The liquidity risk premium is the additional return that investors demand holding assets with lower liquidity or higher trading costs. It compensates investors for the risk associated with the difficulty in buying or selling an asset quickly and at a fair price. The liquidity risk premium is an essential concept in finance, as it influences the pricing of assets and portfolio management decisions. The liquidity risk premium plays a crucial role in financial markets by impacting asset valuations, investment decisions, and the overall functioning of financial markets. Understanding the liquidity risk premium helps investors make informed decisions and manage the risks associated with their investment portfolios. A higher trading volume generally leads to a lower liquidity risk premium, as it is easier to buy or sell assets in a liquid market without significantly impacting the asset's price. Market depth refers to the number of orders available at different price levels in a market. A market with greater depth usually has a lower liquidity risk premium, as it can absorb larger trade sizes without causing significant price changes. Assets with larger market capitalizations typically have lower liquidity risk premiums, as they tend to have higher trading volumes and are more easily traded in the market. Assets with lower credit ratings often have higher liquidity risk premiums because they are considered riskier and may have lower trading volumes, making it more difficult to buy or sell the assets. In fixed-income markets, securities with longer maturities tend to have higher liquidity risk premiums due to their increased sensitivity to interest rate changes and lower trading volumes. During periods of economic uncertainty or financial stress, investors may demand higher liquidity risk premiums for holding less liquid assets, as the overall market liquidity may decline. Market sentiment can influence the liquidity risk premium, with periods of heightened market uncertainty or pessimism leading to higher premiums as investors seek more liquid assets. The bid-ask spread, the difference between the prices at which an asset can be bought and sold, is a common measure of liquidity risk premium. Wider bid-ask spreads indicate higher trading costs and higher liquidity risk premiums. In fixed-income markets, the difference in yields between a less liquid security and a more liquid benchmark security (e.g., a government bond) can be used as a measure of the liquidity risk premium. The price impact, the change in an asset's price due to a given trade size, can be used to measure the liquidity risk premium. Higher price impacts indicate lower liquidity and higher liquidity risk premiums. Higher price volatility can be indicative of higher liquidity risk premiums, as less liquid assets may experience larger price swings due to changes in supply and demand. The LCAPM extends the traditional Capital Asset Pricing Model (CAPM) by incorporating a liquidity risk premium into the calculation of expected returns, allowing for the estimation of the liquidity risk premium for individual assets. Amihud's illiquidity measure calculates the average price impact per unit of trading volume, providing a measure of the liquidity risk premium based on price changes and trading volumes. Corporate bonds typically exhibit higher liquidity risk premiums compared to government bonds due to their lower trading volumes, credit risk, and varying maturities. Government bonds generally have lower liquidity risk premiums, as they are considered safer investments and often have higher trading volumes. However, bonds from countries with higher credit risk or less developed financial markets may still have elevated liquidity risk premiums. Equities can exhibit varying levels of liquidity risk premiums depending on factors such as market capitalization, trading volume, and industry sector. Generally, small-cap stocks and those with lower trading volumes have higher liquidity risk premiums. Real estate investments, particularly those in illiquid markets or involving non-tradable assets, can have significant liquidity risk premiums due to the high transaction costs and the time required to buy or sell properties. Alternative investments, such as private equity, hedge funds, and other illiquid assets, often have higher liquidity risk premiums due to their unique investment structures, limited trading opportunities, and the potential for higher transaction costs. Diversifying a portfolio across asset classes, sectors, and geographies can help manage liquidity risk premiums by reducing the impact of any single illiquid asset on the portfolio's overall performance. Incorporating liquidity risk premiums into risk-adjusted return calculations can help investors make more informed investment decisions by accounting for the additional risk associated with less liquid assets. Understanding the liquidity risk premiums associated with various asset classes and individual assets can help investors optimize their asset allocation to achieve their desired risk-return profile while managing the potential impact of liquidity risk. The liquidity risk premium is a vital concept for investors and market participants, as it influences asset valuations, investment decisions, and overall market functioning. By understanding the factors affecting liquidity risk premiums, such as market liquidity, asset characteristics, and macroeconomic conditions, investors can better manage the risks associated with their portfolios. Measuring liquidity risk premiums using spread-based, price-based, and model-based measures can provide valuable insights for asset allocation and portfolio management decisions. Recognizing the role of liquidity risk premiums in different asset classes and their impact on portfolio management can help investors optimize their investment strategies and achieve their financial goals.Definition of Liquidity Risk Premium

