper understanding of an investor's true risk propensity beyond what's revealed through traditional methods. The Risk Propensity Score is a numerical representation of an investor's willingness to take financial risks. It's derived from a combination of quantitative and qualitative assessments, including financial questionnaires and behavioral analyses. This score provides a more comprehensive view of an investor's risk-taking tendencies, enabling more accurate portfolio construction. Psychological assessment tools play a crucial role in evaluating risk propensity. These tools include psychometric tests, questionnaires, and interviews that assess an individual's emotional response to risk and loss. The insights gained from these tools can help advisors understand a client's true risk propensity beyond mere financial capability. Financial risk assessment tools are used to quantify an investor's risk propensity. These tools may include risk propensity scoring systems, portfolio simulation tools, and software that uses machine learning algorithms to assess risk propensity based on historical financial data and behavior. Risk propensity refers to an individual's willingness to take risks, influenced by factors like personality and experiences. Risk tolerance, however, measures the amount of risk a person can handle before it becomes unbearable, dependent on elements like financial standing and age. Risk propensity directly influences risk-taking decisions, such as starting a business or investing in volatile markets. On the other hand, risk tolerance is about managing potential losses, guiding toward more conservative decisions when tolerance is low. Risk propensity assessment involves subjective measures like personality tests and behavioral analysis and can change over time. Risk tolerance assessment, however, is more objective and involves financial analysis or life-stage considerations. In financial planning, understanding risk propensity helps tailor investment strategies to clients' comfort with risk-taking, while assessing risk tolerance ensures the proposed strategies won't jeopardize the clients' financial stability or future obligations. A balanced approach optimizes a financial plan. Risk propensity is a key factor in determining an investor's risk profile. The risk profile is a classification that reflects an investor's willingness to risk losing some or all the original investment in exchange for higher potential returns. The higher the risk propensity, the more aggressive the risk profile is likely to be. The risk profile directly impacts investment decisions. A conservative profile may lead to an investment strategy focused on bonds and large-cap equities. In contrast, an aggressive profile might involve a significant allocation to small-cap equities, emerging markets, and alternative investments. The risk profile guides the asset allocation in the investment portfolio, balancing potential returns with acceptable risk. Effective communication about risk propensity is a cornerstone of a successful client-advisor relationship. Advisors must ensure that clients understand the concept of risk propensity and its implications for their investment strategy. Similarly, clients must feel comfortable discussing their risk-related feelings and concerns. Advisors must align a client's risk propensity with their financial goals. This alignment ensures that the client is comfortable with the investment strategy and understands the potential outcomes, both positive and negative. The client's risk propensity should guide the selection of investments, but always within the context of their overall financial goals. Advisors must be able to advise clients with different levels of risk propensity. For risk-averse clients, the focus may be on preserving capital and generating consistent returns. For clients with a high-risk propensity, the focus may be on capital growth and potentially higher returns, despite the greater risk. Risk propensity is a fundamental concept in wealth management that represents an individual's inherent tendency to take risks, particularly in financial decision-making and investing. Assessing risk propensity is crucial for financial advisors in order to create investment strategies that align with their client's preferences and comfort levels regarding risk-taking. A combination of traditional methods, such as questionnaires and interviews, as well as modern approaches like behavioral finance techniques and risk propensity scoring systems, are employed to gauge a client's risk propensity accurately. Utilizing various tools, including psychological assessment instruments and financial risk assessment technologies, enables advisors to gain deeper insights into their clients' true risk-taking tendencies. By understanding and effectively evaluating risk propensity, financial advisors can better serve their clients, fostering strong client-advisor relationships and ultimately guiding investors toward achieving their financial goals.Definition of Risk Propensity

