Trend following is a trading strategy that seeks to profit from the long-term directional movement of financial markets. The goal of this approach is to identify and follow trends, buying assets that are rising in price and selling those that are falling. In essence, trend followers aim to ride the momentum of a market trend for as long as possible, with the hope of capturing significant gains. The main concept behind trend following is that markets exhibit prolonged periods of upward or downward movement, and these trends can provide profitable trading opportunities. Trend followers believe that it is more profitable to ride the trend rather than trying to predict or time market reversals. The strategy is often applied to various financial instruments, including stocks, commodities, currencies, and futures contracts. Trend following in trading requires a disciplined approach, adherence to risk management principles, and continuous monitoring of market conditions. Traders often combine trend following with other technical or fundamental analysis techniques to refine their trading decisions. One of the main benefits of trend following is its simplicity. Unlike other trading strategies that require complex algorithms or sophisticated technical analysis, trend following can be implemented using a few basic tools and principles. Another advantage of this approach is that it can be applied to a wide range of financial markets, including stocks, bonds, currencies, and commodities. This makes trend following a versatile and adaptable trading method that can be used in various market conditions. Moreover, trend following has been shown to be an effective way to generate consistent profits over the long term. According to some studies, trend following strategies have delivered higher returns than buy-and-hold strategies over periods of five, ten, and even twenty years. This is because trend following allows traders to capture large market moves while avoiding significant losses during periods of market volatility or uncertainty. The first principle of trend following is to identify market trends. This can be done using a variety of tools, including trend lines, moving averages, and price channels. A trend is generally defined as a series of higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend. Once a trend has been identified, trend followers will typically look for opportunities to enter the market in the direction of the trend, buying assets that are rising in price and selling those that are falling. The second principle of trend following is to trade with the trend. This means that trend followers will typically buy assets that are in an uptrend and sell those that are in a downtrend. The idea behind this approach is that markets tend to move in long-term trends, and that following these trends can lead to significant profits. However, it's important to note that not all trends are created equal, and that some trends may be stronger or more reliable than others. As such, trend followers will typically use a variety of indicators and tools to help them identify and confirm the strength of a trend before entering a trade. The third principle of trend following is to manage risk. This is because even the best trend following strategies can result in losses during periods of market volatility or uncertainty. To manage risk, trend followers will typically use stop-loss orders or other risk management techniques to limit their losses and protect their capital. The fourth principle of trend following is position sizing. This refers to the process of determining how much of a given asset to buy or sell based on the size of a trader's account and the level of risk they are willing to take. Position sizing is an important component of trend following, as it can help traders to manage their risk and maximize their potential profits. Moving averages are one of the most popular trend following indicators. A moving average is a line that represents the average price of an asset over a specific period of time. Traders will often use moving averages to help identify trends and confirm the strength of a trend before entering a trade. The Relative Strength Index (RSI) is another commonly used trend following indicator. The RSI measures the strength of a trend by comparing the average gains and losses over a specific period of time. Traders will typically use the RSI to identify overbought and oversold conditions in the market, which can help them to make better trading decisions. The Moving Average Convergence Divergence (MACD) is a trend following indicator that measures the difference between two moving averages. Traders will often use the MACD to identify changes in momentum or trend direction, which can help them to enter or exit trades at the right time. Bollinger Bands are a popular trend following indicator that uses a series of lines to represent the upper and lower boundaries of a trading range. Traders will often use Bollinger Bands to help identify overbought and oversold conditions in the market, as well as potential trend reversals. The Simple Moving Average Crossover is one of the most basic trend following strategies. This strategy involves buying an asset when its short-term moving average crosses above its long-term moving average, and selling when the short-term moving average crosses below the long-term moving average. The Dual Moving Average Crossover is similar to the Simple Moving Average Crossover, but uses two different moving averages instead of one. Traders will typically use a shorter-term moving average and a longer-term moving average to help identify trends and confirm the strength of a trend before entering a trade. Price Channel Breakouts involve buying an asset when it breaks above a previous high or selling when it breaks below a previous low. Traders will often use price channels to help identify potential breakout points, as well as to confirm the strength of a trend before entering a trade. Moving Average Envelopes are similar to Bollinger Bands, but use a fixed percentage rather than a fixed number of standard deviations to represent the upper and lower boundaries of a trading range. Traders will often use Moving Average Envelopes to help identify potential overbought and oversold conditions in the market, as well as to confirm the strength of a trend before entering a trade. Backtesting is a critical component of trend following, as it allows traders to test their strategies using historical market data to see how they would have performed in the past. This can help traders to identify potential flaws in their strategy and make adjustments before risking real capital in the markets. Choosing the right data is also important when backtesting a trend following strategy. Traders will typically use a combination of historical price data, volume data, and other relevant market data to build their backtesting models. Testing parameters, such as the length of moving averages or the size of stop-loss orders, can have a significant impact on the performance of a trend following strategy. As such, it's important to test different parameters and optimize the strategy to achieve the best possible results. Risk management is another critical component of trend following. Traders will typically use a variety of risk management techniques, such as stop-loss orders or position sizing, to limit their losses and protect their capital. Choosing the right market is an important part of implementing a trend following strategy. Traders will typically look for markets that exhibit strong trends and have sufficient liquidity to support their trading activity. Choosing the right broker is also important when implementing a trend following strategy. Traders will typically look for brokers that offer low commissions, fast execution, and reliable trading platforms that are compatible with their trading style. Choosing the right trading platform is also important when implementing a trend following strategy. Traders will typically look for platforms that offer advanced charting capabilities, real-time market data, and customizable indicators and tools. Managing trades is a critical component of trend following, as it can help traders to maximize their profits and limit their losses. Traders will typically use a combination of technical analysis, risk management techniques, and market intuition to manage their trades and make adjustments as needed. Trend following is a simple yet effective trading strategy that seeks to profit from long-term market trends. By identifying and following trends, traders can capture significant gains while avoiding significant losses during periods of market volatility or uncertainty. To successfully implement a trend following strategy, traders must be able to identify trends, trade with the trend, manage risk, and optimize their strategy using historical market data. With the right tools and techniques, trend following can be a profitable and rewarding trading method that can be used in various market conditions. The future of trend following is likely to be shaped by advances in technology and changes in market dynamics. With the rise of machine learning and artificial intelligence, trend following strategies are likely to become more sophisticated and adaptive to changing market conditions. Additionally, as markets become more interconnected and globalized, trend following strategies may become more effective in identifying and following trends across multiple asset classes and geographies.What Is Trend Following?