Importance of Liquidity Risk Premium in Financial Markets

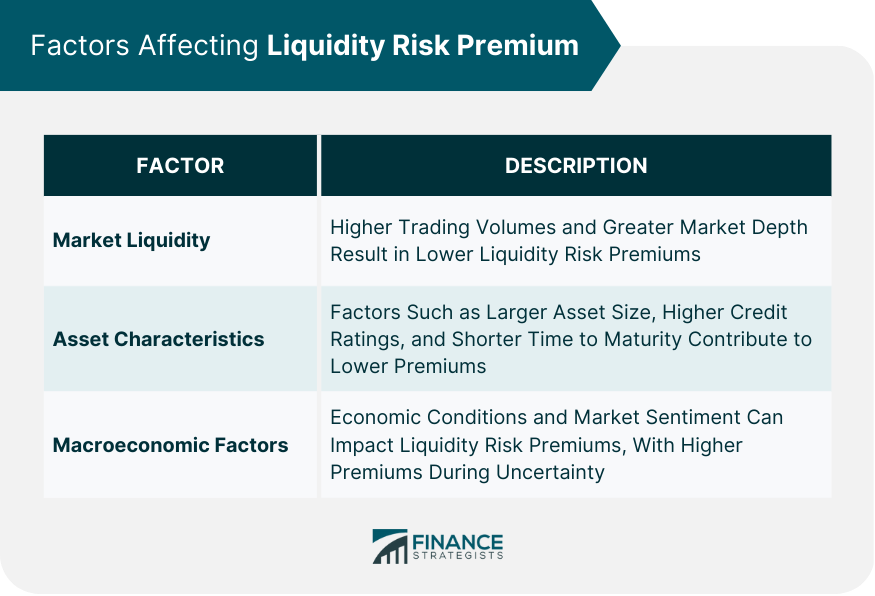

Factors Affecting Liquidity Risk Premium

Market Liquidity

Trading Volume

Market Depth

Asset Characteristics

Asset Size

Credit Rating

Time to Maturity

Macroeconomic Factors

Economic Conditions

Market Sentiment

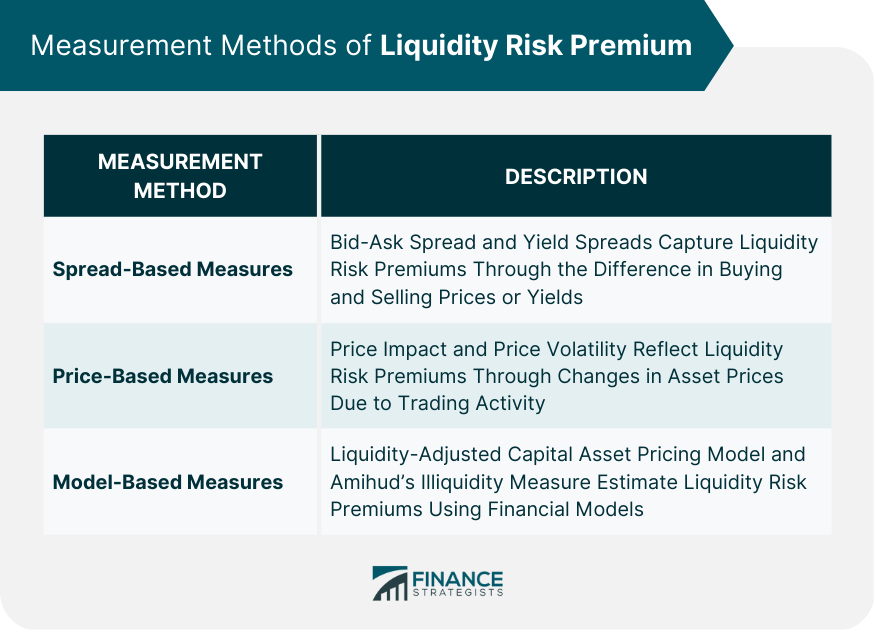

Measuring Liquidity Risk Premium

Spread-Based Measures

Bid-Ask Spread

Yield Spreads

Price-Based Measures

Price Impact

Price Volatility

Model-Based Measures

Liquidity-Adjusted Capital Asset Pricing Model (LCAPM)

Amihud's Illiquidity Measure

Liquidity Risk Premium in Different Asset Classes

Fixed Income Securities

Corporate Bonds

Government Bonds

Equities

Real Estate

Alternative Investments

Role of Liquidity Risk Premium in Portfolio Management

Diversification and Liquidity Risk Premium

Risk-Adjusted Returns

Asset Allocation and Liquidity Risk Premium

The Bottom Line

Liquidity Risk Premium FAQs

The liquidity risk premium is the additional return that investors demand for holding less liquid or more difficult-to-trade assets. It is important for investors because it influences asset pricing, investment decisions, and portfolio management strategies.

The liquidity risk premium can be affected by various factors, including market liquidity (trading volume and market depth), asset characteristics (asset size, credit rating, and time to maturity), and macroeconomic factors (economic conditions and market sentiment).

Investors can measure the liquidity risk premium using spread-based measures (bid-ask spread and yield spreads), price-based measures (price impact and price volatility), and model-based measures (liquidity-adjusted Capital Asset Pricing Model and Amihud's Illiquidity Measure).

The liquidity risk premium can vary across different asset classes, such as fixed income securities (corporate and government bonds), equities, real estate, and alternative investments. Generally, less liquid assets or those with higher trading costs exhibit higher liquidity risk premiums.

Understanding the liquidity risk premium can help investors optimize their asset allocation, manage risk-adjusted returns, and diversify their portfolios to reduce the impact of illiquid assets on overall performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.