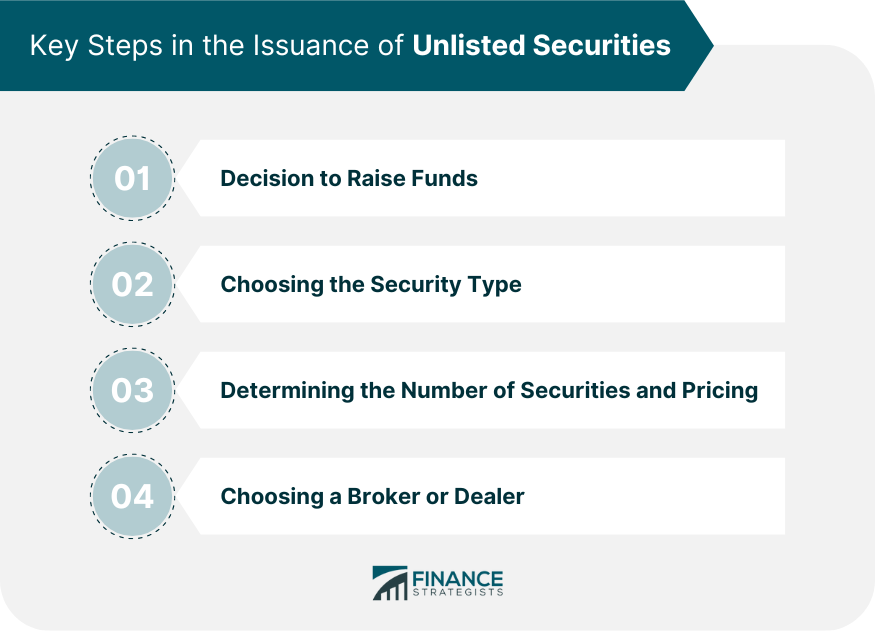

Unlisted security refers to a financial instrument, such as shares, bonds, or derivatives, that does not trade on a formal, organized exchange like the New York Stock Exchange or Nasdaq. These instruments derive their name because they do not meet specific listing requirements set forth by these exchanges. While listed securities are publicly traded on organized exchanges and come with stringent regulatory oversight and disclosure requirements, unlisted securities are traded privately, often over-the-counter (OTC). This trading method can afford the issuing companies and investors more privacy but typically entails less regulatory oversight. By grasping the concept of unlisted securities, you open doors to unique investment avenues, offering distinct opportunities and enhanced privacy. The process of issuing unlisted securities usually unfolds through a series of predefined steps: 1. Decision to Raise Funds: The first step in issuing unlisted securities is a company's decision to raise funds. This decision is typically motivated by the company's desire to finance growth initiatives, research, development, debt repayment, or other corporate activities. 2. Choosing the Security Type: Once the decision to raise funds is made, the company selects the type of unlisted security it wants to issue. This could be shares, bonds, or derivatives, depending on the company's strategy and the investor appetite in the market. 3. Determining the Number of Securities and Pricing: The company then decides on the number of securities to be issued. The price per unit is also determined at this stage. This might be influenced by several factors, including the company's valuation, the nature of the security, market conditions, and funding requirements. 1. Choosing a Broker or Dealer: The final step in the issuance process is choosing a broker or dealer to handle the transactions. This is a critical part of the process as these intermediaries facilitate the securities trading between the company and investors. Intermediaries play a critical role in the issuance of unlisted securities. They bridge the gap between the issuers of the securities and the investors. Their roles can be broadly classified as follows: 1. Connecting Buyers and Sellers: Broker-dealers are the key intermediaries in the trading of unlisted securities. They connect buyers and sellers and facilitate transactions between them. 2. Ensuring Compliance: Intermediaries also ensure that transactions comply with relevant legal and financial regulations. This is important because it protects investors and helps maintain the integrity of the financial markets. One of the most common types of unlisted securities is private company shares. Unlike public companies, the shares of private companies are not listed on public exchanges. Venture capitalists, private equity firms, and accredited individual investors often buy these shares. Although most government bonds are listed, some types can be unlisted securities, especially those issued by local or municipal entities. These bonds offer a way for governments to raise funds directly from investors without the regulatory scrutiny associated with listing on a formal exchange. Over-the-counter derivatives, including swaps, options, and exotic derivatives, are often unlisted. These financial contracts are traded directly between two parties without an exchange. The OTC market is the primary trading venue for unlisted securities. It comprises a network of broker-dealers who negotiate directly with one another over computer networks and by phone. Dealers and brokers are integral to the OTC market. Dealers trade on their accounts, while brokers are intermediaries between buyers and sellers. They facilitate transactions, provide liquidity, and help maintain a fair and orderly market. Unlisted securities markets tend to be less liquid than their listed counterparts. This can result in larger spreads between bid and ask prices and higher price volatility. 1. Diversification: Unlisted securities can provide investment diversification, potentially reducing portfolio risk. 2. Potential for higher returns: Some unlisted securities, particularly shares in private companies, may offer substantial returns if the company succeeds. 1. Lack of liquidity: Unlisted securities can be harder to sell, especially during market stress. 2. Limited information: Issuers of unlisted securities are not subject to the same disclosure requirements as listed companies, making it more difficult for investors to assess the investment's risk. Thorough research and due diligence are key for anyone considering an investment in unlisted securities. This includes understanding the issuer's business model, reviewing their financial statements and other available documents, and potentially consulting with financial advisors or legal professionals. Acquiring unlisted securities often involves direct transactions with the issuer or through broker-dealers in the OTC market. The process generally involves negotiation on the price, quantity, and terms of the securities. Investing in unlisted securities should be approached with consideration for portfolio balance and diversification. While they can offer unique opportunities, these securities also bring additional risks and should thus form a proportionate part of a balanced investment portfolio. Although unlisted securities are not subject to the same level of regulation as listed ones, the SEC still oversees this area to some extent. For instance, issuers of unlisted securities must submit certain disclosures if they have more than a specified number of shareholders. Other regulatory bodies, such as the Financial Industry Regulatory Authority (FINRA), also play a role in the oversight of unlisted securities, primarily by enforcing rules for broker-dealers involved in the OTC market. Regulation of unlisted securities varies globally. Some countries have more robust regulations to protect investors, while others may offer greater leeway to companies issuing these securities. Unlisted securities span various industries and sectors, providing diverse investment opportunities for discerning investors. Let's explore the presence of these securities in three key sectors: technology, energy, and real estate. The technology sector often harbors many unlisted securities, especially among startups and growth-stage companies yet to go public. Investing in these unlisted securities can offer a lucrative opportunity for investors, given the high growth potential of tech startups. However, it's also worth noting that this sector is marked by rapid changes and high competition, making it essential for investors to carry out comprehensive due diligence before investing. Unlisted securities also have a notable presence in the energy sector. They may include shares in private oil, gas, or renewable energy companies and bonds issued by such entities. These securities offer a unique opportunity for investors to contribute to and benefit from the growth of private companies in the energy sector, which could be focused on anything from traditional oil and gas exploration to innovative renewable energy technologies. Real estate investment trusts (REITs) often issue unlisted securities. REITs own, operate, or finance income-generating real estate and their unlisted securities enable individual investors to invest in large-scale, income-producing real estate. This opens the door for individual investors to be part of substantial real estate projects that would otherwise be beyond their reach. Unlisted securities may be suitable for sophisticated investors who understand their additional risks and have a higher tolerance for potential losses. They might not be suitable for conservative investors seeking steady income and preservation of capital. Investments in unlisted securities can have unique tax implications. For example, in some jurisdictions, losses from investments in certain unlisted securities can offset other income, reducing the investor's overall tax liability. Unlisted securities, not traded on formal exchanges, present unique investment opportunities with additional risks. These risks include low liquidity, limited information, and less regulation. They encompass various types, like private company shares, government bonds, and over-the-counter derivatives traded in the over-the-counter market. Successful investment in unlisted securities requires thorough research, due diligence, and portfolio balance and diversification consideration. Tax implications and regulatory variations across jurisdictions should also be taken into account. While investing in unlisted securities can be complex, it can be rewarding with professional guidance. Seeking a wealth manager's expertise and advice is crucial for navigating this asset class effectively. They assess risk tolerance, financial goals, and investment options, help devise a suitable strategy, and monitor portfolio performance. Engaging a wealth manager enables individuals to unlock the potential of unlisted securities, making informed decisions and maximizing their investment objectives. What Is an Unlisted Security?