Benefits of Trend Following

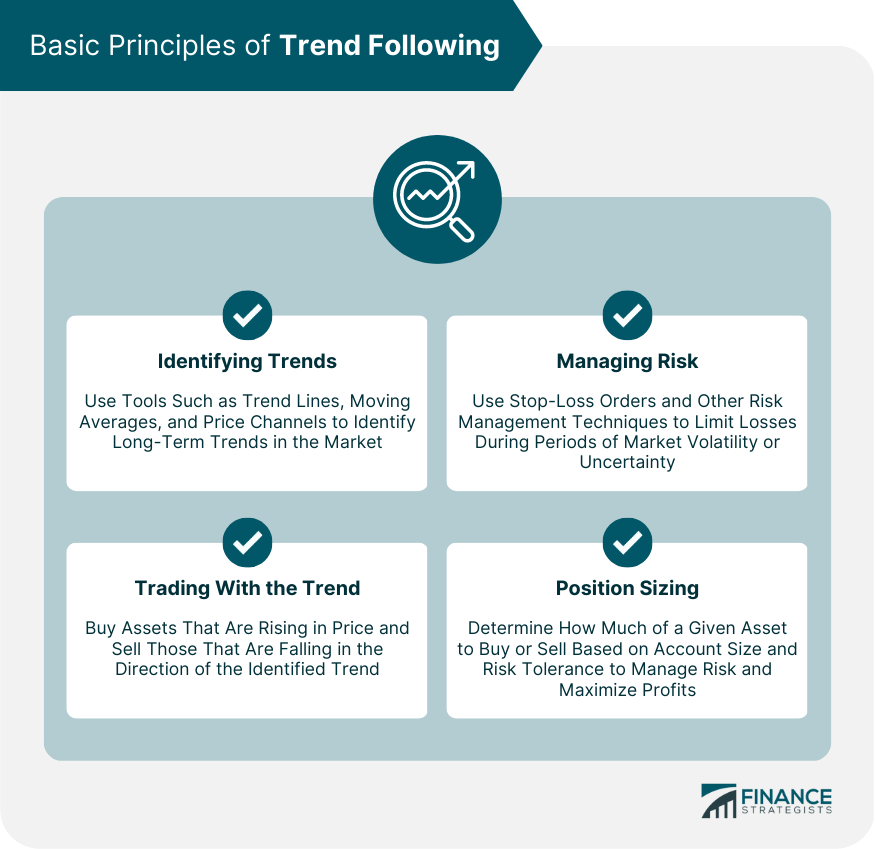

Basic Principles of Trend Following

Identifying Trends

Trading With the Trend

Managing Risk

Position Sizing

Trend Following Indicators

Moving Averages

Relative Strength Index

Moving Average Convergence Divergence

Bollinger Bands

Trend Following Strategies

Simple Moving Average Crossover

Dual Moving Average Crossover

Price Channel Breakouts

Moving Average Envelopes

Backtesting and Optimization

Importance of Backtesting

Choosing the Right Data

Testing Parameters

Risk Management

Implementing Trend Following

Choosing a Market

Choosing a Broker

Choosing a Trading Platform

Managing Trades

Conclusion

Trend Following FAQs

Trend following is an investment strategy that involves buying assets that are trending upward and selling assets that are trending downward.

Trend following works by identifying trends in the market and buying or selling assets based on those trends. It involves using technical analysis to identify patterns in price movements and making investment decisions based on those patterns.

The benefits of trend following include the potential for higher returns during market uptrends, as well as reduced risk during market downtrends. Trend following also helps investors avoid emotional decision-making by relying on objective technical indicators.

The drawbacks of trend following include the potential for missed opportunities if a trend changes quickly, as well as the possibility of false signals that result in losses. Trend following also requires consistent discipline and may not be suitable for all investors.

Yes, trend following can be applied to different types of assets, including stocks, bonds, commodities, and currencies. The same principles of identifying trends and using technical analysis can be applied across different markets and asset classes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.