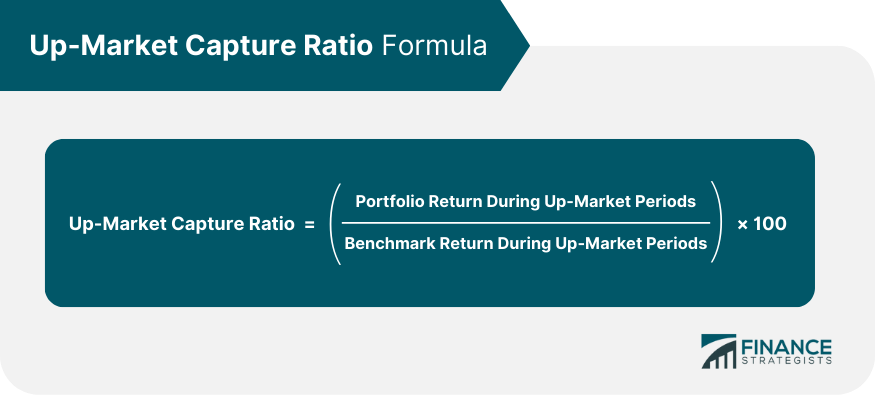

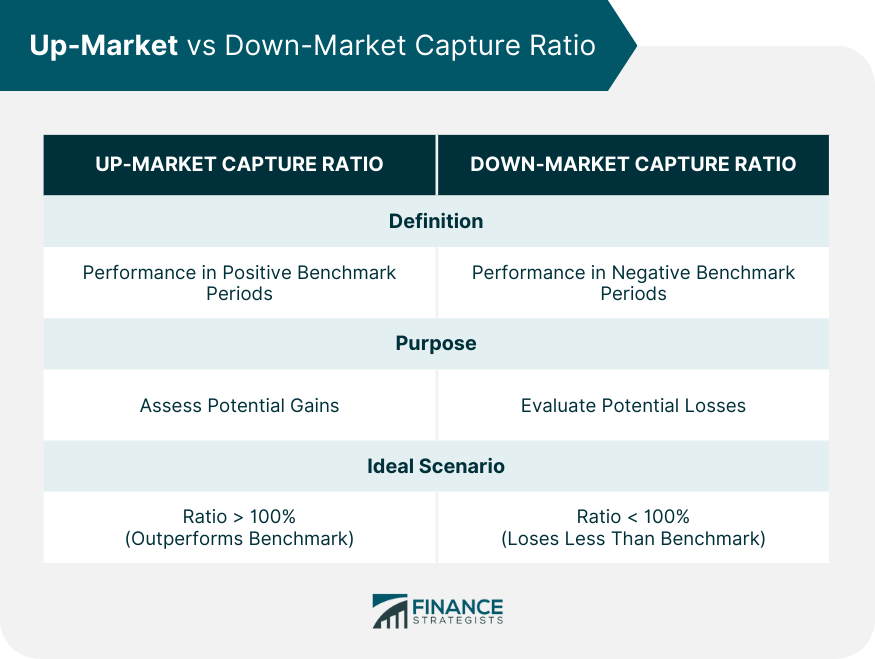

The up-market capture ratio is a statistical measure that reveals how well an investment, such as a mutual fund or a portfolio, performed relative to an index when it rose. This ratio is crucial for understanding an investment’s upside potential and how it could perform in bullish markets. The up-market capture ratio is significant in investment analysis for many reasons. It provides insights into how much of the up-market an investment captures, giving an investor an idea of what to expect during favorable market conditions. This measure can guide investors in choosing suitable funds or portfolios that align with their risk tolerance and investment goals. The up-market capture ratio is calculated by dividing the portfolio's return during up-market periods by the return of the benchmark or index during the same periods. The formula looks like this: Here's a step-by-step breakdown of the calculation: 1. Identify the Up-Market Periods: First, determine the periods when the benchmark or index had positive returns. These are the up-market periods. 2. Calculate the Portfolio's Return During Up-Market Periods: Next, calculate the portfolio's return during the identified up-market periods. 3. Calculate the Benchmark's Return During Up-Market Periods: Calculate the return of the benchmark or index during the same up-market periods. 4. Divide Portfolio's Return by Benchmark's Return: Divide the portfolio's return by the benchmark's return and multiply by 100 to get a percentage. A ratio greater than 100% indicates the portfolio has outperformed the benchmark during up-market periods. Conversely, a ratio less than 100% means the portfolio underperformed compared to the benchmark in periods of positive returns. A high up-market capture ratio is generally favorable. It indicates that the investment has outperformed the benchmark index during periods of positive returns. For example, a ratio of 120% means that the investment gained 20% more than the index during up-market periods. Conversely, a low up-market capture ratio can be a cause for concern. It suggests that the investment has underperformed the benchmark index during periods of positive returns. This might point to issues with the investment strategy or management. The up-market capture ratio is a vital metric for developing an effective investment strategy as it provides insight into how an investment performs during favorable market conditions. Understanding this measure can aid in both the selection and timing of investments. Investors can use the up-market capture ratio to assess an investment's historical performance. If the ratio is more than 100%, the investment has outperformed the benchmark during up-market periods. Conversely, a less than 100% ratio indicates that the investment could have performed better during positive market trends. Investors can make a comprehensive risk-reward analysis by comparing the up-market capture ratio with the Down-Market Capture Ratio (how an investment performs during negative market conditions). Ideally, investors seek assets with high up-market capture and low down-market capture ratios, signifying strong performance in good times and resilience during downturns. This ratio can also aid in portfolio diversification. For instance, investors may want to balance their portfolio with some investments having high up-market capture ratios for growth potential and others with low down-market capture ratios for stability. It's also a valuable tool for evaluating fund managers. A fund manager with a consistent record of high up-market capture ratios demonstrates skill at capitalizing on favorable market conditions. However, it's essential to note that this ratio is based on past performance, which doesn't guarantee future results. As market conditions can change, investors should use this metric with other indicators and analysis tools to form a comprehensive view of an investment's potential. Understanding both Up-Market and Down-Market Capture Ratios provides a comprehensive picture of an