Process of Issuing Unlisted Securities

Key Steps in the Issuance

Roles of Intermediaries

Types of Unlisted Securities

Private Company Shares

Government Bonds

Over-The-Counter Derivatives

Understanding the Market for Unlisted Securities

Role of the Over-The-Counter Market

Role of Dealers and Brokers

Volatility and Liquidity in the Unlisted Security Market

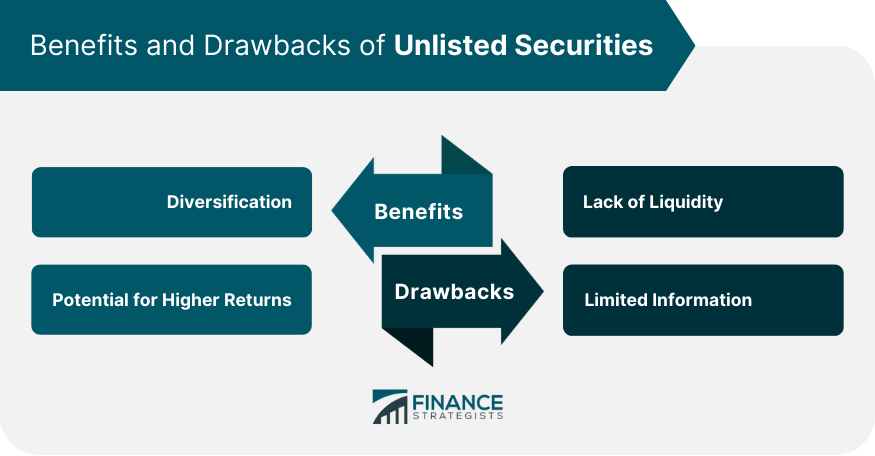

Benefits and Drawbacks of Unlisted Securities

Potential Advantages

Potential Risks

Process of Investing in Unlisted Securities

Research and Due Diligence

Process of Acquisition

Portfolio Considerations and Diversification

Legal and Regulatory Framework for Unlisted Securities

Securities and Exchange Commission (SEC) Role and Regulations

Other Regulatory Bodies and Their Role

Global Regulatory Variations

Unlisted Securities in Various Sectors

Technology

Energy

Real Estate

Unlisted Securities and Financial Planning

Suitability for Different Investor Profiles

Impact on Tax Planning

Takeaway

Unlisted Security FAQs

An unlisted security is a financial instrument, such as shares, bonds, or derivatives, that does not trade on a formal, organized exchange.

Investments in unlisted securities are typically made directly through the issuer or via broker-dealers operating in the OTC market.

Risks of investing in unlisted securities include lack of liquidity, limited availability of information, and less regulatory oversight.

While unlisted securities, particularly those issued by private companies, have the potential to offer high returns, they also carry a higher level of risk compared to listed securities.

Unlisted securities typically suit sophisticated investors who can understand and tolerate the associated risks. They may be unsuitable for conservative investors seeking steady income and capital preservation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.