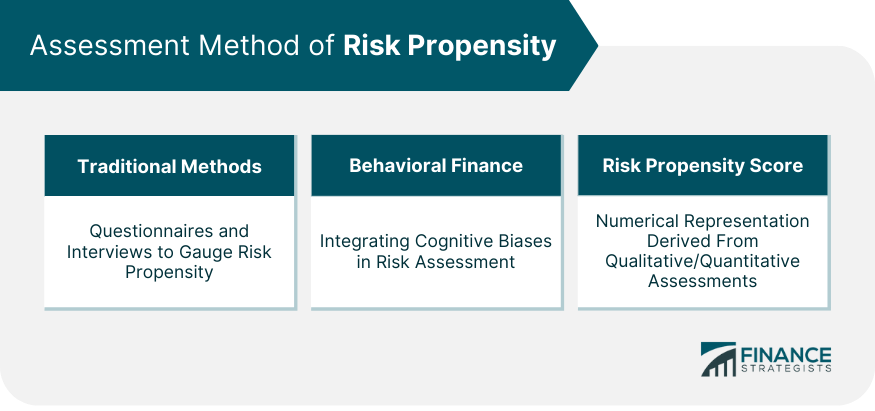

Methods of Assessment of Risk Propensity

Traditional Methods

Behavioral Finance

Risk Propensity Score

Tools for Evaluating Risk Propensity

Psychological Assessment Tools

Financial Risk Assessment Tools

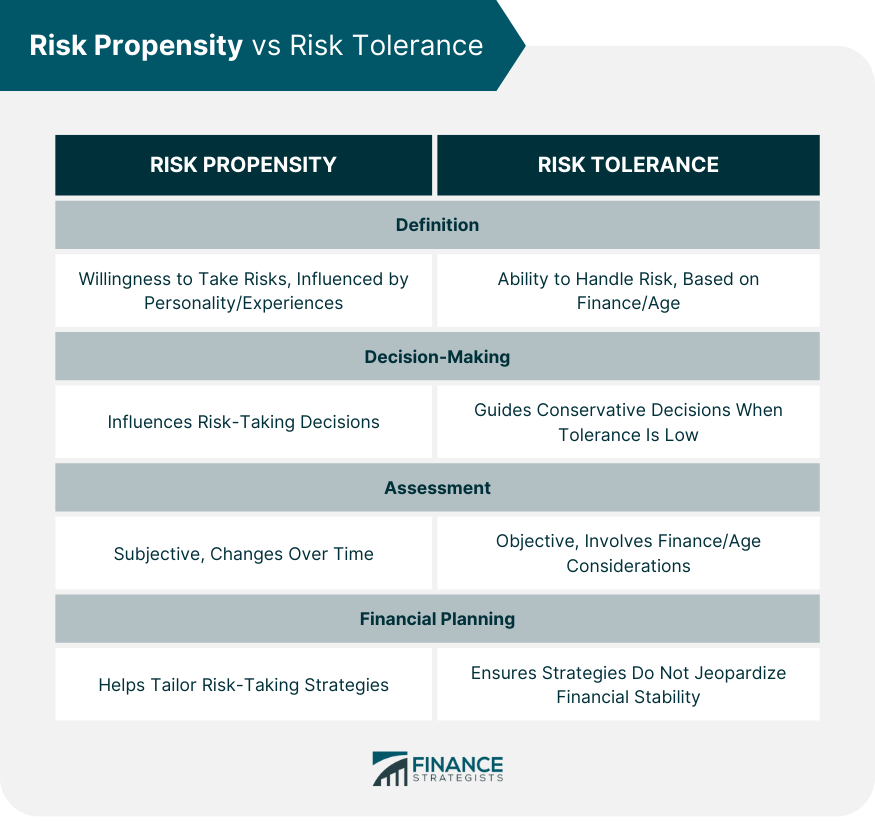

Risk Propensity vs Risk Tolerance

Definition

Decision-Making Implications

Assessment

Implications for Financial Planning

Risk Propensity and Risk Profile

How Risk Propensity Influences Risk Profile

Impact of Risk Profile on Investment Decisions

Role of Risk Propensity in Client-Advisor Relationships

Communication About Risk Propensity

Aligning Risk Propensity With Financial Goals

Advising Clients With Different Levels of Risk Propensity

Bottom Line

Risk Propensity FAQs

Risk propensity refers to an individual's inherent or natural inclination to take risks. It is a crucial concept in finance and wealth management.

Risk propensity is assessed through a combination of traditional methods like questionnaires and interviews and modern approaches such as behavioral finance techniques and risk propensity scoring systems.

Risk propensity is the natural inclination to take risks, while risk tolerance refers to the amount of risk one can handle without undue stress or anxiety.

Risk propensity is a key factor in determining an investor's risk profile, which reflects their willingness to risk losing some or all of their original investment in exchange for higher potential returns.

Risk propensity plays a crucial role in client-advisor relationships as it guides effective communication, aligns investment strategies with financial goals, and allows advisors to cater to clients with different risk propensities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.