investment's overall performance and risk characteristics in different market conditions. The up-market capture ratio measures how well an investment performs in relation to a benchmark during periods when that benchmark has increased. If the ratio is over 100%, it indicates that the investment has, on average, outperformed the benchmark during periods of positive returns. This ratio helps investors understand the potential for gain when market conditions are favorable. On the other hand, the Down-Market Capture Ratio measures an investment's performance in declining markets. If the Down-Market Capture Ratio is less than 100%, the investment has lost less than its benchmark during periods of negative returns. This ratio provides valuable insights into the potential for loss mitigation when market conditions are unfavorable. A high up-market capture ratio and a low Down-Market Capture Ratio suggest a desirable investment. Such an investment would theoretically yield greater returns than the benchmark during periods of positive market performance and incur fewer losses during downturns. However, it's critical to remember that these ratios are based on historical data, and past performance may not indicate future results. Therefore, investors should use these ratios as just one of many tools for assessing an investment's suitability for their portfolio and risk tolerance. Insight Into Performance During Bull Markets: The up-market capture ratio provides valuable information about how an investment or fund performs during periods of positive returns. This can help investors anticipate how their investment may perform during similar conditions. Comparison Across Funds: It can compare different funds or investments based on their relative performance in bullish markets. This can be particularly useful for investing in funds that perform well during market upswings. Understanding Fund Manager's Strategy: The up-market capture ratio can shed light on the fund manager's strategy, particularly their approach to capitalizing on positive market conditions. Limited Time Frame: The ratio is based on specific periods of positive market performance, which may not accurately reflect the fund's potential performance over the long term or during different market conditions. Dependence on Benchmarks: The up-market capture ratio's effectiveness largely depends on the chosen benchmark. If the benchmark isn't appropriately chosen, the ratio may provide a misleading picture of the fund's performance. Incomplete Picture: While the up-market capture ratio provides insights into performance during positive market conditions, it does not offer information on how the fund might perform during downturns. For a comprehensive understanding, the Down-Market Capture Ratio must also be considered. Potential for Misinterpretation: A high up-market capture ratio could indicate strong performance during positive market periods. However, it could also suggest that the fund is taking on excessive risk to achieve these returns. Thus, the ratio should be analyzed in conjunction with other risk metrics. The up-market capture ratio is a vital statistical measure that indicates how an investment has performed relative to a benchmark during periods of positive market performance. It is a critical part of investment analysis, giving investors a better understanding of an investment's upside potential. Investors seeking to optimize their wealth management strategies would benefit from paying close attention to this measure. By understanding the up-market capture ratio and how to use it effectively, investors can make more informed decisions that align with their investment goals and risk tolerance. In the future, as financial markets continue to evolve and become more complex, the up-market capture ratio will likely remain a valuable tool for investment analysis. As always, it will be necessary for investors to understand this measure and use it as part of a holistic approach to investment analysis, which includes consideration of a wide range of factors and metrics.What Is the Up-Market Capture Ratio?

