Risk-neutral measures, sometimes referred to as equivalent martingale measures, are a pivotal concept in the field of mathematical finance. These measures stem from the idea that under certain market assumptions, the expected return on a risky asset is equivalent to the risk-free rate. In a risk-neutral world, all investors are indifferent to risk, which simplifies the pricing of financial derivatives and the assessment of risk in financial markets. Risk-neutral measures provide a useful perspective for financial analysts and wealth managers. They offer a theoretical framework for pricing derivatives, managing portfolios, and assessing risk. By negating the risk preferences of individual investors, these measures focus solely on the potential rewards of a financial instrument, thereby enabling more objective decision-making in investment strategies. A risk profile is an evaluation of an individual's willingness and capacity to take on risk in their investments. It is a crucial component of wealth management and investment planning, helping to determine the appropriate strategy and asset allocation for an investor. Risk-neutral measures provide an important tool in aligning investment strategies with the risk profiles of investors. They provide a benchmark for understanding the inherent risks and potential returns of different assets, devoid of subjective risk preferences. By doing so, they help to align investment decisions with an investor's risk tolerance and investment goals. By evaluating the potential rewards of investments under a risk-neutral measure, investors and wealth managers can make more informed decisions about adjusting a risk profile. If an investment's risk-neutral evaluation suggests higher potential returns than initially anticipated, an investor might consider adjusting their risk profile to accommodate these potential gains. Probability plays a key role in financial markets, informing decisions about investment and risk management. In the context of risk-neutral measures, probability is used to evaluate the likelihood of different outcomes for a given financial instrument, ignoring the risk preferences of individual investors. Risk-neutral probability is applied in wealth management to optimize investment strategies and manage risk. By using this concept, wealth managers can make more objective decisions about asset allocation and portfolio construction, aligning these strategies with the risk tolerance and investment goals of their clients. The risk-neutral world is a theoretical construct in which all investors are indifferent to risk. In this world, the expected return on a risky asset equals the risk-free rate. However, the real world is filled with risk-averse and risk-seeking investors. Recognizing this difference is crucial in translating the insights gained from risk-neutral analysis into practical wealth management strategies. Financial derivatives are financial instruments whose value is derived from an underlying asset. These include options, futures, and swaps. They are primarily used for hedging risk or speculating on future price movements. Risk-neutral measures are central to the pricing of financial derivatives. They allow for the calculation of the expected payoff of a derivative under the risk-neutral measure, which equals the derivative's market price. This pricing mechanism disregards the subjective risk preferences of individual investors, providing a more objective and universally applicable pricing model. Understanding the risk-neutral pricing of derivatives is crucial for wealth managers. It helps them to assess the value and risk associated with derivatives, informing decisions about their inclusion in an investment portfolio. This understanding can also aid in risk management, as derivatives can be used to hedge against potential losses in other investment positions. The expected return is a key concept in finance, representing the potential profit or loss an investor might expect from an investment over a given period. It's calculated by multiplying the potential outcomes by their probabilities and summing these products. In a risk-neutral world, the expected return on a risky asset is the risk-free rate, as all risk is disregarded. This offers a simplified approach to calculating expected return, focusing solely on the potential rewards of an investment. By using risk-neutral measures to calculate expected returns, investors and wealth managers can gain a clearer understanding of the potential rewards of an investment. This information can be used to align investment strategies with risk profiles, informing decisions about asset allocation and risk management. Portfolio construction involves selecting a mix of investments that align with an investor's risk profile and investment goals. Diversification is a key strategy in portfolio construction, aiming to spread risk across different assets and asset classes to reduce potential losses. Risk-neutral measures can be used in portfolio optimization to evaluate the potential rewards of different assets and asset combinations. By disregarding individual risk preferences, they provide a more objective basis for portfolio construction and diversification decisions. Incorporating risk-neutral measures into wealth management strategies can enhance decision-making in portfolio construction and risk management. They provide a robust framework for evaluating the potential rewards of different investments, informing decisions about asset allocation, diversification, and risk mitigation. Risk management strategies aim to identify, assess, and mitigate the risks associated with investment activities. They are crucial in preserving wealth and achieving investment goals. Risk-neutral measures provide a tool for assessing the inherent risks and potential rewards of different investments. By disregarding individual risk preferences, they offer a more objective basis for risk assessment and mitigation decisions. Using risk-neutral measures in risk management can contribute to wealth preservation. By providing a more objective assessment of risk, they can inform more effective risk mitigation strategies, helping to protect against potential losses. They will offer wealth managers more sophisticated tools for evaluating investment opportunities and managing risk, potentially leading to more effective wealth management strategies. Risk-neutral measures are pivotal tools in financial mathematics, enabling the pricing of derivatives and risk assessment under the assumption of risk indifference. These measures hold paramount importance in facilitating objective decision-making in investment strategies, negating individual risk preferences. They play a key role in risk profiling, aiding in aligning investment strategies with an individual's risk tolerance and goals. Moreover, the application of risk-neutral measures extends to understanding probabilities in financial markets, pricing financial derivatives, and portfolio management. By providing a benchmark for understanding the inherent risks and potential returns of various assets, risk-neutral measures greatly enhance the capacity to construct and diversify investment portfolios effectively. Ultimately, the power of risk-neutral measures lies in their capacity to illuminate the complexities of financial markets, driving more informed and strategic wealth management.Definition of Risk-Neutral Measures