Calculation of the Up-Market Capture Ratio

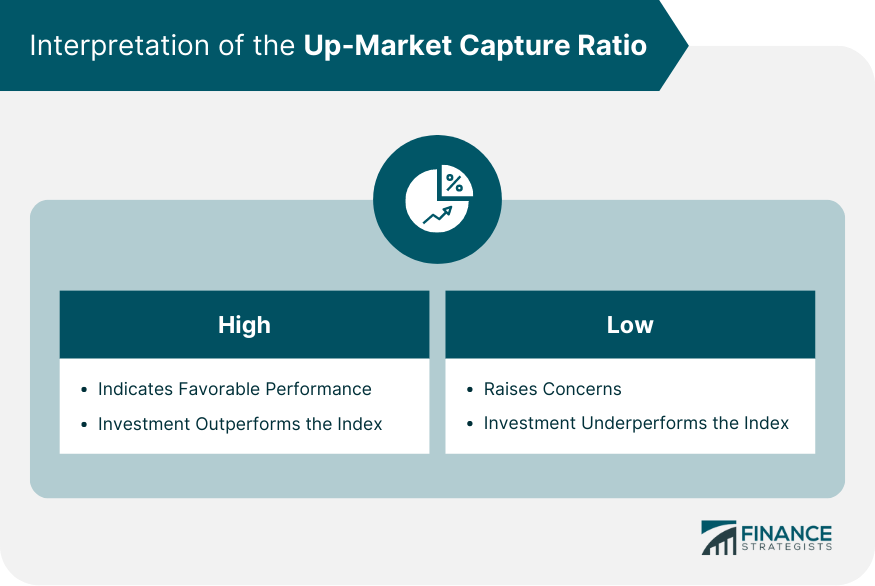

Interpretation of the Up-Market Capture Ratio

What a High Ratio Indicates

What a Low Ratio Indicates

Up-Market Capture Ratio and Investment Strategy

Assessing Performance

Risk-Reward Analysis

Portfolio Diversification

Selection of Fund Managers

Comparison Between Up-Market and Down-Market Capture Ratios

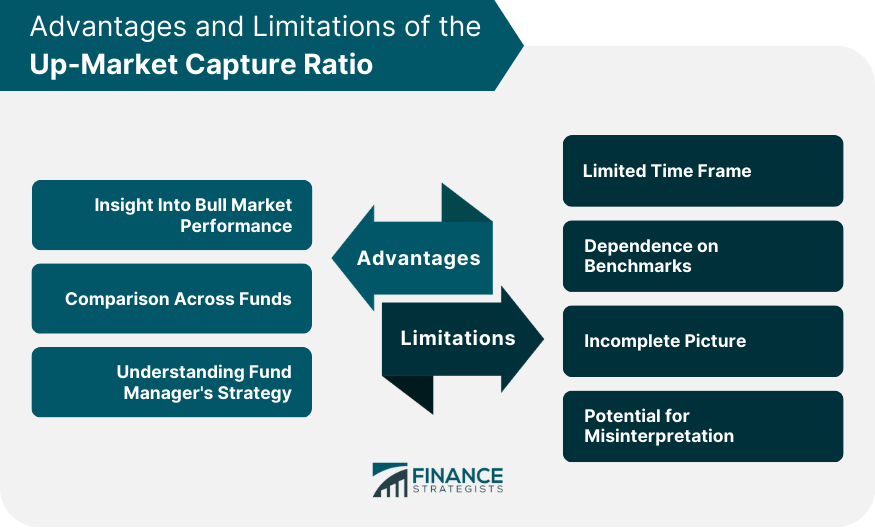

Advantages and Limitations of the Up-Market Capture Ratio

Advantages

Limitations

Conclusion

Up-Market Capture Ratio FAQs

The up-market capture ratio measures how an investment has performed relative to a benchmark during periods when the benchmark has risen.

The up-market capture ratio is calculated by dividing the investment's return during up-market periods by the benchmark's return during the same periods and multiplying the result by 100.

A high up-market capture ratio indicates that the investment has outperformed the benchmark during periods of positive returns.

While the up-market capture ratio measures performance during favorable market conditions, the Down-Market Capture Ratio measures performance during negative market conditions.

While the up-market capture ratio provides valuable insights, other metrics should be considered when evaluating an investment. It's also important to consider risk, volatility, and performance during down-market periods.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.