Risk-Neutral Measures and Risk Profiling

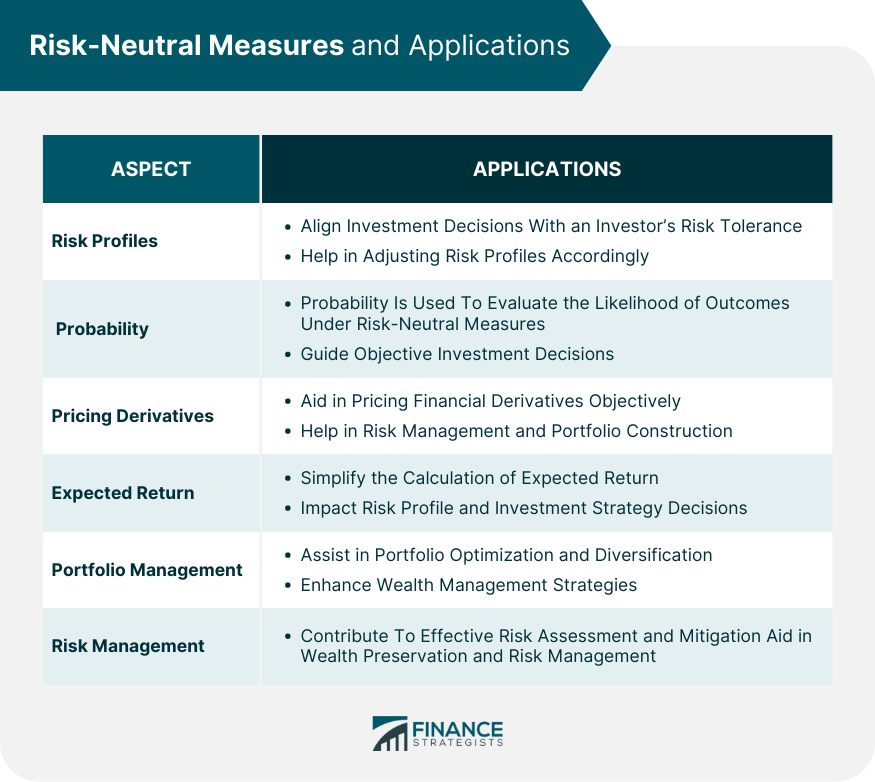

Understanding Risk Profile

How Risk-Neutral Measures Align With Different Risk Profiles

Adjusting Risk Profile Based on Risk-Neutral Measures

Risk-Neutral Measures and Probability

Concept of Probability in Financial Markets

Applying Risk-Neutral Probability in Wealth Management

Understanding the Risk-Neutral World and the Real World

Risk-Neutral Measures in Pricing Financial Derivatives

Concept of Financial Derivatives

Role of Risk-Neutral Measures in Pricing Derivatives

Implications for Wealth Management

Risk-Neutral Measures and Expected Return

Understanding Expected Return

Role of Risk-Neutral Measures in Calculating Expected Return

Implications for Risk Profile and Investment Strategy

Risk-Neutral Measures in Portfolio Management

Portfolio Construction and Diversification

Use of Risk-Neutral Measures in Portfolio Optimization

Impact on Wealth Management Strategy

Risk-Neutral Measures in Risk Management

Risk Management Strategies

Role of Risk-Neutral Measures in Risk Assessment and Mitigation

Ensuring Wealth Preservation Through Effective Risk Management

Bottom Line

Risk-Neutral Measures FAQs

Risk-neutral measures are theoretical constructs used in financial mathematics to price derivatives and assess risk, assuming all investors are indifferent to risk.

Risk-neutral measures provide an objective benchmark for understanding the inherent risks and potential returns of different assets, helping wealth managers align investment decisions with an investor's risk tolerance and investment goals.

Risk-neutral measures allow for the calculation of the expected payoff of a derivative under the risk-neutral measure, which equals the derivative's market price.

Risk-neutral measures can be used to evaluate the potential rewards of different assets and asset combinations, providing a more objective basis for portfolio construction and diversification decisions.

The future of risk-neutral measures lies in the evolution of financial theory and technological advances, like machine learning, potentially leading to more effective wealth management strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.